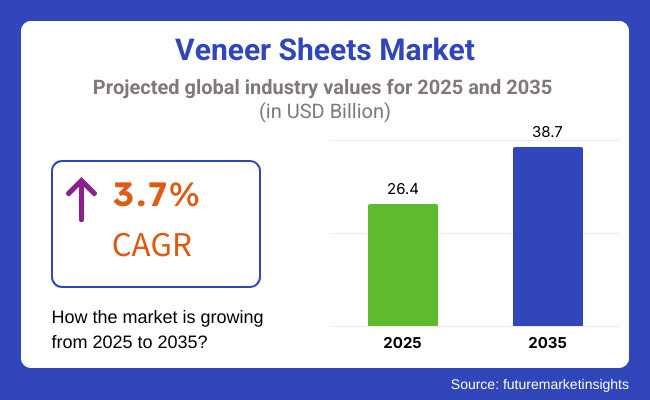

The veneer sheets market is expected to witness steady growth between 2025 and 2035, driven by increasing demand for high-quality interior décor, rising construction activities, and growing preference for sustainable wood products. The market is projected to expand from USD 26.4 billion in 2025 to USD 38.7 billion by 2035, reflecting a CAGR of 3.7% over the forecast period.

Veneer sheets, which are thin slices of wood applied to furniture, flooring, cabinetry, and decorative paneling, have gained popularity due to their aesthetic appeal, durability, and eco-friendly attributes. They offer a natural wood finish while minimizing timber consumption, making them a preferred choice for sustainable construction and interior design. The demand for customized and premium furniture solutions is rising, with veneer sheets widely used in luxury home décor, commercial spaces, and high-end hotels.

The increase in the market is also due to the improvements in wood processing machines, the creation of engineered veneer sheets, and the digital printing techniques that are used for the enhancement of texture and durability. Besides, more and more manufacturers are interested in the development of sustainable products made of veneer that are sourced from responsibly managed forests, thus contributing to global sustainability trends.

Inexpensive (luxury) and (environmentally) friendly furniture driving the market growth case, the main contributing factors are the availability of surplus disposable income, the construction of newly built commercial premises, and the shift towards luxury and environmentally safe furnishing.

The market is driven by the strong demand coming from building companies, furniture producers, and interior decorators, which makes the use of veneer sheets in the construction sector and home renovation projects a necessity.

Explore FMI!

Book a free demo

The veneer sheets market is largely led by North America, which is the largest share-holder is the furniture segment, the sale of new homes, and the need for eco-friendly building materials are the main drivers.

The United States and Canada enjoy a solid woodworking industry and the public has a high preference for natural wood finishes, FSC-certified veneers, and formaldehyde-free adhesives. Veneer sheets, which have gained inclination within the modern kitchen interior, modular office space, and commercial renovations, BR butt furniture among both residents and commercial designers.

The main reason for the growth of the market is that more and more people are going for DIY home improvement as well as the fact that online stores are starting to sell veneer directly to the customers.

Furthermore, North America is a region where rules concerning the sustainability of forests and low-emission materials are very strict, and this is the reason manufacturers are pushed to create products that are good for the environment. The prominent companies are focusing their attention on the product innovation, engineered veneers, and digitally printed wood textures, which they offer to their customers who want to realize their wood interior design with their own ideas.

Veneer sheets market in Europe is experiencing an upsurge and the primary cause of it is the substantial interest in the green architecture movement, green building certifications, and the premium house decoration trend.

The leading countries in the luxury furniture, interior design, and commercial real estate sectors are Germany, France, Italy, and the United Kingdom which, in turn, stimulate the demand for first-rate veneer sheets. The environmentally-conscious attitude reflected by European consumers is seen in their preference for natural wood finishes, recycled veneer sheets, and biodegradable adhesives.

At the same time, Scandinavian states, famous for their space-saving designs and the inspiration they draw from nature, are also facing high demand for light-shaded and textured wood veneer sheets.

The EU's serious regulations on deforestation, greenhouse gas emissions, and the use of sustainable raw materials are the main drivers of the rise in the popularity of FSC-certified veneer sheets Furthermore, the wood-processing companies in Germany and Italy are introducing products with a new digital technology, including moisture-proof veneer, countertops, and fire-protected composite wood, specifically targeted at luxury home and office refurbishment projects.

The veneer sheets market in Asia-Pacific is developing at the fastest pace worldwide due to rapid urbanization, increased disposable income, and growing investments in home decor and furniture production.

