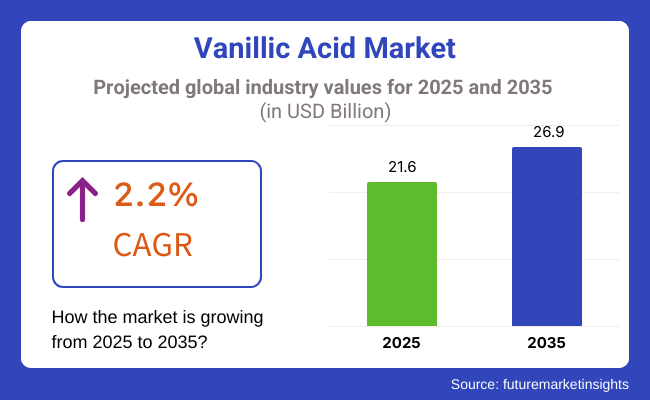

The vanillic acid market is projected to grow steadily, and its demand is expected to be around USD 21.6 billion in 2025. The overall market is expected to demonstrate a CAGR of 2.2% through the forecast period between 2025 to 2035. The total valuation will increase to USD 26.9 billion by the year 2035.

Vanillic acid is common in the food, pharmaceutical, and cosmetic industries because it is an antioxidant, antimicrobial, and flavor enhancer. The growing need for organic substances continuously drives sales of natural and functional ingredients. Besides that, the company is engaged in fragrant composition with the support of this material, among other things.

The major aspect of growth has been the escalation of consumer inclination toward natural and clean-label products. The use of vanillic acid in the food and beverage sector is extensive, for instance, in confectionery, bakery, and dairy products, where it contributes to aromatic and taste enhancement. This, in turn, is contributing to the increasing demand for clean-label products and organic food ingredients.

In addition to these, the pharmaceutical and nutraceutical applications of vanillic acid are another important element in the continued growth. This is due to the fact the antioxidant and anti-inflammatory properties of vanillic acid have made it a valuable ingredient in the development of dietary supplements and functional foods. Furthermore, the studies being carried out on how this compound could benefit people's health by preventing cancer and acting as a neuroprotective agent are helping to advance sales further.

Nevertheless, there are irreconcilable issues, such as the lack of availability of raw materials and the fluctuating prices of raw materials, which vanillic acid, being mostly obtained from plant sources, very often faces. The legal requirements for manufacturing vanillic acid in the food and pharmaceutical industries differ from one region to another, leading to compliance problems for manufacturers.

On the other hand, the chances for the market to grow stay vigorous. As the demand for eco-friendly and sustainable ingredients in cosmetics and personal care products rises, the production of vanillic acid will jump. Meanwhile, the innovation of extraction and bio-synthesis technologies continues to lead the way in the improvement of production efficiency and cost-effectiveness.

Explore FMI!

Book a free demo

There was considerable growth during the period from 2020 to 2024 due to increasing demand for natural flavoring agents and food preservatives in food and beverage products. With consumers leaning toward clean-label and plant-based products, the focus for manufacturers was to procure vanillic acid from natural sources like ferulic acid and vanilla beans.

The increase in health-aware consumers enhanced demand for natural antioxidants, with vanillic acid being employed as a preservative in processed foods and soft drinks. Vanillic acid was also used more extensively in the cosmetic and pharmaceutical sectors because of its anti-inflammatory and antimicrobial effects.

Companies invested in optimizing extraction processes and cleaning greener production processes to address consumers' demands for greener products. In the future, 2025 to 2035, the industry will be fueled by biotechnology and synthetic biology advancements that will make it more cost-effective and scalable.

Microbial fermentation-derived bio-based vanillic acid will shatter the dependency on traditional plant sources and render it more sustainable. AI and machine learning will optimize extraction yield and product composition, enabling manufacturers to tailor vanillic acid content to the needs of a particular industry.

Increased applications of vanillic acid in pharmaceuticals and functional foods will be driven by research into its potential health benefits, such as anti-inflammatory, antioxidant, and anti-cancer effects. Regulatory favor for sustainable and natural ingredients will also catalyze growth, with new product applications in personal care, nutraceuticals, and food preservatives leading future demand.

A Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increasing demand for natural flavoring agents and preservatives. | Expansion of bio-based vanillic acid via microbial fermentation. |

| Growing applications in food, beverages, pharmaceuticals, and cosmetics. | Improved extraction efficiency with AI and machine learning. |

| Clean-label and plant-based product formulation focus. | Tailored vanillic acid formulations for targeted industry applications. |

| Investment in eco-friendly extraction and production processes. | Regulatory incentives for natural and sustainable ingredients. |

| Increasing demand for health benefits, such as antioxidant activity. | Moving into functional foods, nutraceuticals, and personal care. |

The industry is picking up rapid pace in various industries due to its preservative, antimicrobial, and antioxidant properties. Vanillic acid occurs widely in the food and beverages sector as a natural flavoring and preservative agent, mainly in premium products with clean-label and organic orientation

In pharmaceuticals, its demand is rising because of its anti-inflammatory, anti-cancer, and neuroprotective activities, and it is a promising compound for drug development and therapeutic use. Likewise, in cosmetics and personal care, vanillic acid is being added to anti-aging creams, serums, and skincare products because of its free-radical scavenging activity.

The research and biotechnology industry is investigating vanillic acid for emerging applications in synthetic biology and the manufacturing of biopolymers. Sustainability continues to be a focal point, and more interest in bio-based methods of extraction continues to grow. With natural ingredients still preferred, the demand for vanillic acid is also anticipated to continue growing steadily in the future years.

The expansion of vanillic acid is mainly attributed to its growing usage in food, pharmaceuticals, and cosmetics. However, it is punctuated by the tight restrictions on food additives and synthetic ingredients, which is the least compliance-posing challenge. Businesses are to follow the path of dynamic global safety standards, procure the required approvals, and label them correctly if they want to uphold the credibility and the trust of their customers.

Supply chain disruptions like the inadequate availability of raw materials and limited production capacity at regions are the reasons behind the variations in price. The dependency on the natural extraction of vanilla beans or the use of chemical means makes the system vulnerable to fluctuations in agri-yields and petroleum supply lines. The adoption of alternative sourcing platforms and the realization of different production methods would alleviate these difficulties.

The competition from natural antioxidants and flavoring agents such as ferulic acid and vanillin is quite tough. Businesses must take the initiative and improve the production process so that they can remain competitive in the changing industry environment.

Economic slowdowns and changes in raw material costs, along with shifting consumer preferences, are hinderers of growth. To secure the longevity of firms, companies should enter emerging industries, fund research and development for layers of additional applications, and fine-tune the pricing strategies to maintain profitability while changing according to regulations and consumer demands.

The vanillic acid market is most extensively divided into various purity forms such as 99% dominates the share with 65% and Purity 98% is 35% Purity >99% is a higher purity grade required in applications where concentrated vanillic acid is needed, such as pharmaceuticals and fragrances.

High demand for >99% purity due to its significance in the production of world-class products. To give a specific example, in the pharmaceutical industry, vanillic acid (purity > 99%) serves as a precursor for the production of medicines that are effective against cardiac disorders, cancer, etc.

It is also the preferred choice in flavor and fragrance formulations where potency and consistency are of utmost importance. Top firms such as BASF and Lonza use purity> 99% for their formulations. The ongoing trend toward natural ingredients in wellness products is further driving the growth of this segment.

Even though purity >99% is the king, Purity 98% has practical uses where lower purity is adequate, e.g., food and beverage additives or as a precursor for a range of chemical syntheses. Its low cost ensures its appeal for bulk production in those industries where the final purity is not critical. Companies like Givaudan and Firmenich use Purity 98% in their non-premium flavor products.

The vanillic acid market is majorly classified into pharmaceutical intermediates and flavors & fragrances, both of which contribute significantly. Revenue share in 2025 was 25% for pharmaceutical intermediates and 50% for flavors and fragrances.

Vanillic acid is considered an important precursor to pharmaceutical compounds and contributes about 25% to the share. Its powerful antioxidant, anti-inflammatory, and antimicrobial properties are valuable for drug discovery and treatment of several diseases such as cancer, heart ailments, and inflammation. It plays a critical role in designing drugs that target heart disease, cancer, and inflammatory disorders.

Some companies, such as BASF and Lonza, are incorporating vanillic acid in their formulations, and the consumer demand for sustainable, natural drugs may develop. Furthermore, the rising interest in medicinal and plant-derived components in drugs also propels the growth of vanillic acid demand, which makes it an essential ingredient in health and wellness products.

Vanillic acid is primarily used in flavors and fragrances, accounting for 50% of the share. Vanillic acid is increasingly being used to add vanilla-like flavors and aroma to bakery products, dairy products, confectionery, drinks , and other foodstuffs. According to Givaudan and Firmenich flavor houses, another application of vanillic acid is their formulations aiming to grow natural-based ingredients.

Its role in the fragrance industry is crucial as well because it helps develop essential oils in perfumes, air fresheners, and personal care products. Both Symrise and International Flavors & fragrances (IFF) use vanillic acid in certain fragrance lines to create rich, warm notes, and such notes are increasing in demand by consumers seeking natural and clean-label products.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.2% |

| UK. | 4.8% |

| France | 4.5% |

| Germany | 4.7% |

| Italy | 4.6% |

| South Korea | 5.1% |

| Japan | 4.9% |

| China | 5.4% |

| Australia | 4.3% |

| New Zealand | 4.2% |

The USA will expand during 2025 to 2035 at a CAGR of 5.2%. Expanded applications across the food, pharmaceutical, and cosmetic industries support the expansion. Demand for natural and organic products, especially food and beverages, is rising and driving sales further.

Pharmaceutical industry-based strong R&D also fuels the growth. The existence of leading players like Sigma-Aldrich and Thermo Fisher Scientific also offers additional industry opportunities through new product development.

The nation also boasts an excellent industry base underpinned by an emerging trend for plant-based and clean-label commodities, which supports the demand for vanillic acid as a natural flavoring substance. The nation's robust regulatory environment ensures quality and safety standards, promotes consumer confidence, and promotes increased adoption. Additionally, the partnerships between academia and biotech companies fuel product development and increased industrial applications.

The UK will register a growth rate of CAGR of 4.8% over the forecast period, which is largely supported by increased demand for natural food additives and expanded R&D activities in pharmaceuticals. Growing consumer awareness towards clean-label products also supports the adoption levels of vanillic acid for food and beverage applications.

Growth is also driven by the prevalence of top players in food ingredients manufacturing within concentrations. Personal grooming and cosmetics also lead to demand since businesses such as Lush and The Body Shop focus heavily on using natural and environmentally friendly substances in their products. Regulation by the UK of artificial additives also stimulates demand for bio-based alternatives, so there is a demand throughout a wide variety of industries.

The industry is likely to grow at a CAGR of 4.5% during the period from 2025 to 2035, as the country has a robust food culture and demand for premium quality natural ingredients. Organic and clean-label food products are increasingly required by French consumers, which stimulates applications in flavoring. The presence of strong food ingredients players such as Roquette and Naturex supports growth.

Besides food, France's perfume and cosmetics industry is a primary driver of demand. Major players such as L'Oréal and Chanel prefer natural ingredients, thus expanding the industry. Additionally, government support for bio-based chemicals contributes to the attractiveness of the nation's market.

Germany is projected to expand at 4.7% because of the pharmaceutical and food sectors in the country, which are well-developed. The nation focuses on formulating drugs with the help of scientific development. German consumers' preference for organic and natural food also boosts demand for vanillic acid in food products.

Germany has gigantic chemical and ingredient firms such as BASF and Symrise, which are fully engaged in research in the natural ingredient industry. The country's sustainability and environmental policies also encourage its use in different industrial applications.

Italy will experience a CAGR of 4.6%, with the nation having a vibrant food culture and with the need for natural flavor persistently increasing. Italian food places the utmost significance on natural ingredients and, therefore, allows for the use of vanillic acid in food processing and confectionery products.

In addition, the Italian cosmetics sector, spearheaded by firms such as Kiko Milano and Acqua di Parma, utilizes natural ingredients to foster the demand to a larger extent. The government's encouragement to adopt clean production further underpins the sector's growth.

South Korea is also expected to grow at a CAGR of 5.1% due to the country's developed cosmetics and skincare industry. Innisfree and Amorepacific, two of South Korea's biggest beauty companies, are always looking for natural components, which drives the increasing need for vanillic acid for personal care and skincare use.

South Korean pharmaceuticals are crucial in sales expansion since they use their finances to research bioactive compounds. Besides, South Korea's new food industry, which includes functional foods, uses vanillic acid not only as a preservative but also as an ingredient to provide flavor.

Japan is expected to register a CAGR of 4.9%, primarily due to the rising demand for clean-label and high-quality ingredients in the country. Food manufacturers in Japan are keen on clean-label formulations, thus propelling the popularity of this product as a food ingredient in food applications.

Besides, it is used in Japan's pharmaceutical industry in new drug preparations. Shiseido and Kao are some of the sectors that create demand for the cosmetics market, where bio-products and natural extracts are demanded in large quantities.

The industry is expected to expand at a CAGR of 5.4% with the help of the nation's food and pharmaceutical sectors. China is a major producer of natural and synthetic flavoring chemicals, thereby increasing its demand for domestic as well as international markets.

The growth of the country's cosmetics industry, led by companies such as Pechoin and Chando, also drives market growth. Government initiatives that support bio-based chemicals and sustainable chemicals are also driving industrial demand for this product.

Australia is predicted to expand at a CAGR of 4.3% due to escalating demand from customers for organic and natural food products. Stringent food safety policies in the country support the usage of bio-based ingredients, thereby strengthening market penetration.

Additionally, Australia's cosmetics and personal care market, with brands like Aesop focusing on natural ingredients, fuels the demand. The pharmaceutical industry also investigates vanillic acid use in health supplements and medications.

The industry is expected to reach a CAGR of 4.2% because the country's organic and natural food trend is extremely robust. Market growth is driven by consumers' demand for clean-label products, mainly in the functional food and dairy segment.

In addition, New Zealand's sustainability focus also encourages the adoption of bio-based ingredients in the pharmaceutical and personal care sectors. Domestic natural skincare-focused brands are also driving market expansion, and therefore, industries are demanding vanillic acid as an ingredient.

The industry has a steady growth, which is driven by increased demand for natural antioxidants, flavoring agents, and pharmaceutical intermediates. Higher competition in the chemical manufacturing and food ingredient supplies sectors is mainly attributable to the growing demand among consumers for clean-label and plant-derived ingredients.

Leading players include Solvay, Merck KGaA, Tokyo Chemical Industry (TCI), Toronto Research Chemicals, and Oakwood Products. They provide high-purity products to use in food, cosmetics, and pharmaceutical applications. Startups and niche providers are, however, innovating toward biotechnological extraction methods for sustainability as well as purity enhancement.

The industry is also propelled by the revolutionary changes in biosynthetic production processes and the advent of green chemistry that drives cost-effective and eco-friendly manufacturing. The use of vanillic acid is, therefore, more widely applied in functional foods, skincare formulations, and pharmaceutical research, thus driving its increasing use.

With strategic factors concerning optimizing the supply chain, investing in research, and natural extraction development, as well as making sure that regulatory affairs are investigated, companies also consider strategic partnerships and use the worldwide distribution network to strengthen their position in relation to mounting demands for high-quality vanillic acid from various sectors.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Solvay S.A. | 20-25% |

| Merck KGaA | 15-20% |

| TCI Chemicals (Tokyo Chemical Industry) | 10-15% |

| Oakwood Products, Inc. | 8-12% |

| Toronto Research Chemicals (TRC) | 5-10% |

| Other Players (Combined) | 15-30% |

| Company Name | Key Offerings & Focus |

|---|---|

| Solvay S.A. | Leading supplier of high-purity vanillic acid, used in pharmaceuticals and food applications, with a focus on sustainable production. |

| Merck KGaA | Specializes in lab-grade and industrial vanillic acid, leveraging strong distribution networks and research-driven innovation. |

| TCI Chemicals | Offers research-grade vanillic acid for academic and industrial applications known for high-purity analytical chemicals. |

| Oakwood Products | Focuses on custom synthesis and specialty chemicals, catering to niche pharmaceutical and food industries. |

| Toronto Research Chemicals (TRC) | Provides high-quality vanillic acid for research and industrial uses, serving pharmaceutical and cosmetic applications. |

Key Company Insights

Solvay S.A. (20-25%)

The industry leader in pharmaceutical-grade vanillic acid, investing in green chemistry for sustainable extraction.

Merck KGaA (15-20%)

Strengthens industry presence through global distribution and supply of research and industrial-grade vanillic acid.

TCI Chemicals (10-15%)

Focuses on high-purity chemicals for academic and industrial research, expanding product availability globally.

Oakwood Products (8-12%)

Specializes in custom synthesis of vanillic acid derivatives, targeting pharmaceutical and biotechnology firms.

Toronto Research Chemicals (5-10%)

Expanding into cosmetic and nutraceutical applications, leveraging expertise in fine chemical production.

The industry is expected to generate USD 21.6 billion in 2025, driven by increasing demand in pharmaceuticals and flavor and fragrance applications, alongside advancements in fine chemical production.

The market is projected to grow to USD 26.9 billion by 2035, supported by expanded use in pharmaceutical intermediates and natural flavor enhancers. Moderate growth is expected at a CAGR of 2.2%, with demand steady across multiple industrial sectors.

Key players include Solvay S.A., Merck KGaA, TCI Chemicals, Oakwood Products, Toronto Research Chemicals (TRC), Sigma-Aldrich (MilliporeSigma), Alfa Aesar (Thermo Fisher Scientific), Vigon International, Penta Manufacturing Company, and Parchem Fine & Specialty Chemicals.

North America and Europe lead in demand due to robust pharmaceutical and specialty chemical industries, while East Asia shows increasing consumption for flavors and intermediates in manufacturing.

Vanillic acid, with 99% purity, dominates, particularly in pharmaceutical applications. Flavors and fragrances are also key segments, with consistent demand across the food and personal care industries.

It's classified as Purity 99% and Purity 98%.

It's classified as Pharmaceutical Intermediates, Flavors and Fragrances, and Other Applications.

It's divided into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

Take Out Coffee Market Growth - Consumer Trends & Market Expansion 2025 to 2035

Vegan Protein Market Analysis - Size, Share & Forecast 2025 to 2035

Taste Modulators Market Trends - Growth & Industry Forecast 2025 to 2035

Western Europe Whole-wheat Flour Market Analysis by Product Type, Nature, Application, Packaging, Sales Channel, and Country through 2035

Western Europe Fusion Beverage Market Analysis by Product Type, Distribution Channel, and Country through 2035

Western Europe Duckweed Protein Market Analysis by Nature, Species, End Use Application, and Country Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.