Vapor barrier films are key materials applied in several industries such as construction, packaging, and electronics to impede the passage of moisture and maximize product durability.

The films have better resistance against vapor intrusion than other forms, and therefore are best suited for use in applications involving insulation, food packaging, and the fabrication of semiconductors. The growth of demand for resilient and water-repellent barrier solutions will help propel tremendous growth in the industry over the upcoming decade.

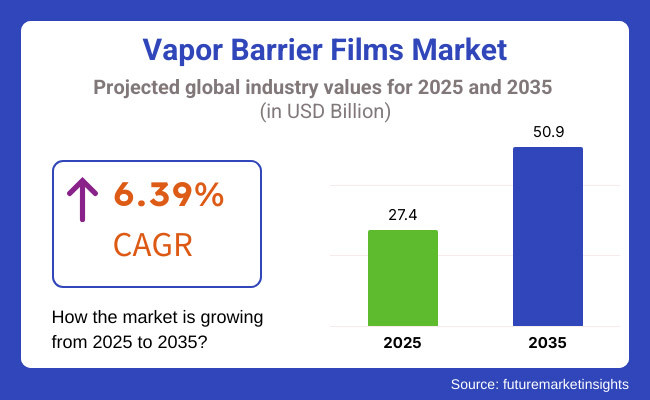

The size of the market is anticipated to register a value of USD 27.4 Billion in 2025 and to expand at a 6.39% CAGR between 2025 and USD 50.9 Billion by 2035.

Its growth is encouraged by expanding building construction activities, the rising international demand for flexible packaging, and innovation in nanotechnology-based barriers. Moreover, increasing regulatory needs for moisture control in critical uses like electronics and pharmaceuticals are also fueling market growth.

Market growth is also influenced by higher innovation in high-performance and environmentally friendly barrier films, such as recyclable and bio-based solutions. The growth in food preservation technology and improved high-barrier packaging solutions are further propelling market growth.

Technological innovations in multilayer vapor barrier film compositions, for instance, thermal insulation improvements and UV-resistant coatings, are anticipated to increase the efficiency and lifespan of products.

Explore FMI!

Book a free demo

Asia-Pacific is expected to dominate the market, driven by rapid industrialization, expanding infrastructure projects, and the growing demand for high-performance packaging solutions.

Countries such as China, India, and Japan are key contributors, with significant investments in construction insulation, electronics manufacturing, and flexible packaging. Additionally, the increasing use of products in agricultural applications, such as greenhouse films, is further accelerating market growth.

The region’s market expansion is supported by stringent government regulations for moisture control and energy efficiency in buildings. Additionally, advancements in high-barrier biodegradable films are expected to drive innovation in the sector.

The increasing presence of global packaging and insulation material manufacturers in Asia-Pacific is also boosting local production capacities. Furthermore, research and development in lightweight yet durable products are expected to create new growth opportunities in the region.

North America remains a prominent market for products due to strong demand from the construction, healthcare, and electronics industries. The United States and Canada are leading the region with technological advancements in moisture-resistant and energy-efficient building materials. The growing preference for sustainable and high-performance packaging solutions among industries is further boosting market demand.

The adoption of advanced vapor barrier film materials is gaining traction, influenced by government regulations promoting energy efficiency and sustainable packaging. Increasing investments in research and development for high-performance nanotechnology-based films are further propelling market growth.

Additionally, the rise in semiconductor manufacturing and food preservation technologies is driving demand for enhanced vapor-resistant films. Many companies in North America are also focusing on improving the recyclability and durability of products to enhance product performance. Innovations in smart vapor barrier films, such as humidity-responsive coatings, are expected to further shape the market in the coming years.

Europe holds a significant share of the market, driven by stringent regulatory frameworks supporting sustainable and high-barrier packaging solutions. Leading economies such as Germany, France, and the UK are at the forefront of eco-friendly vapor barrier film innovations.

The increasing investments in circular economy initiatives and research into high-performance biodegradable films are further strengthening the region's leadership in the market.

Stringent environmental policies promoting the reduction of single-use plastic films are accelerating the shift towards sustainable vapor barrier solutions. Additionally, increasing consumer awareness and demand for moisture-resistant green packaging are expected to contribute to long-term market growth.

The region is also witnessing an increasing number of collaborations between barrier film manufacturers and technology companies to develop advanced moisture-control solutions.

Furthermore, research institutions across Europe are investing in next-generation barrier films with improved efficiency and recyclability. These advancements are expected to enhance the overall efficiency and adoption of vapor barrier films in various industries.

Challenges

High production costs

The manufacturing process for high-performance requires specialized materials and technology, impacting production expenses.

Regulatory restrictions on plastic waste

Government mandates are pushing for sustainable alternatives, requiring vapor barrier film manufacturers to develop recyclable and eco-friendly solutions.

Opportunities

Expansion into new industries

Vapor barrier films are increasingly being explored for applications in energy-efficient construction, electric vehicle batteries, and pharmaceutical packaging, offering new growth avenues.

Advancements in biodegradable and nanotechnology-based film technology

Research in lightweight, high-barrier, and moisture-resistant materials is expected to drive innovation and enhance product applications.

Between 2020 and 2024, the vapor barrier films market witnessed steady growth due to rising demand in construction insulation, food packaging, and electronics protection. However, challenges such as high production costs and plastic waste concerns remained key obstacles for manufacturers.

Additionally, the market saw increased investments in research to improve film recyclability, thermal performance, and moisture resistance. Growing concerns over energy efficiency prompted regulatory bodies to encourage the adoption of advanced vapor barrier materials. Furthermore, advancements in multilayer film compositions contributed to increased durability and functionality.

Moving forward, market expansion will be driven by innovations in biodegradable films, AI-integrated barrier technologies, and improved moisture control solutions. The integration of automation in film production and AI-driven quality control systems will further enhance market competitiveness.

Additionally, increasing demand for vapor barrier film solutions in high-tech industries, such as electric vehicle battery protection and medical device packaging, will create new growth opportunities. Companies are also focusing on enhancing film reusability and recyclability to meet industry-specific needs. The rise of customized product tailored for niche applications is expected to gain momentum in the coming years.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Initial focus on reducing plastic-based barrier films. |

| Material and Formulation Innovations | Development of multilayer products. |

| Industry Adoption | Widely used in construction and food packaging. |

| Market Competition | Dominated by major film and packaging brands. |

| Market Growth Drivers | Growth driven by food safety and moisture protection. |

| Sustainability and Environmental Impact | Early-stage transition to biodegradable film options. |

| Integration of AI and Process Optimization | Limited use of AI in film production. |

| Advancements in Packaging Technology | Focus on film durability and moisture resistance. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global policies mandating biodegradable and high-performance films. |

| Material and Formulation Innovations | Expansion of bio-based, recyclable, and moisture-proof film materials. |

| Industry Adoption | Increased adoption in electric vehicles, medical devices, and advanced electronics. |

| Market Competition | Rise of sustainable film startups and collaborations with technology firms. |

| Market Growth Drivers | Market expansion fueled by AI-integrated solutions and eco-friendly designs. |

| Sustainability and Environmental Impact | Large-scale adoption of fully recyclable and compostable vapor barrier films. |

| Integration of AI and Process Optimization | AI-driven predictive modeling and automated manufacturing enhancements. |

| Advancements in Packaging Technology | Development of smart, humidity-responsive, and multi-functional products |

The USA dominates the market, driven by increasing demand for moisture-resistant and durable packaging solutions in industries such as construction, food & beverage, electronics, and healthcare. The need for superior protection against moisture and vapor transmission has encouraged manufacturers to develop high-performance vapor barrier films with enhanced barrier properties.

Additionally, government regulations promoting sustainable and energy-efficient materials are pushing companies to adopt recyclable and biodegradable. Moreover, advancements in nanotechnology-based coatings are improving moisture resistance and overall durability.

Businesses are also exploring multi-layered vapor barrier film designs to optimize product performance and efficiency. Furthermore, the increasing adoption of products in smart packaging and insulation applications is driving innovation in the sector.

Country | CAGR (2025 to 2035) United States | 5.2%

The UK market is expanding as businesses prioritize sustainability and compliance with environmental regulations. The rising demand for moisture-proof and energy-efficient packaging solutions has led to increased adoption across multiple industries, including construction, pharmaceuticals, and food storage.

Government initiatives promoting eco-friendly building materials and food safety regulations are further pushing companies to integrate high-performance products. Additionally, innovations in breathable and anti-fungal vapor barrier formulations are making these materials more attractive for extended storage applications.

Companies are also exploring RFID-enabled vapor barrier films for improved inventory management and traceability. Furthermore, the shift toward green building certifications is increasing the demand for products in the UK market.

Country | CAGR (2025 to 2035) United Kingdom | 4.7%

Japan’s market is growing steadily due to the increasing need for precision-engineered moisture protection solutions in the electronics, automotive, and healthcare industries. Companies are developing high-performance products with advanced polymer blends to enhance moisture resistance in sensitive components.

With strict regulations on packaging waste reduction, businesses are transitioning toward biodegradable and recyclable vapor barrier materials. Additionally, advancements in smart vapor barrier films, such as temperature-sensitive coatings and humidity control features, are driving demand in applications requiring real-time monitoring.

