Global Vapour Recovery Units is likely to grow with a CAGR of 5.3% and is projected to reach USD 2,334.5 million by 2035. The global market for vapor recovery units (VRU) is driven by environmental regulations to limit VOC emissions. In the oil & gas industry, stringent regulatory compliance is essential to reduce emissions.

Demand in upstream, midstream, and downstream applications has been rising and is higher for the upstream sector due to storage and production facility compliance. Technology advancements in hybrid and cryogenic VRUs give higher efficiency at cheaper costs, thereby fueling growth.

| Attribute | Details |

|---|---|

| Projected Value by 2035 | USD 2,334.5 million |

| CAGR during the period 2025 to 2035 | 5.3% |

North America is still the largest regional market, fueled by stringent EPA regulations and strong oil & gas infrastructure. The European market is also gaining in adoption due to emissions reduction requirements. The Asia-Pacific market is growing due to increasing refinery activity and increasing pollution concerns, primarily in China and India. Industry leaders are positioning themselves with more modular and skid-mounted VRUs to service a wide variety of industry requirements and enhance the flexibility of their operations.

Future Market Trends Include Increased Adoption of Digital Monitoring and Automation Solutions for Enhanced Efficiency of VRUs, Especially in Remote Operations; VRUs in Chemical and Petrochemical Processing Gains Momentum As Industries Strive to Meet Global Sustainability Goals. In this growing world where carbon capture and abatement strategies are trending, VRUs have become an integral part of the industrial gas recovery solutions. If you want a detailed segment-wise analysis, let me know.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

| Category | Industry Share (%) |

|---|---|

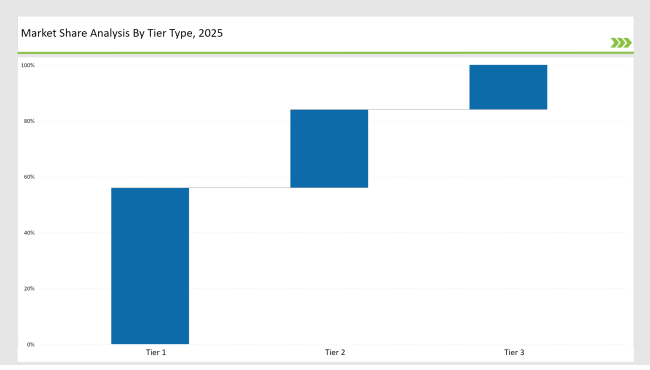

| Top 3 Players(John Zink Hamworthy Combustion, AEREON, PSG Dover) | 56% |

| Rest of top 5 (Cool Sorption A/S, Hy-Bon/EDI) | 28% |

| Rest of Top 10 | 16% |

The market is consolidated, with leading players shaping pricing, technology, and industrial partnerships. Regional and niche companies remain competitive by providing cost-effective, application-specific solutions tailored to local market needs.

Adsorption technology is still the king of the vapor recovery unit market, accounting for 39% share. It is believed that adsorption-based hydrocarbon vapor recovery is more efficient compared to other technologies, generates very low energy consumption, and has low maintenance, thus it is further leading in the market.Some major adsorption-based VRU manufacturers include PSG Dover and John Zink Hamworthy Combustion, who deliver best-in-class fuel recovery while meeting all regulations.

Membrane separation is rapidly becoming popular, especially in gas-liquid separation applications in pipelines and fuel recovery at hubs of transportation. Cool Sorption A/S delivers high-performance membrane separation VRUs with a focus on efficient performance in both marine and industrial applications.

Absorption-based VRUs are becoming more popular in the chemical and petroleum industries due to the requirement of high-volume vapor recovery in these industries to ensure operational efficiency. AEREON is one of the companies that provide sophisticated absorption technologies to refineries and chemical processing plants.

Low-temperature hydrocarbon vapor recovery applications are made with condensation technology, particularly cryogenic condensation. Hy-Bon/EDI is a leader in cryogenic condensation VRUs, with effective solutions for VOC recovery in industrial and pipeline operations. Technologies continue to advance as industries pursue energy-efficient and cost-effective solutions for emission control.

Storage tank vents have been the largest application segment, with 31% of the total market share. This is because of the increase in VOC emission control regulations and the demand for fuel recovery in bulk storage facilities. The leaders in this category include John Zink Hamworthy Combustion and PSG Dover. They offer robust storage tank vapor recovery systems designed towards efficiency and compliance.

