The market for variable speed generators is to reach USD 9.4 billion by 2025. FMI's analysis predicts that the market will grow at a 5.3% CAGR, valuing it at USD 15.75 billion by 2035.

In 2024, increasing investments in renewable energy significantly influenced the demand. Governments in North America, Europe, and Asia-Pacific accelerated efforts to integrate wind and hydroelectric power into national grids, boosting demand for energy-efficient solutions. Leading producers ramped up manufacturing capacities to meet rising orders, particularly in offshore wind farms. Additionally, regulatory policies promoted energy efficiency, leading to increased adoption in industrial and commercial sectors.

The industry is expected to progress in 2025 with the initiation of various large-scale infrastructure projects infrastructure projects. The expansion of smart grids and microgrids will accelerate adoption, while continued innovation in power electronics will improve generator efficiency.

Key companies are expected to focus on joint ventures and innovations to bolster their worldwide presence. Post to 2025, the growing electrification of off-grid areas and carbon neutrality initiatives will sustain long-term demand, positioning these generators as key components of the evolving energy landscape.

Industry Forecast Table

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 9.4 Billion |

| Industry Value (2035F) | USD 15.75 Billion |

| CAGR (2025 to 2035) | 5.3% |

Explore FMI!

Book a free demo

The power systems industry in automation is growing consistently owing to the rise in use of renewable energy and power grid upgradations. Manufacturers of energy-efficient generator systems will benefit from government and industry initiatives that emphasize sustainability and grid stability. Demand for such conventional fixed-speed generator suppliers is likely to fade away as regulatory forces and technological innovation conditions squeeze the industry toward more flexible, high-efficiency solutions.

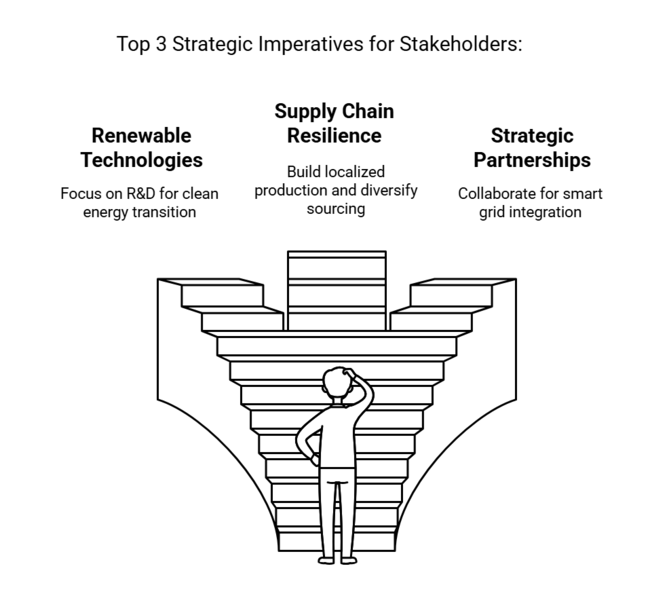

Increased Investment in Renewable-Compatible Technologies

The change would help align executives’ attention with the global energy transition and focus on R&D and variable speed generators production.

Enhance supply chain resilience and local manufacturing.

Since local manufacturing clusters and diversified sourcing of components reduce geopolitical risks and supply chain disruptions, critical sectors will benefit from improved supply security.

Grow strategic partnerships and integrate smart grids.

The industry position is expanding through collaboration with grid operators, energy companies, and automation technology providers. This is to integrate power system into advanced and microgrid systems.

| Risk | Probability & Impact |

|---|---|

| Supply Chain Disruptions | High Probability - High Impact |

| Regulatory Uncertainty | Medium Probability - High Impact |

| Competition from Alternative Technologies | Medium Probability - Medium Impact |

1-Year Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Secure Critical Component Supply | Establish long-term contracts with key suppliers to mitigate raw material shortages |

| Advance Smart Grid Compatibility | Invest in R&D for seamless integration with digital grid infrastructure |

| Strengthen Aftermarket Services | Expand service networks and introduce predictive maintenance solutions |

To stay ahead, companies must significantly increase investment into renewable-capable power system industries while developing supply chains to remain competitive in the evolving energy paradigm. Grid modernization and electrification can fast-track demand, while the integration of smart technologies and the expansion of strategic alliances will be crucial in capitalizing on that momentum.

These advancements necessitate a transition to digitized, flexible power solutions to stay relevant in an industry increasingly shaped by energy transition regulations. It’s time for innovation to take the lead, to innovate the manufacturing process and ensure long-term viability in a dynamic business.

Regional Differences

Technology Adoption

From the ROI Perspective

Automation's long-term cost savings were acknowledged by 73% of North American stakeholders as part of the benefit, compared to 35% in Asia-Pacific, who integrated early costs over economic benefits.

Consensus on Durability

68% preferred hybrid steel-aluminium designs for durability and corrosion resistance.

Regional Variances

Global Cost Pressures

86% identified rising costs of raw materials as a top challenge, including a 28% increase in steel and a 22% climb in power electronics in 2024.

Regional Preferences

Manufacturers

Distributors

End-Users (Industrial & Utility Operators)

Alignment

71% of global manufacturers plan to invest in R&D on next-generation power control systems.

Regional Variances

Regulatory Impact

High Consensus

The global industry is shaped by increasing energy efficiency needs, grid stability efforts, and supply chain challenges.

Key Differences

Strategic Insight

Such developments will require tailored approaches. To stay ahead of the competition, companies need to change their strategies so that their products work with the way things work in each area. In North America, this means combining strategies with the smart grid; in Europe, it means using designs that are good for the environment; and in Asia-Pacific, it means focusing on costs.

| Countries | Policies, Regulations & Mandatory Certifications |

|---|---|

| United States | The Federal Energy Regulatory Commission (FERC) requires grid interconnection standards compliance. The Department of Energy (DOE) provides tax credits for energy-efficient generators under the Inflation Reduction Act. Grid-connected generators are required to be National Electrical Code (NEC) and IEEE 1547 compliant. |

| United Kingdom | The UK's Energy Security Bill encourages grid modernisation with mandatory G99 grid connection standards for compliance with distributed generation. Firms need to comply with ISO 50001 (Energy Management) and Ecodesign Directive requirements. |

| France | The Law on Energy Transition requires reduced carbon emissions from industrial power equipment. The equipment must be in line with CE Marking and the EU's Ecodesign Directive. |

| Germany | The Renewable Energy Sources Act (EEG) encourages interconnection with wind and sun grids. Generators are required to meet VDE-AR-N 4110 and 4120 specifications for grid stability. TÜV certification is desirable for energy-efficient equipment. |

| Italy | The Italian National Energy Strategy (SEN) encourages high-efficiency power systems. Grid-connected generators are required to comply with CE Marking and GSE (Gestore dei Servizi Energetici) standards. |

| South Korea | The Renewable Portfolio Standard (RPS) requires a percentage of renewable energy production. Generators are required to meet KS C IEC standards for efficiency and safety. KEPCO approval is required for grid connection. |

| Japan | The Energy Conservation Act encourages power equipment efficiency. JIS certification for safety and grid compliance is necessary. High-efficiency generators are subsidized by the government through the Green Innovation Fund. |

| China | The National Development and Reform Commission (NDRC) regulates energy efficiency standards. GB/T certification is necessary for all power generators. Integration of renewable energy is given priority in the Dual Carbon Goals. |

| Australia-New Zealand | The Clean Energy Regulator enforces generator efficiency in accordance with the Renewable Energy Target (RET). Grid connectivity requires compliance with AS/NZS 3000 and AS/NZS 4777 standards. |

| India | Central Electricity Authority (CEA) requires compliance with IS 325 for generator efficiency. The Faster Adoption and Manufacturing of Electric Vehicles (FAME) program covers incentives for hybrid power systems. BIS (Bureau of Indian Standards) certification is a requirement. |

Mechanical variable speed generators continue to be the dominant segment, holding a significant industry share because of their dependability in industrial use. Future Industry Insights (FMI) states that the mechanical segment is expected to advance at a 5.2% CAGR until 2035. Traditional grid infrastructure, marine use, and oil & gas operations extensively employ mechanical generators due to their ruggedness and long operating life.

Despite their dominance, moderate growth is expected in this segment as industries transition toward more efficient options. Power electronics-based variable speed generators are the fastest-growing segment, supported by the increasing use of smart grids, renewable energy integration, and industrial automation. They provide higher efficiency, real-time monitoring, and improved load control, making them suitable for wind and hydroelectric power generation.

Demand is also rising in business and residential applications, where energy-efficient solutions are becoming popular. The FMI analysis opines that manufacturers investing in cutting-edge semiconductor technologies and digital control systems will gain industry share, as sectors focus on energy efficiency and regulatory compliance.

Renewable power generation is the biggest end-use segment, driven by international efforts to move towards sustainable sources of energy. According to Future Industry Insights (FMI), the renewable power generation segment is expected to increase at a 5.0% CAGR by 2035. Wind farms and solar farms depend on variable speed generators to integrate efficiently into the grid, maximizing power output and minimizing fluctuations.

Government policies and net-zero emissions goals in places like Europe, China, and North America remain a motivator for investments in renewable energy infrastructure. Hydroelectric power generation is also a prominent segment, with investments in small and large hydro projects to stabilize the power grid. The power system industry demand in hydro applications is evidenced by the requirements of high-efficiency power conversion and synchronization to the grid.

The most rapidly expanding segment is marine & shipbuilding, where the drive for fuel efficiency and emissions cuts is driving the take-up of hybrid and electric propulsion systems. With strict International Maritime Organization (IMO) regulations encouraging cleaner marine technologies, shipbuilders are increasingly adopting advanced variable-speed generator systems.

The United States is expected to have a stable income, in the variable speed generators area, driven by growing investments in renewable energy generation and enhancement of the grid. The industry is anticipated to grow at a 5.7% CAGR from 2025 to 2035. Demand will be fueled by the Inflation Reduction Act, in addition to adopting IEEE 1547 for connection to the grid.

The industrial use - oil and gas, data centers and military power systems - will drive demand. Digital monitoring and hybrid functionality are increasing competitiveness in the industry. However, supply chain disruptions and volatile raw material prices could hinder growth. FMI has calculated that companies investing in automation and interconnecting the grid will reap the benefits competitively.

The UK's transition to renewable power will largely drive the demand for variable speed generators. The UK's power systems industry in automation is projected to register 5.4% growth between 2025 and 2035. Government assistance for wind power and offshore energy, along with the G99 grid connection rules, will drive this growth. The energy security bill speeds up grid modernization, which is driving more industrial consumers.

Corporate sustainability initiatives will drive organizations to invest in power-efficient solutions. According to an analysis by FMI, manufacturers that focus on low-carbon technology and smart controls will gain a competitive edge. Post-Brexit trade policy and import legislation can, though, impact supply chains, and firms will need local access to manufacturing capabilities.

France's energy transition focus will drive variable speed generators. The industry is projected to achieve a compound annual growth rate (CAGR) of 5.2% during the transformation period 2025 to 2035. The Energy Transition Law has made lower carbon emissions mandatory and is making efficient power solutions more required. Expansion in offshore wind farms and industrial automation will drive further use.

The CE marking ensures compliance with the EU Ecodesign Directive. The national industrial base is trending towards smart energy systems, which would increase R&D investments in high-efficiency generators. The study highlighted that even as regulatory complexity presents a hurdle, firms that invest in compliance and innovation around hybrid generator systems are likely to reap long-term dividends.

Germany will boost variable speed generators sales due to its renewable energy policies and industrial automation. The industry is expected to grow at a compound annual growth rate (CAGR) of 5.8% in the forecast years 2025 to 2035. The Renewable Energy Sources Act (EEG) enables the integration with wind and solar power grids, resulting in high demand. In addition, it shall have to comply with stability grid codes VDE-AR-N 4110 and 4120.

In Germany, de-carbonization and energy security will take center stage, and investment in effective generator solutions will receive a boost. Analysis from the Bethesda, Maryland-based Future Industry Insights found that companies focusing on green technologies such as hydrogen-compatible generators and digital monitoring systems will capture industry share. Supply chain constraints driven by energy cost fluctuation may interrupt growth as companies in the chain obsessively seek alternative sources of supply.

The expanding renewable energy industry and industrial automation in Italy will drive the demand for power system industry in automation sector. The industry in Italy is set to grow significantly at a CAGR of 5.2% during forecast period. High-efficiency power systems are also promoted by the National Energy Strategy (SEN), which consequently leads to an obligation for CE Marking and GSE (Gestore dei Servizi Energetici).

Industrial and commercial use is increasingly adopting hybrid and smart generators. FMI research showed that while uncertainties in the economy may cause companies to slow capital investments, those focusing on automation and outstanding grid reliability will find opportunities to make dollars. They will need to ramp up local manufacturing and R&D to keep pace in the new energy landscape.

The renewable energy and industrial segment in South Korea will lead the end-use industries for power system industry in automation sector. The industry is projected to thrive at a CAGR of 5.1% throughout the years 2025 to 2035. The RPS is essential for the increased use of renewable energy, which in turn accelerates the demand for power-efficient solutions. It is necessary to obtain KS C IEC compliance and KEPCO approval for connecting to the grid.

Hydrogen and smart energy systems receive government attention and present new growth opportunities. According to the FMI study, manufacturers investing in advanced, low-emission generators will see stronger industry growth. However, intense competition from Chinese manufacturers and price-sensitive customers may compel companies to offer differentiated solutions with advanced automation capabilities.

The Industry for Variable Speed Generators (Honda, Siemens, GE) in Japan: Industrial Automation & Energy Efficiency Policies The industry will witness a CAGR of 4.8% over the period 2025 to 2035. Next, the Energy Conservation Act ensures efficient products and their quality through JIS certification. The government's Green Innovation Fund supports R&D on next-generation power systems.

There is growing demand for data centers and industrial automation, but cost concerns hinder their broad adoption. FMI analysis predicts a gain in industry share for compact and high-efficiency designs intended for space-constrained environments. But weaker enforcement of energy policies relative to Western counterparts may inhibit adoption rates.

The biggest growing country for variable speed generators is projected to be China, with a few large infrastructure developments and renewable energy growing rapidly. The industry is expected to grow at a CAGR of 6.2% during the forecast period (2025 to 2035). The government’s 14th Five-Year Plan emphasizes energy efficiency, with greater investment in smart grids and in automating industries.

Meeting GB/T national standards and goals for carbon emissions neutrality will drive high demand for low-emission generators. According to an FMI study, domestic manufacturers are benefiting from government incentives, whereas the international players face regulatory challenges. Despite threats such as raw material price fluctuations and supply chain disruptions, firms utilizing local alliances and automation technologies will discover long-term growth.

The demand for variable speed generators is promoting the growth of renewable energy in Australia and New Zealand. The industry is projected to grow at a 5.3% CAGR during the assessment years of 2025 to 2035. Government policies such as the Australian government’s Renewable Energy Target (RET) or New Zealand’s Carbon Neutral 2050 plan encourage investment in wind energy as well as hybrid systems with renewable sources.

AS/NZS approval for product acceptance Europe and MEA have been evaluated to be more demanding for off-grid solutions and presented opportunities for off-grid solution manufacturers that are manufacturing off-grid solutions for remote and industrial applications, according to the analysis by FMI. However, high import costs and industry concentration can be challenging for new entrants, requiring firms to build strong distributor networks and local manufacturing bases.

Due to rapid industrialization and the increasing use of renewable energy, India will experience significant growth in variable speed generators. Over the period 2025 to 2035, the sector will grow 6.0%, concentrating on annual growth. Incentives to manufacture high-efficiency generators are also available in terms of government programs, such as Make in India and the National Electricity Plan. Power grid applications need to comply with CEA(BIS) standards.

FMI analysis indicated that data centers, telecom infrastructure, and industrial automation are expected to be the emerging end users driving the demand for the reference sensors industry. But barriers such as high import duties on key components and fragmented supply bases can affect growth. Firms focusing on low-cost production and localized supply chain partnerships will command the competition.

The FMI survey anticipates that top players emphasize low-cost solution offerings for price-sensitive buyers and invest in high-efficiency and digitally controlled generator research and development. The organizations are entering into partnerships with strategic renewable energy developers and industrial participants to strengthen supply chains and gain deeper industry penetration. Expansion into emerging industries remains the favored strategy, with businesses establishing manufacturing bases in Asia and Latin America. According to FMI, industry M&A activity is on the rise as leading players acquire niche technology firms with the expressed intent of bolstering their competitive position.

Industry Share Analysis

Siemens Energy

Industry Share: ~25-30%

Siemens Energy is a global leader in power generation solutions and dominates the variable speed generators industry with its integrated turbine-based system as well as strong partnerships for renewable energy projects.

General Electric (GE Vernova)

Industry Share: ~20-25%

GE Vernova is readjusting its focus as a contender, which draws its experience in the gas and wind turbine generator industry but is targeting hybrid energy systems and providing grid reliability.

ABB Ltd. (15-20%)

ABB powers various industries and also has a strong industry position on account of its efficient generator and digital automation solutions, especially in the industrial and maritime segments.

Wärtsilä (10-15%)

The Finnish firm specializes in flexible power plants and the integration of energy storage systems with variable speed generators, a fundamental component of its hybrid systems.

Mitsubishi Heavy Industries (8-12%)

MHI has a robust position in the variable speed industry, particularly in gas turbine applications, with a well-established base in Asia and Europe.

Yanmar Holdings (5-10%)

Yanmar is a leading provider of small-size variable speed drives, with a specialization in marine and decentralized power, which is being increasingly adopted in emerging industries.

Key Developments in 2024

Schneider Electric added the EcoStruxure Control Expert software to its EcoStruxure automation platform, enabling integrated development, management, and operational capabilities for industrial machines and processing facilities. Also, it forged a contract with a European offshore wind farm to integrate variable speed with energy storage.

GE Vernova added a new member to its 7HA.03 gas turbine portfolio and debuted variable speed capability to support grid stability in industries with elevated levels of renewables. It published its own venture with a Middle Eastern utility to combine hybrid power plants with its newest form of generator technology (Source: GE Vernova News, February 2024).

ABB launches a new digital twin platform of power systems indutry to provide predictive maintenance and for optimized performance. Further, the company secured an order to supply its generators to an India-based large-scale solar-wind hybrid project (Source: ABB Press Room, January 2024).

Wärtsilä worked with ESB Ireland to deliver a 200 MW battery-backed variable speed generators plant, one of the largest flexible power projects in Europe (Source: Wärtsilä News; April 2024).

Mitsubishi Heavy Industries accelerated the development of ammonia-compatible generators, intending to deploy them commercially by 2025. Moreover, after investing in Germany, the firm also opened a new R&D center for variable speed technology to support de-carbonized power systems (Source: MHI Website, May 2024).

Yanmar launched a new marine variable speed generators series for smaller and mid-sized yachts with improved fuel efficiency. The company increased its distribution network in Southeast Asia to benefit from growing demand (Source: Yanmar Global News, June 2024).

Increasing demand for renewable energy, fuel efficiency, and industrial automation is driving adoption.

Hybrid power solutions, smart grids, and supportive energy policies will drive consistent growth.

The top manufacturers in the industry include ABB Ltd., Atlas Copco AB, Ausonia srl, Cummins, Inc, Fischer Panda GmbH, Generac Holdings Inc, General Electric Company, Innovus Power, Inc, Rolls-Royce Holdings PLC, Siemens AG, Innovari Inc., Schneider Electric SE, Emerson Electric Co., Danfoss A/S, Yanmar Co., Ltd., Generac Holdings Inc.

Renewable power generation in the end use segment is expected to remain dominant, driven by growth in wind and hydroelectric power generation.

The industry would be valued at USD 15.75 billion with a 5.3% CAGR.

The industry is bifurcated into mechanical and power electronics.

It is segmented into renewable power generation, hydroelectric power generation, marine & shipbuilding, oil & gas and mining, commercial & residential and others.

The industry is segmented among North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and Pacific, Middle East and Africa.

Hedge Trimmers Market Growth - Trends & Forecast 2025 to 2035

High Speed Steel (HSS) Tools Market Growth - Trends & Forecast 2025 to 2035

Fluid Conveyance Systems Market Growth - Trends & Forecast 2025 to 2035

GCC Magnetic Separator Market Outlook – Growth, Trends & Forecast 2025-2035

United Kingdom Magnetic Separator Market Analysis – Size, Share & Forecast 2025-2035

Glass Door Merchandisers Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.