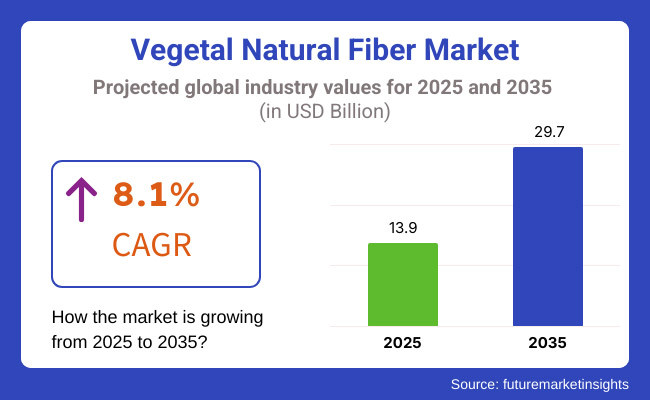

The global vegetal natural fibers market is set to witness USD 13.9 billion in 2025. The industry is expected to capture 8.1% CAGR from 2025 to 2035 and reach USD 29.7 billion by 2035.

The market growth can be credited to the significant demand for lightweight, biodegradable, and sustainable materials in the textile, construction, and automotive industries, as well as in the packaging sector. The natural fibers that are displacing nylon are cotton, flax, hemp, jute, coir, and ramie due to the increasing threat to the environment posed by the plastics, the introduction of stringent regulations on plastics, and the progress in fiber processing technology.

For instance, as an alternative to plastic bags, there is a greater use of jute-based packaging, on the contrary, clothing made from hemp is gaining popularity in ethical fashion. As well as increasing demand, the application of natural fiber composites in the automotive industry for the interior design, the insulation material and their use in biodegradable textiles is also a contributing factor to this sector's growth.

The shift toward bio-based fibers in garments, home textiles, and engineering composites is increasing per sustainability policies and the rise in consumer preference for ecological products. Countries that are banning the use of single plastics and backing the circular economy are accelerating the use of vegetable fibers in sectors like biodegradable packaging, and plant-based leather.

Also, the processing of fibers through enzymatic methods and nanocellulose extraction is remarkably enhancing water resistance, strength and antimicrobial properties of the fibers which are being expanded into the areas like medical textiles, automotive interiors, and sports apparel.

Explore FMI!

Book a free demo

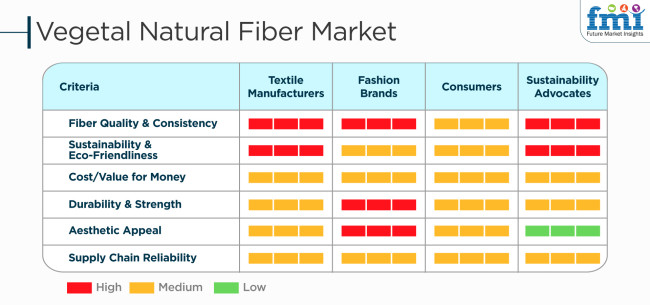

The vegetal natural fiber market is influenced by several factors that affect textile producers, fashion companies, consumers, and sustainability supporters. Fiber consistency and quality are of great concern to textile producers and fashion companies, as they ensure the production of high-quality materials. Sustainability and eco-friendliness are of great significance, especially to sustainability supporters and fashion companies, as the sector shifts towards greener options. Value for money and cost are a medium concern for all stakeholders, being balanced between affordability and quality.

Strength and durability are of great importance to textile producers and fashion companies whereas consumers rate it as of moderate importance. Consumers and fashion brands prioritize aesthetic value highly when it comes to determining purchasing decisions. Supply chain reliability is of medium priority to most stakeholders with sustainability groups placing lesser priority. Due to rising demand for sustainable fiber, the industry is evolving continually with a prime focus on innovation and improved fiber technologies.

During 2020 to 2024, vegetal natural fibers came into application in the textile, automotive, packaging, and construction industries. It was particularly due to environmental sustainability issues, circular economy, and biodegradable content replacing man-made fibers. As people became more aware of green products, this made them to use cotton, hemp, flax, jute, coir, sisal, and ramie fibers. In addition, anti-plastic pollution government initiatives encouraged the use of natural fiber-based composites and biodegradable packages. However, supply chain disruption, uneven quality of fiber, and processing capacity affected market stability.

During 2025 to 2035, the vegetal source natural fiber market will see revolutionary growth on the back of bio-based technologies, intelligent textile technologies, and carbon-neutral production of fibers. Fiber processing technology innovations, enzymatic treatment of fibers, and quality control with artificial intelligence will improve fiber attributes and increase their applications. Transition to regenerative agriculture for fiber crops and biodegradable automotive and packaging industry composites will further establish natural fibers as the cornerstone of sustainable production.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| EU plastic ban, circular economy policies, and sustainable textile regulations boosted demand for natural fibers in packaging and fashion. | Stricter carbon neutrality targets mandate low-impact fiber processing, biodegradable composites, and bio-circular production models. Governments incentivize regenerative fiber farming. |

| Rising consumer preference for organic cotton, hemp, and linen-based apparel. Major fashion brands introduced sustainable fiber-based collections. | Growth in smart natural textiles, including biodegradable performance fabrics and antimicrobial plant-based fibers. Expansion of closed-loop fiber recycling systems. |

| Increasing use of natural fiber-reinforced plastics (NFRPs) in lightweight vehicle interiors, door panels, and dashboards. | Advanced bio-composites with nanocellulose and lignin-based reinforcements enhance strength and thermal properties, replacing synthetic composites. |

| Initial adoption of low-water, low-chemical farming methods for fiber crops. Growth in biodegradable fiber-based packaging materials. | Zero-waste natural fiber processing and AI-optimized fiber farming become standard. Bio-based nanocoatings improve fiber durability in technical applications. |

| Innovations in enzyme-treated fibers for better softness and durability. Digital weaving and 3D fiber knitting optimized material use. | Smart vegetal fibers with embedded conductivity for wearables. Development of self-repairing, moisture-adaptive natural fiber materials. |

| Natural fibers like flax, hemp, and coir were used for thermal insulation and acoustic panels in eco-friendly buildings. | Expansion of biofiber composites in prefabricated construction materials. Development of fire-retardant vegetal fiber panels for sustainable architecture. |

| Growth fueled by sustainability mandates, rising eco-conscious consumerism, and plastic-free packaging initiatives. | Market expansion was driven by bioengineering, functional fiber modifications, and AI-integrated fiber processing for next-gen bio-based materials. |

The most significant risk factor in the market is the instability of the supply chain. The production of fibers like cotton, flax, hemp, jute, sisal, and coir mainly depends on the agricultural conditions which makes them very much depend upon the weather, soil quality and farming practices. Extreme weather events such as droughts or pest infestations may cause lower yields, supply shortages, and increased costs.

Competition from synthetic fibers like polyester, nylon, and acrylic remains a major complication. Synthetics are often cheaper, stronger, and more durable than the biotechnological alternatives. Companies in the vegetal fiber market should pivot by utilizing the high-performance, blended, or treated fibers which are developed by them and are able to meet the synthetic strains physical properties and besides sustain the environment.

Processing inefficiencies could also act as a barrier to market growth. The procurement of labor, energy, and water for the extraction and refinement of natural fibers is significant which in turn adds to the costs. Moreover, the irregular quality of fibers due to the fluctuations in the crop weather might cause end-product problems in standardization, thus demoting the manufacturers from this possibility.

Consumer demand trends have a major influence on the market. Even though biodegradables and eco-friendly products are becoming more and more wanted, natural fiber stakeholders have to make sure that their goods offer enough durability, affordability, and scalability in order to be a match for synthetic counterparts. Fluctuations in demand can be significantly influenced by fashion trends, construction materials, or automotive applications.

The pricing strategies utilized in the industry have to consider the volatility of agriculture, production costs, the demand for sustainability, and the competition from synthetic materials. Long-term profitability can only be achieved through the effective ecological balancing of cost-cutting and the value-adding efforts.

Value-based pricing is a viable choice for the higher-quality natural fibers like organic cotton, elite hemp, and specialty flax. Eco-friendly, high-quality fibers cost more through industries like luxury, sustainable home textile, and automotive parts. Marketing the sustainability and performance benefits of these fibers can justify higher pricing.

The widely used cost-plus pricing strategy ensures the total cost covering of raw material sourcing, processing, labor, transportation, and compliance along with a profit margin. However, the fluctuating costs of agriculture-based inputs makes companies cogitate on pricing strategies to cope with competition accordingly.

In price-sensitive areas such as mass-market textiles, ropes, mats, and nonwoven applications, competitive pricing is a must. Companies can gain industry share by setting prices in alignment with or slightly below those of their competitors whilst assuring their product differentiation through quality improvements or certifications.

The companies have to, however, grow gradually in the direction of sustainable pricing ideas after they have made a market breakthrough and mostly be operational to ensure their profitability.

Jute is the most used vegetal natural fiber with its immense volume of production, affordability, and extensive range of uses across various sectors. Jute dominates the industry for vegetal natural fibers in applications like packaging, textile, and agricultural use. Its high yield from areas such as India and Bangladesh, in addition to having low production prices, makes jute a desirable commodity for producers as well as users.

One of the most important reasons for the dominance of jute is its biodegradable and environmentally friendly nature, which fits in with the increasing global focus on sustainable and green products. With the increasing demand for plastic-free packaging solutions, jute is being used more and more in the manufacture of shopping bags, sacks, and ropes, especially in the packaging and agricultural industries. Its tensile strength, durability, and breathability also make it an ideal candidate for these uses.

Packaging materials are the largest end-use application for vegetal natural fibers because of the increased worldwide demand for environmentally friendly and biodegradable packaging. With environmental pressures mounting on plastic pollution, companies and consumers are looking increasingly for sustainable alternatives to traditional plastic packaging. Vegetal natural fibers such as jute, coir, and hemp possess superior attributes like strength, biodegradability, and breathability and are thus the perfect materials for making sacks, shopping bags, and packaging protection.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 10.2% |

| China | 9.6% |

| India | 8.7% |

Several industries, including clothing and packaging industries, are increasingly using sustainable, biodegradable, and eco-friendly materials; this drives the growth of the vegetal natural fiber market in Japan. The textile industry is making a big move toward sustainable fabrics like jute, hemp, flax, and bamboo due to the growing sustainable fashion movement.

Also, strict environmental regulations put into place by government urging the plastic reduction have doubled up the growth of vegetal fibers across biodegradable packaging & eco-friendly alternatives. As lightweight and long-lasting composites, natural fibers are also now being used in the automotive and construction industries. FMI anticipates Japan's industry to grow at 10.2% CAGR during the study period.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Natural & Plant-Based Preferences | There is increasing demand for sustainable, plant-based fibres across the textiles, packaging and other industries. |

| Sustainability Focus | The rise of biodegradable and eco-friendly fibres to minimize their damage on the environment. |

The industry for the vegetal natural fiber in China is growing due to the increasing use of eco-friendly, biodegradable, and sustainable materials in a variety of industries. Government policies encourage the protection of the environment which ultimately shifts toward natural fibers including hemp, flax, jute and bamboo.

The growing sustainable fashion industry is also fueling the demand for plant-based fibers, with consumers preferring organic and chemical-free apparel. Moreover, the stringent plastic reduction policies present in China promote the use of vegetal fibers for the manufacture of biodegradable packaging and industrial uses. FMI anticipates Chinese industry to grow at 9.6% CAGR during the study period.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Plant Based & Natural Preference | Increasing adoption of sustainable, plant-derived fiber in textile, packaging, and industrial applications. |

| Sustainability Focus | Rise in usage of biodegradable and renewable fibres to encourage eco-friendly lifestyle. |

Demand for sustainable, biodegradable, and eco-friendly materials across industries is driving the growth of the vegetal natural fiber market in India. Fibers from plants such as jute, coir, hemp, flax, and banana fiber are extensively used in textiles, packaging, and construction.

Through its efforts to limit plastic waste, the government has driven up the demand for plant-based fibers in biodegradable packaging. Moreover, the growth of sustainable fashion and home textiles are fueling demand for natural fibers. Further industry growth is being driven by technological advancements in fiber processing technologies and rising investments in R&D.

The Indian industry is expected to expand at 8.7% CAGR during the forecast period, according to FMI.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| Natural & Plant-Based Preference | The top ten threads or yarns are a result of the growing demand for mostly plant-based fibers, such as banana, hemp, flax, coir, and jute, in clothing and packaging. |

| Sustainability Focus | More use of biodegradable and eco-friendly fibres to lessen carbon footprint. |

The USA natural fiber vegetal market is growing on the back of an increasing appetite for eco-friendly, sustainable, and biodegradable materials in various sectors. The demand for hemp-based textiles is also growing due to the growth of sustainable fashion and home textiles with consumers shifting to natural fiber-based textiles. Moreover, stringent environmental regulations and plastic reduction initiatives are propelling the adoption of vegetal fibers in biodegradable packaging and industrial applications.

Natural fiber composites are already being used in construction and automotive sectors to create lightweight yet durable material. Rapid R&D progresses in fiber processing and the development of new materials also contribute to the growth of the industry.

Growth factors in USA

| Key Drivers | Details |

|---|---|

|

Natural & Plant-Based Preference |

Increasing consumer demand for sustainable and eco-friendly fibers in textiles, packing, and other industrial applications. |

| Sustainability Focus | Expansion of biodegradable and renewable fibers in order to minimize environmental effect |

Growth in the UK vegetal natural fiber market is due to an increasing demand for eco-friendly, biodegradable and sustainable materials in various industries. The sustainable fashion movement is encouraging natural fibers like hemp, flax and organic cotton for use in clothing and home textiles. The regulatory framework surrounding plastic reduction and carbon neutrality opened up the market to plant-based fibers in biodegradable packaging and industrial applications.

Vegetal fibers are also finding use in the construction and automotive sectors for lighter, more durable and energy-efficient materials. This is further aided by the introduction of fiber processing technologies.

Growth factors in UK

| Key Drivers | Details |

|---|---|

|

Natural & Plant-Based Preference |

Growing demand from consumers for the use of natural fibers such as hemp, flax, and organic cotton in textiles and packaging. |

| Sustainability Focus | Increased focus on bio-based and renewable fibers for less environmental harm. |

The industry is shaped by advancements in fiber extraction technology, increased adoption of technical textiles and composites, and regulatory support for biodegradable materials. Leading companies focus on fiber quality enhancement, circular economy initiatives, and expansion into bio-based industrial applications. Alliances between producers of fibers and packaging, automotive, and construction industries are promoting diversification of products and expansion of industry. Increased government support for biodegradable products also further enhances competition, with firms investing in green supply chains and advanced processing technologies.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Terre de Lin | 3-4% |

| Bast Fibre Technologies Inc. | 2-3% |

| Callin | 2-3% |

| J. Rettenmaier & Söhne GmbH | 2-3% |

| Safilin | 1-2% |

| Enkev B.V. | 1-2% |

| Norlin Flax | 1-2% |

| Other Companies (combined) | 85% |

| Company Name | Key Offerings/Activities |

|---|---|

| Terre de Lin | Leading global flax fiber supplier specializing in premium linen fibers for textiles, composites, and technical fabrics. |

| Bast Fibre Technologies Inc. | Develops hemp, flax, and jute fibers for nonwoven fabrics, filtration media, industrial reinforcement, and eco-friendly composites. |

| Callin | Produces high-quality flax fibers for luxury textiles, bio-based reinforcements, and natural fiber composites. |

| J. Rettenmaier & Söhne GmbH | Specializes in cellulose fibers from wood, hemp, and coir, catering to food, pharmaceuticals, and biodegradable material applications. |

| Safilin | Manufactures long-staple flax fibers for textiles, technical fabrics, and composite materials, emphasizing premium fiber quality. |

| Enkev B.V. | Develops natural fiber solutions from coir, flax, and wool, serving bedding, automotive, and packaging industries. |

| Norlin Flax | Processes European flax fibers, supplying textile-grade and industrial fiber blends for woven fabrics and sustainable composites. |

Terre de Lin

Terre de Lin is one of the world’s largest flax fiber producers, supplying high-performance linen fibers for fashion, home textiles, technical fabrics, and composites. The company integrates sustainable farming practices and advanced processing techniques, ensuring superior fiber durability and eco-friendly production.

Bast Fibre Technologies Inc.

Bast Fibre Technologies focuses on bast fibers from hemp, flax, and jute, catering to nonwoven textiles, filtration applications, and high-performance fiber reinforcements. The company specializes in chemical-free processing, ensuring its fibers meet biodegradable and high-strength standards for industrial and consumer apPlications.

Callin

Callin is a premium flax fiber producer known for luxury linen textiles, high-strength industrial reinforcements, and sustainable bio-composites. The company employs advanced retting and fiber refinement to enhance fiber moisture resistance, tensile strength, and elasticity.

J. Rettenmaier & Söhne GmbH

J. Rettenmaier & Söhne specializes in natural cellulose fiber production, offering wood-based and plant-derived fiber solutions for food, pharmaceuticals, packaging, and biocomposites. The company has expanded its global reach in biodegradable fiber markets, integrating sustainable processing methods.

Safilin

Safilin is a global leader in long-staple flax fibers, supplying textiles, technical fabrics, and lightweight composite materials. The company focuses on high-precision fiber spinning technology, ensuring breathable, durable, and moisture-resistant fibers for premium textile and industrial applications.

Enkev B.V.

Enkev specializes in natural fiber solutions, producing coir, flax, and wool-based materials for bedding, automotive, insulation, and sustainable packaging. The company’s low-impact material innovations are widely adopted in eco-friendly consumer and industrial applications.

Norlin Flax

Norlin Flax is a key global supplier of flax fiber, offering textile-grade and industrial fiber blends for woven fabrics, composites, and bio-based reinforcements. The company integrates eco-friendly fiber treatments to ensure high-performance and recyclable fiber solutions.

Other Key Players

The industry is set to hit USD 13.9 billion in 2025.

The industry is projected to reach USD 29.7 billion by 2035.

Key companies include

The products are widely used in packaging materials.

Japan, set to grow at 10.2% CAGR during the forecast period, is projected to witness fastest growth.

With respect to product type, the industry is classified into hemp, flax, jute, sisal, bamboo, and coir.

In terms of end use, the industry is segmented into technical textile, automotive industry, construction and building materials, packaging materials, oil and gas industry, and geotextiles.

In terms of region, the industry is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

Diamond Wire Market Size & Outlook 2025 to 2035

Thioesters Market Growth & Trends 2025 to 2035

The Self-Healing Materials Market is segmented by product, technology, and application from 2025 to 2035.

Polyurethane Foam Market Size & Trends 2025 to 2035

Polyurethane Adhesives Market Trends 2025 to 2035

Heat Resistant Glass Market Size & Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.