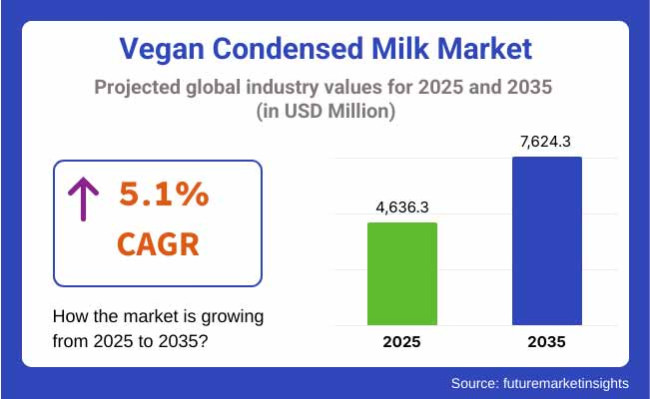

Global vegan condensed milk market was USD 4,231.8 million in the year 2023. Year-over-year sales of vegan condensed milk were growing at the rate of 4.8% in 2024 and the market size of the world in the year 2025 would be equivalent to USD 4,636.3 million. Global sales in the period of 2025 to 2035 would be increasing at the compound annual growth rate of 5.1% and would be nearing the sales value of USD 7,624.3 million as on 2035.

Vegan condensed milk also experiences high global traction led by expanding demand for alternative plant-based food and beverages. Lactose-free food also benefits from increased prevalence of consumers with lactose intolerance, expanding ethical consciousness of how animals should be treated, and increasing consumers' awareness toward green issues and sustainability. Following more and more consumers going green on the sustainability and health dimensions, consumption of dairy-free condensed milk will likewise increase steadily.

Plant milks like coconut milk, almond milk, oat milk, and soy milk condensed milks are top-selling store replacement products. Beyond advertising plain the same rich creamy texture of regular dairy-based condensed milk, plant-based milks are gaining ground on the nutrition and diet need of the most significant consuming segment. Businesses are launching next-gen flavor and chemical-free organic versions in the battle to gain traction with the growing wellness-driven segment.

Increased use of vegan condensed milk as a bakery and confectionery item is still one of the strongest drivers of growth in the market. Healthy growth within the plant-based desserts market also had its part to play in building demand, and high-end bakery companies and craft patisseries are adding dairy-free lines to the mix.

Geographically, the North American and European markets are presently dominating the market with robust plant-based dairy companies, robust flexitarian and vegan consumer bases, and robust policies for sustainable food systems. The Asia-Pacific market is extremely likely to be an emerging market for this intent due to urbanization, increasing disposable incomes, and increasing bases of healthy, plant-based food product consumers.

There would be a growing demand for food that is dairy-free and allergen-free and food that is eco-friendly, and that would be the driving force behind the industry. Since there would be ongoing developments of technology for food, there would be the need for formulation enhancement, flavor enhancement, and shelf life extension types for vegan condensed milk foods.

The following table is a comparative table of the six-month CAGR volatility between the base year (2024) and the current year (2025) of the global vegan condensed milk market, with emphasis on key differences in performance and serving as a timeline of realization trends of revenues. It thus provides stakeholders with a better understanding of the trend of growth in the year. January to June is referred to as first half-year (H1), and July to December as second half-year (H2).

| Particulars | Value CAGR |

|---|---|

| H1 | 4.7% (2024 to 2034) |

| H2 | 4.9% (2024 to 2034) |

| H1 | 5.0% (2025 to 2035) |

| H2 | 5.1% (2025 to 2035) |

In H1 of the decade 2025 to 2035, the company will increase at a CAGR of 5.0%, whereas in H2 of the same decade, it will increase at an increased CAGR of 5.1%. Starting the following decade from H1 2025 to H2 2035, the CAGR will be increased. In H1 2025, the industry achieved a growth of 30 BPS, whereas in H2 2025, the business achieved a growth of 20 BPS compared to the previous survey.

With growing need for plant-based milk substitutes, growing demand for sustainable and hypoallergenic food and ongoing technological progress in food processing technology, demand for vegan condensed milk will mainly witness fast growth over the next decade. Organic, clean-label, and premium formats are the areas where firms need to focus to meet shifting consumer preferences.

While Tier 1 encompasses a larger group, there is a smaller competitive set within Tier 1 that are considerable both by revenue and by category breadth and footprint in plant-based dairy alternatives. Strong brand equity and ongoing investment in product innovation, aggressive marketing campaigns, and sustainability initiatives make these companies well-positioned to capture the growing traction for vegan and lactose-free alternatives.

For example, Nestlé launched Carnation Vegan Condensed Milk Alternative that has rapidly taken up space on the shelf of supermarkets and online platforms around the world. Another big contender, Nature’s Charm, was among the first makers of coconut-based vegan condensed milk and has global distribution and a deep plant-based product portfolio.

These Tier 1 companies leverage their economies of scale, established retail networks, and aggressive marketing to achieve market dominance in retail and foodservice channel.

Tier 2 consists of moderately-ranked brands by revenue (in comparison to Tier 1 brands) but with strong performances in niche and regional markets, particularly those dedicated to specialty plant-based products. Edward & Sons Trading Co., for example, has built a following with its Let’s Do Organic family, featuring organic coconut condensed milk substitutes.

Another is Califia Farms, a well-established player in the dairy-free beverage market that now seems to be slowly but surely expanding into the vegan dessert ingredient space with condensed milk alternatives and the like. These companies are leveraging on premium positioning, clean-label ingredients, and innovation (e.g., oat-based, almond-based condensed milk, etc.) to target health-conscious and ethical consumers.

Tier 3 players are fresh entrants and smaller players gaining the attention of local and online markets. These companies often have little distribution but use e-commerce, social media marketing and partnerships with vegan influencers to expand. One company, Nature’s Greatest Foods, sells organic coconut condensed milk through direct-to-consumer sites and health food stores.

Meanwhile, artisanal producers and startups are launching in the space, with niche formulations (e.g., cashew or hemp condensed milk) targeting gourmet and specialty food consumers. These companies often focus on sustainability, ethical sourcing and innovation in flavor or packaging to differentiate themselves from competitors in a rapidly growing segment.

Adoption in Global Cuisines and Ethnic Dessert Recipes

Shift: Vegan condensed milk is now being baked in with other ingredients around the world and in ethnic cuisines, as consumer curiosity shifts toward plant-based on traditional desserts. Familiar recipes for Thai iced tea, Indian barfi, Filipino leche flan and Latin American tres leches cake have long been made with condensed milk but are now being reformulated with plant-based substitutes, aiming at vegan, flexitarian and health-conscious consumers.

The rise of plant-based culinary inclusivity is being driven by immigrant communities, food bloggers and culinary tourism, all of whom are pushing for its embrace.

Strategic Response: Brands are finding ways to localize marketing content, both through culturally relevant recipes and through collaborations with the ethnic chefs and influencers. Nature’s Charm, for instance, launched a “Global Vegan Sweets” campaign, with recipes for products like vegan mango sticky rice and coconut flan, leading to a 12 percent increase in sales in Southeast Asia and Latin America.

A Sri Lankan brand, Cocomi Bio, marketed its vegan condensed milk for the Asian dessert market, and it has since taken off in Asian supermarkets across the United Kingdom and Canada. USA-based So Delicious partnered with Hispanic and Asian recipe sites to highlight vegan twists on traditional desserts, increasing traffic to its website and direct-to-consumer sales by 15 percent. Such culinary inclusivity is driving market growth outside niche vegan communities into the mainstream-ethnic-food-adoring public.

Focus on Foodservice and Commercial Baking Channels

Shift: The demand for plant-based-tasting menu items is leading to extensive use of vegan condensed milk in foodservice establishments such as cafés, dessert parlors and commercial patisseries. Starting with café- and patisserie-established vegan iterations of familiar desserts and drinks (think things like vegan Vietnamese coffee, caramel lattes and banoffee pies), retail demand spills over.

Targets for hospitality sector sustainability and an increase in consumer demand for ‘better for you’ ingredients are also pushing restaurants to menu dairy-free options, making vegan condensed milk a B2B essential.

Strategic Response: Nestlé Professional, launching in bulk packs vegan condensed milk for café chains and suppliers to commercial bakeries across Europe months later, grew B2B sales +10% over six-month period. Milk alternative brand Oatly is rollinga barista edition vegan condensed milkfor use in coffee shops around Scandinavia.

Well in Asia, we secured hotel and foodservice relationships in Singapore and Malaysia providing vegan condensed milk for dessert buffets and High Tea programmes resulting in 13% revenue growth from this partnership. These moves highlight the B2B potential of the vegan condensed milk space beyond consumer retail.

Minimalist & Aesthetic Packaging - The Rise of Shelf Appeal

Shift: With the battle for shelf space intensifying, shoppers are flocking to aesthetic, clean-packaging that represent premium and ethical values. Vegan shoppers are particularly concerned with eco-friendly, recyclable packaging, and tend to respond to visual cues that target their lifestyle. This is part of a broader trend in which product design influences purchasing decisions almost as much as ingredients or nutrition.

Strategic Response: The brands Plant Pantry and Nature’s Charm switched to matte finishes and pastel color schemes with clean type that demonstrated a 20 percent lift in both shelf visibility and impulse purchases at premium grocery stores. Silk also promoted limited-edition tins of its products with seasonal art collabs to tap into design-conscious millennials, boosting sales by 9% in urban stores.

Oatly’s new prototype vegan condensed milk not only enters the zero-waste consumers with compostable containers, and eco-retailers, but carbon-labeling its ingredients, sustainability. These packaging innovations are not just aesthetics: they function as a non-verbal marketing item, speaking to inherent quality and sustainability values with a glance.

Emergence of DIY Vegan Condensed Milk Kits

Shift: As consumers focus on home cooking and clean-label eating, they are also looking to take full control of vegan condensed milk by making it from scratch at home using customizable ingredients. That trend is fueled by ingredient-focused consumers and cost-conscious shoppers seeking control over sugar level, flavor and base milk. It’s also part of maker culture, the idea of people producing foods, for themselves, with their own hands.

Strategic response: USA-based DIY Pantry introduced its Vegan Condensed Milk Mix Kits that include organic coconut milk powder and organic cane sugar, resulting in first-quarter sales soaring 30% in sales. Nature’s Charm launched a “Make Your Own” bundle, which included condensed milk base powders and recipe guides, driving 25% growth in DTC website traffic.

In Japan, Muji launched do-it-yourself vegan condensed milk pouches as part of its growing range of food kits, garnering healthy traction among health-conscious urbanites. Invested with additional educational elements, the kits serve experimental cooks and contribute to the wider messaging about how to assemble vegan-friendly meals, creating additional brand touchpoints and community mitigation.

Lifestyle and Dietary Nutritional Trends Integration

Shift: Vegan condensed milk is increasingly gaining status as an ingredient for functional and nutritional diets including high-protein, keto and fortified eating plans. Consumers now demand a condensed milk alternative with benefits: MCT natural oils, plant proteins, vitamins (B12, D) and adaptogens to enhance their energy, mind-muscle connect, and overall well-being. It taps into the biohacking and functional foods trend, particularly among fitness enthusiasts and wellness-minded consumers.

Strategic response: Elmhurst 1925 is producing a protein-fortified almond condensed milk that can be used in smoothies and desserts, aimed at fitness and recovery food. Nature’s Charm rolled out a new functional collection powered by MCT oil and B12 directly geared to health food stores and wellness platforms, helping to propel sales up 14% throughout North America.

In Australia, NutraMylk hit the stage with a sugar-free condensed milk alternative, sweetened with monk fruit and coconut, which plays in the paleo and keto diet spaces. This new research on these innovative uses elevates vegan condensed milk beyond mere dessert ingredient it’s capable of fulfilling its role as a functional food ingredient, adding utility, versatility and intrigue.

The following table shows the estimated growth rates of the top five territories. These markets are set to experience high consumption through 2035.

| Country | CAGR, 2025 to 2035 |

|---|---|

| USA | 4.9% |

| Germany | 5.3% |

| China | 5.0% |

| Japan | 4.7% |

| India | 5.5% |

Many USA consumers are opting for dairy-free alternatives también, increasing the demand of vegan condensed milk. As vegan baking, desserts, and coffee creamers become more popular, the demand for plant-based condensed milk has grown.

Under strict quality protocols, retail chains and online stores currently sell vegan condensed milk some are even organic, non-GMO and preservative free. Manufacturers have responded to the clean-label movement by adding better, higher-quality options like coconut, oat and almond milk.

In Germany, there is a sizable plant-based food sector, and vegan dairy replacements are highly sought after. Awareness about lactose intolerance, as well as ethical and sustainability issues has increased the demand for vegan condensed milk. Supermarkets, health food stores and organic retailers are still increasing their plant based product range.

The growth of this market is also driven by regulatory support for plant-based food innovation and interest from consumers in cruelty-free and environmentally-friendly able products.

Ever more conscious of lactose intolerance and plant-based diets, China is leading demand for vegan condensed milk. Desire for non-dairy options for everything from desserts and beverages; healthier alternatives to traditional choices. E-commerce platforms & food delivery services have further ensured the widespread availability of vegan condensed milk.

And government-funded programmes which promote plant-based nutrition within the context of a sustainable food strategy have incentivized food manufacturers to develop dairy-free products.

Japan’s inclination for functional and high-quality food products has aided the continuous demand for vegan condensed milk. Increasing consumption of dairy alternatives in coffee, desserts, and traditional sweets is driving the market growth.

Convenience stores, supermarkets and premium grocery chains are expanding their plant-based selections. There is a high demand for texture and taste in the Japanese market, so vegan condensed milk from coconut, soy and oat milk can be innovative and high-quality.

India’s traditional dependence on dairy, coupled with the expansion of vegan awareness, has driven more demand for plant-based condensed milk. With supermarkets and net portals expanding their vegan and lactose-free choices, the marketplaces grew significantly. Plant-based condensed milk is also increasingly being used to prepare traditional Indian sweets and beverages, given India’s large vegetarian population and growing health consciousness.

Moreover, the Western population dietary trends and sustainability concerns have motivated manufacturers to produce dairy free substitutes that meet changing consumer choices.

| Segment | Value Share (2025) |

|---|---|

| Cans (By Packaging Type) | 55.8% |

Owing to the long shelf life, easy storage, and convenience, canned vegan condensed milk has emerged as the most preferred packaging format. The airtight seal of cans makes them a popular option for both consumers and manufacturers because they preserve the product and eliminate the need to refrigerate before opening. The increasing application of dairy-free and plant-based substitutes in home baking and cooking is another factor driving demand for canned condensed milk.

Others have followed suit, brands such as Nature’s Charm, Coconut Merchant and Sweetened Condensed Coconut Milk entering the space with canned vegan condensed milk with coconut, oat or almond bases, long used by home bakers, dessert makers and makers of confectionery.

Cans also claim market share owing to their durability and eco-friendliness as sustainability is becoming increasingly important for consumers when making purchasing decisions. Furthermore, the growing need for vegan and lactose-free dessert will compel manufacturers to expand their product portfolio by introducing a wide range of sweetened and unsweetened canned products.

| Segment | Value Share (2025) |

|---|---|

| Bakery (By Application) | 47.3% |

Including vegan condensed milk is one of the plant-based products that will be used in cakes, cookies, pastries, and other bakery goods as the plant-based market gain its ground due to high demand in the industry. With consumers looking for dairy-free and allergen-friendly options, vegan condensed milk makes a superb binding agent and sweetener in a range of recipes.

Whether you choose full or low-fat coconut milk, the rich and creamy texture combined with the natural sweetness (when allowed to reduce) of plant-based condensed milk make it perfect for replacing traditional dairy-based condensed milk in vegan and gluten-free baking.

Condensed milk based on oats, soy, coconut and almond are in the works to meet the demand from those who are vegan, lactose-intolerant or health-conscious, bakeries and home bakers said. Artisan and specialty bakeries are also using vegan condensed milk in their frostings, fillings and dairy-free caramel sauces, so its application in the bakery sector is being extended too. Are also contributing to the growth of vegan condensed milk in bakery applications as the viral social media home baking trends and the plant-based recipe innovations continue.

The Vegan Condensed Milk Market faces intense competition as the top organizations like Nestlé Nature’s Charm and Califia Farms are acquiring market share through advertising, production through quality, and new ideas in development. These companies are pushing consumer preference by making many varieties of plant-based condensed milk alternatives (i.e. coconut, oat, almond, and soy), catering to the growing need for lactose-free and lactose intolerant options.

By releasing flavored and sweetened varieties, they are targeting both home bakers and commercial food manufacturers, expanding their consumers. Manufacturers focus on product quality, formulation and packaging improvements in order to remain competitive.

Firms are creating vegan condensed milk that is creamy and rich in texture with a similar mouthfeel to traditional dairy products to ensure they work in baking, cooking and desserts. Furthermore, environmentally preferable, resalable and easy-pour ready-to-eat packaging also is gaining popularity as well convenience and waste is reduced.

For instance:

Market segmented into Online and Offline.

Market segmented into Skimmed, Part Skimmed, Sweetened, and Others.

Market segmented into Cans, Tubes, and Bottles.

Market segmented into Bakery, Confectionery, Foods and Beverages, and Others.

Market segmented into North America, Latin America, Europe, Asia Pacific (APAC), and the Middle East & Africa (MEA).

The global vegan condensed milk market is projected to grow at a CAGR of 5.1% during the forecast period.

The market is estimated to reach approximately USD 7,624.3 million by 2035.

The coconut-based vegan condensed milk segment is expected to witness the fastest growth due to its creamy texture, natural sweetness, and increasing preference for dairy alternatives.

Key growth drivers include rising demand for plant-based dairy alternatives, growing lactose intolerance awareness, and increasing usage of vegan condensed milk in baking, confectionery, and desserts.

Leading companies in the market include Nestlé (Carnation), Nature’s Charm, Edward & Sons, Clean Green Simple, Go Dairy Free, & Goya.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Packaging Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by Sales Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Packaging Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by Sales Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 20: Latin America Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Packaging Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by Sales Channel, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 28: Europe Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 30: Europe Market Volume (Tons) Forecast by Packaging Type, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 32: Europe Market Volume (Tons) Forecast by Sales Channel, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 36: Asia Pacific Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 38: Asia Pacific Market Volume (Tons) Forecast by Packaging Type, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Asia Pacific Market Volume (Tons) Forecast by Sales Channel, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 44: MEA Market Volume (Tons) Forecast by Source, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Packaging Type, 2018 to 2033

Table 46: MEA Market Volume (Tons) Forecast by Packaging Type, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: MEA Market Volume (Tons) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 10: Global Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 14: Global Market Volume (Tons) Analysis by Packaging Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 18: Global Market Volume (Tons) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Source, 2023 to 2033

Figure 22: Global Market Attractiveness by Packaging Type, 2023 to 2033

Figure 23: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 34: North America Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 38: North America Market Volume (Tons) Analysis by Packaging Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 42: North America Market Volume (Tons) Analysis by Sales Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Source, 2023 to 2033

Figure 46: North America Market Attractiveness by Packaging Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 58: Latin America Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 62: Latin America Market Volume (Tons) Analysis by Packaging Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 66: Latin America Market Volume (Tons) Analysis by Sales Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Packaging Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 82: Europe Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 86: Europe Market Volume (Tons) Analysis by Packaging Type, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 90: Europe Market Volume (Tons) Analysis by Sales Channel, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 93: Europe Market Attractiveness by Source, 2023 to 2033

Figure 94: Europe Market Attractiveness by Packaging Type, 2023 to 2033

Figure 95: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Tons) Analysis by Packaging Type, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Tons) Analysis by Sales Channel, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Source, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Packaging Type, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Source, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Packaging Type, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 130: MEA Market Volume (Tons) Analysis by Source, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Packaging Type, 2018 to 2033

Figure 134: MEA Market Volume (Tons) Analysis by Packaging Type, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Packaging Type, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Packaging Type, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 138: MEA Market Volume (Tons) Analysis by Sales Channel, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 141: MEA Market Attractiveness by Source, 2023 to 2033

Figure 142: MEA Market Attractiveness by Packaging Type, 2023 to 2033

Figure 143: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vegan Cheese Market Size and Share Forecast Outlook 2025 to 2035

Vegan Confectionery Market Size and Share Forecast Outlook 2025 to 2035

Vegan Steak Market Size and Share Forecast Outlook 2025 to 2035

Vegan Pasta Market Size and Share Forecast Outlook 2025 to 2035

Vegan Hyaluronic Acid Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Peptides Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Skincare Market Size and Share Forecast Outlook 2025 to 2035

Vegan Protein Powder Market Analysis - Size, Share, and Forecast 2025 to 2035

Vegan Tortillas Market Size and Share Forecast Outlook 2025 to 2035

Vegan Casing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dressing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Sauce Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dips Market Size and Share Forecast Outlook 2025 to 2035

Vegan Yogurt Market Size, Growth, and Forecast for 2025 to 2035

Vegan Meals Market Size, Growth, and Forecast for 2025 to 2035

Vegan Dog Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Protein Bars Market Analysis – Size, Share & Trends 2025–2035

Vegan Vitamins and Supplements Market – Growth & Demand 2025 to 2035

Analysis and Growth Projections for Vegan Fast-Food Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA