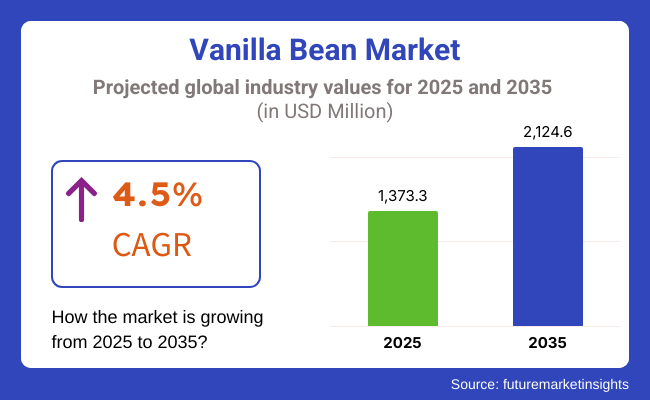

The global Vanilla Bean market is estimated to be worth USD 1,373.3 million in 2025 and is projected to reach a value of USD 2,124.6 million by 2035, expanding at a CAGR of 4.5% over the assessment period of 2025 to 2035

The global food and beverage industry is witnessing significant expansion, especially in emerging markets where rising disposable incomes and changing lifestyles are driving consumption. This growth leads to increased demand for vanilla in a variety of products, including ice cream, baked goods, and flavored beverages. As consumers seek unique and high-quality flavors, manufacturers are incorporating natural vanilla to enhance product appeal, thereby fueling the overall demand for vanilla beans in the market.

Vanilla is gaining popularity in the cosmetics and personal care industry due to its appealing fragrance and potential skin benefits. Its natural scent is often used in perfumes, lotions, and skincare products, enhancing the sensory experience for consumers.

Additionally, vanilla is believed to possess antioxidant properties, making it an attractive ingredient for formulations aimed at promoting skin health. This growing trend in personal care products contributes significantly to the rising demand for vanilla beans globally.

Explore FMI!

Book a free demo

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for global vanilla bean market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision about the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

| Particular | Value CAGR |

|---|---|

| H1 | 3.3% (2024 to 2034) |

| H2 | 3.9% (2024 to 2034) |

| H1 | 4.4% (2025 to 2035) |

| H2 | 5.0% (2025 to 2035) |

The above table presents the expected CAGR for the global vanilla bean demand space over semi-annual period spanning from 2025 to 2035. In the first half (H1) of the year 2024, the business is predicted to surge at a CAGR of 3.3%, followed by a slightly higher growth rate of 3.9% in the second half (H2) of the same year.

Moving into year 2025, the CAGR is projected to increase slightly to 4.4% in the first half and remain relatively moderate at 5.0% in the second half. In the first half (H1 2025) the market witnessed a decrease of 16 BPS while in the second half (H2 2025), the market witnessed an increase of 34 BPS.

Rise of Organic Products

The demand for organic vanilla is experiencing significant growth as consumers become increasingly health-conscious and environmentally aware. Organic vanilla, which is cultivated without synthetic pesticides or fertilizers, appeals to those seeking natural and wholesome ingredients. This trend is further fueled by the rising awareness of the environmental impact of conventional farming practices.

Organic certification not only assures consumers of the product's quality but also aligns with sustainable farming practices that promote biodiversity and soil health. As a result, more consumers are willing to pay a premium for organic vanilla, driving sales in this segment. This shift towards organic products reflects a broader movement towards healthier lifestyles and sustainable consumption patterns in the food industry.

Flavor Innovation in Food Products

Food manufacturers are increasingly embracing flavor innovation, particularly by incorporating vanilla into unique and exciting combinations. This trend is especially prominent in premium and gourmet products, where brands aim to differentiate themselves in a competitive market. Vanilla's versatility allows it to complement a wide range of flavors, from fruity to spicy, making it a popular choice for innovative culinary creations.

As consumers seek novel taste experiences, the demand for high-quality vanilla beans rises, prompting manufacturers to source premium varieties. This focus on flavor innovation not only enhances product appeal but also encourages brands to experiment with artisanal and craft offerings, further driving the growth of the vanilla market as they cater to adventurous palates.

Sustainable Sourcing Initiatives

As consumers become more socially conscious, there is a growing emphasis on sustainable and ethical sourcing of vanilla. Brands that prioritize fair trade practices and support local farmers are gaining consumer trust and loyalty. This trend reflects a broader movement towards responsible consumption, where consumers are increasingly interested in the origins of their food and the impact of their purchasing decisions.

By investing in sustainable sourcing initiatives, companies can ensure that their vanilla is produced under fair labor conditions and environmentally friendly practices. This commitment not only enhances brand reputation but also appeals to ethically-minded consumers, leading to increased sales in the vanilla market. As sustainability becomes a key purchasing criterion, brands that align with these values are likely to thrive.

Global Vanilla Bean sales increased at a CAGR of 3.4% from 2020 to 2024. For the next ten years (2025 to 2035), projections are that expenditure on vanilla bean will rise at 4.5% CAGR.

The rising popularity of plant-based diets is significantly impacting the vanilla market, as consumers increasingly seek dairy alternatives, vegan desserts, and other plant-based options. Vanilla plays a crucial role in enhancing the flavor of these products, making them more appealing to those transitioning to plant-based lifestyles.

As brands innovate and expand their offerings to include delicious, plant-based items, the demand for high-quality vanilla increases, driving growth in this segment and catering to health-conscious consumers.

The globalization of cuisine has introduced consumers to a variety of culinary traditions that prominently feature vanilla, enhancing its appeal across different markets. As people explore international flavors and dishes, the demand for vanilla-flavored products has surged.

This exposure not only broadens consumer palates but also encourages manufacturers to incorporate vanilla into their offerings, from desserts to beverages. Consequently, the heightened interest in diverse culinary experiences is driving increased demand for vanilla globally.

Tier 1 Companies: This tier consists of industry leaders with annual revenues exceeding USD 20 million, capturing approximately 40% to 50% of the global market share. These companies are characterized by their high production capacity, extensive product portfolios, and strong brand recognition. They often engage in vertical integration, controlling multiple stages of the supply chain, from cultivation to distribution.

Their robust consumer base and global reach enable them to significantly influence market trends and pricing. Prominent companies in Tier 1 include McCormick & Company, Kerry Group, Givaudan, and Ajinomoto. These leaders leverage advanced technologies and sustainable sourcing practices to maintain their competitive edge, ensuring consistent quality and supply of vanilla products.

Tier 2 Companies: This tier includes mid-sized players with revenues ranging from USD 5 million to USD 20 million. These companies typically have a strong regional presence and play a crucial role in local markets, influencing retail dynamics and consumer preferences. While they may not possess the extensive global reach of Tier 1 companies, they excel in niche markets and have a deep understanding of local consumer demands.

Tier 2 companies are characterized by their commitment to quality and regulatory compliance, utilizing good manufacturing practices. Notable companies in this tier include Sensient Technologies Corporation, Symrise, and Ingredion. These firms often focus on specific product varieties, such as organic or specialty vanilla, catering to the growing demand for premium offerings.

Tier 3 Companies: This tier encompasses a large number of small-scale enterprises with revenues below USD 5 million. These companies primarily operate at a local level, serving niche markets and fulfilling specific consumer demands. Tier 3 players are often characterized by limited production capabilities and geographical reach, making them more vulnerable to market fluctuations.

Despite their smaller scale, these companies contribute to the diversity of the vanilla market by offering unique products and local flavors. The Tier 3 segment is often viewed as unorganized, lacking the formal structure and resources of larger competitors.

| Countries | Market Value (2035) |

|---|---|

| United States | USD 318.7 million |

| Germany | USD 212.5 million |

| China | USD 170.0 million |

| India | USD 106.2 million |

| Japan | USD 42.5 million |

Culinary exploration among American consumers is driving a growing interest in global flavors, with vanilla emerging as a key ingredient in various international dishes and desserts. As people seek to expand their palates, they are increasingly incorporating vanilla into a diverse array of products, from traditional baked goods to innovative beverages.

This trend is evident in the popularity of vanilla-infused items, such as chai lattes, tropical smoothies, and gourmet pastries. The desire for authentic culinary experiences encourages manufacturers to experiment with vanilla in unique ways, further enhancing its appeal and solidifying its place in contemporary American cuisine.

The plant-based food movement is rapidly gaining momentum in Germany, significantly driving the demand for vanilla in various applications. As consumers increasingly adopt vegan diets and seek dairy alternatives, the need for natural flavoring agents has surged. Vanilla, known for its rich and versatile flavor profile, is being incorporated into a wide range of products, including plant-based milks, yogurts, and desserts.

This trend reflects a desire for authentic taste experiences without artificial additives. Manufacturers are responding by enhancing their plant-based offerings with real vanilla, catering to health-conscious consumers who prioritize quality and natural ingredients in their food choices.

In China, a growing interest in baking and culinary arts, especially among younger generations, is significantly driving the demand for vanilla beans. Influenced by social media platforms and popular cooking shows, many consumers are embracing baking as a creative and enjoyable hobby.

This trend has led to an increased focus on high-quality ingredients, with vanilla being a staple in numerous baked goods, such as cakes, cookies, and pastries. As home bakers and artisanal bakeries seek to elevate their creations, the demand for authentic vanilla beans has surged, reflecting a broader shift towards gourmet and homemade culinary experiences.

| Segment | Value Share (2025) |

|---|---|

| Madagascar (Product Variety) | 21% |

The growing demand for natural ingredients is significantly boosting the popularity of Madagascar vanilla in the global market. As consumers become more health-conscious and environmentally aware, they are actively seeking natural and organic products, steering clear of artificial flavors and additives. Madagascar vanilla, known for its authentic flavor and natural origins, aligns perfectly with this clean-label trend.

Manufacturers are responding by prioritizing real vanilla in their formulations, recognizing that consumers value transparency and quality. This shift towards natural ingredients not only enhances product appeal but also drives the demand for Madagascar vanilla beans, solidifying their position as a preferred choice in the industry.

Key players are investing in sustainable sourcing practices and forming partnerships with local farmers to ensure ethical production. Additionally, manufacturers are enhancing their product offerings by developing organic and specialty vanilla varieties to cater to health-conscious consumers. Embracing technology for improved cultivation and processing methods, along with effective marketing strategies, further helps companies maintain a competitive edge in this dynamic market.

For instance

The global Vanilla Bean industry is estimated at a value of USD 1,373.3 million in 2025.

Sales of Vanilla Bean increased at 3.4% CAGR between 2020 and 2024.

Symrise AG, Eurovanille, Takasago International Corp., Synergy Flavors Inc., Archer Daniels Midland Co. are some of the leading players in this industry.

The South Asia domain is projected to hold a revenue share of 24% over the forecast period.

North America holds 37% share of the global demand space for Vanilla Bean.

This segment is further categorized into Organic and Conventional.

This segment is further categorized into Whole and Extract.

This segment is further categorized into Indonesian, Madagascar, Mexican, Ugandan, Tahitian and Others.

This segment is further categorized into Direct, Online Retailer, Specialty Store, Supermaret/Hypermarket and Wholesaler.

Industry analysis has been carried out in key countries of North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus and the Middle East & Africa.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.