China and India are the ones getting most of the veneer sheet orders these days, and the construction sector, modular kitchen, and office furniture account for a big portion of it. The increased demand for veneer sheets in premium hotels, resorts, and shopping centers have also been backed by the real estate and hotel industry boom in these nations.

Veneer sheets are mainly produced and exported by China which is mainly influenced by a functional woodworking industry and a ton of timber resources. Meanwhile, India is also rising in the furniture industry and home improvement sector.

The growth is detected by an increasing number of consumers that prefer wooden interiors and eco-friendly design solutions. On the other hand, the Japanese and South Korean companies are investing in adhesion, moisture and fire resistance, and digitized technologies in making high-rise buildings, hospitals, and corporate offices more durable and thus, healthier.

Veneer sheets are finding their way to Latin America, the Middle East, and Africa where they are being pushed by high-end home construction, commercial real estate broadening, and the quest for sustainable building materials. Brazil and Mexico are among the countries where requests for luxury furniture along with top-quality veneer panel are increasing. Luxury hotels, shopping malls, and ultra-modern residential buildings in the UAE, and Saudi Arabia are providing strong traction for wooden veneers.

Africa's expanding urban infrastructure and an emerging furniture sector are the two forces that will let the Ikea furnish the market with the most cost-effective veneer category sheets in both low-cost and high-end housing projects. As the real estate stays on the path of growth, it is logical that the market for veneer sheets which are suitable for the given conditions is going to be strong in the humid and high-temperature environments.

Challenges

Volatile Raw Material Prices & Supply Chain Shortages

The veneer sheets market is mainly driven by popular timber species that are in high demand, such as the most widely known ones, including oak, mahogany, walnut, and teak.

The accessibility of these resources, however, faces serious challenges due to factors such as deforestation laws, trade restrictions, and even climate change, which, in turn, lead to price fluctuations and supply shortages. In addition, the global supply chain crisis and rising transport costs along with import-export restrictions all create troubles for the veneer producers that then affect production efficiency and market stability.

Competition from Alternative Materials

Veneer sheets are up against buttons, engineered wood, and synthetic decorative surfaces that match them in look and are generally cheaper. Laminates and PVC-based furniture materials are becoming more and more popular because of their low cost, durability, and moisture & scratch resistance as well as being a preferred choice for customers who want to save money.

The rise of 3D-printed furniture and digitally manufactured composites is also affecting the demand for traditional veneer sheets, requiring manufacturers to innovate with high-performance finishes and advanced surface treatments.

Moisture Sensitivity & Maintenance Requirements

In contrast to solid wood, veneer sheets need appropriate sealing, finishing, and care to be taken against warping, cracking, or peeling over time. Many consumers visualize veneer sheets as a less enduring material compared to solid wood or high-pressure laminates, so that often, they are not being used in high-moisture places such as kitchens and bathrooms.

To counteract this problem, producers are engaging in formulating waterproof coatings, UV-proof finishes, and improved adhesive technologies to enhance the durability and service life of veneer sheets.

Opportunities

Expansion of Sustainable & Eco-Friendly Veneer Products

Eco-efficient innovations not only attract a crowd but also capture the attention of the ever-increasing number of consumers who are interested in environment-friendly FSC-certified, low-VOC, and recyclable veneer sheets.

The production of wood using environmentally friendly techniques is becoming a trend among the manufacturers who are turning to biodegradable glues and carbon-zero production technologies as a response to the demand for ecological home and building materials. The advent of bamboo-based veneer sheets as well as engineered wooden veneer alternatives is the new direction for sustainability lovers searching for such products.

Growth of E-Commerce & Digital Retailing in Veneer Sheets

Online furniture marketplaces and digital veneer sales platforms is disrupting the way how veneer sheets are distributed. E-commerce platforms direct sales, personalized peel, and streamlined logistics have made it be simple for clients to have a variety of wood species, finishes, and textures.

Companies putting money on artificial intelligence techniques for product recommendations, 3D visualization gadgets, and virtual showroom experiences are believed to gain an edge in the digital veneer market.

Advancements in Manufacturing Technologies

The creation of the digitally printed veneers, engineered veneer sheets, and water-resistant coatings with multi-layer is positively impacting the durability and versatility of veneer use.

Breakthroughs like the sorting of wood accomplished with AI, precision laser cutting, and the involvement of machines in the bonding of veneer are responsible for the rise in production efficiency and the fall in material waste. The integration of modern manufacturing techniques, as well as automated systems for the grading of veneer, is the reason for the manufacturers to improve product consistency, quality control, and custom design.

The veneer sheets market witnessed steady growth from 2020 to 2024, driven by increasing demand in furniture, interior design, and construction industries. Veneer sheets, known for their aesthetic appeal and cost-effectiveness compared to solid wood, gained popularity in residential and commercial applications. Advancements in manufacturing techniques, sustainability initiatives, and consumer preference for eco-friendly materials also contributed to market expansion.

Postponing the development of new technologies, the market is expected to experience further evolution in materials, the broader spread of engineered veneer sheets, and their introduction in completely new industries like automotive interiors and modular construction. The sector will also be reshaped by the greater understanding of environmentally sound forestry practices and the use of recycled wood products.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with deforestation and sustainable wood sourcing regulations. |

| Technological Advancements | Development of high-quality engineered veneer sheets. |

| Industry-Specific Demand | High demand in furniture, cabinetry, and flooring. |

| Sustainability & Circular Economy | Increased use of FSC-certified wood and recycled veneers. |

| Market Growth Drivers | Rising urbanization, increasing home renovation trends, and demand for eco-friendly materials. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter global sustainability mandates and increased certification requirements. |

| Technological Advancements | Introduction of AI-driven quality control and 3D-printed veneer sheets. |

| Industry-Specific Demand | Expansion into automotive interiors, modular construction, and smart furniture. |

| Sustainability & Circular Economy | Full-scale adoption of biodegradable adhesives and zero-waste manufacturing. |

| Market Growth Drivers | Growth in prefabricated housing, luxury furniture, and hybrid wood composite innovations. |

The United States market of veneer sheets is gradually improving, primarily due to more homes being renovated as well as furniture makers finishing work on high-end furniture and the commercial interior applications. Consumer preference for natural and premium wood aesthetics is the main issue behind the use of high-quality veneer sheets in cabinetry, flooring, and wall paneling.

Furthermore, consumers are also looking more to use veneer sheets made of wood from responsibly sourced materials. The introduction of engineered veneers that are not only more durable but are also less costly is another factor which drives the market forward. The growth of e-commerce businesses supplying furniture online and the digital printing of finishes have added new aspects to the trade.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.5% |

The UK veneer sheets sector is developing because of the increased funding in the sustainable buildings and similar architecture programs, the need for superior wooden interiors, and the expansion of individualized furniture solutions. The trend toward minimalism and Scandinavian-style interiors is pushing up the use of light-colored natural veneers in both residential and commercial projects.

The governmental policies that endorse the use of sustainable materials in building and interior design are also a main factor of the growth of this market. In addition, the increased use of engineered and reconstituted veneers, which are the most durable and have a smaller impact on the environment, is getting widely disbursed in the UK market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.6% |

The European Union true wood veneer sheets market is experiencing some particular growth because of the high demand in the furniture, flooring, and interior design sectors. European countries like Germany, France, and Italy dominate the market for veneer sheets, being the leading producers and consumers of the product, thanks to their well-established woodwork and furniture sectors.

The EU's strict environmental policies and sustainability initiatives have forced manufacturers to move towards the adoption of responsibly sourced wood and low-emission production processes. Furthermore, the increasing trend of wood-based modular furniture and prefabricated housing solutions is leading to an increased requirement of veneer sheets in engineered wood applications.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.7% |

Japan's market for veneer sheets is climbing well, fabricated by the admiration for beauty of the high-quality wood finishes in traditional and modern indoor arrangement. The tendency of the country to go with nature and the fact that people prefer wood-based furniture are the two factors that are gradually growing the market.

Veneer manufacturers in Japan are embracing modern processing methods to add flexibility and durability to veneer products while still lending them a natural wood look. Furthermore, the adoption of modular and lightweight houses that are resistant to earthquakes is also pushing the usage of engineered veneer sheets, which are both visually pleasing and structurally efficient.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.4% |

The growing veneer sheets market in South Korea is largely influenced by the rising demand for decorative and sustainable wood-based materials in the interior of modern houses and business offices. The fast pace of urbanization and the rapid growth of luxury real estate projects are creating a surge in the demand for top-notch veneer finishes.

Innovative techniques in the manufacturing of veneer, including the introduction of fire-resistant and antimicrobial veneer, have a driving force in the South Korean market. Furthermore, the trend of minimalism and the development of smart homes are the reasons why people are more interested in using engineered and digitally enhanced veneer products.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.8% |

Glass Vapour Barriers Offer Superior Moisture Resistance and Durability

Glass vapor barriers are utilized generally in high-performance applications where moisture resistance for an extended period and minimal permeability are a must. This technology is mainly seen in industrial and commercial premises where it is used to safeguard insulation and structural components from deterioration caused by humidity.

The impermeable character of glass helps discharge the vapor far more than other materials, therefore, it is often the material of choice for the researchers' labs and data centers that need a controlled atmosphere. Other than that, the laminated glass coatings that have been developed add to the efficiency of vapor barriers through improved UV resistance and thermal insulation, thus they become valued by many sectors.

Sheet Metal Vapour Barriers Gain Traction in Industrial and Roofing Applications

Sheet metal vapour barriers are being installed in more and more applications in industrial construction and roofing as they provide an outstanding solution with their long-lasting durability, strength, and weather resistance. Usually, they are made from aluminum or galvanized steel, and these barriers present a reliable solution for moisture ingress in such high-exposure areas as warehouses, factories, and underground structures.

Besides, the increasing interest of customers in eco-friendly and energy-efficient construction materials has a direct impact on the implementation of sheet metal vapour barriers since they provide better thermal regulation and condensation control. Furthermore, the creation of corrosion-resistant surface treatments and the incorporation of lightweight metal alloys facilitate the adaptation of sheet metal vapour barriers to sustainable and aesthetic criteria of modern architecture.

Membrane Vapour Barriers Lead Due to Flexibility and Versatile Applications

Membrane vapor barriers are used primarily in residential and commercial buildings due to their flexibility, ease of installation, and compatibility with many substrates. These barriers, usually produced from polymer-based materials, are found to be an effective moisture barrier for walls, floors, and roofs.

The growing trend for green building practices and the demand for energy-efficient insulation are driving the quest for high-performance vapor membranes which in turn leads to the betterment of indoor air quality and building longevity. In addition to that, the membrane options have gained self-adhering and spray-applied properties that are favored for their superior sealing characteristics and ability to collect on complex shapes, rendering them the first choice for the cutting-edge construction methods.

Fluid Vapour Barriers Expand Market Opportunities with Seamless Protection

Fluid applied vapour barriers are being introduced as a new moisture protection solution, they are applied seamlessly and provide continuous barrier against vapor flow. The fluid coatings, which can be used under this approach, generally contain elastomeric and polymer-based formulations, therefore they are applied by spray or roller methods ensuring that the substrate is entirely covered and that air gaps are minimal.

The rise of fluid barriers demand is clearly observed in both commercial and industrial markets, with emphasis on higher adhesion, flexibility, and durability. Also, fluid vapour barriers disclose their advantages during retrofitting work when it comes to traditional sheet or membrane barriers installations challenges. The continuing development of eco-friendly and low-VOC formulations will further enhance the application of these fluid vapour barriers in sustainable construction works.

The Vapour Barrier market is strolling through a period of rapid development under the pressure of the ever-increasing demand for moisture control interventions especially in construction, packaging, and industrial applications. Moisture barriers are crucial in moisture control, the possible future risks are mold growth, corrosion, and structural failure of buildings. Moreover, the focus on energy-efficient buildings and the implementation of rigorous building standards are also factors that temporarily boost the market.

Technological progress in vapour barrier materials, such as the arrival of high-performance polymer-based and green friendly barriers, are stake in the bad guys what stands as the impact. Companies are diving into research and development in order to lay aside more durable, lighter, and recyclable vapour barriers.

The public demand for artifacts that are both sustainable and energy-efficient is presumed to further trigger material innovation in the sector. Besides, the popularity of smart buildings and modern construction methods has in fact increased the demand for vapour barriers that not only enhance air quality and insulation performance but also minimize energy use in residential, commercial, and industrial buildings.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Dow Inc. | 18-22% |

| DuPont de Nemours, Inc. | 15-18% |

| Saint-Gobain | 10-14% |

| 3M Company | 8-12% |

| Sika AG | 5-9% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Dow Inc. | Develops advanced polymer-based vapour barriers with high moisture resistance for construction and industrial applications. |

| DuPont de Nemours, Inc. | Specializes in energy-efficient vapour barriers, focusing on sustainable and high-performance building solutions. |

| Saint-Gobain | Offers innovative vapour barrier solutions for residential and commercial buildings, emphasizing durability and energy efficiency. |

| 3M Company | Provides multi-functional vapour barriers with high adhesive properties for insulation and industrial applications. |

| Sika AG | Focuses on construction-grade vapour barriers with superior moisture protection and easy application features. |

Dow Inc.

Dow Inc. is the top polymer-based vapour barriers manufacturer in the world known for their highest durability and moisture resistance. The decisional factor in the R&D is based on the development of cutting-edge eco-friendly and energy-efficient solutions for the construction industry. Dow's vapour barriers are extensively used in commercial and residential projects providing top-notch protection against humidity and condensation.

It is the sustainability and the innovation of the company that gives it the opportunity to be a powerful player in the market. Aside from that, Dow is cooperating with partners from the industry to integrate smart moisture detection systems into vapour barriers, enabling real-time monitoring of the humidity levels and increasing the building's longevity.

DuPont de Nemours, Inc.

DuPont de Nemours, Inc. is a company that manufactures state-of-the-art vapour barriers that provide energy-efficient buildings. The solutions are built so as to comply with the most stringent of environmental standards while remaining moisture-proof for the longest time possible. The catalogue of DuPont includes high-performance breathable barriers that ensure structural integrity among other things by controlling the humidity.

Backed up by an abundant resource of latest research and technological progress, DuPont has always been a pioneer in the international market. Along with that, the company is implementing an investment in AI-driven predictive maintenance tools which assist construction workers in finding out the early signs of the moisture invasion thus eliminating the down-the-road damage expenses.

Saint-Gobain

Saint-Gobain is one of the few manufacturers around that provide a complete range of vapour barriers for both residential and commercial purposes. Their solutions’ primary goal is to increase energy efficiency via the elimination of the water vape. The company of Saint-Gobain takes care of the planet and is actively implementing projects to promote the use of recyclable and low-emission vapour barriers corresponding to their quest for ecological design.

In addition to this, it means that the company is inventive and also it is a measure of quality for materials so it will surpass its rivals in the market. Furthermore, the company is emphasizing digital construction solutions which will involve the use of BIM (Building Information Modeling) technique for the placing and installation of vapour barriers in newly built facilities.

3M Company

3M Company is recognized for its multi-functional vapour barriers which are distinguished by exceptional adhesion and moisture resistance. The priority of the company is to devise answers to the issues concerning insulation, consumer products, and construction. 3M has made the vapour barriers which not only are used to the objective of the function but also help in the revitalization of the indoor air quality.

In the productivity field, 3M is looking for new materials and ways to produce environmentally-friendly filters at a cheaper cost. On the other hand, 3M is attempting to work on nanotechnology-based vapour barriers that possess extended life and find applications in abnormal environmental conditions solidifying the idea of the company as an innovator and quality practitioner.

Sika AG

Sika AG, a top actor in the construction materials sector, is offering vapour barrier solutions premiumly designed for high-performance moisture control. In fact, the collection is such that one will use them on roofs, flooring, and walls to avoid the causes of surface deterioration as a result of humidity.

The firm, in its commitment to research and the sustainability sector, has come up with an easy-to-use, eco-friendly vapour barrier which plays its part in energy-efficient building construction. Moreover, Sika is broadening its presence in the modular construction sector where the cutting-edge vapour barrier is crucial in maintaining the modular components’ integrity during transit and assembly.

The global veneer sheets market is projected to reach USD 26.4 billion by the end of 2025.

The market is anticipated to grow at a CAGR of 3.7% over the forecast period.

By 2035, the veneer sheets market is expected to reach USD 38.7 billion.

The Commercial segment is expected to hold a significant share due to the increasing demand for high-quality, aesthetic, and durable wood veneer sheets in interior design and furniture applications.

Key players in the veneer sheets market include Dow Inc., DuPont de Nemours, Inc., 3M Company, Saint-Gobain.

The market is segmented into Paper-Backed, Wood-Backed, Phenolic-Backed, Laid-Up, and Others.

The industry is divided into Commercial and Residential.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

Anti-seize Compounds Market Size & Growth 2025 to 2035

Phosphate Conversion Coatings Market 2025 to 2035

Technical Coil Coatings Market Growth 2025 to 2035

Perfluoropolyether (PFPE) Market Size & Trends 2025 to 2035

Cold Rolling Oils/Lubricants Market Size & Growth 2025 to 2035

Basic Methacrylate Copolymer Market Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.