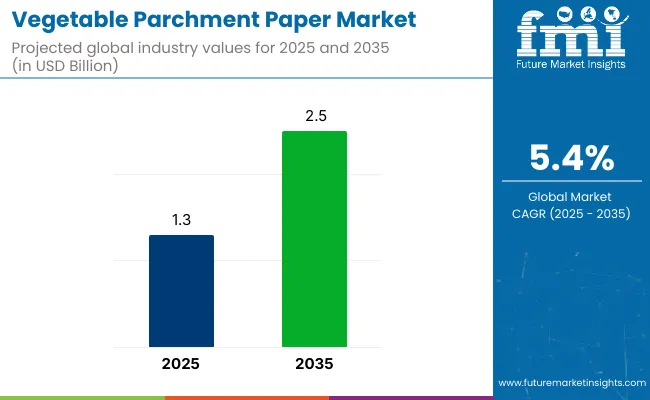

The global vegetable parchment paper market is projected to grow from USD 1.3 billion in 2025 to USD 2.5 billion by 2035, registering a CAGR of 5.4% over the forecast period. Sales in 2024 were recorded at USD 1.28 billion.

This growth is primarily attributed to the increasing demand for eco-friendly and biodegradable packaging solutions across various industries, including food and beverage, cosmetics, and pharmaceuticals. Vegetable parchment paper, made from cellulose fibers, offers a sustainable alternative to traditional plastic packaging, aligning with global efforts to reduce plastic waste and environmental pollution.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 1.3 billion |

| Projected Market Size in 2035 | USD 2.5 billion |

| CAGR (2025 to 2035) | 5.4% |

In May 2025, Ahlstrom, a global leader in fiber-based specialty materials, inaugurated its new parchmentizer, PMZ5, at its Saint-Séverin plant in France. This EUR 15 million investment underscores Ahlstrom’s commitment to sustainable innovation and customer collaboration.

The new parchmentizer enhances the company's capacity to produce vegetable parchment paper, catering to the growing demand for eco-friendly packaging solutions. "For our Saint-Séverin colleagues, this is a major milestone: Ahlstrom’s next step in growing our portfolio of solutions that are safe and sustainable by design. This is a great plant, with great people to match. We believe in you wholeheartedly, and that is why we are investing in Saint-Séverin’s growth," stated Helen Mets, Ahlstrom’s President and CEO at the inauguration.

Recent innovations in vegetable parchment paper have led to significant improvements in product functionality and customization. Manufacturers have focused on developing high-quality, secure, and durable packaging solutions that cater to the specific needs of various industries.

Advancements in processing technologies have enabled the production of visually appealing and intricate packaging designs, enhancing their aesthetic value. Additionally, the integration of eco-friendly materials and sustainable practices has improved the environmental footprint of vegetable parchment paper.

The vegetable parchment paper market is expected to witness significant growth in emerging economies, particularly in the Asia-Pacific region, due to rapid urbanization and increasing consumer awareness. Applications are expanding beyond traditional sectors, with growing adoption in personal care and industrial packaging. Manufacturers are anticipated to focus on developing cost-effective and versatile packaging solutions to cater to diverse consumer needs and comply with evolving environmental regulations

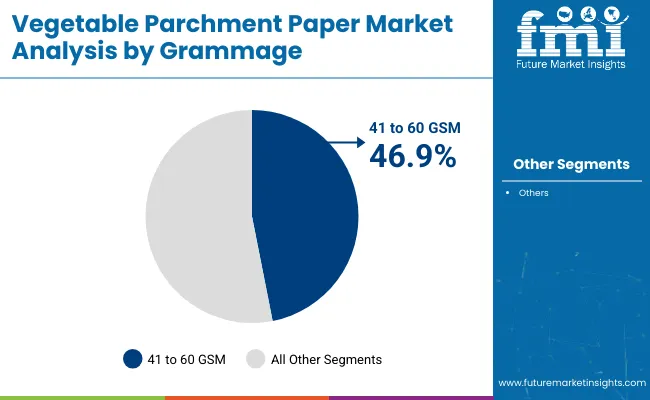

The market has been segmented based on basis weight, material, product type, and region. By basis weight, categories such as below 40 GSM, 41 to 60 GSM, and 61 to 80 GSM have been defined to support various end-use needs in food-grade wrapping and baking applications.

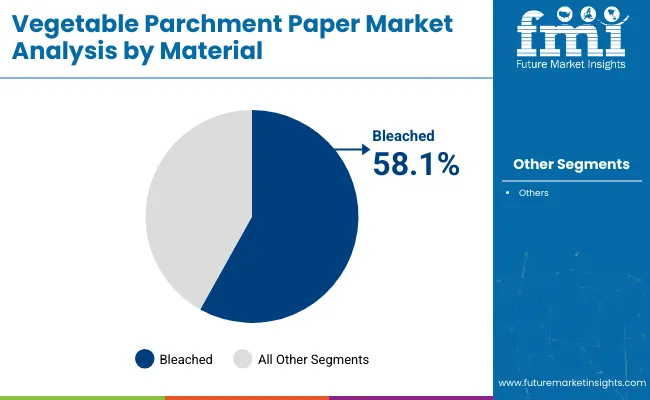

Materials including bleached and unbleached paper have been utilized to provide visual appeal, sustainability, and chemical-free alternatives for diverse customer preferences. Product types have been classified into plain vegetable parchment and siliconized vegetable parchment to meet requirements for grease resistance, moisture control, and surface performance.

Regional segmentation has been carried out across North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Oceania, and the Middle East & Africa to reflect demand variations and production trends globally.

The 41 to 60 GSM segment is expected to capture the largest share of 46.9% in the vegetable parchment paper market by 2025, as its selection has been supported by optimal thickness for baking, wrapping, and industrial use. This weight range has been widely adopted in food preparation where grease resistance, heat tolerance, and handling strength are required.

Sheets and rolls within this range have been preferred for automated cutting, folding, and lining operations. Demand has been reinforced across both domestic and commercial culinary sectors. Applications such as baking trays, deli wraps, and cheese interleaving have utilized this grade for performance consistency.

Ease of printing and embossing has been demonstrated for brand customization. Resistance to curling and tearing has made it suitable for high-speed packing lines. Continued usage has been projected as food processors maintain strict operational standards for packaging materials.

The bleached material segment is projected to account for 58.1% of the vegetable parchment paper market in 2025, as its use has been favored in foodservice and retail packaging requiring bright surfaces. High visual appeal and smooth finish have been leveraged for premium product presentation and labeling clarity. Bleached grades have been extensively deployed for bakery liners, confectionery wraps, and display packs. Strong opacity and uniform texture have supported clean cuts and folds during packaging.

Ink absorption and high-resolution printing have enabled its use in branded formats across supermarket and hospitality settings. Heat resistance and greaseproof properties have remained consistent across food-contact applications. Multi-layer wrapping and tray linings have been executed efficiently using bleached sheets. Market preference has remained high due to aesthetic uniformity and performance across both artisanal and industrial use cases.

Cost sensitivity, performance limitations, and raw material constraints impact scale.

As an expensive, multipurpose DIY option, vegetable parchment paper has yet to catch on in more budget-friendly or low-margin food segments. While good for grease and moisture resistance, it may not be as durable for heavy-duty use as foil or coated alternatives.

Pulp sourcing constraints, specifically for FSC-certified virgin fibers, and energy-intensive processing to reach parchmentization also lead to production bottlenecks. And, the knowledge of small-scale food businesses in developing areas is limited, resulting in less market penetration.

Eco-label certifications, premium food packaging, and industrial baking fuel demand.

There is a huge opportunity for vegetable parchment paper due to increasing demand for compostable and food-grade packaging in artisanal, organic, and ready-to-eat foods. Premise: Manufacturers producing recyclable or dual-use (bake-and-wrap) parchment sheets are appropriately positioned to gain share in premium food retail.

In the global marketplace, eco-label certifications (such as FSC, PEFC, and USDA Biobased) are becoming a very important differentiator. Food processors are also moving away from silicone-coated plastic liners to parchment-based solutions for the baking conveyor belts and packaging liners used in industrial ovens, creating high-volume, B2B opportunities.

Rapid industrialization in the USA along with the increasing use of factors like foodservice, bakery and packaging have aided the growth of the USA vegetable parchment paper market. Adoption in home and commercial kitchens is growing as consumers increasingly prefer non-stick, grease-resistant, and compostable baking solutions.

But first, the FDA has approved vegetable parchment for direct-food contact as being safe for omission under most circumstances, which supports its widespread use in organic and natural food packaging. Manufacturers are getting creative with chlorine-free, silicone-coated and multi-use parchment varieties. Growth is further buoyed by the rising sales of pre-cut sheets and rolls through e-commerce and specialty retail channels.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.7% |

The vegetable parchment paper market is fueled by a growing trend for eco-friendly and plastic-free food preparation products in the UK. There is high demand in artisanal bakeries, cafes and home kitchens looking for sustainable alternatives to waxed or plastic-coated papers.

The UK Plastic Packaging Tax and retailer-led green packaging commitments are propelling the transition to biodegradable parchment. Domestic brands are snarling unbleached and silicone-free varieties certified for compostability and food safety. Vegetable parchment is now available in reusable and resealable formats in premium lines of baking and cooking products.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.2% |

The EU vegetable parchment paper market is driving on the regulatory backing on food-grade, biodegradable, and recyclable packaging under the EU Green Deal and Circular Economy Action Plan. Parchment remains widely produced and consumed in Germany, France and Italy, for both household and industrial use in baking applications.

Vegetable parchment is favoured among EU food processors because of its thermal stability, non-stick function and low risk of chemical migration. Development of parchment laminates and printable formats for branding in baked goods packaging is another prominent factor pushing commercial sector gain in recent years.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.4% |

The Japan vegetable parchment paper market is progressing; with the increase in interest for traditional and fusion baking, food gifting, and convenience cooking. The product is well-suited for use in home kitchens and bakeries for its grease resistance, moisture stability, and clean release properties.

The Ministry of Health, Labour and Welfare promotes the use of food contact safe, low-emission paper product. From patterned to microwave-friendly, domestic brands are even releasing pre-cut parchment papers for packaged meals, pastries and bentos. Consumer interest in zero-waste lifestyles also lends support to compostable parchment formats.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.1% |

Demand for vegetable parchment paper is surging in South Korea on increased home baking trends, ready-to-eat food packaging, and eco-conscious consumption. A staple in oven cooking, air-fryer meals and café dessert preparation, parchment paper is popular for being hygienic, non-toxic and easy to use.

Chlorine-free and PFAS-free parchment adoption is also capitalizing on government regulations that encourage biodegradable and food-safe packaging. Heat-sealable and embossed parchment versions are being launched by Korean manufacturers for bakery chains, patisseries and gourmet food brands. E-commerce platforms are leading to greater sales across urban consumers and DIY cooking communities.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.6% |

Demand for vegetable parchment paper is getting driven by their widely used applications in food processing, bakery applications and sustainable packaging which help to drive steady growth in the vegetable parchment paper market. Vegetable parchment paper is grease-resistant, biodegradable, and heat-resistant, which makes it perfect for baking, wrapping, and separating food products.

Its adoption is being propelled by surging consumer demand for sustainable single-use kitchenware as well as the growing artisanal bakery markets worldwide. Manufacturers are focusing on unbleached, chlorine-free, and silicone-coated parchment paper types for home use as industrial and regulatory standards trend towards plastic alternatives and compostable materials.

The overall market size for the vegetable parchment paper market was approximately USD 1.3 billion in 2025.

The vegetable parchment paper market is expected to reach approximately USD 2.5 billion by 2035.

The demand for vegetable parchment paper is rising due to increasing consumer preference for sustainable and biodegradable packaging solutions, especially in the food industry. The growing popularity of home baking and the need for grease-resistant, heat-resistant, and non-stick packaging materials are further fueling market growth.

The top 5 countries driving the development of the vegetable parchment paper market are the United States, China, Germany, India, and Japan.

Unbleached parchment and bakery applications are expected to command significant shares over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vegetable Glycerin Market Size and Share Forecast Outlook 2025 to 2035

Vegetable Seed Market Size and Share Forecast Outlook 2025 to 2035

Vegetable Sugar Market Size and Share Forecast Outlook 2025 to 2035

Vegetable Shortening Market Trends and Forecast 2025 to 2035

Vegetable Dicing Machines Market Growth – Food Processing Efficiency 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Vegetable Powders Market Insights - Growth & Functional Benefits 2025 to 2035

Vegetable Concentrates Market Growth - Nutrient-Dense Foods & Industry Demand 2025 to 2035

Vegetable Sorting Machine Market Analysis by Processing Capacity, Technology, Operation Type, Vegetable Type, and Region Through 2035

Vegetable Waste Products Market

IQF Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Fresh Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Frozen Vegetable Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Brined Vegetable Market Analysis by Nature, Type, End-use, Distribution Channel and Region through 2035

Savory Vegetable Flavours Market Insights - Applications & Industry Growth 2025 to 2035

Canned Vegetable Market Growth – Preservation & Industry Demand 2024-2034

Textured Vegetable Protein Market Size and Share Forecast Outlook 2025 to 2035

Upcycled Vegetable Snacks Market Size and Share Forecast Outlook 2025 to 2035

Fruit And Vegetable Juice Market Size and Share Forecast Outlook 2025 to 2035

Fruit and Vegetable Ingredient Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA