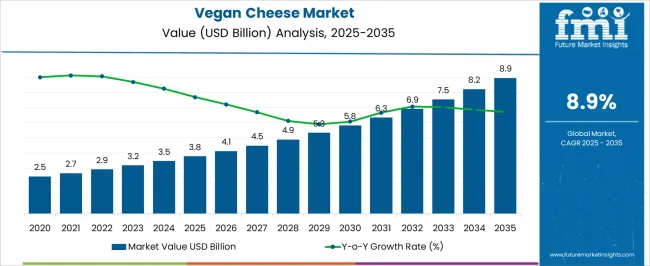

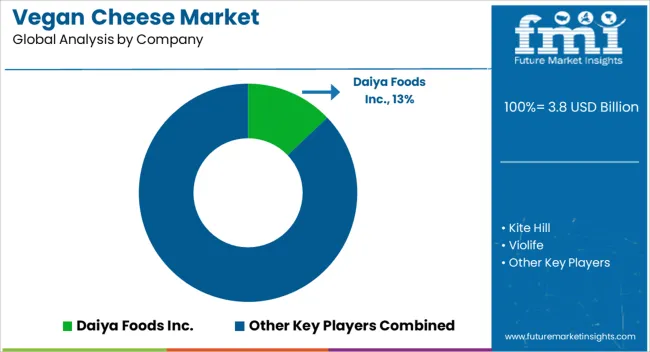

The Vegan Cheese Market is estimated to be valued at USD 3.8 billion in 2025 and is projected to reach USD 8.9 billion by 2035, registering a compound annual growth rate (CAGR) of 8.9% over the forecast period.

| Metric | Value |

|---|---|

| Vegan Cheese Market Estimated Value in (2025 E) | USD 3.8 billion |

| Vegan Cheese Market Forecast Value in (2035 F) | USD 8.9 billion |

| Forecast CAGR (2025 to 2035) | 8.9% |

The vegan cheese market is expanding steadily, propelled by rising consumer preference for plant-based diets, heightened lactose intolerance awareness, and sustainability concerns linked to dairy production. Food industry publications and company reports have highlighted strong demand from both retail and foodservice channels, with vegan cheese increasingly incorporated into mainstream menus and packaged food products.

Advances in food technology have enabled producers to improve taste, texture, and meltability, narrowing the sensory gap between vegan and traditional cheese. Strategic investments in product innovation and raw material diversification, including nuts, seeds, and legumes, have further broadened product portfolios.

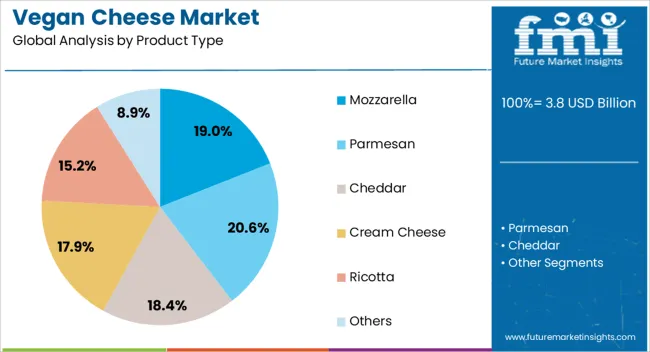

Growing health consciousness has also fueled demand for dairy-free alternatives that support cholesterol management and weight control. Looking ahead, market growth is expected to be supported by regulatory encouragement for plant-based labeling, expanding product availability across global supermarket chains, and rising consumer willingness to pay for sustainable and ethical food options. Segmental expansion is being led by mozzarella within product type, shreds as the dominant form, and almond milk as the primary source base.

The Mozzarella segment is projected to hold 19.0% of the vegan cheese market revenue in 2025, establishing itself as the leading product type. Its dominance has been shaped by strong consumer demand for vegan cheese suitable for pizzas, sandwiches, and baked dishes, where mozzarella is traditionally used.

Food industry announcements have noted that mozzarella formulations have benefited from advancements in melting and stretching properties, aligning closely with consumer expectations. Retail sales data has reflected consistent growth in vegan mozzarella demand due to its versatility across home cooking and foodservice menus.

Manufacturers have prioritized mozzarella development because of its universal appeal and ability to drive repeat purchases. As global quick-service restaurants and bakery chains expand their plant-based offerings, the Mozzarella segment is expected to maintain a central role in sustaining vegan cheese adoption.

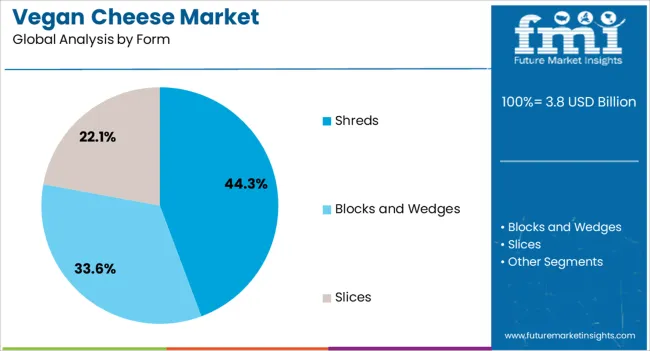

The Shreds segment is anticipated to account for 44.3% of the vegan cheese market revenue in 2025, sustaining its position as the leading form. This growth has been attributed to consumer preference for convenient, ready-to-use cheese formats that reduce preparation time in home and professional kitchens.

Industry sources have reported that shredded vegan cheese has been widely adopted by restaurants, bakeries, and packaged food companies due to its ease of portioning and consistent meltability. Additionally, shredded formats have gained traction in retail channels as they are perceived as versatile, suitable for a wide range of recipes from salads to baked goods.

Packaging innovations, such as resealable pouches, have further supported the popularity of shredded vegan cheese by preserving freshness and extending shelf life. With convenience continuing to shape consumer purchasing behavior, the Shreds segment is expected to remain the dominant choice among vegan cheese forms.

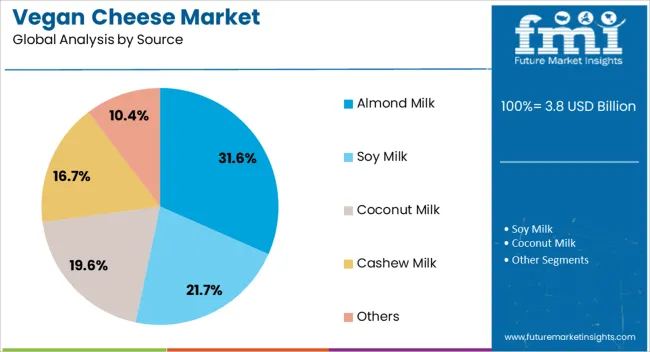

The Almond Milk segment is projected to contribute 31.6% of the vegan cheese market revenue in 2025, maintaining its leadership within source materials. Growth in this segment has been supported by the widespread acceptance of almond-based dairy alternatives across beverages, yogurts, and desserts, which has translated into cheese formulations.

Almond milk has been preferred for its neutral taste, creamy texture, and nutritional attributes, including healthy fats and vitamin E content. Food industry reports have highlighted strong consumer demand for almond-derived products due to their perceived natural and wholesome profile.

Moreover, almond milk-based vegan cheese has gained visibility in supermarkets and specialty stores, supported by brand marketing campaigns emphasizing plant-based wellness. Although concerns about almond cultivation’s water footprint exist, its established market recognition and consumer trust have kept almond milk at the forefront of vegan cheese innovation. This segment is expected to remain resilient as producers continue to refine flavor profiles and expand almond-based cheese varieties.

Mozzarella is estimated to acquire a share of 19% in 2025. The product enjoys significant use in popular dishes, especially pizza. The growing vegan movement is motivating consumers to go for delicious plant-based pizzas. Players are thus introducing improved vegan mozzarella to allow people to indulge in cheesy goodness made without dairy.

| Leading Product Type | Mozzarella |

|---|---|

| Value Share (2025) | 19% |

The application of vegan mozzarella extends to vegan takes on grilled cheese sandwiches, lasagna, salads, and pasta dishes to add the familiar cheesy element. A wide spectrum of applications is making mozzarella more attractive to consumers.

Hypermarkets/supermarkets make up 34% of the global market share. Consumers typically increasingly flock to this sales channel to purchase items after going through their ingredient lists and making a comparative judgment about the other available alternatives. These stores continuously offer discounts to compel consumers to buy from their stores.

| Leading Sales Channel | Hypermarkets/Supermarkets |

|---|---|

| Value Share (2025) | 34% |

These stores are allocating more shelf space to vegan products like dairy-free cheese to increase their visibility among consumers unaware of the product.

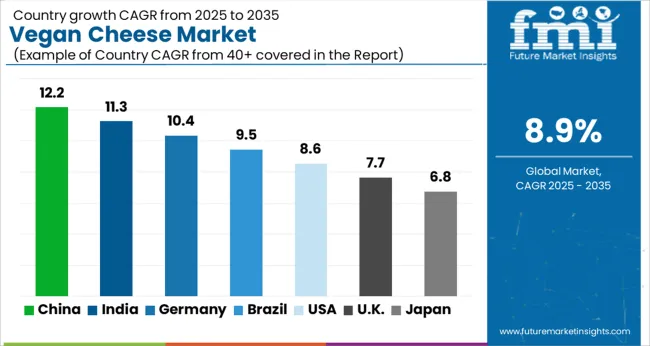

According to the latest industry projections, the demand for vegan cheese is going to be more pronounced in countries of North America and Europe. In Asia Pacific, consumption patterns vary significantly from country to country, with India showing massive demand for cruelty-free cheese.

The United States vegan cheese industry is benefitting from the surge of interest in vegan products, cheese included. The United States Vegan Cheese Market share of 25.4% weighs heavily on the other regional markets. Thus, extending its influence in the global market.

The accelerated consumer demand for vegan cheese, increasing at 6.9% CAGR, is further attracting several key players like Miyoko's Creamery, Treeline Tree Nut Cheese, Follow Your Heart, etc. to absorb emerging demand through new key offerings.

Lactose-intolerant as well as health-conscious consumers are increasingly consuming dairy-free cheese to keep their health in check. The demand for vegan cheese is further supported by the rising availability of dairy-free cheese in popular stores and restaurant chains.

Consumers in the United Kingdom are creating a consistent demand for vegan cheese. Through 2035, the industry is projected to expand at a 5.3% CAGR, supported by government promotion and awareness efforts about the product’s health benefits.

Popular dairy-free cheese brands like Violife are widely available across the country and are loved by the residents. This Greece-based company, especially, comes in slices, shreds, blocks, and more. Thus, impressing people with its flavor and meltability.

Growing vegan population in the country is further strengthening the demand for vegan cheese. Dairy-free cheese, due to its similar attributes to the conventional version, goes along with pasta, pizza, tacos, etc. Rising popularity of this cheese is inducing supermarkets and health food stores to stock innovations in vegan cheese.

Population in India is on the radar of leading dairy-free cheese brands. Increasing income levels and surging willingness to pay for ethically-produced products are consolidating this sector in India. These industry dynamics are supporting the pace of 6.8% over the next decade.

Purchases of the Indian population are driven by concerns over personal health, animal welfare, and the environment. Customers are searching for these 100% cheese alternatives online to get these products quickly delivered to their order location. Stores, convenience stores, etc. are also stocking alternates for parmesan, mozzarella, cheddar, cheesy dips, and more to foster inclusivity.

Players are also introducing dairy-free cheese offerings that are cholesterol-free so that consumers can enjoy a guilt-free experience.

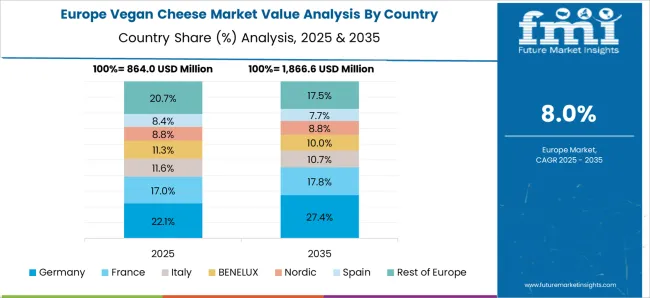

The vegan cheese industry in Germany is predicted to expand at a promising 7.9% over the estimated period. The easy availability of vegan sliced cheese and other vegan cheese forms in German supermarkets is increasing the industry share for dairy-free cheese in the country.

Broader plant-based movement spurring in Germany, giving impetus to the growth of the vegan cheese industry. In line with this, the country is experiencing a steep rise in vegetarian and vegan diets. The plant-based movement is also supported by more people now opting for flexitarian and reducetarian diets to decrease their consumption of animal products.

Increasing awareness of lactose intolerance is also fueling the sales of plant-based cheese. In time, not far from now, dairy-free cheese producers are predicted to innovate more dairy-free cheese options, particularly fermented varieties, to draw in more customers.

Demand for plant-based cheese in China is expanding at a CAGR of 3.9% over the projected period. Rising population readiness to live more sustainably, consciously, and with a lesser carbon footprint, is fueling the demand for plant-based cheese.

Rising integration of dairy-free cheese and its byproducts in Chinese culinary culture to develop novel fusion foods is raising the consumer base of dairy-free cheese.

Companies are increasingly developing strategic partnerships with food distributors to broaden the reach of their dairy-free cheese line across China. For instance, in May 2025, Youkuai Group International, a Chinese plant-based food firm, partnered with Usource, a local food distributor, to enjoy a better reach across the country.

Youkuai’s dairy-free meat brand Zrou is benefitting from this alliance. This is because its products are increasingly being supplied across various food outlets like hotels, breweries, diners, etc. across Tianjin, Beijing, and other regions of North China.

Key players in the vegan cheese sector are focusing on strategic brand positioning in high-potential markets to increase their industry share. Increasingly, players are exploring new opportunities in the dairy alternatives sector to tap into untapped and niche segments for dairy-free cheese.

Despite the growing popularity of cruelty-free cheese, modern consumers are showing concern over the product’s nutritional value and quality. Consequently, full-scale research and development are being made to mimic the traditional cheese’ properties.

Players are also investing their money in these activities to closely replicate the flavor qualities and intricate structure of the cheese. Innovations in vegan cheese development are thus an effective strategy adopted by players to differentiate their product offerings and increase their competitiveness.

Players are also strengthening their ties with different distribution channels of plant-based cheese. Certain distribution channels employ point of sale (POS) marketing to players who give them a higher cut to reach the intended consumers. Thus, increasing their annual sales of dairy-free cheese.

Corporations are also maximizing business synergies to effectively complement their product pipelines to get ahead in this sector.

Following Latest Developments Molding the Vegan Cheese Sector

Based on product type, the industry is segregated into mozzarella, parmesan, cheddar, cream cheese, ricotta, and others

By form, the industry is trifurcated into shreds, slices, blocks, and wedges

Various sources of dairy-free cheese are almond milk, soy milk, coconut milk, cashew milk, and others

Key end uses of dairy-free cheese include processed and packed foods, food processing, baked goods, sauces, snacks, ready meals, dairy and desserts, food service/HoReCa (hotels, restaurants, cafes), dips and dressings, and household/retail

Dairy-free cheese is available in both conventional and organic form

Various sales channels for dairy-free cheese are traditional grocery stores, indirect sales, hypermarkets/supermarkets, convenience stores, direct sales, specialty retail stores, and online retailers

Key countries taken for this research report are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

The global vegan cheese market is estimated to be valued at USD 3.8 billion in 2025.

The market size for the vegan cheese market is projected to reach USD 8.9 billion by 2035.

The vegan cheese market is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key product types in vegan cheese market are mozzarella, parmesan, cheddar, cream cheese, ricotta and others.

In terms of form, shreds segment to command 44.3% share in the vegan cheese market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA