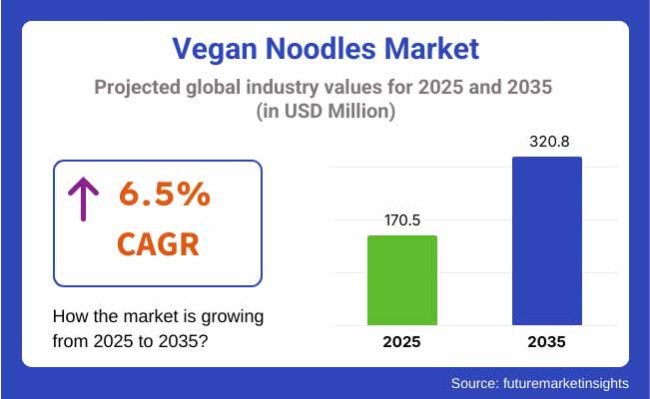

The vegan noodles market is expected to witness significant growth between 2025 and 2035, driven by increasing consumer preference for plant-based, clean-label, and nutritious food products. The market is projected to grow from USD 170.5 million in 2025 to USD 320.8 million by 2035, expanding at a compound annual growth rate (CAGR) of 6.5% over the forecast period.

The increasing popularity of veganism and flexitarian diets, combined with the higher awareness of sustainability as well as responsible food sourcing, has driven the demand for vegan-friendly substitutes of traditional noodles.

Gluten free, organic and high protein noodles are in demand and Noodle makers are coming up with novel products with fortified nutrients, flavors, and functional ingredients. Rising lactose intolerant, gluten allergy and other food intolerances result in an increase in uptake of vegan noodles in the mainstream food market.

The global increase in e-commerce platforms and retail distribution channels is facilitating the accessibility of vegan noodles to consumers. Key food brands are focused on product diversification, sustainable packaging, and sourcing with plant-based ingredients, thereby elevating the growth prospect avenue in the market. Also contributing to higher market penetration is the rise in type consumers, trends on social media, and endorsements from celebrities.

North America and Europe still generate the most revenue from the market regionally, due to their developed plant-based food industries, informed consumers, and increasing retail presence.

By the region, Asia-Pacific is projected to be the fastest growing due to shift in dietary patterns, increased disposable incomes, and growing interest in plant-based substitutes to conventional Asian noodles. The vegan noodle market will continue its growth trajectory in the coming years, propelled by a growing focus on cleaner labels and ongoing innovation in vegan food products.

Demand for plant-based food products and the growing adoption of vegan and flexitarian diets are driving the growth of the vegan noodles market in North America. North America, particularly the United States and Canada, are the major contributors to market growth as consumers are becoming more health-conscious and are looking for sustainable as well as cruelty-free food options.

Environmental concerns and ethical considerations have contributed to the increasing establishment of plant-based eating habits, which have encouraged manufacturers to take their healthy noodle options in new directions, producing innovative vegan noodle products from alternative raw materials such as quinoa, chickpeas, lentils, and brown rice.

Moreover, increased gastronomy of Asian food in Western diets has expanded end-users awareness of noodle-based cuisines, which propels the demand for vegan-friendly food. From retailers and supermarkets to e-grocery sites, the availability of vegan noodle varieties has increased.

But high price points and competition from instant noodles could slow take-off. However, increasing consumption of gluten-free and organic variants, along with regular product innovations, is expected to keep the market growing.

The vegan noodles market is flourishing in Europe due to stringent food safety regulations across the region along with increasing awareness about plant-based nutrition & vegan population in the region. The market in Germany, the UK, France, and Italy is leading the way, as consumers move towards healthier plant-based diets.

Growing ethical concerns towards animal welfare and the region's proactive efforts towards sustainability and reduction in carbon footprint have to lead to an increased demand for vegan alternatives.

The many vegan food brands along with the growing number of product launches featuring plant-based products have driven market growth. Vegan noodles of all kinds wheat-based and also numerous high-protein varieties made of legumes and whole grains occupy shelf space in supermarkets and health food stores across Europe.

Nonetheless, market penetration may be hindered by stringent mandatory labelling laws as well as potential taste and texture challenges relative to conventional noodles. While the recent surge in home cooking might be playing a role, food bloggers and social media are also pushing the number of plant-based recipes available so we can expect growth to continue.

Asia-Pacific has emerged as a fast-growing market for vegan noodles due to the traditional richness in cuisines and growing awareness about plant based diets in the region. Countries like China, Japan, South Korea, and India are seeing an increasing demand for plant-based food substitutes and many Asian people consider noodles a staple food product in their daily diet.

They are also aided by the advent of vegetarian and vegan restaurant chains, and government-backed campaigns that encourage people to eat more plant-based foods for sustainability.

As one of the largest noodle consumer markets in the world, China has experienced increased demand for plant-based noodle alternatives, driven by a rising health-conscious consumer base and a burgeoning middle-class population. Japan and South Korea are the capitals of innovation in their food products and soon ramen and soba noodles will be offered in plant-based versions for both domestic and global consumers.

In India where vegetarianism is embedded in culture and religious traditions the market is growing and many local brands are focusing on organic and high-protein vegan noodle variants. However, consumer perception of taste and texture when compared to traditional noodles is still a challenge. Nonetheless, the thickness in consumption of plant based food and growing range of international vegan food brands will continue to drive the market on long-term basis.

Challenges - High Production Costs and Limited Shelf Stability

High production costs associated with the raw material trade of plant-based and organic ingredients is a key challenge for the vegan noodles market. The demand for vegan noodles is growing, but they often use niche raw materials like lentil, chickpea or quinoa flour that can be relatively pricey and prone to supply chain disturbances compared with traditional noodles.

Allowing shelf stability without using artificial preservatives is also a challenge, which means that the lifespan of the product is shorter and there is potential food waste at the end of the retailer and consumer.

Opportunities - Rising Demand for Plant-Based and Gluten-Free Diets

Growing preference for vegan and plant based diets and increasing demand for gluten-free products is propelling the growth of vegan noodles market. More consumers are aware of their health and looking for nutrient-rich products with high protein levels and free from allergens.

Newer formulations think fortified noodles with addedfiber, protein and probiotics are also extending the market potential. With the proliferation of e-commerce and direct-to-consumer sales channels, vegan noodle brands are also becoming more accessible around the world.

The vegan noodles market witnessed robust growth between 2020 and 2024 due to a surge in the vegan and flexitarian consumer base. From mainstream manufacturers and start-up companies alike, a wide variety of products rushed into the plant-based noodle space, from alternative grains to more fortified options targeting health-conscious consumers. Sustainable packaging solutions were also considered a welcome differentiator between brands.

In 2025 to 2035, improved food technology will improve the texture, taste, and nutritional profile of vegan noodles. Artificial intelligence-powered personalization and accelerated adoption of sustainable components, as well as upcycled ingredients, will fuel innovation in the product. Moreover, the development of regulatory backing for labelling plant-based foods and clean-label transparency will strengthen consumer trust and help expand the market even further.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Increased labelling requirements for plant-based foods |

| Technological Advancements | Innovation in gluten-free and alternative grain noodles |

| Industry Adoption | Expansion of vegan product lines by major food brands |

| Supply Chain and Sourcing | Dependence on niche suppliers for plant-based raw materials |

| Market Competition | Dominance of specialized vegan food brands |

| Market Growth Drivers | Rising health consciousness and flexitarian diet trends |

| Sustainability and Energy Efficiency | Growing focus on recyclable packaging |

| Consumer Preferences | Preference for organic and allergen-free ingredients |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter clean-label regulations and plant-based certifications |

| Technological Advancements | AI-driven recipe formulation and precision fermentation |

| Industry Adoption | Widespread adoption of sustainable and regenerative ingredients |

| Supply Chain and Sourcing | Expansion of localized and climate-resilient crop sourcing |

| Market Competition | Entry of mainstream food giants offering plant-based noodle options |

| Market Growth Drivers | Increased demand for high-protein, fortified, and functional foods |

| Sustainability and Energy Efficiency | Widespread use of biodegradable and compostable packaging solutions |

| Consumer Preferences | Demand for personalized, high-protein, and gut-health-supporting noodles |

The USA vegan noodles market is growing owing to increasing consumer transition to plant based diet and healthy food options. An increase in concerns over sustainability, ethical food consumption, and lactose intolerance has resulted in greater demand for vegan food products which includes noodles.

New flavors, gluten-free options,and high-protein variants by large food manufacturers are also aiding the market growth. Of course, the rise of online grocery platforms and plant-based food chains is also helping make vegan noodles available to a wider audience. This is propelled primarily by health-conscious consumers and millennials and Gen Z.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.0% |

Due to an increasing adoption of plant-based diets and a rising flexitarian consumer base, the United Kingdom is a prominent market for vegan noodles. The market is being positively influenced by government initiatives promoting sustainable and alternative food sources in combination with an expanding network of plant-based restaurants and grocery stores.

Supermarkets and food retailers are launching their own private-label vegan noodle brands to cater torising demand. In addition, the increasing popularity of health-oriented eating habits, coupled with a rising consciousness about the environmental impact of producing animal-based foods, is driving up Demand for vegan noodle products.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.5% |

Europe has an attractive ecosystem for the vegan noodles market with high demand countries like Germany, France, and Italy. The increasing adoption of vegetarian and vegan diets, along with regulatory measures supporting plant-based substitutes, is driving market growth.

Moreover, greater investments in sustainable food innovation and the development of organic and fortified vegan noodles are enticing a broader consumer sector. Ready-to-eat and quick-cook vegan meal options are also proving to be convenient, which is further accelerating sales across retail and foodservice channels.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.7% |

Japan's vegan noodle market a slice of culinary evolution in a massive, cultural feast fuels growing curiosity in this increasingly plant-based society. Although Japan has a huge noodle culture based mainly on ramen and soba, the demand for plant-based versions is increasing, especially by the health-conscious and international tourists.

The market is also receiving a boost from government initiatives aimed at encouraging healthier eating, with food manufacturers creating vegan-friendly noodle products that still taste like traditional Japanese food. The collaboration with convenience stores and online food platforms plays a critical role in market coverage.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.8% |

Driven by an increase in the demand for vegan noodle meat options, as well as a growing interest in plant-based consumption, South Korea is poised to become a burgeoning vegan noodle meat market. The growing vegan and vegetarian communities and an increasing awareness of the health benefits of plant-based diets are driving the demand for vegan noodle options in the country.

The increasing global popularity of Korean cuisine has also driven food manufacturers to launch vegan versions of traditional noodle dishes like ramen and jjajangmyeon. Market growth is additionally accelerated as a result of the growth of e-commerce and plant-based restaurant chains.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.1% |

Rising demand by consumers for clean-label and plant-based food products are propelling the growth of the market.Most of the vegan noodles brand present in global vegan noodles market offer a wide range of healthy eating with fresh ingredients as its core concept.

Additionally, the transformation in consumer eating behaviour towards sustainable eating and increasing awareness regarding plant-based diets have provided the propulsion for the expansion of vegan noodles in all national markets. The ever rising focus on gluten-free and high-protein alternatives has led manufacturers to innovate with varied ingredients and styles of noodles.

Based on type, the ramen and wheat-based noodles segments accounted for the majority of shares owing to the ease of availability, taste familiarity, and immense versatility across culinary applications.

| Type | Market Share (2025) |

|---|---|

| Ramen | 47.3% |

Ramen noodles should account for an estimated 47.3% market share in 2025, owing to their established consumer base and versatility with plant-based broths and flavor profiles. As plant-based diets have gone mainstream, vegan ramen has gained traction in both retail and food service sectors.

The segment’s dominance is further boosted by the growing number of mushrooming vegan friendly instant ramen brands and specialty noodle restaurants.

| Ingredient | Market Share (2025) |

|---|---|

| Wheat | 52.6% |

The wheat-based noodles segment has the largest market share, accounting for 52.6% of the market in 2025, due to low cost and high availability as well as the preferred texture of the noodle.

Traditional wheat ramen,udon, and soba variants have also been viewed positively with evolving consumer tastes for high-quality, innovative vegan products. Although alternative ingredients like quinoa and lentils have emerged, wheat is still the 1st choice by a long shot, as one of the primary ingredients for both fresh vegan and instant noodles.

The vegan noodles market is expanding faster owing to growing consumer demand for plant-based, healthy, and environment-friendly food choices. The market is facilitating due to increasing veganism,gluten-free diet habits, and new product innovations in organic and protein-rich noodle formulations.

Market Share Analysis by Key Players & Manufacturers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Nestlé S.A. | 18-22% |

| Nissin Foods Holdings | 14-18% |

| Unilever (Knorr) | 10-14% |

| Annie Chun’s (CJ Foods USA) | 8-12% |

| Other Companies (Combined) | 34-42% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Nestlé S.A. | Introduced organic plant-based noodle variants , enriched with pea protein in 2024. |

| Nissin Foods Holdings | Launched vegan instant ramen with natural umami flavors and no MSG in 2024. |

| Unilever (Knorr) | Expanded its sustainable, plant-based noodle line , focusing on gluten-free options in 2025. |

| Annie Chun’s (CJ Foods USA) | Released Asian-style vegan noodles with organic ingredients , targeting health-conscious consumers in 2024. |

Key Market Insights

Nestlé S.A. (18-22%)

Nestlé dominates the vegan noodles market as it is already targeting organic and protein-enriched products to meet the demand of consumers for clean-label products.

Nissin Foods Holdings (14-18%)

Now Nissin is expanding its portfolio of vegan instant ramen with Japanese culinary expertise and umami-rich ingredients.

Unilever (Knorr) (10-14%)

Knorr is focused on gluten-free and non-GMO versions of noodles, part of the increasing movement towards plant-based and allergen-free searching.

Annie Chun’s (CJ Foods USA) (8-12%)

Annie Chun’s focuses on Asian-inspired vegan noodle recipes, using clean-label and organic ingredients for health-conscious consumers premium products.

Other Important Players (34-42% Combined)

The global vegan noodles market is extremely competitive and a few of the major players are leveraging on packaging and are involving in healthy formulations, sustainable process, and new product launches. Key players include:

The market was valued at USD 170.5 million in 2025.

The market is projected to reach USD 320.8 million by 2035.

Growth is primarily driven by rising consumer preference for plant-based, clean-label, and nutritious food products, along with increasing awareness of sustainable eating habits.

The top 5 countries driving the development of the vegan noodles market are the USA, Germany, China, India, and the UK.

Ramen and wheat-based variants hold the largest share due to greater availability, convenience, and a growing shift toward e-commerce grocery shopping.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Packaging, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Product, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Packaging, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Product, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Packaging, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 34: Europe Market Volume (MT) Forecast by Product, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 36: Europe Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 38: Europe Market Volume (MT) Forecast by Packaging, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Europe Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: Asia Pacific Market Volume (MT) Forecast by Product, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 46: Asia Pacific Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 48: Asia Pacific Market Volume (MT) Forecast by Packaging, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: Asia Pacific Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 54: MEA Market Volume (MT) Forecast by Product, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 56: MEA Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 58: MEA Market Volume (MT) Forecast by Packaging, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: MEA Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Nature, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 11: Global Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 15: Global Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 19: Global Market Volume (MT) Analysis by Packaging, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Global Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Product, 2023 to 2033

Figure 27: Global Market Attractiveness by Nature, 2023 to 2033

Figure 28: Global Market Attractiveness by Packaging, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 41: North America Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 45: North America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 49: North America Market Volume (MT) Analysis by Packaging, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: North America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Product, 2023 to 2033

Figure 57: North America Market Attractiveness by Nature, 2023 to 2033

Figure 58: North America Market Attractiveness by Packaging, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by Packaging, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Packaging, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 101: Europe Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 105: Europe Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 109: Europe Market Volume (MT) Analysis by Packaging, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Europe Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Europe Market Attractiveness by Product, 2023 to 2033

Figure 117: Europe Market Attractiveness by Nature, 2023 to 2033

Figure 118: Europe Market Attractiveness by Packaging, 2023 to 2033

Figure 119: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Nature, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 131: Asia Pacific Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 135: Asia Pacific Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 139: Asia Pacific Market Volume (MT) Analysis by Packaging, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: Asia Pacific Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Product, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Nature, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Packaging, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Product, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Nature, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 161: MEA Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 165: MEA Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 169: MEA Market Volume (MT) Analysis by Packaging, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: MEA Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: MEA Market Attractiveness by Product, 2023 to 2033

Figure 177: MEA Market Attractiveness by Nature, 2023 to 2033

Figure 178: MEA Market Attractiveness by Packaging, 2023 to 2033

Figure 179: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vegan Cheese Market Size and Share Forecast Outlook 2025 to 2035

Vegan Confectionery Market Size and Share Forecast Outlook 2025 to 2035

Vegan Steak Market Size and Share Forecast Outlook 2025 to 2035

Vegan Pasta Market Size and Share Forecast Outlook 2025 to 2035

Vegan Hyaluronic Acid Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Peptides Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Skincare Market Size and Share Forecast Outlook 2025 to 2035

Vegan Protein Powder Market Analysis - Size, Share, and Forecast 2025 to 2035

Vegan Tortillas Market Size and Share Forecast Outlook 2025 to 2035

Vegan Casing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dressing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Sauce Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dips Market Size and Share Forecast Outlook 2025 to 2035

Vegan Yogurt Market Size, Growth, and Forecast for 2025 to 2035

Vegan Meals Market Size, Growth, and Forecast for 2025 to 2035

Vegan Dog Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Protein Bars Market Analysis – Size, Share & Trends 2025–2035

Vegan Vitamins and Supplements Market – Growth & Demand 2025 to 2035

Analysis and Growth Projections for Vegan Fast-Food Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA