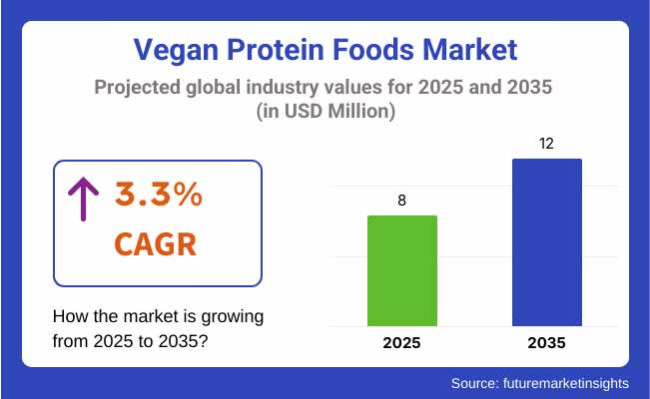

The global vegan protein foods market is projected to grow steadily, with an estimated industry size of USD 8 million in 2025 and a projected value of USD 12 million by 2035, reflecting a CAGR of 3.3%. Increasing demand for plant-based protein sources is driving sales expansion across various food segments.

The industry is witnessing remarkable expansion, primarily due to the heightened awareness of plant-based diets, the issue of sustainability, and the trend of health-conscious eating habits among consumers. The growing number of individuals enrolling in vegan or plant-based lifestyles has led to an accelerated rate of growth in the sector that offers vegan protein foods covering a wide range of food categories.

A key factor supporting growth is the increasing trend of veganism and flexitarian eating. More and more consumers are turning to plant-based sources of protein as they become aware of the negative effects of animal farming on the environment alongside the health benefits from the consumption of plant-based products.

Vegan protein foods, including legumes, soy, peas, and quinoa, can serve as the main sources of protein, are lower in saturated fat, and, thus, increase the attractiveness to health-oriented consumers.

The emergence of vegan and plant-based meat sub-products like vegan burgers and sausages shows good sales. In addition, few plant-based protein materials are known to have a less appealing flavor and texture with respect to their animal-based alternatives, which might be the reason for declining interest in the general consumer group.

The industry is brimming with growth opportunities, particularly where customers are increasingly intent on health and sustainability. The rise of the knowledge about the advantages of plant-based diets has led to support innovation in high-protein vegan products, including, for instance, protein-rich powders, bars, and ready-to-eat meals. They are for those who opt for an active lifestyle, want to add power to the protein, and are available to eat healthy foods fast.

The Vegan Protein Foods Market is growing rapidly as more consumers are moving towards plant-based eating for health, ethical, and environmental motivations. Companies in this category focus on product quality and ingredient sourcing to formulate plant-based proteins that provide taste, texture, and nutrition similar to conventional protein sources.

Distributors stress reliability and cost of supply as plant-based protein ingredients can be costly and require specialized logistics. Maintaining a steady supply of raw materials and finished products is necessary in order to respond to increasing demand from consumers while offering competitive prices.

End users, or the consumers themselves, value taste, texture, and price when choosing vegan protein foods. While ingredient sourcing and sustainability are important to many, their top priority is still convenience, health, and filling plant-based protein sources. With plant-based diets gaining mainstream traction, the salesof vegan protein foods continue to expand, fueled by innovation and demand.

The vegan protein food market has seen strong growth from 2020 through 2024 due to increased use of plant-based food systems, a rising sense of health consciousness, and sustainability awareness. There has been a high demand for plant protein-based food due to consumer enthusiasm for plant-derived protein as compared to protein-rich food based on animals.

There is high demand for proteins made from soy, pea, rice, hemp, and chickpeas. The growth of vegan protein food across different categories, such as meat alternatives, dairy alternatives, protein bars, and meal replacements, has driven sales expansion.

Food companies have pushed the limits of texture, flavor, and nutrient density to create vegan protein products that appeal to mainstream customers. Flexitarianism and consumer awareness have made companies highlight clean-label and organic foods.

From 2025 to 2035, the vegan protein food market will be transformed by improvements in protein extraction, fermentation technology, and novel protein sources such as mycoprotein and insect proteins (for non-vegan hybrid products). High-protein functional foods, including protein-fortified snacks, drinks, and ready-to-eat foods, will be in demand because consumers will seek convenient forms of nutrition.

Cellular agriculture and precision fermentation will provide greater protein quality and digestibility, decreasing dependence on conventional plant protein sources. Regenerative farming practices, carbon-zero manufacturing, and sustainable packaging will be the luxury features for brands.

There will be regional diversification, with more acceptance of vegan protein foods across Asia-Pacific, Latin America, and the Middle East, developing on top of its traditionally dominant position in North America and Europe.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 Trends | 2025 to 2035 Projections |

|---|---|

| Growing consumer demand for plant-based diets and sustainability | Progress in protein extraction and fermentation processes |

| Soy, pea, rice, hemp, chickpea proteins | Mycoprotein , precision-fermented protein, new plant sources |

| Premium demand for high-protein, organic, non-GMO alternatives | Growing interest in functional, gut-friendly protein |

| Meat alternatives, milk alternatives, protein bars | Industry growth in high-protein snack foods, drinks, RTD meals |

| Enhanced texturization for meat substitutes | Advancements in precision fermentation and cellular agriculture |

| Plant-based protein as a sustainable substitute for meat | Carbon-neutral production and regenerative agricultural practices |

| Increased cost of plant proteins, enhancement in taste and texture | Availability of alternative proteins at scale and price competitiveness |

| Stronger base in North America and Europe | Expansion in Asia-Pacific, Latin America, and the Middle East |

| New entry of vegan food brands and investment in R&D | Strategic alliances and acquisitions to increase product offerings |

Radical changes can happen in consumer tastes toward plant-based food. Despite this fact, it comes with a number of risks about which it can grow, including sourcing ingredients, consumer perception and demand fluctuations, industry competition, and the lack of technology in the product development process. Stressing and working on those risks should be the priority in the long run.

One of the major issues is the unpredictable nature of ingredient sourcing. Plant protein products such as pea protein, soy, lentils, and mycoprotein rely immensely on agricultural factors. Climate change, supply chain problems, and trade rules can influence these factors.

The unavailability of ingredients will definitely increase production costs due to price volatility and will cause a decrease in production stability. Companies can use risk diversification to develop the supplier network, invest in vertical farms, and look for other protein sources.

The competitive environment is an additional burden. The competition is cut-throat, with both established food companies and newcomers vying for the same fleeting industry prospects, which are branding, shelf space, and customer loyalty. As a result, smaller companies might become the victim of a price war that will lead to lowered profits.

A company can separate itself from others if it focuses on the promotion of its unique values, such as organic materials, transparent labels, fortifying with required amino acids, or catering to personalized nutrition designed for small groups.

Several of the challenges are related to technology in the product development processes. Reaching the desirable plant-based proteins involves sophisticated food science technology such as fermentation, precision fermentation, and extrusion technology.

On the contrary, these technologies can be costly, and small and mid-sized enterprises may not have the means to buy them. Cooperating with research and development firms and biotech firms through shared manufacturing, funding, and collaborative projects can help overcome these challenges.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.1% |

| UK | 7.4% |

| France | 6.8% |

| Germany | 7.0% |

| Italy | 6.5% |

| South Korea | 8.5% |

| Japan | 6.2% |

| China | 9.3% |

| Australia | 7.1% |

| New Zealand | 6.9% |

The USA ranks as one of the prominent producers of vegan protein food, with a forecasted CAGR of 8.1% in 2025 to 2035. The nation's robust growth is propelled by rising health awareness, a trend towards sustainable food products, and growing investment in plant-based food technology.

Fast-food chains and big-box stores are increasing their sales of vegan products, supporting the growth. Also, key plant-based protein producers such as Beyond Meat and Impossible Foods are propelling product development and consumer appetite.

The UK vegan protein food market is expected to expand at a CAGR of 7.4% between 2025 and 2035. The UK government's efforts towards promoting plant-based diets and lowering meat consumption align with consumers' desire for sustainable and responsible food.

Restaurants and supermarkets are also growing plant-based foods and food technology developments are enhancing the quantity and quality of vegan protein foods. High demand for substitute protein sources such as pea, soy, and hemp food products also enhances growth.

The French vegan protein food market is expected to register a CAGR of 6.8% over the forecast period. Although the nation has a robust meat- and dairy-based cooking culture, there is emerging plant-based eating behavior. The younger generation, especially in cities, is embracing flexitarian and vegan diets, spurring demand for plant-based protein substitutes. Government policies and programs encouraging plant-based consumption by schools and public institutions facilitate growth.

Germany is also predicted to register a 7.0% CAGR from 2025 to 2035 in its vegan protein food market. Germany is at the forefront when it comes to vegan innovation, and there are high levels of launches of vegan foods and new firms with new protein sources. High consumer interest in plant-based nutrition, along with government policies promoting sustainability, supports growth. German food companies continue to introduce diversified plant-based proteins like soy-based meat, algae, and insect protein.

The Italian vegan protein food market will have a CAGR of 6.5% during the forecast period. Meat and cheese consumption is traditionally well-liked by Italians, but plant-based consumption is becoming popular among consumers, particularly the younger generation. The growing use of vegan meat, pasta, and cheese is affecting the industry. Media and campaign awareness about sustainability are also altering dietary patterns.

South Korea is anticipated to show one of the highest sales growth rates of vegan protein food at a CAGR of 8.5%. The region developed as a result of increased awareness regarding health-related benefits linked with plant-based nutrition and a strong attraction to Western food trends.

Growth is supported by the easy availability of upcoming innovative plant-based brands and merging with global players in the sector. The increasing trend in flexitarianism combined with government-supported programs for sustainable food production continues to keep the growing demand for plant protein food strong.

Japan is expected to expand at a CAGR of 6.2% during 2025 to 2035. Despite the nation's historically fish- and meat-dominated diet, there is an increasing preference for plant-based food, driven especially by young people. Plant-based meat substitutes are being invested in by large corporations as well as small companies, tapping into Japan's technological prowess to develop new sources of protein. The increasing availability of soy-based and fermented plant proteins is altering consumer patterns.

China is also expected to take the lead with the highest CAGR among the chosen countries at 9.3% for the forecast period. The middle class of the country is increasing very fast, and the rising need for food sustainability and food security is fuelling demand for plant-based protein food.

The government's encouragement of a plant-based diet and significant investment in alternative protein is also propelling strong growth. Domestic and overseas players in China are increasing their presence in the country's plant-based dairy and meat industry at a fast rate.

Australia is expected to grow at a CAGR of 7.1% during the period 2025 to 2035. The nation has a strong-established plant-based food industry coupled with a high level of consumer awareness of the advantages of vegan diets. Increased demand for plant proteins like peas, chickpeas, and soy is underpinned by a growing chain of restaurants and retailers serving vegan food. Health concerns and concerns regarding sustainability are major drivers.

New Zealand will record a CAGR of 6.9% during the forecast period. People are turning to plant-based food in the country, especially due to the sustainable food and agricultural tech innovation urged by the government. Growth in the plant-based protein industry is being fueled by the use of New Zealand's fertile agrarian resources for the production of high-quality plant-based proteins, thus further fueling the sales

| Segment | Value Share (2025) |

|---|---|

| Soy Protein (Product Type) | 45% |

Soy protein is anticipated to lead the vegan protein foods market in 2025, commanding a 45% share, while wheat protein will follow with a 30% share.

Soy protein is leading this segment majorly because of its high protein content, complete amino acid profile, and wide applications in plant-based meat, dairy alternatives, and protein supplements. Due to its functional properties, soy protein is used by leading brands such as Beyond Meat, Impossible Foods, and Danone (Alpro) to improve the texture and nutritional value of their products.

In the Vegan food circuit, soy protein is preferred as it mimics the texture and taste of animal protein and is rich in nutrients. The demand for soy protein alternatives is still higher in North America and Europe, where consumers seek high-protein plant alternatives.

Wheat protein holds 30% of the revenue share and is steadily gaining acceptance due to its functional properties in the meat and bakery sectors. Wheat protein is used to make seitan, and brands such as Upton's Naturals and Tofurky use it to create products with a meat-like texture for vegan-friendly cuisines.

Demand for wheat protein has been prominent in Asian and European markets, where wheat-based meat alternatives have traditionally become a staple. The demand for high-protein vegan food products with clean-label ingredients is thus driving the growth in this segment.

Soy protein continues to remain the leading segment. However, the growth of wheat proteins has been seen in the changing consumer demand for diverse plant sources of proteins. The continuous innovation trend in plant proteins will, therefore, spur growth.

| Segment | Value Share (2025) |

|---|---|

| Protein Concentrates (Form) | 39% |

In 2025, the Vegan Protein Foods Market will be dominated by Concentrates, holding 39% of the total share, followed by Isolates at 36%.

Protein concentrates compete with a more balanced average protein content, low pricing, and wide applicability in plant-based dairy, meat substitutes, and protein supplements. Importance is given to. However, the retention of its nutrients and fiber makes it the first consideration of functional food manufacturers.

The protein concentrates are supplied to brands engaged in vegan-friendly nutrition supplements, energy bars, and plant-based beverages by such companies as Cargill, Axiom Foods, and ADM. Affordable high-protein items have always been a significant growth driver for this segment.

Isolates, which account for 36% share, are mainly applied in high-protein vegan products because they have much better purity and digestibility than other sources. They have a higher protein percentage than concentrates, which causes their popularity in making protein powders and specialized plant-based diets.

MyProtein, Vega, and Orgain are some brands that use soy, pea, and wheat protein isolates to formulate their products to give high-performance protein sources to consumers. Demand for isolates is thriving among fitness enthusiasts and consumers pursuing low-carb as well as hypoallergenic categories of proteins.

Concentrates would still be the most cost-effective and widely applicable segment, while types of isolates are rapidly being integrated into higher grades of nutritional and sports supplement products. Therefore, more innovations based on plant protein would lead to moderate, steady growth relative to the development of the two segments in the years to come.

The industry is highly competitive, with major players putting a lot of money into innovating their products and alternative protein sources with massive production capabilities to secure their ground. Major established players, including ADM, Cargill, Roquette, Beyond Meat, and Impossible Foods, are currently leading advances in protein extraction, hybrid formulations, as well as fermentation-based technologies, which are aimed at meeting the increasing demand for high-quality plant proteins.

New ideas in the sources of proteins can differentiate offerings. Companies are exploring formulations based on pea, soy, rice, fava bean, chickpea, and mycoprotein to improve nutritional profiles, texture, and functionality. ADM and Cargill are busy trying to build out their plant protein offerings, with Roquette focusing on pea protein innovation for dairy and meat alternatives. Impossible Foods and Beyond Meat are creating 'meat-like' textures and flavors via fermentation and bioengineering.

Such competition is invariably based on sustainability and clean-label ingredients, with most brands emphasizing organic, non-GMO, and allergen-free sources of protein. Cargill and ADM have opened their coffers towards investments in carbon-neutral and regenerative agriculture initiatives as Beyond Meat and Impossible Foods push their eco-friendly models of lab-based protein production.

Strategic partnerships and distribution expansions are crucial routes through which penetration would be achieved. Companies partner with food service chains, grocery retailers, and even e-commerce platforms to open new access points. Impossible Foods and Beyond Meat have made headway with quick-service restaurants, while Roquette and Ingredion have strengthened their B2B supply chains for food manufacturers.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Beyond Meat | 18-22% |

| Impossible Foods | 15-18% |

| ADM (Archer Daniels Midland) | 12-16% |

| Cargill, Inc. | 10-14% |

| Roquette Frères | 8-12% |

| Other Companies (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Beyond Meat | Plant-based meat alternatives (beef, sausage, chicken) with proprietary pea and rice protein formulations. |

| Impossible Foods | Soy and heme -based meat substitutes with advanced protein texturization . |

| ADM | Large-scale supplier of pea, soy, and wheat proteins for food manufacturers. |

| Cargill | Focus on plant-based protein supply, including pea, soy, and novel fermentation proteins. |

| Roquette | It specializes in pea protein isolates and caters to meat, dairy, and bakery applications. |

Key Company Insights

Beyond Meat (18-22%)

Leading in the plant-based meat segment, with a strong presence in retail and food service partnerships.

Impossible Foods (15-18%)

Innovating with heme-based proteins, expanding into global markets and alternative seafood.

ADM (12-16%)

A top supplier of plant-based proteins, focusing on supply chain scalability.

Cargill (10-14%)

Investing in fermentation-based proteins, targeting mass-market food brands.

Roquette (8-12%)

Dominant in pea protein, expanding into functional protein applications for dairy and bakery products.

Other Key Players (30-40% Combined)

The segmentation is into Soy Protein, Wheat Protein, and Pea Protein.

The segmentation is into Isolates, Concentrates, and Hydrolysates.

The segmentation is into Organic and Conventional.

The segmentation is into Nutritional Products, Bakery Items, Snacks and Cereals, Dairy Alternatives, Confectionery and Desserts, Convenience Foods, Beverages, and Animal Feed.

The segmentation is into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan & Baltic Countries, Russia and Belarus, and the Middle East & Africa.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Source, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Application, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Application, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 34: Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 36: Europe Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Europe Market Volume (MT) Forecast by Application, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Europe Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 44: Asia Pacific Market Volume (MT) Forecast by Source, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 46: Asia Pacific Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Asia Pacific Market Volume (MT) Forecast by Application, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 50: Asia Pacific Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 54: MEA Market Volume (MT) Forecast by Source, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 56: MEA Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 58: MEA Market Volume (MT) Forecast by Application, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 60: MEA Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Nature, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 11: Global Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 15: Global Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 19: Global Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 23: Global Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Source, 2023 to 2033

Figure 27: Global Market Attractiveness by Nature, 2023 to 2033

Figure 28: Global Market Attractiveness by Application, 2023 to 2033

Figure 29: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 41: North America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 45: North America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: North America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 53: North America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Source, 2023 to 2033

Figure 57: North America Market Attractiveness by Nature, 2023 to 2033

Figure 58: North America Market Attractiveness by Application, 2023 to 2033

Figure 59: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 101: Europe Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 105: Europe Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 109: Europe Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 113: Europe Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 116: Europe Market Attractiveness by Source, 2023 to 2033

Figure 117: Europe Market Attractiveness by Nature, 2023 to 2033

Figure 118: Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Nature, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 131: Asia Pacific Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 135: Asia Pacific Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Asia Pacific Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 143: Asia Pacific Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Source, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Nature, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Source, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Nature, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 161: MEA Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 165: MEA Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 169: MEA Market Volume (MT) Analysis by Application, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 173: MEA Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 176: MEA Market Attractiveness by Source, 2023 to 2033

Figure 177: MEA Market Attractiveness by Nature, 2023 to 2033

Figure 178: MEA Market Attractiveness by Application, 2023 to 2033

Figure 179: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

The industry is expected to reach USD 8 million in 2025.

The market is projected to grow to USD 12 million by 2035.

China is expected to experience significant growth with a 9.3% CAGR during the forecast period.

The Soy Protein segment is one of the most popular categories in the market.

Leading companies include Beyond Meat, Impossible Foods, ADM (Archer Daniels Midland), Cargill, Inc., Roquette Frères, DuPont (IFF), Kerry Group, Glanbia plc, Nestlé (Garden Gourmet & Sweet Earth), The Hain Celestial Group (Linda McCartney Foods & Yves Veggie Cuisine), SunOpta Inc., and Burcon NutraScience Corporation.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.