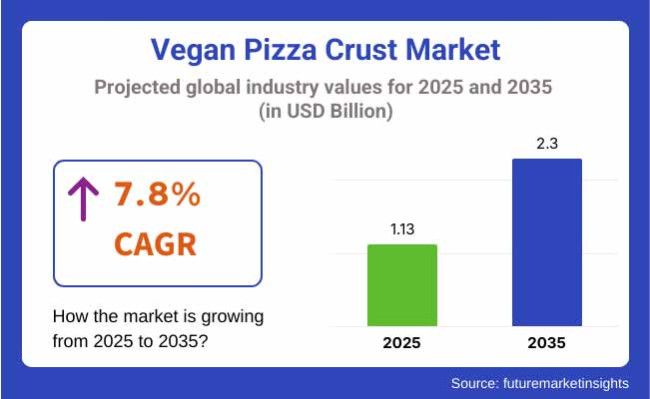

The vegan pizza crust market is projected to be valued at USD 1.13 billion in 2025 and is expected to reach USD 2.3 billion by 2035, expanding at a CAGR of 7.8% during the forecast period.The industry is growing at rapid pace which is due to the factors of increasing consumer demand for plant-based and gluten-free, as well as healthier than traditional pizza crusts.

As individuals switch to vegan and plant-based diets for health, ethical, and environmental reasons, the demand for vegan pizza crusts, which are made without animal-derived ingredients, is growing at a steady pace across the food sector.

The growing popularity of veganism and the increasing number of flexitarians who are looking to cut their meat and dairy consumption are the most important forces behind this industry. Vegan pizza crusts are a good example of such a trend that is becoming popular because they have a delicious and easy option for people who do not want to compromise with their decisions about the food they eat.

In addition to that, more and more people are becoming aware of gluten intolerance and celiac disease, which has also led to the rise of gluten-free options, thus making the industry even more potential.

The industry still holds a good number of opportunities. The surge for healthier and plant-based options is making the pizza industry find new innovations through the proposals of the crusts. Industry trends are the expansion of the premium collection and the introduction of frozen vegan pizza crusts for increased convenience.

Moreover, with sustainability a top priority among consumers, eco-friendly packaging and the use of locally sourced organic materials are rising their way into the limelight. Against this backdrop, the industry is characterized by high growth, with plenty of options catered to dietary requirements.

The industry has experienced a growth in demand due to increased consumers embracing plant-based diets. The manufacturers focus on creating high-quality vegan crusts that will fulfil the increasing demand for delicious, plant-based substitutes. High-quality ingredients like gluten-free and organic are key to sustaining a premium product while keeping regulatory compliance in check to adhere to food safety standards.

The distributors are concerned with the cost of production and supply dependability. Vegan pizza crusts tend to have special ingredients, which are costlier and challenging to obtain. Distributors must find dependent supply lines to keep up with the growing demand so that production costs are not prohibitive, allowing products to reach the retailers at competitive prices.

End users, by and large consumers, care about the quality of products, price, and the convenience of using ready-to-use pizza crusts. With the increasing demand for plant-based food, they anticipate that vegan pizza crusts should be tasty, convenient to use, and available at a reasonable price. With the rise in plant-based alternatives, the industry keeps expanding based on taste and dietary choice.

The below table gives an overview of the change in CAGR over six months of the base year (2024) and current year (2025) for the industry. This analysis uncovers the critical fluctuations of performance and shows the pattern of revenue realization - giving stakeholders a clearer sight on the annual growth trajectory. H1 is short for the first six months of the year, from January to June. H2, the latter half of the year, the months of July through December.

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 3.5%, followed by a higher growth rate of 3.8% in the second half (H2) of the same decade. Moving into the subsequent period, from 2025 to 2035, the CAGR is projected to increase to 3.6% in the first half (H1) and remain considerably high at 3.7% in the second half (H2).

| H1 CAGR (%) | H2 CAGR (%) |

|---|---|

| 3.5% (2024 to 2034) | 3.8% (2024 to 2034) |

| 3.6% (2025 to 2035) | 3.7% (2025 to 2035) |

In the first half (H1), the sector witnessed an increase of 10 basis points (BPS), while in the second half (H2), the business experienced a decrease of 10 BPS. The continued rise in consumer demand for plant-based alternatives, natural ingredient preferences, and sustainability-driven product innovations are shaping the future growth of the global industry.

The world industry witnessed a steady growth between the years 2020 and 2024 owing to increasing demand for allergen-free and plant-based food alternatives. Ingredients such as quinoa, almond flour, chickpeas, cauliflower, and whole grains used to make the vegan pizza crust were used to meet the dietary needs, health awareness, and environmental conservation.

Gluten-free, organic and non-genetically modified organism (non-GMO) foods have gained traction, both among vegan consumers and those interested in health foods. Frozen pizza brands and foodservice chains have also developed pizza crusts that are plant-based, thereby providing the products to a wider consumer audience. Clean-labeling and flexitarian diets are also affecting the worldwide demand.

The industry will continue to feather by innovation in alternative flour blends, fermentation technologies and high-protein advancements for the texture and nutritional value through 2025 to 2035.

Resistant starches and prebiotics will all be utilized as the demand for fiber-dense, gut-friendly pizza crusts continue. Food science will fortify the textural properties of crusts, so plant-based crusts are crispy and pliant, unlike regular dough.

E-commerce and private-label product innovation will drive sales growth, while sustainability trends will push brands to new recyclable and biodegradable packaging. Regionally flavored and superfood systems will also be increasingly applied to pizza crust in the global marketplace, where health-conscious consumers are everywhere.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 Trends | 2025 to 2035 Projections |

|---|---|

| Higher demand for plant-based and allergen-free foods | Growth in high-protein and fiber-based crust formulations |

| Cauliflower, chickpeas, quinoa, whole grains | Resistant starches, prebiotics, superfood-enriched blends |

| Gluten-free, organic, and non-GMO crust industry | Functional and gut-friendly pizza base development |

| Higher availability in frozen food aisles and restaurants | E-commerce growth and private-label brand creation |

| Alternative flour blends enhancing texture and elasticity | Fermentation innovation for enhanced structure and digestibility |

| Increased use of recyclable and biodegradable packaging | Emphasis on locally sourced and upcycled ingredients |

| Increased production cost and pricing issues | Attaining affordability and popularity among the mainstream |

| High popularity in Europe and North America | Growth in Asia-Pacific and Latin America |

| New plant-based food companies entering the industry | Increased pizzeria and plant-based business collaborations |

The industry is prone to different risks besides standard problems like supply chain interruptions and compliance with regulations, which can have a serious impact on its growth and stability. A few main difficulties are the instability of the source of ingredients, the instability of consumer demand, the competitive industry, and the necessity of the brand to be different from others. The main problem for manufacturers in this niche industry is wisely addressing these risks.

Ingredient sourcing variability is a notable threat to manufacturers. The crucial materials, like gluten-free flours, plant-based oils, and sustainable additives, are even subject to the industry's ups and downs and/or availability concerns. The effects of climate change disrupted global trade, or other challenges in agriculture could make these elements' supply less consistent, leading to cost swings or quality problems.

The landscape is also a worry. The situation arises where more brands are joining the bandwagon, not excluding some larger pizza manufacturers who are also moving into offering plant-based crusts, thus the bulled pressure to even maintain or catch the industry share.

In addition, price wars, brand loyalty, and marketing strategies are some common problems for companies. A company that dwells on brand positioning the right way with product quality, merits, and marketing strategies will outperform others who are finding the industry crowded.

Sustainability issues are the new risks emerging in the vegan crust industry. Numerous consumers go for products that are vegan, produced in an ethical manner, and environmentally safe. The company's implementation of sustainability from the very start in terms of sourcing, packaging, and manufacturing will not only bring about additional production costs but will also achieve a major differentiator.

Non-adopting companies, the ones that we cannot drive along and embrace the rising demand of the people for sustainability, might possibly have a real effect on the company's good name.

Wheat-Based Vegan Pizza Crust Dominates the Market

| Segment | Value Share (2025) |

|---|---|

| Wheat(By Ingredient) | 45% |

In the year 2025, the industry is likely to observe a high share of 45% for the wheat-based crust, following the corn-based crust segment, which is going to contribute to almost 25% of the industry share in the future.The wheat-based crust segment is further popular because of its increased availability and popularity among consumers compared to the other crust types.

Wheat-based options tend to mimic the traditional chewy and soft texture and elasticity associated with regular pizza crusts, along with the best toppings' holding attributes for the people who are vegan but do not want to sacrifice the great taste. Some of the popular brands offering wheat-based crusts are Udi's Gluten Free, Daiya, and Banza.

The Corn-Based Crust segment represents a 25% share of the industry, which is obviously attractive in the line of gluten collectors as well as those looking for options in other grains. Naturally gluten-free corn-based crusts are a very good choice for people who have dietary restrictions or intolerances.

Other brands, such as Caulipower and Wholly Veggie, have launched corn-based crusts.For consumer preferences, wheat base takes the lead, but corn-based alternatives counter the trend regarding the diversity of demand for gluten-free and allergen-friendly products. Ongoing product innovations by brands offer solutions to changing dietary needs among consumers through possible future innovations in crusts made from new ingredients.

Thin Crust Vegan Pizza: The Preferred Choice Among Consumers

| Segment | Value Share (2025) |

|---|---|

| Thin Crust(By Type) | 50% |

The thin crust segment, with its 50% industry share, will remain the leading one for vegan pizza crusts in 2025; thick crusts will follow with a 30% industry share. The thin crust segment has the largest share due to its popularity among health-conscious consumers, with lighter, crispier pizza bases that have fewer calories and carbohydrates.

Thin crusts are much sought after in the vegan industry as they let the toppings take the limelight while still offering the right balance of texture. Thin-crust vegan pizzas are currently offered by brands like Daiya, Udi's Gluten Free, and Wholly Veggie, targeting consumers looking for low-calorie, plant-based meal options. Meanwhile, the thin crust is also gaining momentum from the growing popularity of artisanal and Neapolitan-style vegan pizzas, with increasing numbers of pizzerias and food service outlets keeping thin crust on the menu.

The thick crust segment accounts for about 30% of the industry share for consumers seeking more filling and a doughy texture. Thick crusts form part and parcel of instantly recognizable deep-dish or pan-style pizzas that have a solid follower base in North America, some parts of Europe, and growing popularity in Latin America.

The brands provide thick-crust vegan pizza consumers wishing for hearty meals with plant-based alternatives. For this reason, the vegan format is becoming very popular among consumers looking for that comfort food."Although thin crust keeps growing ahead with the health argument, thick crust remains a sizeable segment as customers demand filling, hearty vegan food. The plentiful crust offerings continue to promote vast growth across various consumer inclinations.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.5% |

| UK | 7.2% |

| France | 6.5% |

| Germany | 6.8% |

| Italy | 6.3% |

| South Korea | 7.8% |

| Japan | 7.1% |

| China | 8% |

| Australia | 7.4% |

| New Zealand | 7% |

The USA industry is projected to grow significantly, with a CAGR of 7.5% from 2025 to 2035. The primary growth driver is rising consumer demand for plant-based foods due to ethical, environmental, and health considerations. Chain food service restaurants and single-unit pizzerias are adding more vegan items in an effort to keep up with the growing industry.

In addition, advances in food technology have made it possible to manufacture new crust types like gluten-free and protein-fortified ones. Increased use of e-commerce and direct-to-consumer platforms has also increased the availability of products, allowing consumers to try many different types of vegan pizza crusts.

The UK is expected to register a 7.2% CAGR during the forecast period on the strength of increasing numbers of consumers following plant-based diets. State support of sustainability and plant-based diets has been the driving impetus for industry expansion. Restaurant and supermarket chains continue to unveil a chain of vegan-friendly pizza options, embracing flexitarians and hardline vegans alike.

Growing focus on carbon footprint reduction has also seen increasing demand for locally sourced, organic produce when crafting vegan pizza crusts. With food tech companies joining the industry, new crusts made from new grains and legumes are taking off.

The French industry is anticipated to experience a CAGR of 6.5% during the period 2025 to 2035. Though traditionally famous for rich food whose hub is around milk and meat products, France is now in transition towards plant-based food consumption patterns. Younger populations and urban dwellers are particularly receptive to novel food options, fueling the growing demand.

Specialty and gourmet ancient grain-based vegan pizza crusts made with spelled and buckwheat are becoming more popular, indicating the nation's shift towards premium, high-taste ingredients. Health-driven diet trends and rising vegan restaurant chains are also fueling industry growth.

Germany is expected to record a CAGR of 6.8% in the industry based on the high vegan and vegetarian consumer base. Germany has one of the largest numbers of vegans in Europe. It has rising numbers of consumers looking for plant-based alternatives driven by the power of health and sustainability concerns.

Food services and supermarkets are continuously innovating, with the launch of crusts made with nutrient-dense ingredients like quinoa and flaxseed. The well-established organic food industry in the nation is also a significant force, with consumers choosing low-processed, clean-label plant-based foods. Expansion in private-label plant-based brands has also enhanced product diversity.

Italy, with an estimated CAGR of 6.3%, is gradually accepting the vegan crust pizza trend despite having a well-established traditional food culture. Conventional pizza has a following, but individuals are demanding more and more plant-based alternatives, particularly health-conscious customers.

Italian manufacturers are finding new ways to utilize chickpea flour, spelt, and other alternative grains in handling crusts to meet vegan and gluten-free requirements. Organic health food shops and pizzerias are driving industry growth, with additional premium plant-based products now available. Locally grown organic produce is used to fulfill customer requirements for organic products and high-quality products.

The South Korean industry is estimated to expand at a CAGR of 7.8% during the development of plant-based consumption and functional foods. Younger generations, particularly millennials and Gen Z, oversee eating better.

Additional plant-based fast food options and Western food trends have fueled the industry. Food companies are innovating with nutrient-dense ingredients like black rice and sweet potato flour to meet changing consumer tastes. The online food delivery phenomenon has also increased the reach to more consumers.

Japan's industry for plant-based pizza crusts is also likely to grow at a 7.1% CAGR due to increasing health awareness and the rising need for Western-style plant-based food. Plant-based food ingredients, such as seaweed and soy, used in classic Japanese foods naturally complement the vegan trend.

With large food service players launching vegan lines of their menu products, there is greater demand for premium, natural, minimally processed pizza crusts. Innovations such as matcha-doughed pizzas and fermented rice crusts bring in the local tastes, pushing Japan's industry to be different from the others. Flexitarian consumer expansion also provides steady industry expansion.

China will lead the industrywith a CAGR of 8% during the period 2025 to 2035. Urbanization, increasing disposable income, and growing interest in international food trends are key drivers for industry growth. Historical trends in vegetable consumption, coupled with the global popularity of Western food in general, have made veganism accessible.

Local vendors are sprinkling crusts of native background, such as mung bean flour and purple sweet potato, to entice the taste buds of Chinese consumers. China's saturation with e-commerce hugely enhances availability, with vegan pizza crust being accessible across the country.

Australia will be in a good position to post a 7.4% CAGR in the industry for, fueled by an extremely health- and eco-conscious populace. The country has witnessed a strong rise in plant-based eating, with increasing numbers of people opting for vegan and gluten-free diets.

Domestic companies are at the forefront with alternative-style crusts based on indigenous ingredients such as macadamia and wattleseed flour and catering to the premium health-food industry. The availability of specialty health stores and positive sentiments toward organic farming also indicate the development of the industry well. Further, growth in vegan restaurant chains has also been a significant driver of industry growth.

New Zealand's industry is expected to develop at a CAGR of 7% during the forecast period. New Zealand's focus on sustainable agriculture and organic produce has been rather influential in changing attitudes among consumers. Flexitarianism and veganism are gaining popularity, and consumers are looking for an ever-growing number of plant-based items.

New recipes that involve using produce such as kumara (sweet potato) and hemp seeds for the crust are becoming mainstream because they are healthy. Government initiatives for making vegetarian food a part of sustainable food culture, enhanced promotion of vegan food festivals, and vegan campaign societies also help fuel the industry growth.

The vegan crust industry is rapidly expanding, which is attributed to increased consumer indications toward plant-based and gluten-free products. Key competitors such as Daiya, The Pizza Plant, and Pizza-Pizza engage in competition through innovative measures, product diversification, and strategic branding.

Product innovation is a key factor of differentiation, with brands concentrating on taste, texture, and other nutritive aspects. Companies have particularly experimented with alternative raw materials like cauliflower, chickpeas, quinoa, and ancient grains, designing crunchy, nutrient-rich, allergen-friendly bases.

Daiya, the dairy-free forerunner, has rolled out gluten-free, whole-grain, and fiber-enriched bases to meet the needs of various diets. The Pizza Plant and Pizza-Pizza (UK) are going the organic route and non-GMO, targeting health-conscious consumers.

Expansion through distribution channels is also one way the competition is impacted further in this industry. Brands are making it a point to partner with grocery stores, specialty retail stores, and foodservice providers to ensure maximum availability. The Pizza Plant (UK) has expanded its operations to include other parts of Europe, while Daiya's products are available in all supermarket chains and online marketplaces.

Sustainability and ethical sourcing remain two of the biggest selling points for companies interested in eco-friendly packaging, responsibly sourced ingredients, and carbon-neutral production methods. Such strategies are preferred by environmentally conscious consumers looking for sustainable plant-based alternatives.

To heighten competition, brands have to tread on the path of digital marketing, influencer collaboration, and e-commerce strategies to increase visibility. They also suggest unique product features such as high-protein, keto-friendly, and allergen-free formulations that reach out to a wider array of audiences, including those with vegan, vegetarian, and flexitarian preferences. The continuing product inventions, together with the enlarged adaptation of plant-based foods by consumers, are foreseen to astound the industry further.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Daiya | 20-24% |

| The Pizza Plant | 15-18% |

| Pizza-Pizza | 12-16% |

| The Pizza Plant (UK) | 8-12% |

| Pizza-Pizza (UK) | 6-10% |

| Other Companies (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Daiya | It specializes in gluten-free, allergen-friendly crusts and caters to vegan and dairy-free consumers. |

| The Pizza Plant | Focuses on organic, nutrient-rich crusts, emphasizing whole-food ingredients. |

| Pizza-Pizza | Offers high-protein, fiber-rich vegan crusts, available in North America and the UK |

| The Pizza Plant (UK) | Expanding in Europe, introducing alternative flour-based vegan crusts. |

| Pizza-Pizza (UK) | Competing in the UK industry with versatile, plant-based crust options. |

Key Company Insights

Daiya (20-24%)

A leader in gluten-free and allergen-friendly vegan crusts, widely available in retail as well as foodservice chains.

The Pizza Plant (15-18%)

Growing presence in whole-food, organic crusts in natural and specialty food channels.

Pizza-Pizza (12-16%)

Extending its presence in North America and the UK through fiber-high and protein-rich vegan crusts.

The Pizza Plant (UK) (8-12%)

Spreading presence in European regions through sustainable sourcing practices.

Pizza-Pizza (UK) (6-10%)

Rivaling in the UK's growing plant-based pizza industry, providing adaptable crust varieties.

Other Key Players (30-40% Combined)

The industry is segmented into wheat-based crust, corn-based crust, rice-based crust, and other ingredients-based crust.

The industry is categorized into thin crust, thick crust, and stuffed crust.

The industry is segmented into supermarkets and hypermarkets, convenience stores, online channels, and others.

The industry is segmented into household, food service, and commercial.

The industry is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan & Baltic Countries, Russia and Belarus, and the Middle East & Africa.

The industry is expected to reach USD 1.13 billion in 2025.

The industry is projected to grow to USD 2.3 billion by 2035.

China is expected to experience significant growth with an 8% CAGR during the forecast period.

The thin crust segment is one of the most popular categories in the industry.

Leading companies include Daiya, The Pizza Plant, Pizza-Pizza, The Pizza Plant (UK), Pizza-Pizza (UK), Lucky Jack Coffee, Stumptown Coffee Roasters, La Colombe, High Brew Coffee, and Califia Farms.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Source, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by End Users, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Source, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by End Users, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Source, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by End Users, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Source, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by End Users, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 36: Asia Pacific Market Volume (Units) Forecast by Source, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 38: Asia Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 40: Asia Pacific Market Volume (Units) Forecast by End Users, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 44: MEA Market Volume (Units) Forecast by Source, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 46: MEA Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by End Users, 2018 to 2033

Table 48: MEA Market Volume (Units) Forecast by End Users, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by End Users, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Source, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by End Users, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 21: Global Market Attractiveness by Source, 2023 to 2033

Figure 22: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 23: Global Market Attractiveness by End Users, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by End Users, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Source, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by End Users, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 45: North America Market Attractiveness by Source, 2023 to 2033

Figure 46: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 47: North America Market Attractiveness by End Users, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by End Users, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Source, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by End Users, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 71: Latin America Market Attractiveness by End Users, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by End Users, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Source, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by End Users, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 93: Europe Market Attractiveness by Source, 2023 to 2033

Figure 94: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 95: Europe Market Attractiveness by End Users, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by End Users, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Units) Analysis by Source, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Units) Analysis by End Users, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Source, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by End Users, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Source, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by End Users, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 130: MEA Market Volume (Units) Analysis by Source, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 134: MEA Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by End Users, 2018 to 2033

Figure 138: MEA Market Volume (Units) Analysis by End Users, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by End Users, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by End Users, 2023 to 2033

Figure 141: MEA Market Attractiveness by Source, 2023 to 2033

Figure 142: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 143: MEA Market Attractiveness by End Users, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vegan Cheese Market Size and Share Forecast Outlook 2025 to 2035

Vegan Confectionery Market Size and Share Forecast Outlook 2025 to 2035

Vegan Steak Market Size and Share Forecast Outlook 2025 to 2035

Vegan Pasta Market Size and Share Forecast Outlook 2025 to 2035

Vegan Hyaluronic Acid Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Peptides Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Skincare Market Size and Share Forecast Outlook 2025 to 2035

Vegan Protein Powder Market Analysis - Size, Share, and Forecast 2025 to 2035

Vegan Tortillas Market Size and Share Forecast Outlook 2025 to 2035

Vegan Casing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dressing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Sauce Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dips Market Size and Share Forecast Outlook 2025 to 2035

Vegan Yogurt Market Size, Growth, and Forecast for 2025 to 2035

Vegan Meals Market Size, Growth, and Forecast for 2025 to 2035

Vegan Dog Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Protein Bars Market Analysis – Size, Share & Trends 2025–2035

Vegan Vitamins and Supplements Market – Growth & Demand 2025 to 2035

Analysis and Growth Projections for Vegan Fast-Food Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA