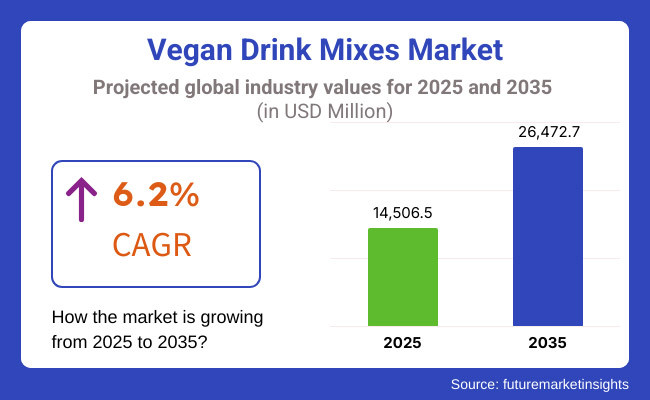

The global Vegan Drink Mixes market is estimated to be worth USD 14,506.5 million in 2025 and is projected to reach a value of USD 26,472.7 million by 2035, expanding at a CAGR of 6.2% over the assessment period of 2025 to 2035

The increasing prevalence of dietary restrictions, such as lactose intolerance and gluten sensitivity, has led many consumers to seek alternatives that align with their health needs. Vegan drink mixes serve as a suitable option, as they are typically free from dairy and gluten, making them accessible to a wider audience. This inclusivity not only caters to those with specific dietary requirements but also appeals to health-conscious individuals looking for nutritious, plant-based alternatives in their diets.

The vegan drink mixes market has experienced significant innovation, resulting in a diverse array of flavors and formulations. Manufacturers are continuously developing new products that incorporate unique ingredients, such as superfoods, adaptogens, and natural sweeteners, to enhance taste and nutritional value. This variety attracts consumers who are eager to explore novel options and experiment with different flavors. As a result, the market is becoming increasingly dynamic, appealing to adventurous palates and fostering consumer loyalty.

Orgain provides organic protein powders and drink mixes that are vegan-friendly. Their products are designed to be nutritious and convenient, catering to those looking for healthy meal replacements or snacks.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for global Vegan Drink Mixes market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision about the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 5.3% (2024 to 2034) |

| H2 | 5.9% (2024 to 2034) |

| H1 | 6.4% (2025 to 2035) |

| H2 | 7.0% (2025 to 2035) |

The above table presents the expected CAGR for the global Vegan Drink Mixes demand space over semi-annual period spanning from 2025 to 2035. In the first half (H1) of the year 2024, the business is predicted to surge at a CAGR of 5.3%, followed by a slightly higher growth rate of 5.9% in the second half (H2) of the same year.

Moving into year 2025, the CAGR is projected to increase slightly to 6.4% in the first half and remain relatively moderate at 7.0% in the second half. In the first half (H1 2025) the market witnessed a decrease of 16 BPS while in the second half (H2 2025), the market witnessed an increase of 34 BPS.

Rise of Functional Beverages

The demand for functional beverages is on the rise as consumers seek drinks that provide health benefits beyond basic nutrition. Vegan drink mixes are increasingly incorporating functional ingredients such as probiotics, vitamins, minerals, and adaptogens, which are believed to enhance physical and mental well-being.

This trend is closely tied to the growing interest in wellness and self-care, as individuals look for convenient ways to support their health through their dietary choices. By offering products that promote immunity, digestion, and overall vitality, brands can cater to health-conscious consumers who prioritize functional benefits in their beverage selections, ultimately driving sales and fostering brand loyalty in the competitive market.

Plant-Based Innovation

The vegan drink mixes market is experiencing a wave of plant-based innovation, with brands exploring diverse and unique formulations. Companies are experimenting with a variety of ingredients, including superfoods like spirulina and maca, ancient grains such as quinoa and amaranth, and alternative protein sources like pea and hemp.

This innovation not only enhances the nutritional profile of vegan drink mixes but also appeals to consumers seeking novel and exciting flavor experiences. As brands continue to push the boundaries of creativity in their product offerings, they attract a wider audience, including those who may not strictly adhere to a vegan diet but are interested in healthier, plant-based options.

Personalization and Customization

The trend towards personalized nutrition is significantly influencing the vegan drink mixes market, as consumers increasingly seek products tailored to their specific dietary needs and preferences. This shift is driven by a desire for individualized health solutions, prompting brands to offer customizable options.

For instance, consumers may want to mix and match flavors, adjust nutrient profiles, or select specific functional ingredients that align with their health goals. By providing these personalized experiences, brands can enhance customer satisfaction and loyalty, as consumers feel more connected to products that cater to their unique lifestyles. This trend not only fosters brand differentiation but also encourages repeat purchases in a competitive marketplace.

Global Vegan Drink Mixes sales increased at a CAGR of 5.4% from 2020 to 2024. For the next ten years (2025 to 2035), projections are that expenditure on Vegan Drink Mixes will rise at 6.2% CAGR

As environmental concerns become more prominent, consumers are increasingly seeking products that reflect their eco-friendly values. Vegan drink mixes, typically made from plant-based ingredients, offer a sustainable alternative to traditional beverages that rely on animal products.

By choosing vegan options, consumers can reduce their carbon footprint and support practices that promote biodiversity and resource conservation. This alignment with sustainability not only appeals to environmentally conscious individuals but also encourages brands to adopt ethical sourcing and production methods, further enhancing their market appeal.

Social media platforms have emerged as powerful tools for promoting vegan lifestyles and products, significantly impacting consumer behavior. Influencers, health advocates, and content creators share recipes, product reviews, and lifestyle tips that highlight the benefits of vegan drink mixes.

This online visibility fosters a sense of community and encourages individuals to explore plant-based options. As consumers engage with relatable content and recommendations, their awareness and interest in vegan drink mixes grow, driving demand and shaping market trends in the process.

Tier 1 Companies: This tier comprises industry leaders with annual revenues exceeding USD 20 million and a market share of approximately 40% to 50%. These companies are recognized for their extensive product portfolios, high production capacities, and strong brand recognition. They often have a global presence, allowing them to cater to a wide consumer base across multiple regions.

Tier 1 companies are distinguished by their advanced manufacturing technologies, robust supply chains, and significant investments in research and development. Prominent players in this tier include Vega, Orgain, Garden of Life, and Sunwarrior, all of which have established themselves as leaders in the vegan drink mixes segment through innovation and quality.

Tier 2 Companies: This tier includes mid-sized players with revenues ranging from USD 5 million to USD 20 million. These companies typically have a strong regional presence and significantly influence local markets. While they may not possess the extensive global reach of Tier 1 companies, they are characterized by a solid understanding of consumer preferences and trends within their specific markets.

Tier 2 companies often focus on niche segments, offering specialized products that cater to local tastes and dietary needs. Notable companies in this tier include Nutiva, KOS, and Ripple Foods, which have carved out substantial market shares in their respective regions through targeted marketing and product differentiation.

Tier 3 Companies: This tier consists of small-scale companies with revenues below USD 5 million. These businesses primarily operate within local markets, serving niche demands and focusing on specific consumer segments. Tier 3 companies are often characterized by limited resources, smaller product lines, and a lack of extensive distribution networks.

However, they play a crucial role in fulfilling localized consumer needs and can be agile in responding to emerging trends. This tier is often seen as an unorganized sector, with many players lacking formal structures compared to their larger counterparts.

| Countries | Market Value (2035) |

|---|---|

| United States | USD 3,970.9 million |

| Germany | USD 3,176.7 million |

| China | USD 2,382.5 million |

| India | USD 1,588.4 million |

| Brazil | USD 1,058.9 million |

The rise of plant-based alternatives in the USA market is fueled by increasing consumer awareness of the health risks linked to animal products, including heart disease, obesity, and cholesterol-related issues. As individuals seek healthier lifestyle choices, vegan drink mixes emerge as appealing substitutes for traditional dairy-based or sugary beverages.

These mixes often boast lower calories, reduced sugar content, and higher nutritional value, making them attractive to health-conscious consumers. Additionally, the growing popularity of plant-based diets, including flexitarian and vegan lifestyles, further drives demand for these alternatives, positioning vegan drink mixes as a viable option for those aiming to enhance their overall well-being.

The German government actively supports plant-based initiatives through policies that promote sustainable agriculture and healthy eating, creating a favorable environment for vegan products. Efforts to reduce meat consumption and encourage plant-based diets enhance awareness and acceptance of vegan drink mixes among consumers. Additionally, Germany hosts a variety of vegan festivals, markets, and community events that celebrate plant-based living.

These gatherings not only educate attendees about the benefits of vegan products but also foster a sense of community among like-minded individuals. As consumers participate in these events, they are more inclined to explore and adopt vegan drink mixes, further driving demand. This combination of regulatory support and community engagement significantly contributes to the growing popularity of vegan options in Germany.

The rise of fitness culture in India has significantly influenced consumer preferences, with more individuals participating in yoga, gym workouts, and various wellness activities. This shift towards an active lifestyle has created a heightened demand for products that support health and fitness goals. Vegan drink mixes, often marketed as protein-rich and energy-boosting, align perfectly with the needs of health enthusiasts seeking convenient and nutritious post-workout options.

These drink mixes provide essential nutrients that aid in recovery and muscle building, making them attractive to fitness-conscious consumers. As awareness of the benefits of plant-based nutrition grows, vegan drink mixes are increasingly seen as an integral part of a balanced diet, further driving their popularity in the Indian market.

| Segment | Value Share (2025) |

|---|---|

| Oats-based (Source) | 14% |

Oats are recognized for their high fiber content, particularly soluble fiber known as beta-glucan, which plays a crucial role in promoting satiety. This fiber absorbs water and expands in the stomach, leading to a feeling of fullness that can help curb hunger and reduce overall calorie intake.

As a result, oats-based drink mixes are increasingly popular as meal replacements or healthy snacks, especially among individuals aiming to manage their weight. By providing sustained energy and reducing the likelihood of overeating, these drink mixes offer a convenient solution for those seeking to maintain a balanced diet while controlling their appetite.

| Segment | Value Share (2025) |

|---|---|

| Meal Replacement Drinks (Application) | 24% |

The increasing pace of modern life has created a strong demand for convenient meal solutions, particularly among busy individuals seeking to maintain a healthy diet. Vegan drink mixes stand out as an ideal option, as they can be easily prepared and consumed on the go, fitting seamlessly into hectic schedules. Additionally, many consumers are turning to meal replacement drinks as a strategy for weight management.

Vegan drink mixes are often lower in calories and high in fiber, which promotes satiety and helps individuals feel full longer. This combination of convenience and nutritional benefits makes vegan drink mixes effective tools for those looking to lose or maintain weight while ensuring they have access to healthy meal options, even amidst their busy lifestyles.

Companies are focusing on product differentiation by introducing diverse flavors, functional ingredients, and health benefits to cater to evolving consumer preferences. Strategic partnerships with health influencers and e-commerce platforms enhance brand visibility and accessibility. Additionally, many brands emphasize sustainability in sourcing and packaging to appeal to eco-conscious consumers, while investing in marketing campaigns that highlight the nutritional advantages of their products.

For instance

This segment is further categorized into Vegan Hot Drinks, Vegan Cold Drinks, Vegan Juices.

This segment is further categorized into Soy-base, Coconut-based, Rice-based, Almond-based, Oats-based, Fruits-based, Hazelnut-based, Cashew-based, Flax-based, and Others.

This segment is further categorized into B2B and B2C.

This segment is further categorized into Plain and Flavored.

This segment is further categorized into Sports Nutrition, Functional Beverages, and Meal Replacement Drinks.

Industry analysis has been carried out in key countries of North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus and the Middle East & Africa.

The global Vegan Drink Mixes industry is estimated at a value of USD 14,506.5 million in 2025.

Sales of Vegan Drink Mixes increased at 5.4% CAGR between 2020 and 2024.

Grote company, Hobart, Berkel, Vollrath, Bizerba are some of the leading players in this industry.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2032

Table 2: Global Market Volume (MT) Forecast by Region, 2017 to 2032

Table 3: Global Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 4: Global Market Volume (MT) Forecast by Type, 2017 to 2032

Table 5: Global Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 6: Global Market Volume (MT) Forecast by Application, 2017 to 2032

Table 7: Global Market Value (US$ Million) Forecast by Packaging, 2017 to 2032

Table 8: Global Market Volume (MT) Forecast by Packaging, 2017 to 2032

Table 9: Global Market Value (US$ Million) Forecast by Flavor, 2017 to 2032

Table 10: Global Market Volume (MT) Forecast by Flavor, 2017 to 2032

Table 11: Global Market Value (US$ Million) Forecast by Source, 2017 to 2032

Table 12: Global Market Volume (MT) Forecast by Source, 2017 to 2032

Table 13: North America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 14: North America Market Volume (MT) Forecast by Country, 2017 to 2032

Table 15: North America Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 16: North America Market Volume (MT) Forecast by Type, 2017 to 2032

Table 17: North America Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 18: North America Market Volume (MT) Forecast by Application, 2017 to 2032

Table 19: North America Market Value (US$ Million) Forecast by Packaging, 2017 to 2032

Table 20: North America Market Volume (MT) Forecast by Packaging, 2017 to 2032

Table 21: North America Market Value (US$ Million) Forecast by Flavor, 2017 to 2032

Table 22: North America Market Volume (MT) Forecast by Flavor, 2017 to 2032

Table 23: North America Market Value (US$ Million) Forecast by Source, 2017 to 2032

Table 24: North America Market Volume (MT) Forecast by Source, 2017 to 2032

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 26: Latin America Market Volume (MT) Forecast by Country, 2017 to 2032

Table 27: Latin America Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 28: Latin America Market Volume (MT) Forecast by Type, 2017 to 2032

Table 29: Latin America Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 30: Latin America Market Volume (MT) Forecast by Application, 2017 to 2032

Table 31: Latin America Market Value (US$ Million) Forecast by Packaging, 2017 to 2032

Table 32: Latin America Market Volume (MT) Forecast by Packaging, 2017 to 2032

Table 33: Latin America Market Value (US$ Million) Forecast by Flavor, 2017 to 2032

Table 34: Latin America Market Volume (MT) Forecast by Flavor, 2017 to 2032

Table 35: Latin America Market Value (US$ Million) Forecast by Source, 2017 to 2032

Table 36: Latin America Market Volume (MT) Forecast by Source, 2017 to 2032

Table 37: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 38: Europe Market Volume (MT) Forecast by Country, 2017 to 2032

Table 39: Europe Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 40: Europe Market Volume (MT) Forecast by Type, 2017 to 2032

Table 41: Europe Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 42: Europe Market Volume (MT) Forecast by Application, 2017 to 2032

Table 43: Europe Market Value (US$ Million) Forecast by Packaging, 2017 to 2032

Table 44: Europe Market Volume (MT) Forecast by Packaging, 2017 to 2032

Table 45: Europe Market Value (US$ Million) Forecast by Flavor, 2017 to 2032

Table 46: Europe Market Volume (MT) Forecast by Flavor, 2017 to 2032

Table 47: Europe Market Value (US$ Million) Forecast by Source, 2017 to 2032

Table 48: Europe Market Volume (MT) Forecast by Source, 2017 to 2032

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 50: East Asia Market Volume (MT) Forecast by Country, 2017 to 2032

Table 51: East Asia Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 52: East Asia Market Volume (MT) Forecast by Type, 2017 to 2032

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 54: East Asia Market Volume (MT) Forecast by Application, 2017 to 2032

Table 55: East Asia Market Value (US$ Million) Forecast by Packaging, 2017 to 2032

Table 56: East Asia Market Volume (MT) Forecast by Packaging, 2017 to 2032

Table 57: East Asia Market Value (US$ Million) Forecast by Flavor, 2017 to 2032

Table 58: East Asia Market Volume (MT) Forecast by Flavor, 2017 to 2032

Table 59: East Asia Market Value (US$ Million) Forecast by Source, 2017 to 2032

Table 60: East Asia Market Volume (MT) Forecast by Source, 2017 to 2032

Table 61: South Asia Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 62: South Asia Market Volume (MT) Forecast by Country, 2017 to 2032

Table 63: South Asia Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 64: South Asia Market Volume (MT) Forecast by Type, 2017 to 2032

Table 65: South Asia Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 66: South Asia Market Volume (MT) Forecast by Application, 2017 to 2032

Table 67: South Asia Market Value (US$ Million) Forecast by Packaging, 2017 to 2032

Table 68: South Asia Market Volume (MT) Forecast by Packaging, 2017 to 2032

Table 69: South Asia Market Value (US$ Million) Forecast by Flavor, 2017 to 2032

Table 70: South Asia Market Volume (MT) Forecast by Flavor, 2017 to 2032

Table 71: South Asia Market Value (US$ Million) Forecast by Source, 2017 to 2032

Table 72: South Asia Market Volume (MT) Forecast by Source, 2017 to 2032

Table 73: Oceania Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 74: Oceania Market Volume (MT) Forecast by Country, 2017 to 2032

Table 75: Oceania Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 76: Oceania Market Volume (MT) Forecast by Type, 2017 to 2032

Table 77: Oceania Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 78: Oceania Market Volume (MT) Forecast by Application, 2017 to 2032

Table 79: Oceania Market Value (US$ Million) Forecast by Packaging, 2017 to 2032

Table 80: Oceania Market Volume (MT) Forecast by Packaging, 2017 to 2032

Table 81: Oceania Market Value (US$ Million) Forecast by Flavor, 2017 to 2032

Table 82: Oceania Market Volume (MT) Forecast by Flavor, 2017 to 2032

Table 83: Oceania Market Value (US$ Million) Forecast by Source, 2017 to 2032

Table 84: Oceania Market Volume (MT) Forecast by Source, 2017 to 2032

Table 85: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 86: Middle East and Africa Market Volume (MT) Forecast by Country, 2017 to 2032

Table 87: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2017 to 2032

Table 88: Middle East and Africa Market Volume (MT) Forecast by Type, 2017 to 2032

Table 89: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2017 to 2032

Table 90: Middle East and Africa Market Volume (MT) Forecast by Application, 2017 to 2032

Table 91: Middle East and Africa Market Value (US$ Million) Forecast by Packaging, 2017 to 2032

Table 92: Middle East and Africa Market Volume (MT) Forecast by Packaging, 2017 to 2032

Table 93: Middle East and Africa Market Value (US$ Million) Forecast by Flavor, 2017 to 2032

Table 94: Middle East and Africa Market Volume (MT) Forecast by Flavor, 2017 to 2032

Table 95: Middle East and Africa Market Value (US$ Million) Forecast by Source, 2017 to 2032

Table 96: Middle East and Africa Market Volume (MT) Forecast by Source, 2017 to 2032

Figure 1: Global Market Value (US$ Million) by Type, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by Application, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by Packaging, 2022 to 2032

Figure 4: Global Market Value (US$ Million) by Flavor, 2022 to 2032

Figure 5: Global Market Value (US$ Million) by Source, 2022 to 2032

Figure 6: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2017 to 2032

Figure 8: Global Market Volume (MT) Analysis by Region, 2017 to 2032

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 11: Global Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 12: Global Market Volume (MT) Analysis by Type, 2017 to 2032

Figure 13: Global Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 14: Global Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 15: Global Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 16: Global Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 17: Global Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 18: Global Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 19: Global Market Value (US$ Million) Analysis by Packaging, 2017 to 2032

Figure 20: Global Market Volume (MT) Analysis by Packaging, 2017 to 2032

Figure 21: Global Market Value Share (%) and BPS Analysis by Packaging, 2022 to 2032

Figure 22: Global Market Y-o-Y Growth (%) Projections by Packaging, 2022 to 2032

Figure 23: Global Market Value (US$ Million) Analysis by Flavor, 2017 to 2032

Figure 24: Global Market Volume (MT) Analysis by Flavor, 2017 to 2032

Figure 25: Global Market Value Share (%) and BPS Analysis by Flavor, 2022 to 2032

Figure 26: Global Market Y-o-Y Growth (%) Projections by Flavor, 2022 to 2032

Figure 27: Global Market Value (US$ Million) Analysis by Source, 2017 to 2032

Figure 28: Global Market Volume (MT) Analysis by Source, 2017 to 2032

Figure 29: Global Market Value Share (%) and BPS Analysis by Source, 2022 to 2032

Figure 30: Global Market Y-o-Y Growth (%) Projections by Source, 2022 to 2032

Figure 31: Global Market Attractiveness by Type, 2022 to 2032

Figure 32: Global Market Attractiveness by Application, 2022 to 2032

Figure 33: Global Market Attractiveness by Packaging, 2022 to 2032

Figure 34: Global Market Attractiveness by Flavor, 2022 to 2032

Figure 35: Global Market Attractiveness by Source, 2022 to 2032

Figure 36: Global Market Attractiveness by Region, 2022 to 2032

Figure 37: North America Market Value (US$ Million) by Type, 2022 to 2032

Figure 38: North America Market Value (US$ Million) by Application, 2022 to 2032

Figure 39: North America Market Value (US$ Million) by Packaging, 2022 to 2032

Figure 40: North America Market Value (US$ Million) by Flavor, 2022 to 2032

Figure 41: North America Market Value (US$ Million) by Source, 2022 to 2032

Figure 42: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 44: North America Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 47: North America Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 48: North America Market Volume (MT) Analysis by Type, 2017 to 2032

Figure 49: North America Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 50: North America Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 51: North America Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 52: North America Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 53: North America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 54: North America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 55: North America Market Value (US$ Million) Analysis by Packaging, 2017 to 2032

Figure 56: North America Market Volume (MT) Analysis by Packaging, 2017 to 2032

Figure 57: North America Market Value Share (%) and BPS Analysis by Packaging, 2022 to 2032

Figure 58: North America Market Y-o-Y Growth (%) Projections by Packaging, 2022 to 2032

Figure 59: North America Market Value (US$ Million) Analysis by Flavor, 2017 to 2032

Figure 60: North America Market Volume (MT) Analysis by Flavor, 2017 to 2032

Figure 61: North America Market Value Share (%) and BPS Analysis by Flavor, 2022 to 2032

Figure 62: North America Market Y-o-Y Growth (%) Projections by Flavor, 2022 to 2032

Figure 63: North America Market Value (US$ Million) Analysis by Source, 2017 to 2032

Figure 64: North America Market Volume (MT) Analysis by Source, 2017 to 2032

Figure 65: North America Market Value Share (%) and BPS Analysis by Source, 2022 to 2032

Figure 66: North America Market Y-o-Y Growth (%) Projections by Source, 2022 to 2032

Figure 67: North America Market Attractiveness by Type, 2022 to 2032

Figure 68: North America Market Attractiveness by Application, 2022 to 2032

Figure 69: North America Market Attractiveness by Packaging, 2022 to 2032

Figure 70: North America Market Attractiveness by Flavor, 2022 to 2032

Figure 71: North America Market Attractiveness by Source, 2022 to 2032

Figure 72: North America Market Attractiveness by Country, 2022 to 2032

Figure 73: Latin America Market Value (US$ Million) by Type, 2022 to 2032

Figure 74: Latin America Market Value (US$ Million) by Application, 2022 to 2032

Figure 75: Latin America Market Value (US$ Million) by Packaging, 2022 to 2032

Figure 76: Latin America Market Value (US$ Million) by Flavor, 2022 to 2032

Figure 77: Latin America Market Value (US$ Million) by Source, 2022 to 2032

Figure 78: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 80: Latin America Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 83: Latin America Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 84: Latin America Market Volume (MT) Analysis by Type, 2017 to 2032

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 87: Latin America Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 88: Latin America Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 91: Latin America Market Value (US$ Million) Analysis by Packaging, 2017 to 2032

Figure 92: Latin America Market Volume (MT) Analysis by Packaging, 2017 to 2032

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Packaging, 2022 to 2032

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Packaging, 2022 to 2032

Figure 95: Latin America Market Value (US$ Million) Analysis by Flavor, 2017 to 2032

Figure 96: Latin America Market Volume (MT) Analysis by Flavor, 2017 to 2032

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Flavor, 2022 to 2032

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Flavor, 2022 to 2032

Figure 99: Latin America Market Value (US$ Million) Analysis by Source, 2017 to 2032

Figure 100: Latin America Market Volume (MT) Analysis by Source, 2017 to 2032

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Source, 2022 to 2032

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Source, 2022 to 2032

Figure 103: Latin America Market Attractiveness by Type, 2022 to 2032

Figure 104: Latin America Market Attractiveness by Application, 2022 to 2032

Figure 105: Latin America Market Attractiveness by Packaging, 2022 to 2032

Figure 106: Latin America Market Attractiveness by Flavor, 2022 to 2032

Figure 107: Latin America Market Attractiveness by Source, 2022 to 2032

Figure 108: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 109: Europe Market Value (US$ Million) by Type, 2022 to 2032

Figure 110: Europe Market Value (US$ Million) by Application, 2022 to 2032

Figure 111: Europe Market Value (US$ Million) by Packaging, 2022 to 2032

Figure 112: Europe Market Value (US$ Million) by Flavor, 2022 to 2032

Figure 113: Europe Market Value (US$ Million) by Source, 2022 to 2032

Figure 114: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 115: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 116: Europe Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 117: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 118: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 119: Europe Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 120: Europe Market Volume (MT) Analysis by Type, 2017 to 2032

Figure 121: Europe Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 122: Europe Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 123: Europe Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 124: Europe Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 125: Europe Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 126: Europe Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 127: Europe Market Value (US$ Million) Analysis by Packaging, 2017 to 2032

Figure 128: Europe Market Volume (MT) Analysis by Packaging, 2017 to 2032

Figure 129: Europe Market Value Share (%) and BPS Analysis by Packaging, 2022 to 2032

Figure 130: Europe Market Y-o-Y Growth (%) Projections by Packaging, 2022 to 2032

Figure 131: Europe Market Value (US$ Million) Analysis by Flavor, 2017 to 2032

Figure 132: Europe Market Volume (MT) Analysis by Flavor, 2017 to 2032

Figure 133: Europe Market Value Share (%) and BPS Analysis by Flavor, 2022 to 2032

Figure 134: Europe Market Y-o-Y Growth (%) Projections by Flavor, 2022 to 2032

Figure 135: Europe Market Value (US$ Million) Analysis by Source, 2017 to 2032

Figure 136: Europe Market Volume (MT) Analysis by Source, 2017 to 2032

Figure 137: Europe Market Value Share (%) and BPS Analysis by Source, 2022 to 2032

Figure 138: Europe Market Y-o-Y Growth (%) Projections by Source, 2022 to 2032

Figure 139: Europe Market Attractiveness by Type, 2022 to 2032

Figure 140: Europe Market Attractiveness by Application, 2022 to 2032

Figure 141: Europe Market Attractiveness by Packaging, 2022 to 2032

Figure 142: Europe Market Attractiveness by Flavor, 2022 to 2032

Figure 143: Europe Market Attractiveness by Source, 2022 to 2032

Figure 144: Europe Market Attractiveness by Country, 2022 to 2032

Figure 145: East Asia Market Value (US$ Million) by Type, 2022 to 2032

Figure 146: East Asia Market Value (US$ Million) by Application, 2022 to 2032

Figure 147: East Asia Market Value (US$ Million) by Packaging, 2022 to 2032

Figure 148: East Asia Market Value (US$ Million) by Flavor, 2022 to 2032

Figure 149: East Asia Market Value (US$ Million) by Source, 2022 to 2032

Figure 150: East Asia Market Value (US$ Million) by Country, 2022 to 2032

Figure 151: East Asia Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 152: East Asia Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 153: East Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 154: East Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 155: East Asia Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 156: East Asia Market Volume (MT) Analysis by Type, 2017 to 2032

Figure 157: East Asia Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 158: East Asia Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 159: East Asia Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 160: East Asia Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 161: East Asia Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 162: East Asia Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 163: East Asia Market Value (US$ Million) Analysis by Packaging, 2017 to 2032

Figure 164: East Asia Market Volume (MT) Analysis by Packaging, 2017 to 2032

Figure 165: East Asia Market Value Share (%) and BPS Analysis by Packaging, 2022 to 2032

Figure 166: East Asia Market Y-o-Y Growth (%) Projections by Packaging, 2022 to 2032

Figure 167: East Asia Market Value (US$ Million) Analysis by Flavor, 2017 to 2032

Figure 168: East Asia Market Volume (MT) Analysis by Flavor, 2017 to 2032

Figure 169: East Asia Market Value Share (%) and BPS Analysis by Flavor, 2022 to 2032

Figure 170: East Asia Market Y-o-Y Growth (%) Projections by Flavor, 2022 to 2032

Figure 171: East Asia Market Value (US$ Million) Analysis by Source, 2017 to 2032

Figure 172: East Asia Market Volume (MT) Analysis by Source, 2017 to 2032

Figure 173: East Asia Market Value Share (%) and BPS Analysis by Source, 2022 to 2032

Figure 174: East Asia Market Y-o-Y Growth (%) Projections by Source, 2022 to 2032

Figure 175: East Asia Market Attractiveness by Type, 2022 to 2032

Figure 176: East Asia Market Attractiveness by Application, 2022 to 2032

Figure 177: East Asia Market Attractiveness by Packaging, 2022 to 2032

Figure 178: East Asia Market Attractiveness by Flavor, 2022 to 2032

Figure 179: East Asia Market Attractiveness by Source, 2022 to 2032

Figure 180: East Asia Market Attractiveness by Country, 2022 to 2032

Figure 181: South Asia Market Value (US$ Million) by Type, 2022 to 2032

Figure 182: South Asia Market Value (US$ Million) by Application, 2022 to 2032

Figure 183: South Asia Market Value (US$ Million) by Packaging, 2022 to 2032

Figure 184: South Asia Market Value (US$ Million) by Flavor, 2022 to 2032

Figure 185: South Asia Market Value (US$ Million) by Source, 2022 to 2032

Figure 186: South Asia Market Value (US$ Million) by Country, 2022 to 2032

Figure 187: South Asia Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 188: South Asia Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 189: South Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 190: South Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 191: South Asia Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 192: South Asia Market Volume (MT) Analysis by Type, 2017 to 2032

Figure 193: South Asia Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 194: South Asia Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 195: South Asia Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 196: South Asia Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 197: South Asia Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 198: South Asia Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 199: South Asia Market Value (US$ Million) Analysis by Packaging, 2017 to 2032

Figure 200: South Asia Market Volume (MT) Analysis by Packaging, 2017 to 2032

Figure 201: South Asia Market Value Share (%) and BPS Analysis by Packaging, 2022 to 2032

Figure 202: South Asia Market Y-o-Y Growth (%) Projections by Packaging, 2022 to 2032

Figure 203: South Asia Market Value (US$ Million) Analysis by Flavor, 2017 to 2032

Figure 204: South Asia Market Volume (MT) Analysis by Flavor, 2017 to 2032

Figure 205: South Asia Market Value Share (%) and BPS Analysis by Flavor, 2022 to 2032

Figure 206: South Asia Market Y-o-Y Growth (%) Projections by Flavor, 2022 to 2032

Figure 207: South Asia Market Value (US$ Million) Analysis by Source, 2017 to 2032

Figure 208: South Asia Market Volume (MT) Analysis by Source, 2017 to 2032

Figure 209: South Asia Market Value Share (%) and BPS Analysis by Source, 2022 to 2032

Figure 210: South Asia Market Y-o-Y Growth (%) Projections by Source, 2022 to 2032

Figure 211: South Asia Market Attractiveness by Type, 2022 to 2032

Figure 212: South Asia Market Attractiveness by Application, 2022 to 2032

Figure 213: South Asia Market Attractiveness by Packaging, 2022 to 2032

Figure 214: South Asia Market Attractiveness by Flavor, 2022 to 2032

Figure 215: South Asia Market Attractiveness by Source, 2022 to 2032

Figure 216: South Asia Market Attractiveness by Country, 2022 to 2032

Figure 217: Oceania Market Value (US$ Million) by Type, 2022 to 2032

Figure 218: Oceania Market Value (US$ Million) by Application, 2022 to 2032

Figure 219: Oceania Market Value (US$ Million) by Packaging, 2022 to 2032

Figure 220: Oceania Market Value (US$ Million) by Flavor, 2022 to 2032

Figure 221: Oceania Market Value (US$ Million) by Source, 2022 to 2032

Figure 222: Oceania Market Value (US$ Million) by Country, 2022 to 2032

Figure 223: Oceania Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 224: Oceania Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 225: Oceania Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 226: Oceania Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 227: Oceania Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 228: Oceania Market Volume (MT) Analysis by Type, 2017 to 2032

Figure 229: Oceania Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 230: Oceania Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 231: Oceania Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 232: Oceania Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 233: Oceania Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 234: Oceania Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 235: Oceania Market Value (US$ Million) Analysis by Packaging, 2017 to 2032

Figure 236: Oceania Market Volume (MT) Analysis by Packaging, 2017 to 2032

Figure 237: Oceania Market Value Share (%) and BPS Analysis by Packaging, 2022 to 2032

Figure 238: Oceania Market Y-o-Y Growth (%) Projections by Packaging, 2022 to 2032

Figure 239: Oceania Market Value (US$ Million) Analysis by Flavor, 2017 to 2032

Figure 240: Oceania Market Volume (MT) Analysis by Flavor, 2017 to 2032

Figure 241: Oceania Market Value Share (%) and BPS Analysis by Flavor, 2022 to 2032

Figure 242: Oceania Market Y-o-Y Growth (%) Projections by Flavor, 2022 to 2032

Figure 243: Oceania Market Value (US$ Million) Analysis by Source, 2017 to 2032

Figure 244: Oceania Market Volume (MT) Analysis by Source, 2017 to 2032

Figure 245: Oceania Market Value Share (%) and BPS Analysis by Source, 2022 to 2032

Figure 246: Oceania Market Y-o-Y Growth (%) Projections by Source, 2022 to 2032

Figure 247: Oceania Market Attractiveness by Type, 2022 to 2032

Figure 248: Oceania Market Attractiveness by Application, 2022 to 2032

Figure 249: Oceania Market Attractiveness by Packaging, 2022 to 2032

Figure 250: Oceania Market Attractiveness by Flavor, 2022 to 2032

Figure 251: Oceania Market Attractiveness by Source, 2022 to 2032

Figure 252: Oceania Market Attractiveness by Country, 2022 to 2032

Figure 253: Middle East and Africa Market Value (US$ Million) by Type, 2022 to 2032

Figure 254: Middle East and Africa Market Value (US$ Million) by Application, 2022 to 2032

Figure 255: Middle East and Africa Market Value (US$ Million) by Packaging, 2022 to 2032

Figure 256: Middle East and Africa Market Value (US$ Million) by Flavor, 2022 to 2032

Figure 257: Middle East and Africa Market Value (US$ Million) by Source, 2022 to 2032

Figure 258: Middle East and Africa Market Value (US$ Million) by Country, 2022 to 2032

Figure 259: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 260: Middle East and Africa Market Volume (MT) Analysis by Country, 2017 to 2032

Figure 261: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 262: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 263: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2017 to 2032

Figure 264: Middle East and Africa Market Volume (MT) Analysis by Type, 2017 to 2032

Figure 265: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 266: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 267: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2017 to 2032

Figure 268: Middle East and Africa Market Volume (MT) Analysis by Application, 2017 to 2032

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 271: Middle East and Africa Market Value (US$ Million) Analysis by Packaging, 2017 to 2032

Figure 272: Middle East and Africa Market Volume (MT) Analysis by Packaging, 2017 to 2032

Figure 273: Middle East and Africa Market Value Share (%) and BPS Analysis by Packaging, 2022 to 2032

Figure 274: Middle East and Africa Market Y-o-Y Growth (%) Projections by Packaging, 2022 to 2032

Figure 275: Middle East and Africa Market Value (US$ Million) Analysis by Flavor, 2017 to 2032

Figure 276: Middle East and Africa Market Volume (MT) Analysis by Flavor, 2017 to 2032

Figure 277: Middle East and Africa Market Value Share (%) and BPS Analysis by Flavor, 2022 to 2032

Figure 278: Middle East and Africa Market Y-o-Y Growth (%) Projections by Flavor, 2022 to 2032

Figure 279: Middle East and Africa Market Value (US$ Million) Analysis by Source, 2017 to 2032

Figure 280: Middle East and Africa Market Volume (MT) Analysis by Source, 2017 to 2032

Figure 281: Middle East and Africa Market Value Share (%) and BPS Analysis by Source, 2022 to 2032

Figure 282: Middle East and Africa Market Y-o-Y Growth (%) Projections by Source, 2022 to 2032

Figure 283: Middle East and Africa Market Attractiveness by Type, 2022 to 2032

Figure 284: Middle East and Africa Market Attractiveness by Application, 2022 to 2032

Figure 285: Middle East and Africa Market Attractiveness by Packaging, 2022 to 2032

Figure 286: Middle East and Africa Market Attractiveness by Flavor, 2022 to 2032

Figure 287: Middle East and Africa Market Attractiveness by Source, 2022 to 2032

Figure 288: Middle East and Africa Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vegan Cheese Market Size and Share Forecast Outlook 2025 to 2035

Vegan Confectionery Market Size and Share Forecast Outlook 2025 to 2035

Vegan Steak Market Size and Share Forecast Outlook 2025 to 2035

Vegan Pasta Market Size and Share Forecast Outlook 2025 to 2035

Vegan Hyaluronic Acid Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Peptides Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Skincare Market Size and Share Forecast Outlook 2025 to 2035

Vegan Protein Powder Market Analysis - Size, Share, and Forecast 2025 to 2035

Vegan Tortillas Market Size and Share Forecast Outlook 2025 to 2035

Vegan Casing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dressing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Sauce Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dips Market Size and Share Forecast Outlook 2025 to 2035

Vegan Yogurt Market Size, Growth, and Forecast for 2025 to 2035

Vegan Meals Market Size, Growth, and Forecast for 2025 to 2035

Vegan Dog Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Protein Bars Market Analysis – Size, Share & Trends 2025–2035

Vegan Vitamins and Supplements Market – Growth & Demand 2025 to 2035

Analysis and Growth Projections for Vegan Fast-Food Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA