The international Veggie Meals market is in for massive growth on the back of increasing demands for plant food, increased sensitivity to health as a result of increasing diseases, and greater environmental awareness through the consumption of meat. Veggie meals provide a green, healthy, alternative to the usual meat meals, and vegetable proteins, fruits, and cereals are the universal ingredient constituents.

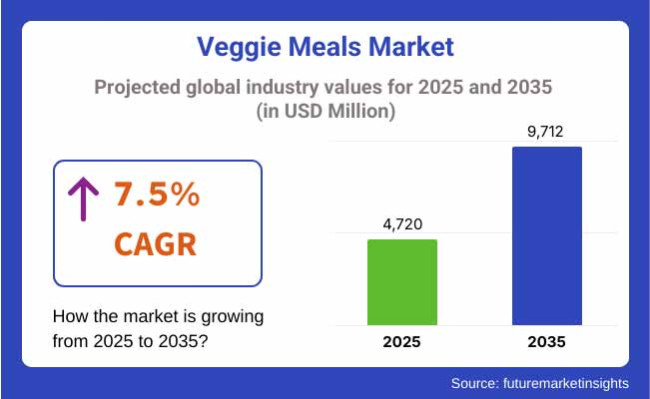

Since the food technology is advancing and vegetable food now produces the same taste and texture as usual food, demand for vegetable food is increasing day by day. The veggie meals market will be around USD 4,720 million globally in 2025. The market will be around USD 9,712 million in 2035 with a 7.5% compound annual growth rate (CAGR).

The market is supported by continuous innovation in plant food technology, i.e., improved meat substitutes, fashionable ingredient pairing, and innovative cooking formats. The market for veggie meals will continue to grow steadily throughout the period of 2035 owing to strong demand in QSRs, retail, and foodservice.

North America is a mature Veggie Meals sector, underpinned by rising take-up of plant-based meals, solid retail trade distribution networks, and increasing food technology start-up investment. The USA is the leading country, with Beyond Meat and Impossible Foods being two of the growth drivers in the plant-based meal solution for the vegan and flexitarian consumer markets.

Europe is another strong market with high demand for sustainable food choice, high government-led plant-based food initiatives, and high customer demand on health considerations. United Kingdom, Germany, and the Netherlands are front-runners, where more plant-based meal solutions in restaurants and stores offer more Veggie Meals solutions on menus.

Asia-Pacific is the fastest-growing Veggie Mealsmarket because of rising vegan and vegetarian consumer base, rising food delivery platforms, and surging popularity of plant-based diets. Demand is rising in China, India, and Japan, and local players are introducing plant-based versions of popular food brands like dumplings, curries, and sushi.

Challenges: Taste Perception, Price Sensitivity, and Supply Chain Constraints

Veggie meals substitute is also confronted with a few challenges such as consumer preference, where meat flavour and texture continue to be preferred by some. Price sensitivity, where veggie meal have an added premium over conventional meals, is also present. Supply chain limitations in the availability of quality plant food can also affect production efficiency.

Opportunities: Ingredient Innovation, Foodservice Growth, and Health-Based Demand

Besides all the challenges, there are optimistic opportunities for growth in the Veggie Meals space. Technological leaps like ingredient technologies like fermentation-derived proteins and cell-based agriculture are making the product more desirable.

Plant-based growth opportunities within the foodservice channel, such as collaboration with quick foods like McDonald's and KFC, is penetrating deeper in the market. Secondarily, increased customer exposure due to health advantages such as reduced cholesterol and reduced chronic disease occurrences are driving demand for the veggie foods worldwide.

Customers embraced plant-based meals between 2020 to 2024 when the food industry committed to healthier and sustainable food. Vego meal demand became even higher as leading food companies had enlarged plant-based ranges, taking more shelf space for veggie meals in retail chains. Cost and taste constraints still limited adoption on a large scale.

Plant-based evening meals from 2025 to 2035 will be cheap, mass-produced, and technology-driven. Plant-based food from AI, precision fermentation, and cell-based plant-based protein will be optimized in flavour and texture so that plant-based evening meals are indistinguishable from their meat counterpart. Green enterprise will compel business to sustainable packaging and local material inputs, and plant-based government policy will compel the market once more.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with vegetarian food labelling, allergen declarations, and nutritional fortification mandates. |

| Consumer Trends | Growing demand for soy and grain-based veggie meals in fast food and retail. |

| Industry Adoption | Expansion in frozen foods, meal kits, and casual dining menus. |

| Supply Chain and Sourcing | Heavy reliance on processed soy and wheat-based protein sources. |

| Market Competition | Led by brands like Amy’s Kitchen, Gardein, and Quorn. |

| Market Growth Drivers | Driven by rising vegetarianism, convenience-focused meals, and demand for meat-free comfort food. |

| Sustainability and Environmental Impact | Early adoption of recyclable packaging and lower carbon footprint meal production. |

| Integration of Smart Technologies | Use of automated meal preparation for consistent portioning and quality. |

| Advancements in Equipment Design | Utilization of conventional cooking and freezing processes for veggie meals. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Implementation of stricter plant-based transparency guidelines, front-of-pack nutrition labelling, and carbon-neutral production standards. |

| Consumer Trends | Shift toward whole-ingredient-based meals with diverse protein sources like lentils, chickpeas, and mushrooms. |

| Industry Adoption | Entry into school nutrition programs, fitness-focused meal plans, and gourmet meal delivery services. |

| Supply Chain and Sourcing | Transition to regenerative agriculture, upcycled vegetable ingredients, and vertically integrated supply chains. |

| Market Competition | Entry of startups focusing on minimally processed veggie meals, whole-food-based options, and sustainable packaging. |

| Market Growth Drivers | Fueled by interest in gut-health-friendly meals, minimally processed whole-food options, and increased government incentives for plant-based innovation. |

| Sustainability and Environmental Impact | Expansion of carbon-neutral food processing, zero-waste meal production, and locally sourced ingredients. |

| Integration of Smart Technologies | Growth in AI-driven meal personalization, blockchain-based ingredient traceability, and smart cooking techniques for optimized flavor retention. |

| Advancements in Equipment Design | Development of high-moisture cooking techniques, hybrid steam-based preservation, and AI-enhanced texture optimization. |

The USA Veggie Meals market has grown as more people demand healthier, plant-based diets. Blue Apron and HelloFresh have added more vegetable-based meals to their offerings, and fast foods such as Sweetgreen and Chipotle offer more varied vegetable-based menu options. Retailers such as Whole Foods and Trader Joe's continually introduce new state-of-the-art veggie-based meal options that appeal to convenience-seekers as well as health-seekers.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.2% |

In the UK, consumers increasingly are ordering veggie dinners due to government-funded veggie campaigns and a huge rise in flexitarian diets. Retail giants Marks & Spencer and Tesco are introducing whole ranges of products centered on veggie dinners, with particular focus on lentil-based curries, plant-centered lasagnas, and ready-to-eat plant bowls. Greater consumer awareness about sustainable consumption and carbon footprints also is fueling demand growth for minimally processed, vegetable-sdominated meal solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.9% |

The strict European Union organic food law and sustainability legislation have had a significant impact in the Veggie Meals segment. German, French, and Dutch markets are seeing growth in demand for whole-food-based vegetarian meals with clear sourcing and clean labeling.

Healthy meal substitutes such as Mediterranean grain bowls and mushroom burgers are becoming increasingly sought after as European consumers are more and more concentrating on health, sustainability, and local sourcing.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.5% |

Japan's veggie meals market is changing as consumers move towards plant foods aligned with long traditions of eating habits. New dinner options involve the use of domestic ingredients such as tofu, seaweed, and fermented soybeans to create warm, comforting umami flavor profiles. Convenience store retailers such as FamilyMart and 7-Eleven are increasing ready-to-eat plant food dinner sales, and restaurants are adding plant-based versions of signature dishes such as ramen and donburi.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.7% |

South Korea is experiencing a Veggie Meals boom, especially in its convenience food and online ordering sectors. Bricks-and-mortar quick-growth companies are introducing plant-based meal solutions to K-food classics like bibimbap and kimchi stews. With the new health-conscious lifestyle and functional food demand taking hold, South Korean consumers increasingly rely on veggie-stuffed meals that highlight natural flavor and gut health benefits.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.4% |

| By Distribution Channel | Market Share (2025) |

|---|---|

| Supermarket/Hypermarket | 46% |

Supermarkets and hypermarkets are projected to hold 46% of the Veggie Meals market share by 2025. Walmart, Kroger, and Tesco have also increased their department of plant foods, such as additional veggie meals, thereby becoming highly available to flexitarian and vegetarian customers. Store sales have enhanced with a range of different products provided ranging from cauliflower meal bowls to mushroom burgers.

Convenience stores are also catching up, especially in city neighborhoods where grab-and-go health food is in great demand. Specialty stores serve the niched consumers who pay extra for organic and non-GMO veggie food.

| By Storage | Market Share (2025) |

|---|---|

| Refrigerated | 58% |

Refrigerated vegetable dishes will lead the market with 58% of total sales in 2025. Increased demand for fresh, lightly prepared, and ready-to-consume plant food has driven this category's growth. Refrigerated lentil patties, pea-protein stir-fries, and mushroom risottos, among others, are some best-selling items in this category which are highly desired by health-focused consumers seeking convenient yet healthy foods.

Shelf-stable vegetable foods, though present, find relatively small use in long-duration storage and emergency supplies. But with the growing popularity of refrigerated package meals and plant foods in pre-packaged, pre-trimmable packages on main-stream supermarket shelves has given consumers an alternative option for fresh products.

Growing demand from consumers for veggie and high-nutrient meal alternatives has driven the Veggie Meals market. Growing health awareness, sustainability, and improved food technology trends propel the market. The market is concentrating on taste, texture, and plant protein enrichment by plant proteins including pea, soy, and mycoprotein. Major players also increase frozen and ready-to-eat meal items to cater to the increasing flexitarian and vegan consumer base.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Beyond Meat, Inc. | 22-26% |

| Impossible Foods Inc. | 18-22% |

| Nestlé S.A. (Garden Gourmet) | 14-18% |

| Kellogg Company (MorningStar Farms) | 10-14% |

| Conagra Brands, Inc. (Gardein) | 6-10% |

| Other Companies (combined) | 12-16% |

| Company Name | Key Offerings/Activities |

|---|---|

| Beyond Meat | In 2024, launched high-protein, soy-free veggie bowls targeting fitness-conscious consumers. In 2025, expanded its production facility in Europe to meet global demand. |

| Impossible Foods | In 2024, introduced plant-based seafood alternatives for frozen meal options. In 2025, enhanced its heme technology to improve flavor authenticity. |

| Nestlé (Garden Gourmet) | In 2024, released microwaveable Veggie Meals kits with globally inspired flavors. In 2025, invested in precision fermentation for next-gen plant-based proteins. |

| Kellogg (MorningStar Farms) | In 2024, expanded its portfolio with kid-friendly veggie nuggets and pasta dishes. In 2025, introduced a subscription meal service for plant-based meal plans. |

| Conagra (Gardein) | In 2024, developed air-fryer-friendly veggie meals. In 2025, partnered with retailers to launch exclusive plant-based meal bundles. |

Key Company Insights

Beyond Meat (22-26%)

The leader in this scenario is Beyond Meat with its extensive list of vegetable-protein foods. Its emphasis on alternative proteins and international growth has made it one of the leaders ready-to-eat plant meal solution companies.

Impossible Foods (18-22%)

Impossible Foods is never behind, constantly building on its lead by driving beyond meat substitutes to plant-based fish and whole-meal packs. Its emphasis on heme-based technology offers maximum flavor realism and thus stands it in good stead as number-one among flexitarians.

Nestlé (Garden Gourmet) (14-18%)

Nestlé Garden Gourmet is a market leader in the United States and European market. Its focus on diverse flavor lines and sustainable protein sourcing positions it as a leader in the competition.

Kellogg (MorningStar Farms) (10-14%)

Kellogg's MorningStar Farms is a market leader in the United States, targeting families and health-oriented consumers. Its focus on convenient, child-friendly meal solutions solidifies its market leadership position.

Conagra (Gardein) (6-10%)

Gardein capitalizes on its background in frozen food to provide a range of vegetarian dinners. Its innovation in product texture and cooking process continues to win over new customers.

Other Key Players (12-16% Combined)

The overall market size for the veggie meals market was USD 4,720 million in 2025.

The veggie meals market is projected to reach USD 9,712 million by 2035.

The increasing health consciousness among consumers and the growing prevalence of veganism and vegetarianism are major drivers fueling the demand for veggie meals during the forecast period.

The top 5 countries driving the development of the veggie meals market are the United States, Germany, the United Kingdom, China, and Japan.

On the basis of meal type, the ready-to-eat meals segment is projected to hold a significant share over the forecast period, reflecting consumer preferences for convenience and time-saving options.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA