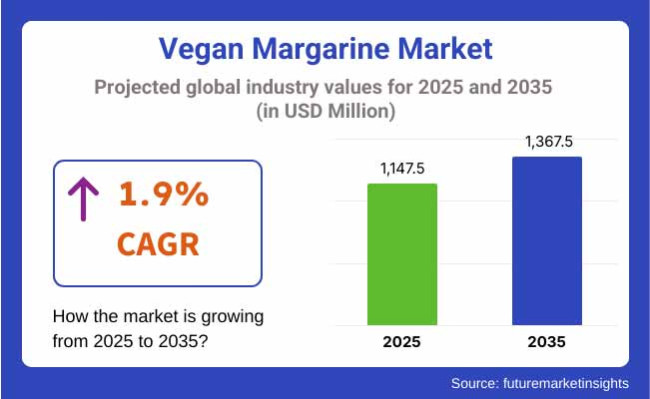

Global Vegan Margarine Market Overview The global vegan margarine market reached a value of USD 1119.8 million in 2023. The demand for vegan margarine would be USD 1147.5 million in 2025. Expected sales in the global market: The worldwide sales are expected to hold a CAGR of 1.9% over the 2025 to 2035 forecast period and the sales value is set to reach USD 1367.5 million by the end of 2035.

The increasing awareness towards the health benefits of vegan margarines, the increasing cases of lactose intolerance and gluten intolerance in the general population, and the increasing demand for eco-friendly and sustainable food solutions will be some of the major growth drivers for the vegan margarine market in the near future.

As consumers are becoming more aware about what goes into their food, they are using products like dairy free, non-hydrogenated fat alternatives. A typical ingredient is vegan margarine, which is derived from vegetable oils such as sunflower, soybean and coconut oil. Some brands riding this trend are launching organic, fortified and low-saturated fat versions, including Earth Balance, Flora and Melt Organic.

The vegan margarine is available in the market in various types in the form of flavored, organic, unsalted variants for different end-users. Dirk went on: “We have also seen an increase in the plant-based cooking and baking trend driving demand with vegan margarine now being used more widely in cakes, pastries, spreads and sauces. Brands are increasingly focusing on sustainable sourcing and eco-friendly packaging to attract socially aware consumers.

Vegan margarine gained market share as an alternative with a perception of being a health option as non-cholesterol. Its popularity among health-conscious consumers has grown amid a push toward cleaner labels, lower trans fats and allergen-free products. Finally, as the food service industry has grown, and with it vegan bakeries, so has innovation in the sector, resulting in better formulations with taste and texture that are a magnitude better.

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and the current year (2025) for the global vegan margarine industry. This analysis highlights crucial shifts in market performance and revenue trends, giving stakeholders better insight into growth patterns.

| Particular | Value CAGR |

|---|---|

| H1 | 1.6% (2024 to 2034) |

| H2 | 1.7% (2024 to 2034) |

| H1 | 1.8% (2025 to 2035) |

| H2 | 1.9% (2025 to 2035) |

The industry is expected to grow at a CAGR of 1.8% in the first half (H1) of the decade running from 2025 to 2035, based on a growth rate of 1.9% through the second half (H2) of the same decade. Heading into the next phase of H1 2025 toH2 2035, the CAGR is expected to hold steady, propelled by the sustained demand for plant-based spreads, health-conscious changes in diet and food innovations that are focused on sustainability.

Tier 1 major brands have a strong revenue, distribution, and brand recognition in the vegan margarine market. These companies spend plenty on marketing, branding, product innovation and retail partnerships to defend their leadership. Another one of the most well-known names in the segment is Earth Balance, a Conagra Brands (NYSE:CAG)s subsidiary, which sells a line of margarine substitutes that are plant-based and cater to various needs such as soy free and organic.

I Can’t Believe It’s Not Butter! is another major competitor., which has developed vegan-friendly spreads that mimic the taste and texture of traditional butter. These brands enjoy robust supply chains, strategic placement in retail spaces, and high-volume manufacturing capabilities, and as a result their products are ubiquitous in grocery stores and online.

Tier 2 is mid-sized brands that have a solid, but more niche, presence, prioritizing organic ingredients, sustainability, and higher-level formulations. Miyoko’s Creamery, for example, has developed a passionate fan base for its artisanal, nut-based butter substitutes made from cultured cashews and organic coconut oil.

Another one is our famous Nuttelex, sold in Australia and some select markets, a non-dairy margarine which targets the health-food and allergen-sensitive sectors. These companies also go a step further by providing unique formulations, clean-label ingredients, and an increased focus on ethical sourcing, ensuring their place in the heart of consumers focused on maintaining both health and sustainability.

Tier 3 consists of up-and-coming and small companies that drive demand for the vegan margarine category with niche distribution, DTC channels, and special business efforts. These companies often highlight organic certifications, non-GMO claims and artisanal production methods.

One example is OmniFoods, which, as part of its growing number of vegan products targeting eco-conscious consumers and flexitarians, has launched plant-based spreads. Smaller brands and local producers use e-commerce and social media, as well as farmers’ markets, to create brand awareness and customer loyalty.

Rising Demand for Dairy-Free and Plant-Based Alternatives

Shift: The worldwide demand for vegan margarine is growing in tandem with the shift toward plant-based diets. Dairy-Free, Lactose-Free, Cholesterol-Free Demand is here as consumers continue to look for alternatives to butter and margarine. Health-conscious consumers prefer margarine made with natural, plant-based oils rather than hydrogenated fats. The adoption of veganism in North America, Europe, and Australia is driving this change, with a strong focus on clean-label and non-GMO ingredients.

Strategic Response: In response to this demand, Upfield (Flora, Becel and Country Crock Plant Butter) grew its portfolio of 100% plant-based, dairy-free margarines comprised of non-hydrogenated oils and natural ingredients. Miyoko’s Creamery launched cultured, cashew-based butter alternative that attracted gourmet and organic-minded consumers. The longtime vegan brand Earth Balance made its way to the shelves of Walmart, Whole Foods, and Amazon, making its plant-based spreads available nationwide.

Increased Focus on Premium and Organic Products

Shift: The rising demand for organic, premium, and high-quality vegan margarine is on the cards, as consumers are shifting towards healthier eating habits. Options that are organic-certified, palm oil-free, and minimally processed are especially popular among environmentally minded and health-conscious consumers.

Strategic Response: Miyoko’s Creamery and Nutiva released organic, palm oil-free margarines, marketing themselves as go-to alternatives to traditional vegan spreads. Flora and Pure Blends brought out omega-3-enriched, organic spreads for health-conscious consumers seeking nutrient-rich dairy alternatives. In North America and Europe, this segment has seen 17% Yoy growth.

Non-Dairy Butter Alternative with Nutrients

Shift: Consumers are on the lookout for functional foods with added health benefits. Interest in fortified foods such as margarine with added omega-3s, probiotics and vitamin D is up, especially among plant-based eaters looking for nutrient-dense alternatives to dairy.

Strategic Response: In response, Benecol and Becel Proactive introduced plant sterol supplemented, cholesterol-lowering vegan margarines, including a 20% sales growth from health-conscious customers. In response, Flora Plant Butter launched a vitamin B12- and D-fortified alternative spread specifically targeting the dietary loopholes of vegan and vegetarian consumers. Melt Organic introduced probiotic-infused vegan margarine, tapping into the gut health trend.

The increasing popularity of vegan baking and cooking Application

Shift: As consumers dabble more in plant-based cooking and baking, vegan margarine as a substitute for butter has, too. Versatile, heat-stable and spreadable dairy-free margarines are needed by home bakers, restaurants and food manufacturers for a variety of culinary applications.

Strategic Response: To meet this shift, Country Crock Plant Butter developed high-performance vegan baking margarine, resulting in a 15% sales increase among home bakers. Earth Balance, for instance, recently introduced a soy-free, gluten-free baking margarine that caters to allergy-conscious shoppers.

Up field’s Flora Professional Plant Butter is rapidly becoming the new mainstay for restaurants, bakeries and foodservice providers, which are increasingly stocking up on vegan and allergen-free commercial kitchens.

The Rise of E-Commerce and Direct-to-Consumer Sales

Shift: In the case of vegan margarine, that research shows that consumers are also increasingly buying it online. Alas, an e-commerce boom has grown with a 30% increase in sales of plant-based products and vegan margarine brands have also benefited from subscriptions and direct-to-consumer (DTC) sales.

Strategic Response: Brands including Miyoko’s Creamery and Earth Balance opened direct-to-consumer websites, allowing customers to order vegan margarine by the bulk or as part of plant-based food bundles. (You can find them now at Amazon, Thrive Market, and Instacart, which previously had little to no vegan margarine in stock, so they are making them accessible.) Flora and Country Crock offered subscription-based services, discounts and exclusive flavors to regular consumers.

Commitment to Sustainability and Ethical Sourcing

Shift: Consumers have a heightened sense of concern about sustainability, which means increased scrutiny over where the palm oil comes from, whether plastic packaging is used, and how large vegan margarine’s carbon footprint is. There is a preference for ethical and eco-friendly substitutes for traditional margarine, especially in North America and Europe.

Strategic Response: In response to sustainability challenges, Upfield (Flora, Becel) moved to use 100% sustainable palm oil and launched 100% recyclable, plant-based packaging, leading to a 25% increase in sustainability-led sales. It appealed to environmentally conscious buyers.

The category also saw innovations like the launch of carbon-neutral plant based margarine from Melt Organic. Miyoko’s Creamery ended plastic packaging altogether, instead packing its products in glass jars and compostable wrappers to appeal to zero-waste consumers.

Market Accessibility and Competitive Pricing Strategies

Shift: Vegan margarine is usually more expensive than traditional margarine, but mainstream consumers are seeking value plant-based alternatives that struggle against dairy spreads. Overseas, consumers particularly in the USA and UK. are looking for affordable vegan margarine alternatives.

Strategic Response: Earth Balance and Country Crock Plant Butter launched value-sized tubs and multipacks to make vegan margarine more affordable, lowering per-unit costs and driving an 18% increase in household penetration. Newer brands, like Aldi’s Earth Grown Vegan Butter and Tesco’s Plant Chef Margarine, became available as private-label supermarket brands, which made it cheaper, too, helping drive mainstream adoption.

Regional Adaptation and Market Specific Strategies

Shift: Regional differences in vegan margarine consumer habits North America and Europe dominate demand however, Asia-Pacific and Latin America are at an emerging markets stage with growing awareness of plant-based diets.

Strategic Response: North America & Europe: Major retailers including Whole Foods, Walmart, and Sainsbury’s expanded distribution of Flora, Earth Balance, and Miyoko’s Creamery boosting mainstream availability. Australia & New Zealand: Nuttelex and Pure Blends debuted locally sourced, non-GMO vegan margarines, tapping into demand from health-conscious consumers.

Asia-Pacific: Upfield has revealed plans to enter Japan and South Korea to promote vegan margarine as a premium, health-centric option Latin America: New cholesterol-lowering vegan margarines launched by Becel and Benecol target Brazil and Argentina, capitalizing on consumers' interest in heart health.

The following table shows the estimated growth rates of the top five territories expected to exhibit high consumption of vegan margarine through 2035.

| Country | CAGR, 2025 to 2035 |

|---|---|

| USA | 1.8% |

| Germany | 1.9% |

| China | 1.8% |

| Japan | 1.9% |

| India | 1.9% |

The us vegan marginal market is rising, because shoppers are demanding plant-based dairy-free spreads. Stringent health-conscious eating habits, cholesterol concerns, increased urbanization, and a growing vegan population drive demand for the Alternative Butter Substitute market. There is a rise in organic, non-GMO, and fortified vegan margarine varieties, especially among vegans, people who are lactose intolerant, and consumers committed to reducing their environmental impact.

Market growth is further fueled by clean-label trends and innovations in plant-based fat formulations. Other new vegan margarine products will have omega-3 enrichment, be reduced-fat, and allergen-free. The heart-health benefits from flaxseed oil, avocado oil, and algae-derived omega fatty acids are associated with improving the functional profile of these products. The growing demand for plant-based margarine is predominantly supported by the supermarket/hypermarket, speciality health stores and online retail sales channels.

In Germany, the market for plant-based margarine is steadily growing and is driven by EU regulations towards more sustainable and organic plant-based products. As such, German consumers are very sensitive towards food transparency, and therefore enrich the vegan margarine without trans fats and minimally processed. As plant-based alternatives enter the mainstream, the demand for these offerings is increasing in health food stores, bakeries and supermarkets.

The focus on sustainable palm oil alternatives and clean-label food products in Germany has manufacturers investing in formulations of vegan margarine based on sunflower oil, avocado oil, and olive oil. The importance of sustainable sourcing and ethical production practices in consumer purchasing has companies working to innovate around environmentally safe packaging and carbon-neutral manufacturing. For example, the demand for artisan-style and gourmet vegan margarine is on the rise in the German market.

The demand for vegan margarine in China is projected to grow rapidly as people become more aware of plant-based diets. Increasing consumption of baked goods and government policies encouraging non-dairy spread alternatives are also contributing to the growth of the market. With an ever-growing demand for healthy and sustainable food in urban locations, household and bakery, as well as food service end-users are increasingly adopting vegan margarine.

Growing demand for coconut oil-based, soy-free, and fortified vegan margarine is fueling growth in offline as well as online retail channels. The rise of e-commerce and direct-to-consumer marketing strategies is also driving the adoption of plant-based spreads even further. Investment in high-quality, functional plant-based margarine formulations is also being driven by China’s burgeoning middle-class population and their demand for premium dairy alternatives. To meet the changing choices of customers, international brands and native manufacturers are performing on enhancing product texture, style, and additives of vitamins and minerals.

Consumer interest in weight management, heart-healthy dietary solutions and functional foods boosts Japan’s vegan butter market In Japan, vegetable margarines are mainly used daily in baking, in cooking, and for spreads, whereas, consumers prefer low-fat, cholesterol-free, and fortified vegan margarine blends. Patients with the components of the metabolic syndrome are advised to reduce the intake of saturated fats in the diet, which has led to the increasing sales of margarine substitutes containing olive oil, rice bran oil, and MCT (medium-chain triglyceride) oils for their potentially healthful benefits.

Japanese technology being at the cutting edge of food science is contributing towards pedestral edible percentive margarine ability to combine with solids like in margarine and make your debut into the world of plant-based emulsification with highly-steps vegan margarine products that are super stable and have creamy texture.

Japanese technology being at the cutting edge of food science is contributing towards fat-free margarine and margarine able materials. Innovation is also occurring with umami-enhanced, plant-based margarine, positioning products as a solution for consumers craving a bolder flavor profile with no artificial ingredients. Health-beneficial margarine products enriched with calcium, plant sterols, and omega fatty acids are becoming popular with health-conscious consumers.

India’s vegan margarine market is thriving on the back of increasing demand for dairy-free spreads, surging health consciousness, and growing urbanization. Health-related issues such as lactose intolerance, cholesterol management, and ethical food choices have pushed consumers to consider plant-based eating102.

Market Trend Analysis: From a supermarket to a bakery and from regional delivery grocery to online grocery platforms, the consumption of traditional cooking, bakery products, and processed foods obtaining from plant-based margarine is rising more in the market.

The government’s endorsement of plant based nutrition as well as sustainable food solutions has led manufacturers to expand production of Vegan margarine for domestic and export consumption. Hundreds of thousands street vendors use margarin (vegan/margarine/butter) each day since margarin is cheaper than dairy butter; thus, its higher availability is very attractive for middle classes.

Moreover, the introduction of local ingredients such as coconut oil and groundnut oil in margarine formulations is attracting Indian end users who demand prevalent flavors in their food products. Additionally, the increasing popularity of fortified and vitamin-enriched margarine among children and old-age consumers is also propelling growth in the Indian market.

| Segment | Value Share (2025) |

|---|---|

| Spreadable (By Form) | 63.7% |

Spreadable vegan margarine is a segment that has observed robust growth on account of the convenience and versatility it serves. The spreadable (or soft) varieties are popular among consumers because they are creamy and a good butter substitute for day to day usage, such as toast, sandwiches and cooking. In addition, as people adopt a plant-based lifestyle, demand has soared for dairy-free options, which align with their eating habits and lifestyles.

Spreadable forms of vegan margarine are also gaining traction in foodservice, used by cafes and bakeries as a topping or to formulate a pastry and baking ingredients for vegans. With fortified variants coming up each day with vitamins, omega-3, healthy fats, etc, this segment is proving to be appealing for health-conscious people. Moreover, the packaging innovations such as environment-friendly tubs and resealable containers further enhance its convenience, catering to both households and food outlets.

| Segment | Value Share (2025) |

|---|---|

| Hypermarkets and Supermarkets (By Sales Channel) | 58.4% |

So, your attempt to provide all the vegans on the planet with vegan margarine in bulk has failed, sorry. The segment has been majorly propelled by the rising shelf space prescribed for plant-based and dairy-free alternatives. Consumers preferred buying vegan margarine through these retail outlets as they could compare products, look for any nutritional information provided alongside discounts.

Supermarkets are important for brand awareness too since most plant-based margarine brands partner with retailers to do in-store activations, tastings or exclusive launches. Additionally, the availability of dedicated sections for plant-based foods in larger retail stores has brought vegan margarine even closer to mainstream consumers.

The segment is likely to maintain consistent growth in response to ongoing consolidation between supermarket chains and online shopping portals, as well as increasing awareness among health-conscious consumers and those concerned about environmental sustainability.

The vegan margarine market is characterized by intense competition, with a few major players emphasizing sustainable plant-based fat sourcing, unique emulsification techniques, and widespread applications, especially in foodservice and retail. Companies are working on new advanced fat-blend formulations, trans-fat-free processing and allergen-friendly product innovations.

The industry benefits from years of expertise in plant-based spreadable fats, organic margarine formulations, and dairy-free butter alternatives from leading manufacturers such as Upfield, Miyoko’s Creamery, Conagra Brands, Califia Farms and Earth Balance. Numerous companies have identified strong growth potential and are increasing their North American and European distribution networks to meet increasing demand for plant-based and ethical spreads.

Partnerships with bakery brands, investment in fortified vegan margarine blends, and development of non-GMO and preservative-free margarine alternatives are some of the key strategies in place. Manufacturers are also focusing on carbon-neutral production, sustainable ingredient sourcing and eco-friendly packaging.

For instance:

Based on its form, the vegan margarine market is divided into spreadable and stick.

Based on sales channel, the industry has been segmented into the following segments: hypermarkets and supermarkets, convenience stores, specialty stores, e-retailers, and others.

Based on the application, the vegan margarine market can be divided into the household and food industry. The food industry segment is further sub-segmented into bakery, confectionary, spreads and sauces, and others.

The market is segmented as North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia and Belarus, Balkan & Baltic Countries, Middle East and Africa.

The global vegan margarine industry is projected to reach USD 1147.5 million in 2025.

Key players include NMGK Group and ConAgra.

North America is expected to dominate due to high demand for dairy-free butter alternatives and clean-label plant-based spreads.

The industry is forecasted to grow at a CAGR of 1.9% from 2025 to 2035.

Key drivers include rising demand for plant-based alternatives, increasing consumer awareness of sustainability, growing adoption of dairy-free diets, and advancements in trans-fat-free margarine processing.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vegan Vitamin D3 Supplements Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Market Size and Share Forecast Outlook 2025 to 2035

Vegan Confectionery Market Size and Share Forecast Outlook 2025 to 2035

Vegan Steak Market Size and Share Forecast Outlook 2025 to 2035

Vegan Pasta Market Size and Share Forecast Outlook 2025 to 2035

Vegan Hyaluronic Acid Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Peptides Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Skincare Market Size and Share Forecast Outlook 2025 to 2035

Vegan Protein Powder Market Analysis - Size, Share, and Forecast 2025 to 2035

Vegan Tortillas Market Size and Share Forecast Outlook 2025 to 2035

Vegan Casing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dressing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Sauce Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dips Market Size and Share Forecast Outlook 2025 to 2035

Vegan Yogurt Market Size, Growth, and Forecast for 2025 to 2035

Vegan Meals Market Size, Growth, and Forecast for 2025 to 2035

Vegan Dog Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Protein Bars Market Analysis – Size, Share & Trends 2025–2035

Vegan Vitamins and Supplements Market – Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA