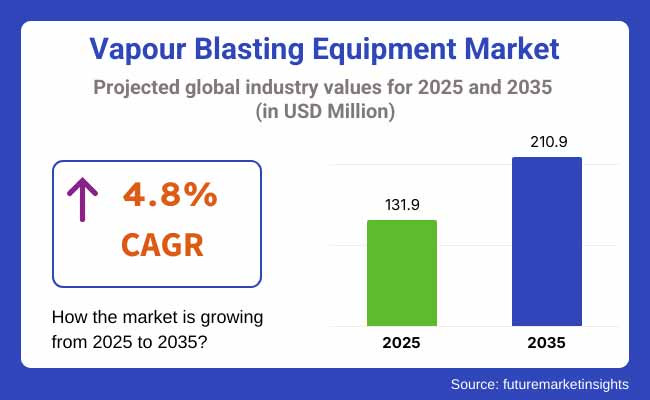

The vapour blasting equipment market is expected to witness steady growth between 2025 and 2035, driven by increasing demand for precision surface finishing, rising adoption in the automotive and aerospace industries, and advancements in eco-friendly blasting technologies. The market is projected to be valued at USD 131.9 million in 2025 and is anticipated to reach USD 210.9 million by 2035, reflecting a CAGR of 4.8% over the forecast period.

Vapour blasting equipment, also known as wet blasting or slurry blasting, are used extensively for cleaning, deburring and restoring delicate surfaces in automotive restoration, metal fabrication, aerospace maintenance and industrial manufacturing.

The shift from dry blasting to water-based abrasive blasting because of lower dust emissions, better surface smoothness, and superior operator safety is fuelling market growth. While challenges to wider market adoption exist, including high entry costs, complexity in maintenance and limited industrial applications in heavy-duty settings.

AI-based blasting automation, robotic-assisted vapour blasting and high-efficacy abrasive recovery systems among new technologies keeping blasting at the cutting edge of process efficiency, cost-effectiveness, sustainability. The market potential is extending even further with the introduction of customized wet blasting solutions for heritage restoration, military equipment maintenance, and clean-room applications.

Strict regulations on surface treatment processes in North America encourage the use of vapour blasting equipment, along with eco-friendly equipment, which is expected to promote the growth of the vapour blasting industry in the region.

High-precision vapour blasting is increasingly used in automotive refurbish, aircraft engine maintenance and industrial components cleaning, while voiding interests on automated wet blasting solution for high volume production facilities in the United States and Canada.

There is a vast adoption of vapour blasting in Europe thanks to regulations on worker safety, emission control and sustainable manufacturing practices which are increasingly driving vapour blasting market across the region.

Hot-spots for automated vapour blasting system integration along with applications related to fine-surface finishing in medical devices and the restoration of classic cars and industrial machinery are Germany, the UK, France and Italy. The European Union's attention to airborne contaminants and green industrial solutions has further boosted the demand for water-based blasting technologies.

Asia-Pacific is expected to rise as the fastest growing market driven by rapid industrialization, increasing automotive production, and growing aerospace manufacturing investments in the countries such as China, Japan, India, and South Korea.

While China continues to dominate the mass-production of vapour blasting hardware, Japan and South Korea are focusing on offering robotic-assisted wet blasting system for high-precision semiconductor and medical equipment applications. In India, the demand for economically feasible vapour blasting units suitable for small scale manufacturing, infrastructure and building maintenance is on the rise.

Challenges: High Equipment Costs and Limited Awareness in Emerging Markets

Although vapour blasting machinery provides better surface finish and dust-free working environment, factors like the high initial investment of vapour machines, upkeep of water and abrasives recycling system and lack of awareness among small manufacturers continue to be the primary challenges. Moreover, the market growth is hindered by the competition from alternative surface finishing methods like dry blasting, ultrasonic cleaning, laser ablation, etc.

Opportunities: Automation and Sustainable Surface Preparation Solutions

New technologies, especially advances in vapour blasting robots powered with AI; automated pressure-controlled slurry blasting systems; and IoT-enabled monitoring solutions is creating more growth opportunities in the market.

These include the development of eco-friendly based blasting media, advancement in hybrid type of wet blasting-dry blasting technology, high-speed multi-nozzle system, which is expected to foster long term market growth. In addition, an increase of vapour blasting units which are compact and mobile for on-site restoration, construction surface preparation and bespoke metal finishes are driving market growth in various end-use industries.

From 2020 to 2024, the Vapour Blasting Equipment Market has demonstrated steady growth, due to precision surface finishing demands, boosted restoration of automobiles, and increased number of industrial applications. The trend of eco-friendly, dustless preparation of surfaces became widely adopted, particularly in aerospace, automotive, marine, and other industries due to various factors.

Automated blasting systems, water recycling, and pressure control based on AI artificially improved effectiveness, safety, and sustainability. Yet, high initial investments in the field of tens and even hundreds of thousands of dollars, the relatively short duration of penetration into the developing markets, and existing competitors’ counterattacks through dry blasting made growth at a slower rate.

From 2025 to 2035, the Vapour Blasting Equipment Market future will transition to precision blasting based on AI, robotic vapour blasting systems, and tracking of equipment maintenance on block chain.

Automated blasting workstations with an AI-based optimizing of abrasive media, as well as IoT-enablement of blasting equipment facilitate cost reduction and process acceleration. Self-cleaning blasting chambers, corrosion detection, and closed-loop water recycling based on AI enablement will disrupt the industry.

Finally, zero-waste industry media, AI-produced inventions and their automation, and a carbon-neutral model will re-create the trends, ensuring that the efficiency is high, environmentally-friendly practices are followed, and the level of penetration is maximized.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with OSHA, EPA, and REACH regulations on worker safety and environmental impact. |

| Technological Innovation | Use of manual vapour blasting, semi-automated systems, and basic water recycling units. |

| Industry Adoption | Growth in automotive restoration, aerospace surface treatment, and industrial machinery refurbishment. |

| Smart & AI-Enabled Solutions | Early adoption of automated pressure control, integrated dust suppression, and digital performance monitoring. |

| Market Competition | Dominated by industrial equipment manufacturers, automotive restoration firms, and aerospace maintenance providers. |

| Market Growth Drivers | Demand fuelled by increasing need for non-abrasive surface finishing, eco-friendly blasting alternatives, and industrial refurbishment projects. |

| Sustainability and Environmental Impact | Early adoption of low-dust vapour blasting, water-based media recycling, and energy-efficient compressor systems. |

| Integration of AI & Digitalization | Limited AI use in process monitoring, equipment diagnostics, and manual workflow optimization. |

| Advancements in Manufacturing | Use of traditional wet blasting techniques, human-operated blasting cabinets, and conventional safety measures. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter AI-driven compliance monitoring, block chain-backed equipment safety certifications, and zero-waste surface treatment mandates. |

| Technological Innovation | Adoption of AI-powered autonomous blasting robots, real-time surface profiling, and quantum-enhanced material wear analysis. |

| Industry Adoption | Expansion into AI-driven predictive surface restoration, Nano coating-integrated blasting, and smart material-based vapour blasting solutions. |

| Smart & AI-Enabled Solutions | Large-scale deployment of AI-powered blasting precision optimization, real-time corrosion detection, and block chain-tracked equipment maintenance. |

| Market Competition | Increased competition from AI-integrated blasting technology companies, robotics-driven surface treatment firms, and eco-friendly equipment manufacturers. |

| Market Growth Drivers | Growth driven by AI-assisted autonomous blasting, sustainable closed-loop water recovery systems, and predictive maintenance-based industrial cleaning. |

| Sustainability and Environmental Impact | Large-scale transition to zero-emission vapour blasting, AI-driven waste reduction strategies, and fully automated green manufacturing facilities. |

| Integration of AI & Digitalization | AI-powered real-time material integrity analysis, block chain-backed component restoration tracking, and fully autonomous vapour blasting stations. |

| Advancements in Manufacturing | Evolution of self-cleaning smart blasting equipment, AI-optimized pressure regulation, and Nano-engineered surface enhancement solutions. |

The vapour blasting equipment market in the United States continues to be strong, due to rising demand for precision surface treatment in the automotive, aerospace, and industrial manufacturing industries. Market growth is being driven by the increased number of restoration and refurbishing projects and an emphasis on restoration and refurbishment in classic vehicle restoration, as well as the upkeep of aerospace components.

Moreover, technological breakthroughs in the eco-friendly blasting process and water-based blasting process are driving operational efficiency and minimizing ecological footprint. Industry trends are also being influenced by the growing use of automation in surface finishing processes and the latest adoption of vapour blasting for post-processing of 3D-printed parts.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.0% |

The market for vapour blasting equipment in the UK is growing steadily, aided by increasing acceptance of cutting-edge surface treatment solutions across industrial manufacturing, aerospace engineering, and precision machining. Antique and heritage vehicle restorations have created new niches for demand to meet, as the restorers required in the restoration sector continue to expand.

Moreover, the growing significance of sustainability in industrial cleaning procedures encourage usage of wet blasting as a substitute to dry abrasive blasting. These factors are complemented by the increasing trend of automated and robotic vapour blasting solutions for high-precision applications facilitating the expansion of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.6% |

The European Union vapour blasting equipment market is dominated by Germany, France, and Italy owing to large-scale industrial manufacturing, escalating demand for high-precision cleaning solutions and growing uptake of eco-friendly surface preparation technologies.

Increasing attention in the EU to reducing emissions and hazardous waste that are generated during industrial processes is accelerating the shift toward water-based blasting technologies.

Closed-loop water recycling systems and high-pressure wet blasting technologies are also driving innovation across the industry. Other factors driving the growth of the market include the increasing utilization of vapour blasting in additive manufacturing and medical device finishing.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.9% |

Japan vapour blasting equipment market is growing on the back of growing adoption in high-precision engineering, increasing adoption of advanced surface treatments in semiconductor and electronics manufacturing and strong automation investments. With a global reputation in nanotechnology and fine surface finishing, the country is already leading innovations in ultra-fine wet blasting techniques.

Other trends influencing the advancement of the vapour blasting system include AI and IoT-enabled monitoring integration. Growing uses of miniaturized and high performance components in the field of robotics and medical technologies are also supporting the market development.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.5% |

Increasing adoption of vapour blasting equipment in precision manufacturing coupled with rising demand for environment friendly cleaning techniques are major driving factors for vapour blasting equipment market in South Korea. Sustainable industrial processes and advanced coatings preparation in the country are driving demand for vapour blasting solutions, which have high efficiency.

Moreover, this market competitiveness is being bolstered by the implementation of automation and AI-driven quality control systems. It is also increasingly finding application in the cleaning of electric vehicle (EV) battery components and semiconductor fabrication, which is driving further adoption in the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

Manual Vapour Blasting Systems Gain Traction Due to Cost Efficiency and Operator Control

Industries that demand high levels of operator control, cost efficiency, and versatility for various surface preparation applications preferred manual vapour blasting systems. Unlike automated systems, vapour blasting in a manual process enables technicians to dynamically adjust pressure, flow rates and nozzle angles to suit in real time, which makes it perfect for applications where precision, tailored finishing and the restoration of intricate components is a must.

The increasing demand for small-scale vapour blasting systems (with portable designs, user-friendly controls, and water-conserving technology) has driven market uptake. And the introduction of ergonomic manual vapour blasting solutions that promote light weight handling, superior grip technology and better nozzle control has increased demand in the market due to greater efficiency and reduced operator fatigue.

The implementation of AI-driven process monitoring, with real-time information flow regarding surface quality, variable pressure adjustment and performance analysis based on data-driven approaches, has contributed to the increased adoption, all while guaranteeing optimal blasting results and improved workplace safety.

Although labour dependency, slow processing speed, and inconsistent output quality are the impediments faced by the manual vapour blasting segment, it is beneficial in terms of cost efficiency, adaptability, and precision.

But advancements in smart nozzle technology, operator alerts driven by AI, and automated pressure calibration are drastically improving efficacy, consistency, and user-friendliness, with a forecast for even greater market growth of manual vapour blasting solutions globally.

Automatic Vapour Blasting Systems Drive Industrial Adoption as Automation Enhances Efficiency

As industries focus increasingly on process automation, repeatability, and high-throughput surface finishing, automatic vapour blasting systems are gaining significant market traction. Unlike manual systems, automated solutions remove human error and improve the speed, precision, and uniformity, making them most suitable for mass production and component finishing of high precision.

The adoption has been driven by the growing demand for robotic and CNC-integrated vapour blasting solutions, which are equipped with real-time surface scanning, automatic pressure adjustments, and predictive maintenance algorithms. More than 50% of high-volume manufacturing sectors integrate automated vapour blasting for their engine components, aerospace parts, and complex metal surface finishing according to recent studies.

The growth of smart vapour blasting workstations, complete with fully enclosed blasting chamber, real-time contaminant detection, and IOT crowd control process monitoring, has further propelled the market demand, providing greater automation, efficiency and process control.

Involvement of more advanced technologies is expected to boost its segment compared to the automatic vapour blasting segment although the dashed waveform familiar systems segment is expected to continue dominating the global vapour blasting machine market, in terms of both revenue and volume as for the automatic vapour blasting apparatus segment, the segment remains shouldering a couple of challenges including the hefty initial investment amount, complex integration, and system maintenance.

Nonetheless, the incorporation of new plug-and-play automation systems, AI driven predictive maintenance systems, and energy-efficient system designs are boosting the cost-effectiveness, ease of use, and industrial acceptance of automatic vapour blasting equipment, enabling steady global market growth.

Automotive Industry Leads Market Demand as Vapour Blasting Optimizes Component Restoration and Finishing

The automotive industry is one of the biggest users of vapour blasting equipment in terms of restoring engine components, reconditioning alloy wheels and preparing the surface of automotive components. Vapour blasting is a mild but effective cleaning process, and unlike traditional abrasive blasting, vapour blasting cleans without damaging fragile automotive components.

Increasing trend towards sustainable automotive surface treatments, which have features such as water-based blasting media, closed-loop recycling systems and lower airborne dust emissions, has further bolstered the uptake.

The rise of touchless cleaning technology, A.I.-based process calibration, and IoT-powered surface profiling in automated automotive vapour blasting booths is boosting the market, providing prolonged component lifespan and optimally superior aesthetic finishes.

Robotic-assisted vapour blasting systems with integrated real-time defect scanning, automated nozzle adjustments, and AI-enabled contamination detection have further stimulated adoption to minimise rework and ensure consistent results.

While this method of blasting offers benefits such as preserving component integrity, improved surface finishes, and reduced environmental impact, the automotive segment of the vapour blasting market are restrained by its higher cost of equipment, increased water consumption, and the unavailability of skilled operators.

Nevertheless, innovative developments such as water-saving blasting chambers, AI-powered quality control, and mobile vapour blasting units are enhancing sustainability, cost-effectiveness, and accessibility, sustaining market expansion of vapour blasting solutions in automotive applications.

Aerospace Industry Strengthens Market Growth as Vapour Blasting Enhances Aircraft Component Maintenance

Vapour blasting equipment is being embraced by the Aerospace Industry, primarily for its precision surface cleaning, metal preparation and non-abrasive finishing capabilities. As a cost effective method of cleaning high-value aerospace components, vapour blasting achieves high cleaning performance without risking material removal, unlike aggressive dry blasting techniques.

The booming need for aviation-grade solution for surface preparation of components with corrosion-resistant cleaning, high-precision coating removal, and damage-free maintenance is driving airlines towards adoption of authorisation granted through AIP.

The growth of aerospace-grade vapour blasting workhouses, consisting of sealed no-pollution avenues, AI-powered blast strength modulation with real-time material integrity monitoring, has enhanced market demand for precision operations and longer component life.

The introduction of robotic-assisted aerospace vapour blasting technologies with adaptive force control, AI defect mapping and predictive wear analyses have driven further uptake, delivering best-in-class component reliability and service longevity.

Though it has benefits in terms of surface uniformity, component integrity preservation, and high-precision cleaning, the aerospace vapour blasting segment is seeing challenges such as compliance to stringent regulations, high initial investment requirements, and requirements for specialized training of operators.

Nonetheless, developments such as automated compliance verification solutions, AI-based process optimization models, and sustainable water reuse technologies that are enhancing overall cost-effectiveness, efficiency, and compliance, are anticipated to ensure vapour blasting coatings solutions in aerospace market grow moving forward.

The vapour blasting equipment market's growth is fuelled by rising demand for precise surface finishing, innovations in environmentally friendly cleaning technologies, and an increase in its use in automotive restoration, aerospace maintenance, and industrial component refurbishment.

The market is steadily growing with the increasing use of Solutions in metal finishing, medical device cleaning, and post-processing of additive manufacturing. Bold trends that are shaping the industry include fully automated vapour blasting systems, environmentally friendly water based abrasive solutions, and dust-free integrated operations.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Vapormatt Ltd. | 12-16% |

| Guyson Corporation | 10-14% |

| Vixen Surface Treatments Ltd. | 8-12% |

| Rösler Oberflächentechnik GmbH | 6-10% |

| Clemco Industries Corp. | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Vapormatt Ltd. | Develops high-performance vapour blasting equipment for precision cleaning and surface finishing. |

| Guyson Corporation | Specializes in automated vapour blasting systems for aerospace and medical industries. |

| Vixen Surface Treatments Ltd. | Offers eco-friendly vapour blasting solutions for automotive and industrial applications. |

| Rösler Oberflächentechnik GmbH | Focuses on high-efficiency wet blasting machines with advanced recycling systems. |

| Clemco Industries Corp. | Provides industrial-scale vapour blasting solutions with dust-free and water-based abrasives. |

Vapormatt Ltd. (12-16%)

Vapormatt leads in precision vapour blasting equipment, integrating automation and high-efficiency surface finishing solutions.

Guyson Corporation (10-14%)

Guyson specializes in automated and robotic vapour blasting systems tailored for aerospace and medical device applications.

Vixen Surface Treatments Ltd. (8-12%)

Vixen focuses on eco-friendly wet blasting systems, catering to automotive restoration and industrial maintenance.

Rösler Oberflächentechnik GmbH (6-10%)

Rösler pioneers in high-efficiency wet blasting equipment with advanced filtration and recycling capabilities.

Clemco Industries Corp. (4-8%)

Clemco provides large-scale vapour blasting solutions, emphasizing dust-free operations and sustainable media options.

Other Key Players (45-55% Combined)

Several surface finishing and blasting equipment manufacturers contribute to the expanding Vapour Blasting Equipment Market. These include:

The overall market size for the vapour blasting equipment market was USD 131.9 million in 2025.

The vapour blasting equipment market is expected to reach USD 210.9 million in 2035.

The demand for vapour blasting equipment will be driven by increasing adoption in automotive restoration and aerospace maintenance, rising demand for eco-friendly surface preparation techniques, growing applications in precision cleaning and finishing, and advancements in water-based blasting technology.

The top 5 countries driving the development of the vapour blasting equipment market are the USA, Germany, China, Japan, and the UK.

The Automatic Vapour Blasting Equipment segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Control Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Control Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End-Use Industry, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Control Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Control Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by End-Use Industry, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Control Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Control Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by End-Use Industry, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Control Type, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Control Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by End-Use Industry, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Control Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Control Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by End-Use Industry, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Control Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Control Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End-Use Industry, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Control Type, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Control Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by End-Use Industry, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Control Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Control Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End-Use Industry, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by End-Use Industry, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Control Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Control Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Control Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Control Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Control Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by End-Use Industry, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 16: Global Market Attractiveness by Control Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Control Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Control Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Control Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Control Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Control Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by End-Use Industry, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 34: North America Market Attractiveness by Control Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Control Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Control Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Control Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Control Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Control Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by End-Use Industry, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Control Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Control Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Control Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Control Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Control Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Control Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by End-Use Industry, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Control Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Control Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Control Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Control Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Control Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Control Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by End-Use Industry, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Control Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Control Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Control Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Control Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Control Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Control Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End-Use Industry, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Control Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Control Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Control Type, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Control Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Control Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Control Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by End-Use Industry, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Control Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Control Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End-Use Industry, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Control Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Control Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Control Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Control Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End-Use Industry, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End-Use Industry, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use Industry, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use Industry, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Control Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End-Use Industry, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vapour Barrier Market Size and Share Forecast Outlook 2025 to 2035

Vapour Recovery Units Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Vapour Recovery Unit Providers

Explosive Vapour Detector Market Size and Share Forecast Outlook 2025 to 2035

Demand for Vapour Barrier in EU Size and Share Forecast Outlook 2025 to 2035

Sandblasting Media Market Size and Share Forecast Outlook 2025 to 2035

Sand Blasting Machines Market Size and Share Forecast Outlook 2025 to 2035

Shot Blasting Machine Market - Size, Share, and Forecast 2025 to 2035

Abrasive Blasting Nozzles Market

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Garage Equipment Market Forecast and Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pavers Equipment Market Size and Share Forecast Outlook 2025 to 2035

Tennis Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA