The international vegan cat food market will expand steadily as a result of growing pet owner interest in humane, sustainable pet foods, improved plant-based pet food formulation, and heightened environmental awareness of conventional meat-based diets. Vegan cat foods are leading the way in delivering essential nutrients without the use of animal products, meeting ethical and health needs for pet owners.

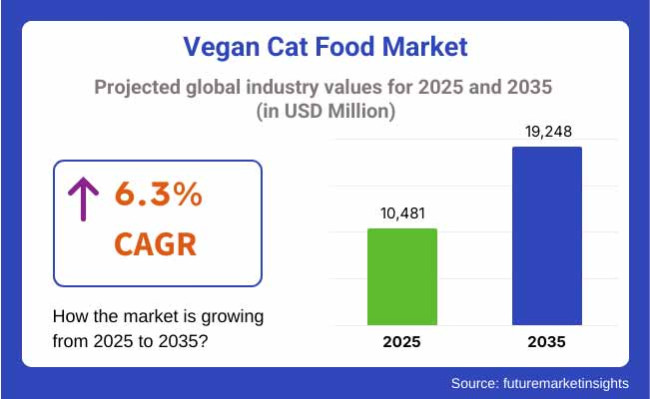

With the increasing trend towards organic and cruelty-free pet products, economic players are investing in new recipes for high-quality cat diet. The size of the vegan cat food market will be approximately USD 10,481 million in 2025. It is expected to be approximately USD 19,248 million in size by the year 2035 with a 6.3% CAGR.

The market is driven by ongoing innovations in vegetable protein substitutes such as pea protein, lentils, and omega-3 substitutes derived from algae. As there is radically high demand coming from cat owners who are sensitive to sustainability issues, animal cruelty, and health concerns of cats, the vegan cat food market will grow consistently throughout 2035.

North America is the leading market for plant-based cat food due to the widespread trend among pet owners towards sustainable and ethical pet food. The United States is specifically a leading market driver with more pet food start-ups and conventional food companies launching series of plant-based cat food. Ease of veterinarian-formulated products and extensive penetration through online channels also boosts market growth.

Europe is another giant market, and the quality of pet food there is good with cultural inclination towards sustainability. United Kingdom, Germany, and Netherlands are some of the front-runners in using plant-based pet food. In these nations, advanced nutritional science is utilized in the production of highly consistent vegan food products that are specifically formulated to meet feline nutritional needs, ending decades of taurine, vitamin B12, and essential amino acid deficiency problems.

There is greater urbanization, good pet adoption levels, and heightened green awareness, and as a result, the Asia-Pacific area is the fastest-growing market in the region for plant-based cat food. South Korea, Japan, and Australia are major movers in the region, and as local participants step up the supply of their products to match a rising wave of green pet owners, it stimulates growing demand for the market within the region. Green farming and government initiative drive regional market expansion.

Challenges: Nutritional Adequacy, Veterinary Skepticism, and Cost Constraints

Among the most substantial challenges in vegan cat food industries are delivering balanced and complete nutrition to obligate carnivores, eradicating skepticism among veterinarian experts, and minimizing relatively high cost of plant-based nutritional maintenance.

Cats demand particular nutrients such as taurine, arachidonic acid, and vitamin D3 that occur naturally in animal nutrition. Nutritionally equivalent vegan replacements come with a monumental research and development effort that becomes production expense and retail cost.

Opportunities: Nutritional Innovation, Functional Ingredients, and Sustainable Packaging

There are challenges, but the vegan cat food market is a great market to enter. Improvements in bioengineered nutrients such as synthetic taurine and algae-derived omega-3 fatty acids are increasingly making nutritionally adequate plant-based diets for cats possible.

Functional ingredients such as probiotics, adaptogens, and fruit and vegetable-derived antioxidants are also contributing to the health values of vegan cat food. Environmentally friendly packaging options like compost packaging and biodegradable packaging are also becoming popular and in demand because of environmentally conscious consumers.

Vegan Cat Food was the rage during 2020 to 2024 when growing concern about the environmental and moral implications of conventional pet food emerged. Veterinarians' skepticism and doubts about the nutrition's sufficiency, however, kept most pet owners under control. Most producers chose to make up for the nutritional deficiency by adding test-tube-cultivated amino acids and synthetic feed additives to their formula.

In 2025 to 2035, plant-based cat food products will become increasingly even more advanced using the components of lab-grown proteins, precision fermentation, and AI-crafted nutrition to deliver very bioavailable plant-based feed.

Regulation policy will shift toward developing stricter policy for vegan pet food standards as sustainability-minded consumers drive mass green packaging and carbon-free production processes adoption. As more and more reports arrive in the form of the effectiveness of plant-based cat food, it will also gain popularity among veterinarians, hence further boosting the market growth.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with fundamental pet food safety protocols and label requirements. |

| Consumer Trends | Increased demand for plant-based pet diets, with pet owners looking at meat-free alternatives. |

| Industry Adoption | New entrants in the market of niche vegan pet food companies that sell plant-based kibble and wet foods. |

| Supply Chain and Sourcing | Source of plant-based material such as pea protein and soy from conventional suppliers. |

| Market Competition | Led by small to medium-sized companies that focus on vegan pet nutrition. |

| Market Growth Drivers | Driven by pet owners' awareness of animal welfare and desire for plant-based diets. |

| Sustainability and Environmental Impact | Progress made in green packaging and minimizing meat-derived ingredients. |

| Integration of Smart Technologies | Restricted use of technology for manufacturing, with an emphasis on conventional production systems. |

| Advancements in Equipment Design | Application of typical pet food processing equipment modified for use with plant-based recipes. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Introduction of strict clean-label requirements, non-GMO certification, and sustainability labels for vegan pet food. |

| Consumer Trends | Growing demand for lab-cultured meat alternatives in pet food, spurred by environmental issues and ethical factors. |

| Industry Adoption | Inroad of leading pet food companies into the vegan space, with novel protein sources such as cultured meat and insect protein. |

| Supply Chain and Sourcing | Transition to sustainable and local ingredients, such as lab-cultured meat and new plant proteins, to minimize carbon footprint. |

| Market Competition | Incorporation of major multinational pet food companies into the vegan sector, further competition and pressure to innovate. |

| Market Growth Drivers | Spurred by technological innovation, including cultured meat, and heightened concern about the environmental footprint of conventional pet food manufacturing. |

| Sustainability and Environmental Impact | Use of carbon-neutral manufacturing processes, zero-waste practices, and alternative proteins to reduce environmental footprint. |

| Integration of Smart Technologies | Deployment of AI-based formulation for balanced vegan diets, blockchain for traceability of ingredients, and precision fermentation methods for alternative proteins. |

| Advancements in Equipment Design | Creation of dedicated equipment for the manufacture of lab-grown meat and insect proteins, increasing efficiency and scalability. |

Vegan cat food market in the USA has expanded significantly because of pet owners' awareness of animal cruelty and the eco-friendly nature of the traditional meat-based diet. The legal approval of artificial lab-cultured meat for animal consumption also offers new business directions, whereby firms can create cruelty-free and green business.

Such companies as Meatly, based on an underlying interest in culture meat substitutes compared to animal food nutrition, have therefore emerged. This movement is an extension of the broad embrace of plant and alternative proteins within human diets, which reflects a shift culturally towards sustainability.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.2% |

The UK boasts a fast-expanding vegan cat food market fueled by the forward-thinking vision of the government regarding alternative proteins. The UK is the first country in Europe to be approved for lab-grown pet food, setting the pace in the new and growing market. Companies are now capitalizing on this support in developing and selling products of pet-cultured meat that appeal to green consumers who seek environmentally friendly and ethical alternatives for pets.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.0% |

The EU vegan cat food labeling and safety laws have placed their stamp on the vegan cat food market with a strong emphasis on natural and organic ingredients. Germany, France, and the Netherlands have an above-average tendency to favor luxury, plant-based pet foods of clean-label stature.

Regulatory hurdles to obtaining approval for approval of lab-grown meat have dissuaded the pet food industry uptake of cultured meat products. Despite this, the market is experiencing slow but consistent growth with consumers interested in purchasing sustainable and ethical goods for their animals.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.5% |

Japan's vegan cat food market is evolving, fueled by the country's advanced food culture and emphasis on quality. Pet owners in Japan are increasingly becoming interested in vegetating cats due to health reasons as well as green living. Lab-grown meat is currently not mainstream, but there's room for acceptance in the longer term as regulatory landscapes evolve. In the interim, firms are working on plant-based alternatives that align with Japan's consumers' liking for natural and lightly processed foods.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.4% |

South Korea's novelty-loving, fast food culture has spilled over into the market for vegan cat food. More and more cat owners are searching for plant-based and alternative proteins to feed their cats as part of a larger cultural trend away from health hazards and towards environmental sustainability. The market is characterized by trail-blazing products leveraging novel ingredients such as insect-derived proteins to offer the nutritional profile of cats in an eco-friendly way.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.6% |

| By Product Type | Market Share (2025) |

|---|---|

| Kibble/Dry | 42.7% |

Kibble/dry vegan cat food is projected to lead the market, with 42.7% of total demand by 2025. Of its subsegments, coated kibble is expanding at a high level due to improvements in plant-based palatability enhancers such as algae oil and yeast extracts that mimic meat flavor. Baked kibble is favored by premium brands targeting health-conscious pet owners since it contains more nutrients than extruded equivalents.

Meanwhile, extruded kibble remains the affordable alternative, favored by mass-market owners who prioritize value. Kibble demand is further fueled by its longer shelf life, ease of storage, and convenience for time-strapped pet parents.

Freeze-Dried Raw vegan cat food, although niche, is increasing steadily due to its high nutrient content and suitability for use in addition to traditional raw diets. Wild Earth and Benevo are at the forefront of this market segment by adding novel protein sources such as fungi and cell-based ingredients in an effort to replicate the texture and aroma of traditional raw meat.

| By Distribution Channel | Market Share (2025) |

|---|---|

| Online Retailers | 48.5% |

Online stores will lead vegan cat food sales, with 48.5% of total sales in 2025. Convenience of doorstep delivery and rising subscription pet food plans have driven growth. Online stores like Chewy and Amazon, and direct-to-consumer companies like Vegan4Cats, are benefiting from tailored nutrition plans that account for special diet needs.

Apart from that, social media and influencer marketing have also played a role in driving consumer consciousness, as pet owners search for increasingly more vet-endorsed recommendations before they buy.

Store-based retailing, including pet specialty and supermarket retailing, is still important, especially among first-time pet owners who want to touch and see a product prior to purchase. Yet, traditional retail is now under siege by price-aggressive e-commerce-only players with promotions and auto-renewal value. E-commerce is a part of the broader pet humanization trend where simplicity of use and custom solutions are the solution for today's pet owners.

Growing animal welfare, sustainability, and ethical sourcing concerns are shaping the market for vegan cat food. Consumers more and more are looking for very nourishing plant-based options that fulfill feline nutritional needs without animal ingredients. This is encouraging manufacturers to invest in high-density protein plant alternatives, taurine synthetization supplementation, and science-formulated solutions supporting best health in cats.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Wild Earth | 22-26% |

| V-dog | 15-19% |

| Benevo | 12-16% |

| Ami Cat | 9-13% |

| Evolution Diet | 5-8% |

| Other Companies (combined) | 16-21% |

| Company Name | Key Offerings/Activities |

|---|---|

| Wild Earth | In 2024, launched a pea and yeast-based high-protein food to maximize feline muscle well-being. In 2025, moved into personalized nutrition, providing AI-based meal plans based on cat breed and age. |

| V-dog | In 2024, introduced a fortified taurine and B12-fortified plant-based kibble to treat typical feline deficiencies. In 2025, collaborated with veterinary nutritionists to create grain-free, hypoallergenic formulas. |

| Benevo | In 2024, extended global distribution to the USA and Canada, making the product more accessible. In 2025, launched an algae-based omega-3 supplement line to promote feline cognitive and cardiovascular health. |

| Ami Cat | In 2024, re-formulated its plant-based wet food range for enhanced palatability and protein digestibility. In 2025, introduced an insect-based protein variant to broaden sustainable protein sources. |

| Evolution Diet | In 2024 created a range of freeze-dried vegan cat treats with an emphasis on gut health and skin support. In 2025 invested in clinical trials of feeding to establish long-term benefits of plant-based feline nutrition. |

Key Company Insights

Wild Earth (22-26%)

Wild Earth dominates the market with its legume and yeast-based high-protein offerings, employing cutting-edge biotech to produce animal-free cat food. Its entry into AI-based meal personalization capitalizes on its dominance in vegan cat nutrition.

V-dog (15-19%)

V-dog stands out for its strict compliance with veterinarian-recommended, taurine-supplemented plant-based ingredients. Its emphasis on grain-free and hypoallergenic content makes it a top contender with food-allergic cats.

Benevo (12-16%)

Benevo's new European foothold and recent North American penetration have increased its worldwide market share. Its pioneering algae-sourced omega-3 supplements address familiar nutritional challenges of vegan cat food.

Ami Cat (9-13%)

Ami Cat is a fan favorite for its delicious wet food and novel protein sources such as insect-based diets. The brand is gaining favor with environmentally conscious pet owners.

Evolution Diet (5-8%)

Evolution Diet focuses on science-based vegan cat nutrition, with investment in clinical trials to ensure long-term efficacy of plant-based diets for cats. Its freeze-dried treats offer targeted functional benefits to skin and gastrointestinal health.

Other Key Players (16-21% Combined)

The overall market size for the vegan cat food market was USD 10,481 million in 2025.

The vegan cat food market is expected to reach USD 19,248 million by 2035.

The increasing ethical concerns regarding animal welfare, perception of plant-based diets as nutrient-rich and healthy, and the desire of environmentally conscious pet owners to reduce their carbon footprint are fueling the demand for vegan cat food during the forecast period.

The top 5 countries driving the development of the vegan cat food market are the United States, Germany, the United Kingdom, China, and India.

Based on product type, the kibble/dry segment is projected to hold more than 35% of the market share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Age Group, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Packaging, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Age Group, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Packaging, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Age Group, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Packaging, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 36: Europe Market Volume (MT) Forecast by Age Group, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 38: Europe Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 40: Europe Market Volume (MT) Forecast by Packaging, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Asia Pacific Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 46: Asia Pacific Market Volume (MT) Forecast by Age Group, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 48: Asia Pacific Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 50: Asia Pacific Market Volume (MT) Forecast by Packaging, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: MEA Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 56: MEA Market Volume (MT) Forecast by Age Group, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 58: MEA Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 60: MEA Market Volume (MT) Forecast by Packaging, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 15: Global Market Volume (MT) Analysis by Age Group, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 19: Global Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 23: Global Market Volume (MT) Analysis by Packaging, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Age Group, 2023 to 2033

Figure 28: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 29: Global Market Attractiveness by Packaging, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 45: North America Market Volume (MT) Analysis by Age Group, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 49: North America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 53: North America Market Volume (MT) Analysis by Packaging, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Age Group, 2023 to 2033

Figure 58: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 59: North America Market Attractiveness by Packaging, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Age Group, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by Packaging, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Age Group, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Packaging, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 105: Europe Market Volume (MT) Analysis by Age Group, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 109: Europe Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 113: Europe Market Volume (MT) Analysis by Packaging, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 116: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Age Group, 2023 to 2033

Figure 118: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 119: Europe Market Attractiveness by Packaging, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Asia Pacific Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 135: Asia Pacific Market Volume (MT) Analysis by Age Group, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 139: Asia Pacific Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 143: Asia Pacific Market Volume (MT) Analysis by Packaging, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Age Group, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Packaging, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: MEA Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 165: MEA Market Volume (MT) Analysis by Age Group, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 169: MEA Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 173: MEA Market Volume (MT) Analysis by Packaging, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 176: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 177: MEA Market Attractiveness by Age Group, 2023 to 2033

Figure 178: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 179: MEA Market Attractiveness by Packaging, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vegan Vitamin D3 Supplements Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Market Size and Share Forecast Outlook 2025 to 2035

Vegan Confectionery Market Size and Share Forecast Outlook 2025 to 2035

Vegan Steak Market Size and Share Forecast Outlook 2025 to 2035

Vegan Pasta Market Size and Share Forecast Outlook 2025 to 2035

Vegan Hyaluronic Acid Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Peptides Market Size and Share Forecast Outlook 2025 to 2035

Vegan Collagen Skincare Market Size and Share Forecast Outlook 2025 to 2035

Vegan Protein Powder Market Analysis - Size, Share, and Forecast 2025 to 2035

Vegan Tortillas Market Size and Share Forecast Outlook 2025 to 2035

Vegan Casing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dressing Market Size and Share Forecast Outlook 2025 to 2035

Vegan Cheese Sauce Market Size and Share Forecast Outlook 2025 to 2035

Vegan Dips Market Size and Share Forecast Outlook 2025 to 2035

Vegan Yogurt Market Size, Growth, and Forecast for 2025 to 2035

Vegan Meals Market Size, Growth, and Forecast for 2025 to 2035

Vegan Chocolate Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Vegan Protein Bars Market Analysis – Size, Share & Trends 2025–2035

Vegan Vitamins and Supplements Market – Growth & Demand 2025 to 2035

Vegan Flavor Market – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA