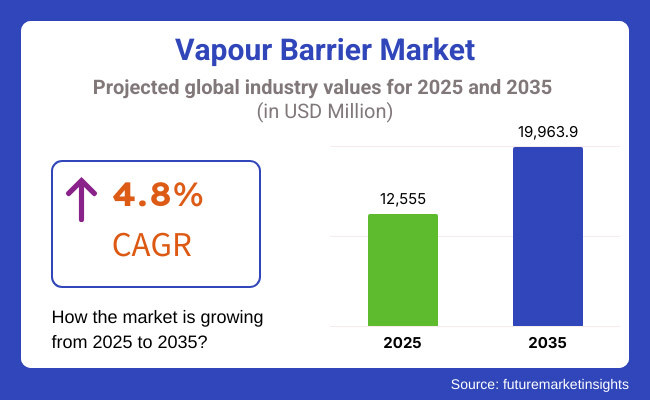

The vapour barrier market is set to experience steady growth between 2025 and 2035, driven by rising construction activities, increasing demand for energy-efficient buildings, and growing awareness of moisture control solutions. The market is expected to expand from USD 12,555.0 million in 2025 to USD 19,963.9 million by 2035, reflecting a compound annual growth rate (CAGR) of 4.8% over the forecast period.

Vapour barriers play a critical role in protecting building structures from moisture damage, preventing mold formation, structural deterioration, and insulation degradation. These types of materials are widely used in residential, commercial, and industrial constructions, but it is in particular areas where they are most necessary, areas with significant temperature variations, high humidity, and energy-saving needs.

The integration of vapour barriers in the roofing, wall insulation, flooring, and foundation waterproofing sections has been trending amid the rising urbanization and infrastructure development of many global regions.

The market dynamics here are a result of different factors including the escalated uptake of ecofriendly building materials, the introduction of stringent energy performance norms, and technological advances in smart moisture management systems.

Vapour barriers are gradually becoming one of the major components in new construction because contractors are often more inclined to the concept of resilience, energy efficiency, and sustainable environment. Besides, the growth of barrier materials, such as going membranes, non-toxic coatings, and intelligent moisture-resistant solutions, is considered the second most important factor that motivates sales of the vapor market.

Market growth is supported by rapid urbanization, increasing investments in commercial and industrial buildings, and rising consumer awareness of sustainable construction materials. Vapour barriers are becoming standard in modern construction, particularly in regions with extreme temperature variations and high moisture levels.

Explore FMI!

Book a free demo

North America remains one of the leading markets for vapour barriers, largely driven by stringent building codes, energy conservation initiatives, and widespread use of moisture control technologies. The United States has, meanwhile, the same standard perimeter that promotes the use and adoption of the best vapour barriers in residential, commercial, and industrial constructions.

In the United States, the growing trend of green buildings and LEED-certified construction projects is further causing market demand. Canada’s cold climate necessitates the use of vapour barriers in roofing, foundation waterproofing, and underlayment applications to enhance insulation efficiency and building longevity.

The increase in vapour barriers is being seen in Europe while the region concentrates on sustainable building. Rise in the Greek building sector alongside such drastically strict energy efficiency regulations makes it harder for countries like Germany, France, and the United Kingdom to reduce carbon emissions. Scandinavian neighborhoods, characterized by long winters, literally need vapour barriers to heat loss from the building.

The green building policies of the European Union like Energy Performance of Buildings Directive (EPBD) are the drivers of facilities in the market with moisture-resistant insulation materials and this gesture is further contributing to the market growth.

The Asia-Pacific geographical area is the area with the most increasing or market vapour barriers, driven by urbanization, infrastructures, and an increase in the knowledge of moisture control amenities. Urbanization, infrastructures, and moisture control availabilities are the driving factors behind the rapid climb of vapour barriers in the Asia-Pacific area.

Countries like China and India that have construction businesses booming are facing the demand increase for vapour barriers in residential areas, business places, and infrastructure projects. The smart cities, updated housing, and energy efficiency building designs are the primary reasons customers push developers to the decision to combine high-quality vapour barriers into the structure plan.

The other two countries, Japan and South Korea, are applying vapour barrier technology between buildings, hospitals, and other commercial complexes in these high buildings to decrease the energy consumption and increase lifetime. The jungles of Southeast Asia are also charming the architects to use vapour barriers more efficiently in hotel building, commercial places, and warehouses to be free from moisture-related damage.

Latin America, the Middle East, and Africa are new emerging markets for vapour barriers, with a massive request for moisture-resistant construction materials in extreme climates. Brazilian and Mexican products are used in residential areas and commerce, and one-sided developments, according to the climate-resilient system of building materials.

The Middle East is a vapor barrier in cooling systems, air-conditioned buildings, and industrial storage facilities as it is the area where vapor is produced due to high temperatures and dry conditions. Mozambique and Nigeria come with urbanization and growth loopholes in energy from water pipes and humidity vents in home and commercial buildings.

Challenges

Fluctuating Raw Material Costs & Supply Chain Disruptions

Fluctuating Raw Material Prices & Supply Chain Disruptions One of the key issues in the market of vapour barrier materials is the fluctuating raw material costs and the supply chain disruptions which are further caused by many incidents as well. Vapour barriers consist mainly of polymers, polyethylene, bitumen, and special coatings respectively; therefore, the price of these materials is vulnerable to changes in crude oil prices.

Global supply chain challenges such as trade bans and transport expenses affected raw material availability and prices which in turn created uncertainty for the manufacturer and developer. Besides supply chain volatility, political rivalries, and environmental policies that affect output from petrochemical-based products are further issues that the industry players have to face.

Lack of Awareness & Adoption in Developing Markets

Summer Problems of Lack of Awareness and Acceptance in Underdeveloped Regions The vapour barrier industry is another one plagued by a lack of awareness and adoption in developing markets. Now that the building codes in the developed areas are already established for these specific appliances, a big gaping void is left for many of the developing markets that are yet to be equipped with such rules and regulations and lack even the information about their advantages.

People living in places where the quality of the work is the most important factor that determines how much it will cost usually choose the cheapest way of doing things by using products that are not as durable as high-cost ones. Activities such as market education campaigns, training programs, and the introduction of cost-effective alternatives are vital for a better adoption of vapour barriers in low-price regions.

Environmental Concerns & Sustainability Challenges

The vapour barriers are non-biodegradable, which is a big deal because they contribute to the solid waste and greenhouse gas emissions. With government and socio-organizations advocating for a reduced harmful building sector, the market for bio-based, recyclable, and low-carbon vapour barrier solutions are booming.

Manufacturers have to spend their money developing new alternatives that are in line with environmental law and what customers want. Such alternatives are being sought in biodegradable polymers, plant fiber composites, and low VOC (volatile organic compound) coatings among others.

Opportunities

Expansion of Smart Buildings & Energy-Efficient Construction

The growth of the vapour barrier market is majorly due to the demand for smart buildings and energy-efficient construction. The phenomena of intelligent houses, green buildings, and passive-house projects make the need for vapour barriers required that much more which adding to the list of feature of better thermal insulation, humidity control, and energy conservation.

The innovations in intelligent moisture control systems, self-regulating vapour barriers, and AI-driven building monitoring solutions are transfiguring the industry thus creating opportunities for firms that actually specialize in moisture control technologies.

Growth of Prefabricated & Modular Construction

Prefabricated buildings necessitate superior vapour barriers which are the only ones that can guarantee moisture protection, energy efficiency, and assure the longevity of the structure. Along with the fact that it is easier to buy prefabricated elements, the constructions faced with the issue of building energy more efficiently will need products that are of a higher performance.

Emerging Innovations in Sustainable Vapour Barriers

Manufacturers are launching ecologically friendly vapour barriers made from organic biodegradable plastics, recycled materials, and plants vs synthetic composites. Water-based vapour barrier coatings, breathable membranes, and self-healing moisture barriers are turning into hot products in the green construction field. Enterprisers will set themselves apart if they carry on with circular economy proposals, zero-waste production, and the introduction of carbon-neutral building materials.

The vapour barrier market was able to thrive from the year 2020 to the year 2024 which was mainly due to a boost in demand from construction, infrastructure, and industrial sectors.

Reducing moisture infiltration and thereby minimizing mold growth, enhancing insulation in residential, commercial, and industrial buildings are the critical roles played by vapour barriers. The market grew bigger due to the increased use of energy-efficient building materials and the regulations imposed on such materials which were behest by the local government.

Discussing ahead to 2025 to 2035 the vapour barrier market shall see advances in technology, like the arrival of eco-friendly vapour barriers, bio-based materials, and increased durability features. The need for sustainability and the green building movement will bring about the approval of eco-friendly materials with lower carbon footprints.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with energy efficiency and building insulation standards. |

| Technological Advancements | Development of multi-layered, high-performance vapour barriers. |

| Industry-Specific Demand | High demand in construction, packaging, and automotive sectors. |

| Sustainability & Circular Economy | Increased focus on recyclable and low-VOC materials. |

| Market Growth Drivers | Rising urbanization, climate resilience, and energy-efficient construction trends. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter green building regulations and widespread adoption of sustainable materials. |

| Technological Advancements | Introduction of smart, self-healing, and nanotechnology-enhanced vapour barriers. |

| Industry-Specific Demand | Expansion into smart homes, advanced insulation systems, and climate-resilient infrastructure. |

| Sustainability & Circular Economy | Full-scale adoption of bio-based and biodegradable vapour barriers. |

| Market Growth Drivers | Integration with IoT-enabled smart buildings and next-gen insulation solutions. |

The market for vapour barriers in the United States is witnessing a slow but steady boost due to the factors like the undergoing environmentally concerned projects aimed at energy efficiency, increasing demand for ecological building materials, and the emerging stricter building codes. The building construction industry in the USA is prioritizing moisture control methods like the usage of vapour barrier materials as a result of incentives from the (USGBC) and energy efficiency codes in order to increase the longevity and efficiency of buildings.

The emergent construction activities in the housing and commercial sectors, especially in wet and coastland areas, results in the application of vapour barriers in building projects, now viewed as the best way to avert the menace of mold growth, damage to the structure, and failure of the insulation. Moreover, the smart vapour barriers having the ability to control permeability and being more durable are also making their mark in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.6% |

The vapor barrier market in the United Kingdom is experiencing slow but steady growth due to such factors as strict building regulations, the gradually increasing demand for energy-efficient homes, and the ongoing development of smart construction technologies. The need for zero net buildings and better indoor air quality is driving the trend of advanced vapour barrier technologies.

Being cold and wet, the UK climate makes moisture control an essential element in construction. The boost in the use of vapor barriers in timber-frame houses, roofing systems, and underfloor insulation is definitely helping the expansion of the market. At the same time, the experience of investments in high-performance, recyclable, and breathable vapor barriers is emerging as a strong trend where sustainability is becoming top priority in the construction industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.7% |

One of the main reasons why the European Union vapour barrier market is growing is the serious energy efficiency regulations, the growing consciousness about the durability of buildings, and the increasing use of the environment-friendly construction materials. Countries like Germany, France, and Italy are the leading countries to implement vapour barriers in green construction projects & efficient insulation systems.

Demand for vapour barriers made of recyclable materials and materials with low emissions is being pushed by the EU's climate action policies and their effort to diminish the construction sector's carbon footprints. Moreover, the introduction of smart vapour control membranes, which change the rate of permeability according to the humidity level, is also something that is creating opportunities for more market growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.8% |

The growth of Japan's vapor barrier market is steady, and it is facilitated by the implementation of the latest technology and the simultaneous construction of more earthquake-resistant and energy-efficient buildings as well as the progress in high-tech construction materials. The country's fluctuating climate conditions, which include humid summers and cold winters, necessitate moisture control as a key design consideration.

The active involvement of Japanese companies in smart vapour barrier technologies, such as nano-coating solutions and ultra-thin moisture-resistant membranes, is directed to enhance the building's lifetime and thermal performance. In addition, Japan's emphasis on quake-proof structures has pushed forward the invention of flexible, multi-layered vapour barriers which do not only improve insulation but also permit ductility.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.5% |

The vapour barrier market in South Korea is surging due to the positive impacts of infrastructure projects, the necessity of energy efficiency, and smart construction technologies. The push for smart cities and sustainable urban development is where the need for highly efficient vapour barriers in residential and commercial buildings finds its origin.

Producers in South Korea are channeling their finances into the innovation of polymer-based barriers with improved thermal and moisture resistance features. Moreover, the prolonged exposure to extremely hot and cold weather conditions in the country make vapour barriers a must-have in the fight against condensation and mold growth in properties. The diffusion of prefabricated construction technology is also a catalyst for the integrated moisture control solutions requirements.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.9% |

Glass Vapour Barriers Offer Superior Moisture Resistance and Durability

Glass vapour barriers are vapour barriers that are made of glass. They are normally used in high-performance applications for their long-term moisture resistance and very low permeability features. These barriers are also extensively applied to industrial and commercial buildings for the protection of insulation and structural components from moisture-related damage.

Since glass is a non-porous material, it is the best substance that prevents vapor diffusion, which is why it is mostly used in laboratories and data cabins. Moreover, continuous innovations and laminated glass coatings are allowed to achieve vapour barriers that have been improved regarding UV resistance and thermal insulation, thus they are more widely used.

Sheet Metal Vapour Barriers Gain Traction in Industrial and Roofing Applications

Metal sheet vapour barriers are in increasing demand in industry construction and roofing application due to their efficiency of being extremely durable, getting high-quality strength, and positive resistance to environmental factors.

They are generally made from aluminum or hot-dip galvanized steel, providing a secure and reliable solution to preventing moisture ingress in areas that are exposed to hazards, such as warehouses, factories, underground tunnels, etc. The growing usage of energy-saving building materials is among the factors that lead to the transition of metal sheet vapour barriers since they play a significant role in the enhancement of energy efficiency and condensation management.

In addition to that, innovations in the area of anti-corrosion coating and lightweight metal alloy manufacturing make the metal sheet vapour barriers more flexible and suitable for modern designs of architecture and ecology.

Membrane Vapour Barriers Lead Due to Flexibility and Versatile Applications

Membrane vapour barriers are literally the most adopted in construction, both residential and commercial, because of their flexibility, ease of installation, and compatibility with a wide variety of substrate types. They are also usually made of polymer-based products for full moisture protection on walls, floors, and roofs.

The recent development of building practices that are energy efficient and the use of wool and other synthetic materials that regulate climate and air quality have been the main driver for these products on the market. Also, membrane options such as self-adhering and spray-applied are catching people's attention due to their increased sealing properties and the fact that they can be used on complex surfaces, which makes them a preferred choice for modern construction.

Fluid Vapour Barriers Expand Market Opportunities with Seamless Protection

Fluid-applied vapour barriers have recently entered the realm of moisture prevention as a stretch technology providing not only but also prominent protection against vapour ingress. These coatings, which are often made from polymeric or elastomeric formulations, are typically applied by spray or roller application to achieve full coverage and ensure that there are no voids left for ingress of any kind. The demand for fluid barriers is growing in commercial and industrial sectors where they are needed to have superior adhesion, flexibility, and durability.

Also, fluid vapour barriers are particularly useful in renovation projects when traditional sheet or membrane barriers might be unwieldy to install. Ongoing product innovations in biodegradability and low-VOC products are expected to make fluid vapour barriers to be embraced in environmentally friendly construction initiatives.

The Vapour Barrier market currently witnesses great strides in growth ventured through moisture control applications in construction, packaging, and industrial spaces. Vapour barriers are vital in avoiding moisture entering buildings hence protecting the areas or parts that are affected by mold, corrosion, and structural damage. With the rising trend of awareness concerning energy-efficient buildings and the introduction of strict building codes the market is also reaching new heights.

Competitive research in the new fields of material vapour barriers such as those made from high-performance polymers and environment-friendly options is dominating the competition. Manufacturers are injecting money into R&D to develop vapour barriers that are more durable, are lighter, and are recyclable.

The trend of using environment-friendly materials and energy-saving materials is expected to trigger more innovation within the industry. Furthermore, the continuous popularity of green structure buildings and smart construction technologies has raised the necessity of vapour barriers which make the indoor air quality better, the insulation work to the fullest, and which save energy in residential, commercial, and industrial facilities.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Dow Inc. | 18-22% |

| DuPont de Nemours, Inc. | 15-18% |

| Saint-Gobain | 10-14% |

| 3M Company | 8-12% |

| Sika AG | 5-9% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Dow Inc. | Designs & manufactures next-generation polymer-based vapour barriers that are highly moisture resistant for construction and industrial applications. |

| DuPont de Nemours, Inc. | Specializes in energy-efficient vapour barriers, focusing on solutions that are both sustainable & high-performance. |

| Saint-Gobain | Provides inventive vapour barrier solutions for residential and commercial buildings, which primarily highlight long-lasting and energy efficiency. |

| 3M Company | Offers multi-functional vapour barriers with superior adhesive features for insulation and industrial applications. |

| Sika AG | Concentrates on construction-grade vapour barriers that have excellent waterproofing and a simple application mechanism. |

Key Company Insights

Dow Inc.

Dow Inc. is one of the main makers of polymer-based vapour barriers that are both the strong and moisture impermeable. They are recognized for their strength and their durability. The company allocates a substantial portion of its resources to R&D activities for the creation of eco-friendly and energy-efficient products for the construction sector.

Dow’s vapour barriers are perfect for use in both commercial and residential projects, as they offer the best quality humidity and condensation protection. The company is making waves in the market as the front-runner, through their operational strategies in the fields of sustainability and innovation.

As a matter of fact, the industry is collaborating with Dow to put into practice smart moisture detecting devices and build them into vapour barriers, thus realizing real-time monitoring of humidity levels and hence, a healthier and longer building.

DuPont de Nemours, Inc.

DuPont de Nemours, Inc. focuses on high-performance vapour barriers, which are specifically designed for energy-efficient buildings. The company's solutions are committed to meeting strict environmental standards, all the while being long-lasting moisture protectors. Among the advanced breathable barriers that DuPont incorporates in its product portfolio are those that regulate humidity without compromising the structural integrity.

The company is mostly known for the strong emphasis on research and technological advancements, which has prompted DuPont to extend its market presence in different parts of the world. The company is also backing the investment on AI-driven predictive maintenance that will be of help in identifying early signs of moisture intrusion and thereafter taking proper steps to mitigate the possible damage.

Saint-Gobain

A full range of vapour barriers for residential and commercial needs is the offering of the company Saint-Gobain. The innovative vapour barriers that the company is introducing are designed to help save precious energy by the unwanted moisture that is let in through them. Saint-Gobain is a company that is devoted to environmental issues and as such has made recyclable and low-emission vapour barriers that are in line with the green building initiatives.

It is with its imaginative practice and the guarantee of physical condition materials that Saint-Gobain has become the industry competition. The digital construction solution is the new area they are looking at, BIM (Building Information Modeling) technology is being used to optimize vapour barrier performance and placement for today's building construction projects.

3M Company

3M Company is the go-to company for multi-functional vapour barriers that distinguish themselves with exceptional adhesion and moisture resistance. The company's focus is on the development of solutions for the insulation sector, industrial applications, and the construction industry. 3M's vapour barriers have the main goal of helping the building last longer and improving the indoor air quality.

In its quest for more cost-effective and environmentally friendly products, the company is always seeking new materials and manufacturing techniques. 3M is similarly exploring the potential of nanotechnology to manufacture vapour barriers that will be even more strong and protective against extreme environmental conditions. This will further add to the existing reputation of innovation and quality that the company has.

Sika AG

Sika AG, as one of the leading names in construction materials, is recognized for its range of premium vapour barrier products specially designed for high-performance moisture control. In addition to standing in the roofing, flooring, and wall spaces to save structural integrity from the humidity due to these preventive defects, the company's products are also applicable in other areas.

Sika's focus and dedication towards research and sustainability that they have devoted in the introduction of easy-to-apply, eco-friendly vapour barriers that make significant contribution to the energy-efficient building solutions.

In the meantime, Sika is also foraying into the prefab construction sector where barriers are essential to the entire process of building the modules, as integrity of the module components needs to be kept throughout transportation, and assembly, so the cover of vapour barriers needs to be used.

The global vapour barrier market is projected to reach USD 12,555.0 million by the end of 2025.

The market is anticipated to grow at a CAGR of 4.8% over the forecast period.

By 2035, the vapour barrier market is expected to reach USD 19,963.9 million.

The Construction segment is expected to hold a significant share due to the increasing demand for insulation and waterproofing solutions in residential and commercial buildings.

Key players in the vapour barrier market include Dow Chemical Company, DuPont, Saint-Gobain, 3M, BASF SE, Soprema, Kingspan Group, GCP Applied Technologies, Carlisle Companies, and Sika AG.

The market is segmented into Glass, Sheet Metal, Polymer Membranes, Asphalt & Bitumen, Gypsum Board, Drywall/Board Lumber, Plywood, and Concrete/Brick.

The industry is divided into Membranes, Sheet, Fluid, Peel & Stick, Films, Coatings, Liquid, Aerosol/Spray Based, Cementitious Waterproofing, and Stacking & Filling.

The market finds applications in Corrosion Resistance, Insulation, Waterproofing, Material Packaging & Stacking, and Microbial & Fungal Resistance.

The major end-use industries include Construction, Packaging, and Automotive.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

Agricultural Fabrics Market Growth - Trends & Forecast 2025 to 2035

Asia Pacific Industrial Solvents Market Growth - Trends & Forecast 2025 to 2035

Asia Pacific Waterproofing Chemicals Market Growth - Trends & Forecast 2025 to 2035

Thioesters Market Growth & Trends 2025 to 2035

Polyurethane Foam Market Size & Trends 2025 to 2035

Polyurethane Adhesives Market Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.