Businesses are also investing in automation-friendly vapor barrier film solutions to improve efficiency in logistics and storage. Furthermore, the rise of compact and lightweight packaging solutions in Japan is fueling demand for vapor barrier films across various industries.

Country | CAGR (2025 to 2035) Japan | 4.5%

South Korea's market is experiencing significant growth due to increased exports and industrial automation. The need for cost-effective and high-performance moisture protection solutions has led manufacturers to develop enhanced barrier films with improved anti-condensation properties.

Government regulations promoting energy-efficient and sustainable packaging further support market expansion. Additionally, businesses are integrating smart tracking technologies such as QR codes and RFID tags into products to improve supply chain efficiency.

The growing demand for high-barrier packaging in electronics and pharmaceuticals is further boosting adoption. Moreover, research into self-healing vapor barrier coatings is helping businesses develop specialized packaging tailored to extreme environmental conditions.

Country | CAGR (2025 to 2035) South Korea | 4.9%

As per FMI analysis, on the basis of material, the market is classified into polyethylene (PE), polyamide (PA), polyethylene terephthalate (PET), and others. Polyethylene (PE), polyamide (PA), and polyethylene terephthalate (PET) are all well-used materials used for products, yet polyethylene (PE) is most widely used since it boasts a good mixture of flexibility, cost-effectiveness, and barrier capacity.

PE films have better moisture barrier, sealability, and flexibility in food packaging, pharmaceutical applications, and other industrial applications. Although PA is stronger mechanically and has better oxygen barrier properties, and PET has heat stability and dimensional stability, PE is used most extensively because it is lightweight, inexpensive, and compatible with multilayer film structures.

In addition, PE's co-extrusion and lamination versatility also makes it a viable candidate for vapor packaging, and it is a prominent material in the industry.

On the basis of thickness, the market is segmented into below 5 mils, 5 mils - 10 mils, 10 mil - 15 mil, and 15 mil and above 5 mil 10 mils are the most widely used as they possess the optimal combination of flexibility, toughness, and barrier characteristics.

These films provide sufficient protection against moisture, oxygen, and contaminants with ease of handling and sealing. They are typically used in food packaging, medical devices, and industrial vapor packaging, where a moderate thickness offers product protection and economy.

Below 5 mil, films are too thin for heavy-duty applications, while 10 mil - 15 mil or 15 mil and heavier films, although possessing greater puncture resistance and superior barrier properties, are less flexible and more expensive and are best utilized in specialty or high-pressure applications.

On the basis of end-use industry, the market is segmented into chemicals, automotive, food & beverages, building & construction, pharmaceuticals & healthcare, electrical & electronics, and other industries. The food & beverages industry is the largest consumer products due to the critical need for freshness preservation, shelf life, and protection of the product against moisture, oxygen, and contamination.

The films are extensively used for packaging perishable foodstuffs like meat, cheese, coffee, and ready-to-eat foods by preventing spoilage and maintaining quality. Vapor barrier films prevent food wastage through the inhibition of oxidation and microbial growth.

While other industries like pharmaceuticals & healthcare and electrical & electronics require high-performance barrier films for product protection, the quantity and ever-lasting demand within the food sector are so high that it continues to be the largest market for these films.

The construction, packaging, healthcare, and electronics applications' increasing demand shape the market. The market is experiencing innovation in the form of novel formulations of materials like bio-based barrier coatings, moisture-resistant nanofilms, and high-strength multi-layer films, which also address issues relating to waste disposal, sustainability, and product functionality.

Moreover, developments in computerized manufacturing and AI-based tracking of the supply chain are influencing industry trends even further. Increased demand for high-performance and sustainable barrier films is also driving growth in the market. In addition, greater investments in environmentally friendly film manufacturing technologies are enhancing product efficiency and broader market potential.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Saint-Gobain Performance Plastics | 14-18% |

| Bemis Company Inc. | 10-14% |

| Toppan Printing Co. Ltd. | 8-12% |

| Berry Global Inc. | 6-10% |

| Other Companies (combined) | 50-60% |

The overall market size for the vapor barrier films market is USD 27.4 Billion in 2025.

The vapor barrier films market is expected to reach USD 50.9 Billion in 2035.

The market will be driven by increasing demand from construction, healthcare, and electronics industries. Sustainability trends, innovations in biodegradable materials, and improvements in vapor barrier film performance will further propel market expansion.

Key challenges include high production costs, difficulty in recycling multi-layer films, and the need for regulatory compliance in different industries. However, advancements in mono-material films and improved barrier technologies are addressing these concerns.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.