It is gaining popularity in oil terminals, ports, and off-shore refueling stations where VOC containment is of prime importance. Cool Sorption A/S is the industry leader in Marine Vapor Recovery Technology. Their solutions reduce emissions in heavy-duty fuel handling facilities.

Truck loading applications are becoming popular nowadays, especially for fuel transport, refilling stations, and petrochemical logistics. Hy-Bon/EDI has designed special VRUs that can be applied for truck loading applications with a safe vapor recovery during fill-up. Railcar loading will be a critical part of transporting petrochemical and hazardous liquid cargo, considering AEREON's high-efficiency vapor recovery solutions for bulk handling sites.

Pipelines are another important application area where VRUs are applied in extensive networks to recover gas, regulate pressure, and contain VOC in pipeline systems. PSG Dover also takes the leadership position in pipeline VRU and provides solutions, enabling industries in attaining green and compliant business operations.

John Zink Hamworthy Combustion

John Zink Hamworthy Combustion is a global leader in industrial combustion as well as environmental solutions. The company has impacted the Vapour Recovery Units market greatly through cutting-edge technologies. The company has its headquarters in Tulsa, Oklahoma and was founded in 1929, which places it among the most innovative companies in emission control and energy efficiency.

John Zink Hamworthy Combustion recently launched AI-integrated vapor recovery systems, which include real-time emission monitoring and automated control capabilities, enhancing operational efficiency and regulatory compliance. The company has a wide global presence and serves industries such as oil & gas, petrochemicals, and power generation.

The company, John Zink Hamworthy Combustion, with a strong focus on sustainability, is investing in new technologies so that advanced VRU solutions help industries reduce the environmental footprint and optimize fuel efficiency.

AEREON

AEREON, founded in 2012 and headquartered in Austin, Texas, is a key player in the vapor recovery solutions market, offering a wide range of technologies that focus on emissions control and operational efficiency. AEREON specializes in providing modular, scalable VRUs that can be deployed rapidly in various industrial applications, including marine and railcar loading operations.

These modular systems enable quick and cost-effective installation in remote or high-demand areas, where flexibility is critical. AEREON’s focus on providing tailored solutions for harsh industrial environments, including refineries and chemical plants, has made it a preferred partner for businesses seeking to meet regulatory emissions standards and improve operational safety. The company's further investment in R&D and its global distribution network ensures it to be on top of VRU innovation.

PSG Dover

PSG Dover, a global leader in fluid and fuel handling solutions, has greatly expanded its reach in the VRU market by developing high-efficiency adsorption-based systems. Founded in 2008 and headquartered in Oakbrook Terrace, Illinois, PSG Dover has become a trusted provider of advanced VRUs for petroleum and chemical storage tank facilities.

The company’s focus on efficiency and reliability has led to the creation of VRUs that minimize VOC emissions while reducing energy consumption, making them ideal for industries seeking to enhance sustainability. PSG Dover has an excellent global spread with operations all over the Americas, Europe, and Asia with customized VRU solutions for diversified industrial clients. Innovation and concern for the environment have continued to be the cornerstone of the success of the vapor recovery business by this company.

Cool Sorption A/S

Cool Sorption A/S is Denmark-based company registered in 2001, majoring in high-tech vapor recovery solutions, significantly in offshore as well as at-sea markets. The base of the Company is located at Aalborg Denmark and has come out to firmly position itself with membrane-based designs, which were highly effective off-shore on refueling bases.These solutions are designed to enhance safety, reduce emissions, and optimize fuel handling in marine environments.

Cool Sorption’s commitment to sustainability is evident in its product development strategy, where energy efficiency and reduced environmental impact are prioritized. With a growing international presence, Cool Sorption continues to innovate, providing specialized VRUs that meet the unique challenges of the offshore oil & gas industry.

Hy-Bon/EDI

Hy-Bon/EDI, established in 1971 and headquartered in Houston, Texas, is a recognized leader in the design and manufacture of vapor recovery systems, focusing on energy-efficient solutions for the oil & gas industry. The company’s specialization in low-energy cryogenic condensation systems for VOC recovery in oil & gas pipelines has positioned it as a leader in emissions control and energy conservation.

Hy-Bon/EDI’s solutions help reduce greenhouse gas emissions while optimizing energy use, contributing to both environmental sustainability and cost-effectiveness. The company’s continued emphasis on research and development ensures its VRUs remain at the cutting edge of technology, offering clients reliable, high-performance systems.

Hy-Bon/EDI operates in over 50 countries, delivering tailored VRU solutions to the global oil & gas sector, with a strong focus on meeting regulatory requirements and enhancing operational efficiency.

| Tier | Examples |

|---|---|

| Tier 1 | John Zink Hamworthy Combustion, AEREON, PSG Dover |

| Tier 2 | Cool Sorption A/S, Hy-Bon/EDI |

| Tier 3 | Regional and niche players |

| Company | Initiative |

|---|---|

| John Zink Hamworthy Combustion | Developed AI-powered vapor recovery systems with real-time VOC tracking, enhancing emission control efficiency in industrial applications. |

| AEREON | Introduced modular VRUs designed for marine and railcar loading applications, enabling rapid deployment and improved operational flexibility. |

| PSG Dover | Expanded its portfolio with high-efficiency adsorption-based VRUs tailored for petroleum and chemical storage tank facilities. |

| Cool Sorption A/S | Launched membrane-based vapor recovery solutions for offshore refueling operations, improving sustainability and emission reduction. |

| Hy-Bon/EDI | Focused on low-energy cryogenic condensation systems for VOC recovery in oil & gas pipelines, optimizing energy consumption and recovery rates. |

| Cimarron Energy Inc. | Enhanced its VRU technology with advanced compression and emission control systems, catering to midstream and upstream oil & gas sectors. |

| Wintek Corporation | Developed solvent recovery VRUs incorporating vacuum technology, improving efficiency in pharmaceutical and chemical processing industries. |

| Accel Compression Inc. | Specialized in compact VRU systems with integrated compression solutions, designed to optimize recovery in small-scale and remote applications. |

| Whirlwind Methane Recovery Systems LLC | Innovated methane recovery systems utilizing advanced separation technology, targeting emission reduction in natural gas processing. |

In future, the VRU market would evolve with growing adoption of digitalized emission tracking and automation. Membrane and cryogenic recovery technologies would get improved efficiency in performance, whereas hybrid VRUs would optimize its performance across several applications.

This would be achieved through stringent environmental policies in the oil & gas, chemicals, and transportation industries. Suppliers need investment in R&D to improve rates of VOC capturing, while offering their products more widely in upcoming markets such as Asia-Pacific and the Middle East. The critical factor will include partnerships with players in the industries for customized application and retrofit of existing storage or processing units by 2035.

The market is moderately consolidated, with leading players holding a collective 56% market share. Key companies include John Zink Hamworthy Combustion, AEREON, PSG Dover, Cool Sorption A/S, and Hy-Bon/EDI. These firms dominate the industry through technological innovations, extensive service networks, and compliance-driven solutions for emission control.

The primary product types include adsorption-based VRUs (39% market share), membrane separation VRUs, cryogenic condensation systems, and absorption-based VRUs. Adsorption technology leads due to its high efficiency in hydrocarbon recovery, while membrane and cryogenic systems are gaining traction for specialized applications.

The oil & gas industry remains the largest demand driver, particularly in upstream crude storage, midstream transportation, and downstream refining. Additionally, chemical processing, petrochemicals, and transportation sectors are increasingly adopting VRUs to comply with stringent VOC emission regulations and enhance sustainability efforts.

The market is projected to grow at a CAGR of 5.3%, reaching USD 2,334.5 million by 2035. Growth is fueled by stricter environmental regulations, rising investments in emission control, and increasing demand for energy-efficient recovery solutions. Emerging economies in Asia-Pacific and the Middle East are expected to offer significant opportunities due to expanding industrial infrastructure and regulatory enforcement.

Innovations such as AI-based real-time monitoring, IoT-enabled VRUs, and hybrid recovery systems are enhancing operational efficiency and regulatory compliance. Companies are integrating automation to improve VOC recovery rates, reduce maintenance costs, and optimize energy consumption. Additionally, advancements in membrane and cryogenic condensation technologies are driving higher adoption in offshore, transportation, and petrochemical applications.

Explore Heavy Engineering Solutions Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.