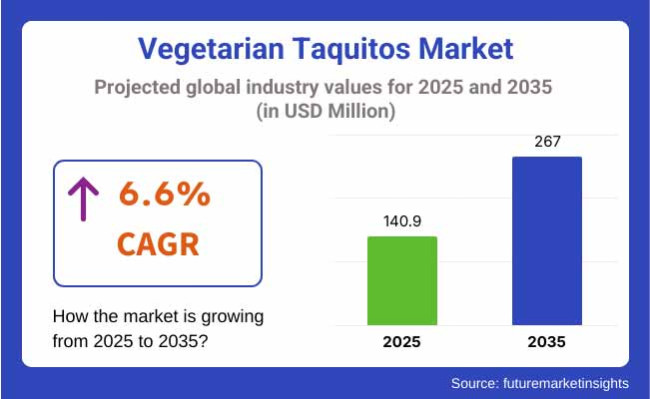

The vegetarian taquitos market is estimated to be worth USD 140.9 million in 2025 and is projected to reach a value of USD 267 million by 2035, expanding at a CAGR of 6.6% over the assessment period of 2025 to 2035.

The industry is currently riding the wave of high growth rate which is primarily being pushed by the higher rate of acceptance of plant-based diets and the growing demand for healthy and easy to cook frozen foods.

Vegetarian taquito that is made with ingredients that are beans, vegetables, and plant-based proteins, are having more demand in the marketplace since the consumers are looking for healthy options and the changes to the ingredients of traditional meat-based taquitos.

The primary push factor for this industry is the growing trend toward vegetarian and flexitarian diets. The number of households consuming less meat has been on the rise due to health, ethical, and environmental reasons, which, in turn, has led to the elevated demand for vegetarian ready-to-eat products. They are an easy and delicious snack or meal option that also fit in with this demand.

Though it is growing, the industry has some issues to deal with. One of the main obstacles is the rivalry from traditional meat-based taquitos which are normally sold at lower prices resulting from cheaper ingredient costs. Furthermore, the industry may at times encounter some consumers' reluctance to accept it in areas where meat-based varieties are more rooted in local food culture. Dealing with these problems will require the company to constantly update its product line through new flavors and ideas to reach more customers.

Despite the challenges the venture also provides numerous pitching areas for the expansion. Due to the increasing trend of interest in plant-based, allergen-free, and organic food products, vegetarian taquitos can be introduced in line with these evolving consumer preferences. Furthermore, the escalating stocks in both supermarkets and dining outlets assure a tremendous growth chance.

Some of the emerging patterns in the marketplace involve the introduction of premium options, which are made with special stuffing, like quinoa, lentils, and plant-based cheese. The boost in the demand for frozen and ready-to-cook meals is linked to the people wanting fewer prep, on-the-go meals. With the vegetarian food subgroup maintaining its positive trajectory, the industry is set for a relentless surge and the introduction of innovative products.

The industry is witnessing steady growth with the demand for veg snack food and ready meal increasing continuously. Manufacturers are interested in developing quality vegetarian taquitos with nutritious and flavorful fillings such as beans, vegetables, and plant protein so that they appeal to vegetarian and flexitarian customers as well.

Retailers, driven by demand, emphasize providing a range of vegetarian taquitos targeting health-conscious consumers who need convenient foods to eat, and which are plant-based. They carry products which are not just of good quality but reasonably priced to reach the mass market.

End users-primarily consumers-are looking for tasty, convenient, and affordable options. While quality and taste are key, they also desire inexpensive products that fit into their busy lifestyles. With growing popularity of plant-based and veg diets, the industry for veg taquitos continues to expand with increasing demand for healthier food and snack choices.

The below table gives an overview of the change in CAGR over six months of the base year (2024) and current year (2025) for the industry. This analysis uncovers the critical fluctuations of performance and shows the pattern of revenue realization-giving stakeholders a clearer sight on the annual growth trajectory. H1 is short for the first six months of the year, from January to June. H2, the latter half of the year, the months of July through December.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 6.1% |

| H2 (2024 to 2034) | 6.6% |

| H1 (2025 to 2035) | 6.3% |

| H2 (2025 to 2035) | 6.8% |

During the first half (H1) of the decade from 2024 to 2034, the industry is expected to grow at a CAGR of 6.1%, followed by a moderate increase to 6.6% in the second half (H2). Moving forward into the period from H1 2025 to H2 2035, the CAGR is anticipated to rise to 6.3% in the first half and maintain a steady momentum at 6.8% in the latter half. The industry observed a 20 BPS increase in H1, while H2 also increase 20 BPS.

From 2020 to 2024, the industry grew steadily owing to demand by consumers for plant-based food and rising demand for convenient high-protein food. Firms like Delimex and El Monterey broadened their meatless selections to encompass taquitos stuffed with plant-based proteins including soy-based meat substitutes, lentils and black beans. The meat-free and vegan crowd pushed the industry even further, while food manufacturers focused on clean-label ingredients and avoiding artificial additives. Grocery chains and food service providers such as Whole Foods Market and Trader Joe's began to offer frozen vegetarian taquito products to satisfy this newfound demand.

Then came air-fried taquito innovations and baked taquitos that let fried taquitos hit the aspirations of more health-conscious consumers seeking guilt-free indulgence. From 2025 to 2035, the vegetarian taquitos industry will narrow using veg protein functional elements innovation, including pea protein, quinoa and chickpea flour.

Global flavors will be tapped by brands as they introduce spices and ingredients characteristic of Latin American, Mediterranean, and Asian cuisine to cater to different tastes. Companies like Amy's Kitchen and Gardein already have begun mass-producing their ethnic-inspired vegetarian taquito products, and the potential for future developments will follow.

In addition, sustainability issues will further influence the industry, with firms using biodegradable packaging and carbon-free production techniques. Direct-to-consumer meal kit purchase with plant-based taquitos will become more trendy and continue to increase availability, compelling such products to be incorporated into mainstream meals even more.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Enabled by flexitarian and plant-based consumers in pursuit of convenient, protein-rich snacks. | Increased demand for high-protein, functional, and globally flavored veggie taquitos. |

| Launch of black bean, lentil, and soy-based fillings by brands like Delimex and El Monterey. | Vegetarian protein formulation with the incorporation of pea protein, quinoa, and chickpea flour to enhance flavor and texture. |

| Focus on reducing artificial ingredients and offering baked or air-fried taquito alternatives. | New recipes with high-fiber ingredients and enhanced nutrients to increase nutritional value. |

| Increased availability of organic, non-GMO products in top retailers. | Transition to biodegradable packaging and carbon-free production to fulfill sustainability objectives. |

| Growth in supermarket freezer aisles and online grocery stores such as Whole Foods Market. | Increased growth in direct-to-consumer meal kits and e-commerce channels for greater access. |

| Expanded retail visibility through large food chains adding vegetarian taquitos to their frozen foods section. | Expanded global industry availability with emphasis on plant-based street foods. |

The industry is witnessing an upward trajectory as consumer preference shifts towards more plant-based convenience foods. Even though the process is on the rise, it comes with various risks, such as challenges of ingredient sourcing, industry competition, and operational constraints. For an extended period, these will be navigated through only by effective decision-making. Combatting the industry is still another prominent point.

The plant-based snack smallholder boom has replaced the talk of the town with the battle for industry space. Apart from newcomers, established brands are also entering the plant-based snacks battleground with their own versions of vegetarian and vegan snack foods, thus putting the manufacturers under pressure to innovate. Only those businesses that will stress out their peculiar tastes, nutritional values, and recyclable packaging instead of plastic will be the ones to make it through a jostling industry.

Operational constraints, be it manufacturing scalability or distribution failures, can meddle with profits. Product line expansion due to companies venturing into new products can sometimes lead to increasing manufacturing costs, supply chain inefficiencies, or inconsistency in achieving set quality standards. On the other hand, the way forward might be through the application of reliable co-manufacturers, distribution network modifications, and utilizing technology for supply chain optimization.

Veg Filling - Dominating the Product Type Segment

| Segment | Value Share (2025) |

|---|---|

| Veg Filling(By Product Type) | 72% |

In 2025, mainly veg filling taquitos will drive the industry, which is estimated to be the industry leader with a share of 72%. Non-veg-filling taquitos will account for 28% of the industry share. In North America, the health risks associated with meat consumption, such as cardiovascular diseases, have created demand for plant-based products. The products are made with organic beans, plant proteins, and vegetables by brands like Amy's Kitchen and Gardenia Foods.

This transition can also be seen in Europe, where sustainability factors are driving this food choice. Companies like El Monterey and Don Miguel are making vegetarian taquitos incorporating locally sourced vegetables and plant-based proteins. In many traditional plant-based countries like India and China, the trend called flexitarian is opening doors for vegetarian offerings.

Like those made available by Tattooed Chef, other brands can provide interesting fillings for sweet potato-and-kale-style taquitos. Increased demand for vegetarian offerings is also evident in Latin America, where brands such as Don Miguel now offer a variety of vegetable fillings, including black beans and corn.

The growing popularity of non-vegetarian filling Taquitos relates directly to Latin America, where meat meals find deep cultural roots however, there will be a slow transition to vegetarian alternatives in the industry. Although companies such as Red's All Natural and Don Miguel continue to introduce their meat-filled offerings, there will undoubtedly be a seismic shift in the taquitos industry with the growth of demand for plant-based food.

Supermarkets - Leading Sales Channel

| Segment | Value Share (2025) |

|---|---|

| Supermarkets(By Sales Channel) | 48% |

In 2025, the industry is expected to be predominantly driven by sales through supermarkets & hypermarkets, which will capture 48% of the industry share, followed by convenience stores at 22%. Supermarkets and hypermarkets have expanded their product assortment and increased customer turnout over the years. It provides its grocery shoppers with easy and quick access to food items that may be frozen or packaged.

For example, major retail shops in North America, including Walmart and Costco, are taking advantage of increased demand for healthy and sustainable foods by expanding their offerings of plant-based foods. As part of a wider shift to health-conscious consumers, Walmart has made more vegetarian and vegan frozen products available, including frozen taquitos.

Tesco and Carrefour in Europe are similarly acting towards eco-conscious demand by providing more plant-based offerings. For instance, Tesco launched vegetarian taquitos filled with organic ingredients and locally sourced vegetables, as appealing healthy eating, sustainable trends have increasingly gained popularity.

For instance, Japan is now introducing frozen options in convenience stores like 7-Eleven, but Asian countries are now introducing plant-based innovation. In busy, health-conscious people's lives, the appeal for heat-and-eat meals is on the rise. This trend is beginning in India, where plant-based is a culture, and convenience stores such as Big Bazaar are populating their offerings with more vegetarian products as demand grows for meat-free foods.

While the industry owned by convenience stores is not so large, it is already trying to change itself to be in line with new consumer requirements. Chains such as Circle K and 7-Eleven are extending their frozen foods drawers with vegetarian taquitos, establishing themselves in the industry as credible sources of affordable, healthy meal options for busy, on-the-go eaters. These concepts prove that the world is slowly going plant based as a whole, and supermarkets, hypermarkets, and convenience stores are major contributors to meeting the demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.5% |

| UK | 5.8% |

| France | 5.4% |

| Germany | 5.6% |

| Italy | 4.9% |

| South Korea | 7.2% |

| Japan | 6.1% |

| China | 8.3% |

| Australia | 5.3% |

| New Zealand | 5% |

The USA industry is forecast to grow at a CAGR of 6.5% through the forecast period. Consumer demand for plant-based foods and the increased Hispanic population are fueling demand. There is a new introduction of taquito flavors and gluten-free products to reach a greater population.

Channels of food service and retailing are witnessing rising penetration of ready-to-eat and frozen options. Health awareness and demand for clean labels are also compelling firms to create organic and non-GMO alternatives. The availability of well-known plant-based food brands and strong marketing campaigns are also driving the industry growth.

The UK industry is anticipated to grow at a CAGR of 5.8% through the years 2025 to 2035. The increasing demand for flexitarian and vegan diets is also driving industry growth considerably. Food retailers are increasing shelf space for prepared and frozen plant-based snacks. Sales are being driven by the Mexican food craze along with high demand for ethically and sustainably sourced food products. Also driving sales are government campaigns towards eating plant-based and sustainability initiatives. Nationwide, the consumption is being driven by such campaigns and efforts.

The French industry is expected to grow at a CAGR of 5.4% during the forecast period. Health consciousness among consumers in France and the active reduction in meat consumption are fueling growth. Increased popularity of cuisines other than traditional French cuisine, such as Mexican cuisine, is contributing to the demand for plant-based foods. The players are emphasizing clean-label, high-quality products to cater to French consumers' needs. The growth of specialty vegan shops and plant-based food sections within conventional supermarkets is also driving the industry.

Germany's industry is expected to progress at a CAGR of 5.6% during 2025 to 2035. The nation has one of the most developed vegan and vegetarian food industries in Europe, with a strong focus on innovation. There is a growing demand for frozen vegetable foods, such as taquitos, by consumers as consumers need easy-to-eat meal options. The manufacturers are using protein-rich ingredients like soy and pea protein to develop healthier options. Online retailing is also fueling industry penetration with higher direct-to-consumer sales.

Italy is anticipated to post a CAGR of 4.9% in the industry during 2025 to 2035. While Italian traditional food is largely meat- and dairy-dominated, there is an emerging trend towards plant food. There is a specific interest among young people toward embracing vegan and vegetarian diets, contributing to the potential of new plant-based snacks.

Greater visibility for Mexican restaurants and frozen vegetarian taquitos available in grocery stores are also helping to drive industry growth. Customers demand quality and authentic tastes, and this has spurred manufacturers to develop products that consist of organic and locally sourced ingredients.

The industry in South Korea is anticipated to have a CAGR of 7.2% from 2025 to 2035. The growth of the industry is being driven by the very high penetration of plant-based food diets, which is being driven by health and the environment. Urbanization, boosted by the popularity of convenience foods and increasing interest in global cuisine, is also fueling demand for vegetarian taquitos.

Korean companies are driving demand for gluten-free, high-protein foods to reach healthy consumers. Online food-delivery companies and retail chains are dominating the effort to increase the availability and visibility of plant-based snack foods.

Japan's industry is expected to grow at 6.1% CAGR through the forecast period. Both domestically and globally, the trend towards plant food consumption is prevailing in the Japanese industry. Because of convenience-orientated food habits in Japan, frozen taquitos with vegetarian ingredients are a demand-driven item. Food manufacturers are adding traditional Japanese cuisine flavors to packaged foods to complement local consumer tastes.

Growing awareness of the advantages of lowering meat consumption, coupled with increasing numbers of launches of plant-based products, is propelling overall industry expansion. Convenience stores and supermarkets are expanding their plant-based product line, and vegetarian taquitos are becoming more widely available.

China is expected to achieve the highest CAGR of 8.3% during the forecast period of 2025 to 2035 in the industry. The demand for plant-based food is gaining momentum due to increased health consciousness and the environment. Young consumers are embracing flexitarianism, which is propelling the industry for vegetarian snacks. Internet channels are majorly fueling sales of frozen plant-based food, such as taquitos.

Large food corporations are engaging in research and development to launch new and protein-rich veg taquitos among Chinese consumers. Government efforts to promote plant-based foods for food security and sustainability are also propelling industry expansion.

Australian vegetable taquitos industry will grow at 5.3% CAGR during the forecast period. Australia boasts among the world's most rapidly emerging plant-based foods industries, led by enhanced health among consumers as well as consumer environmental awareness. Plant-based taquitos are now increasingly found in mainstream grocery retailers, besides being backed by domestic and foreign food companies.

More plant-based snack foods are coming into the food service industry, including quick-service restaurants. Customers want clean ingredient products, and manufacturers are meeting this with organic, non-GMO, and gluten-free options.

The New Zealand industry will increase at a CAGR of 5% from 2025 to 2035. New Zealand has a rich plant-based food culture, with a high percentage of vegetarians and flexitarians. There is growing demand for easy and frozen plant-based snacks, with plant-based products in stores on the rise. Small and medium-sized food businesses are introducing new vegetarian taquito types, employing sustainable and local ingredients. The sector also gains from additional plant-based trends and government incentives for plant-based alternatives.

The industry is witnessing stupendous growth as consumers orient themselves towards plant-based diets, subsequently looking for convenient snack alternatives that match their health and ethical choices. This, in turn, has put pressure on established players to strengthen competitive strategies by diversifying product portfolios, enhancing and expanding distribution networks, and implementing severe marketing efforts to obtain a bigger share of this exponentially increasing industry. Demand for plant-based snacks is growing, especially those that emulate the taste of classic comfort foods like taquitos, driven by an increase in flexitarians, vegetarians as well as health-conscious consumers.

Heavyweight frontiers, such as MorningStar Farms, Gardein, and Boca Foods, are established industry placers with established brands, offering a variety of vegetarian taquitos for various dietary preferences like gluten-free and high-protein. At the same time, companies like Daiya Foods and Planet Based Foods are packaging for the future with innovative twists on taste and alterations of sourcing ingredients to draw on a wider industry. The strong emphasis on the sustainable sourcing of ingredients, like plant-based proteins, also helps with brand differentiation and attracting consumer interest.

Competition is tightening as the industry continues to grow, as well as companies will have to balance maintaining the quality of products with innovative new offerings and strong marketing to stay ahead of competitors. Continued development into both retail and food service channels and strategic partnerships will be the keys to further industry penetration.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| MorningStar Farms | 22% |

| Gardein | 18% |

| Boca Foods | 14% |

| Daiya Foods | 10% |

| Planet Based Foods | 8% |

| Other Key Players | 28% |

| Company Name | Key Offerings/Activities |

|---|---|

| MorningStar Farms | Offers a variety of vegetarian taquitos, focusing on plant-based protein and gluten-free options. |

| Gardein | Known for its wide range of plant-based meat alternatives, including products with bold flavors. |

| Boca Foods | It specializes in vegetarian frozen meals and offers taquitos made from soy protein and other plant-based ingredients. |

| Daiya Foods | It focuses on dairy-free, gluten-free options and caters to customers with specific dietary restrictions. |

| Planet Based Foods | Provides high-protein, plant-based taquitos made from sustainable ingredients like pea protein. |

Key Company Insights

MorningStar Farms (22%)

Being a pioneer in the plant-based foods industry, MorningStar Farms today continues to dominate the vegetarian taquito space with many different flavors as well as varieties, including gluten-free and high-protein options, and its strong brand recognition, giving it an edge over the competition.

Gardein (18%)

Gardein boasts an array of vegetarian taquitos made from plant proteins with unique tastes and quality ingredients. To top it off, the diverse product line and environmental sustainability make Gardein one of the important players in the industry.

Boca Foods (14%)

A veteran in the industry for such frozen vegetarian food, Boca Foods produces taquitos from soy protein and plants. By housing their brand on value and quality, they have secured a fair share of the industry.

Daiya Foods (10%)

Daiya is one of the dominant suppliers in the vegetarian and dairy-free industry. Their products are made gluten-free and dairy-free for consumers with dietary restrictions. So, their angled industry approach is further solidified by a plant-based allergen-free food philosophy.

Planet Based Foods (8%)

Planet Based Foods is gaining traction with its high-protein, plant-based taquitos made using sustainable ingredients such as pea protein. Its current focus on sustainability and product innovation maximizes its differentiation in its area of competitiveness.

Other Key Players (28% Combined)

By product type, the industry is segmented into veg filling taquitos and non-veg filling taquitos

By sales channel, the industry is categorized into supermarkets & hypermarkets, convenience stores, online channels, and other retail outlets.

By type, the industry is divided into baked and fried.

By fillers, the industry is segmented into mushroom, spinach, potato, and bell pepper.

By tortilla, the industry is categorized into Black Bean, Rice, Wheat, and Corn.

By region, the industry is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan & Baltic Countries, Russia and Belarus, and the Middle East & Africa.

The market is expected to reach USD 140.9 million in 2025.

The market is projected to grow to USD 267 million by 2035.

China is expected to experience significant growth with an 8.3% CAGR during the forecast period.

The Veg Filling segment is one of the most popular categories in the market.

Leading companies include MorningStar Farms, Gardein, Boca Foods, Daiya Foods, Planet Based Foods, Amy's Kitchen, El Monterey, 365 by Whole Foods, Trader Joe's, and Alpha Foods.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Fillers, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Fillers, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Tortilla, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Tortilla, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Fillers, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Fillers, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Tortilla, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Tortilla, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Fillers, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Fillers, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Tortilla, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Tortilla, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Fillers, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Fillers, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Tortilla, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Tortilla, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 44: Asia Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Fillers, 2018 to 2033

Table 46: Asia Pacific Market Volume (Units) Forecast by Fillers, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Tortilla, 2018 to 2033

Table 48: Asia Pacific Market Volume (Units) Forecast by Tortilla, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 54: MEA Market Volume (Units) Forecast by Type, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Fillers, 2018 to 2033

Table 56: MEA Market Volume (Units) Forecast by Fillers, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Tortilla, 2018 to 2033

Table 58: MEA Market Volume (Units) Forecast by Tortilla, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: MEA Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Fillers, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Tortilla, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Fillers, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Fillers, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Fillers, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Fillers, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Tortilla, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Tortilla, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Tortilla, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Tortilla, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Fillers, 2023 to 2033

Figure 28: Global Market Attractiveness by Tortilla, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Fillers, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Tortilla, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Fillers, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Fillers, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Fillers, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Fillers, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Tortilla, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Tortilla, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Tortilla, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Tortilla, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Fillers, 2023 to 2033

Figure 58: North America Market Attractiveness by Tortilla, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Fillers, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Tortilla, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Fillers, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Fillers, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Fillers, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Fillers, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Tortilla, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Tortilla, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Tortilla, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Tortilla, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Fillers, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Tortilla, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Fillers, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Tortilla, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Fillers, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Fillers, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Fillers, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Fillers, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Tortilla, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Tortilla, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Tortilla, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Tortilla, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Europe Market Attractiveness by Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Fillers, 2023 to 2033

Figure 118: Europe Market Attractiveness by Tortilla, 2023 to 2033

Figure 119: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Fillers, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Tortilla, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Fillers, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Units) Analysis by Fillers, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Fillers, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Fillers, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Tortilla, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Units) Analysis by Tortilla, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Tortilla, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Tortilla, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Type, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Fillers, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Tortilla, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Fillers, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Tortilla, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 161: MEA Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Fillers, 2018 to 2033

Figure 165: MEA Market Volume (Units) Analysis by Fillers, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Fillers, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Fillers, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Tortilla, 2018 to 2033

Figure 169: MEA Market Volume (Units) Analysis by Tortilla, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Tortilla, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Tortilla, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: MEA Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: MEA Market Attractiveness by Type, 2023 to 2033

Figure 177: MEA Market Attractiveness by Fillers, 2023 to 2033

Figure 178: MEA Market Attractiveness by Tortilla, 2023 to 2033

Figure 179: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vegetarian Tacos Market Analysis by Non-Veg Filling, Veg Filling and Other Variants Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA