The Valve Remote Control Systems Market is estimated to be USD 8.88 billion in 2025. The industry is expected to grow at a CAGR of 6.7% and grow by USD 19.15 billion by 2035. In 2024, the valve remote control systems (VRCS) industry experienced consistent growth due to rising investments in maritime, oil & gas, and industrial automation industries.

The smart and automated valve control system demand skyrocketed as companies focused on operation efficiency, safety, and remote monitoring. Shipbuilding, especially in Asia-Pacific (China, South Korea, and Japan), was a major contributor, with growing orders for commercial ships and naval vessels with advanced VRCS solutions.

Offshore exploration operations in the oil & gas industry grew, boosting demand for electro-hydraulic and pneumatic control systems for valves to improve operational dependability. The chemical and water treatment industry boosted utilization because of increasing environmental restrictions and a requirement for automated flow management systems. Supply chain disturbances and increases in raw material prices affected manufacturing timeliness, and project deployments were delayed.

The industry will continue to grow extensively, with an emphasis on digitalization, Industrial IoT (IIoT), and AI-based predictive maintenance. The major growth drivers are green hydrogen projects, LNG infrastructure development, and smart manufacturing programs.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 8.88 billion |

| Industry Value (2035F) | USD 19.15 billion |

| CAGR | 6.7% |

Explore FMI!

Book a free demo

The industry for valve remote control systems is expanding at 6.7% per annum. It is driven by the increasing need for automation, safety, and efficiency in shipbuilding, oil & gas, and industrial processes. The major players will be adopting digitalization, AI-based maintenance, and IIoT-based solutions. While, others will be those who are slow to adopt or who are facing supply chain disruptions.

Accelerate Digital & Smart Valve Integration

Executives should invest in AI-driven predictive maintenance, IIoT-enabled monitoring, and cloud-based control systems. Enhancing automation will improve efficiency, reduce downtime, and align with industry 4.0 trends.

Align with Sustainability & Regulatory Trends

Focus on eco-friendly materials, energy-efficient valve systems, and compliance with evolving environmental regulations. Green hydrogen, LNG infrastructure, and carbon capture projects present key growth opportunities.

Strengthen Supply Chain & Strategic Partnerships

Develop resilient supplier networks, regional manufacturing hubs, and collaborations with OEMs and maritime/industrial automation leaders. M&A in sensor tech and AI-driven

FMI Survey Results: Valve Remote Control Systems Industry - Stakeholder Insights

(Surveyed Q4 2024, n=500 stakeholders across manufacturers, shipbuilders, oil & gas firms, and industrial automation companies in North America, Europe, and Asia-Pacific.)

Key Priorities of Stakeholders

Reliability & Safety Compliance: 79% identified fail-safe operations as a top priority, particularly in maritime and offshore applications.

Automation & Digital Control: 72% emphasized automated and remote-controlled valve systems to improve efficiency and reduce manual intervention.

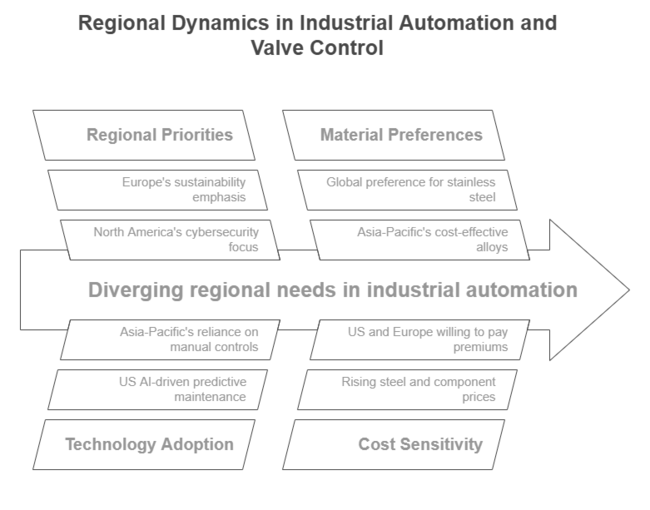

Regional Variance:

North America: 65% focused on cybersecurity for IIoT-enabled systems, compared to 39% in Asia-Pacific.

Europe: 81% highlighted sustainability and compliance with emissions regulations, vs. 58% in the USA.

Asia-Pacific: 67% prioritized cost-effective pneumatic systems over high-end electric variants.

Adoption of Smart Technologies

High Variance:

USA: 55% of oil & gas firms already integrated AI-driven predictive maintenance into valve control systems.

Europe: 60% of shipbuilders focused on electro-hydraulic systems for fuel efficiency.

Asia-Pacific: 42% remained reliant on manual/hydraulic valve controls due to lower capital expenditure budgets.

Convergent ROI Perspective:

74% of stakeholders in automation-heavy industries deemed IIoT-enabled VRCS “worth the investment.”

In contrast, only 34% of smaller industrial firms in Asia-Pacific saw a clear ROI for advanced digital systems.

Material & Design Preferences

Steel Dominates: 66% globally preferred stainless steel valves for durability and corrosion resistance.

Regional Variance:

Europe: 55% preferred hybrid composite valves due to weight reduction and sustainability.

Asia-Pacific: 48% opted for cast iron or cost-effective alloy-based valves to balance durability and cost.

Price Sensitivity & Cost Pressures

Universal Cost Concerns: 85% cited rising steel and electronic component prices as a major challenge.

Regional Differences:

USA & Europe: 64% would pay a 20% premium for fully automated systems.

Asia-Pacific: 72% sought lower-cost mechanical valve solutions (<$8,000 per unit).

South Korea & Japan: 47% supported leasing models to reduce upfront investment risks.

Pain Points in the Value Chain

Manufacturers:

USA: 59% struggled with skilled labour shortages in assembly and testing.

Europe: 50% cited strict regulatory certification processes (CE, DNV-GL, ABS) as bottlenecks.

Asia-Pacific: 57% faced delayed technology adoption due to cost concerns.

Distributors & Integrators:

USA: 67% reported supply chain delays for electronic control units (ECUs).

Europe: 55% saw competition from low-cost Eastern European suppliers.

Asia-Pacific: 62% highlighted installation challenges in ageing industrial facilities.

Future Investment Priorities

Alignment: 76% of manufacturers plan R&D investment in automation and predictive analytics.

Regional Differences:

USA: 63% plan to develop modular, plug-and-play VRCS for various industrial applications.

Europe: 58% aim to shift towards carbon-neutral production and smart monitoring systems.

Asia-Pacific: 52% will focus on affordable, scalable valve solutions for expanding mid-size industries.

Regulatory & Compliance Impact

USA: 69% cited EPA and OSHA safety regulations as key drivers for automation adoption.

Europe: 82% saw EU Green Deal policies as accelerating demand for eco-friendly and energy-efficient systems.

Asia-Pacific: 35% indicated lower regulatory pressure, leading to slower technology adoption rates.

Conclusion: An Industry of Diverging Needs

Consensus: Reliability, safety, and cost-efficiency remain universal concerns.

North America & Europe: Prioritizing automation, sustainability, and compliance-driven innovation.

Asia-Pacific: Focused on cost-sensitive, scalable, and gradual automation adoption.

Strategic Insight: A one-size-fits-all approach won't work. Regional customization-high-tech solutions for developed industries, and cost-effective automation for emerging industries-is key to industry penetration.

| Country/Region | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States | EPA & OSHA Regulations: Stricter safety and environmental standards drive demand for automated, fail-safe VRCS in oil & gas and industrial sectors. Mandatory Certifications: API 6D (Pipeline Valves), ANSI/ISA-75 (Control Valves), UL 1203 (Explosion-proof Systems). |

| European Union | EU Green Deal & Industrial Emissions Directive: Encourages energy-efficient, low-emission valve control systems. Mandatory Certifications: CE Marking, PED (Pressure Equipment Directive), DNV-GL (Maritime Compliance), ATEX (Explosive Atmosphere Safety). |

| China | Made in China 2025 & Environmental Policies: Push for domestic manufacturing and eco-friendly automation, increasing demand for local VRCS production. Mandatory Certifications: GB/T (Chinese National Standards), CCC (China Compulsory Certification) for electrical control units. |

| Japan | METI Industrial Safety Standards: Drives high-reliability and earthquake-resistant VRCS in industrial and maritime applications. Mandatory Certifications: JIS (Japanese Industrial Standards), KHK (High-Pressure Gas Safety Law Compliance). |

| South Korea | KOSHA & Industrial Automation Policies: Government incentives for smart manufacturing drive IoT-based VRCS adoption. Mandatory Certifications: KS (Korean Standards), KOSHA (Occupational Safety Certification). |

| India | BIS & Oil & Gas Safety Regulations: Growing focus on industrial automation and offshore safety is driving VRCS demand. Mandatory Certifications: BIS (Bureau of Indian Standards), PESO (Petroleum & Explosives Safety Organization). |

| Middle East (UAE, Saudi Arabia) | Aramco & ADNOC Safety Standards: Strict oil & gas safety regulations mandate explosion-proof VRCS. Mandatory Certifications: API 6A/6D (Oil & Gas Valves), IECEx (Hazardous Area Equipment). |

The valve remote control systems (VRCS) industry in the United States is driven by Oil & gas, maritime, and industrial automation industrial sectors are propelling demand for smart valve technology, as smart valve investments are trending to shift toward remote monitoring and predictive maintenance.

As a result, stricter OSHA and EPA regulations are leading the industries to deploy fail-safe, explosion-proof VRCS in hazardous environments. The IIoT (Industrial Internet of Things) and AI-driven automation (AI-driven manufacturing) are pushing the industry towards this transformation relying on an electronic and electro-hydraulic control system.

FMI projects that the United States Valve Remote Control Systems sales will grow at nearly 7.2% CAGR through 2025 to 2035.

Between 2025 and 2035, solid growth is expected in the UK VRCS industry, driven by similar factors in the global industry. The North Sea continues as a leading driver of demand, with the offshore oil & gas industry in particular embracing electro-hydraulic and pneumatic valve control systems to streamline efficiency. Growth in the maritime industry, particularly in commercial and naval shipbuilding, also drives the need for remotely controlled valve networks.

The UK has strict carbon reduction policies, and utilities and manufacturers alike are being forced to comply with the ATEX - the EU Pressure Equipment Directive (PED) standards which is also promoting the development of energy-efficient and low-emission VRCS. The demand for revolutionizing the adoption of AI-based monitoring solutions in industrial plants is rising, although industry players face demands such as high implementation costs and trade uncertainties that arose out of Brexit.

FMI projects that the United Kingdom Valve Remote Control Systems sales will grow at nearly 6.5% CAGR through 2025 to 2035.

The industry is driven by industrial automation, nuclear power, and shipbuilding sectors. Modernization is underway for the country’s nuclear energy industry, a large user of high-pressure valve control systems, with smart, automated VRCS that can be integrated with safety and efficiency.

Additionally, Close EU environmental policies are driving a transition to energy-efficient, AI-powered VRCS. More slowly, the adoption of digital automation also in traditional industries and dependence on imported electronic components could slow the expansion of the industry.

FMI projects that the France Valve Remote Control Systems sales will grow at nearly 6.6% CAGR through 2025 to 2035.

Germany's industry for VRCS possesses consistently high rates of adoption, regarding modernization with industrial automation and IIoT arrangements. Demand for smart valve control systems is driven by the manufacturing, energy, and offshore wind sectors. Germany’s pioneering Industry 4.0 is propelling investments in AI-enabled, cloud-connected VRCS for predictive maintenance.

Shipbuilding in Hamburg and Bremen is moving toward zero emissions and sustainable operation with digital valve control on board. The EU’s initiative for Green Deal and carbon-neutral operations is knocking down doors for low-emission VRCS adoption in factories and power plants. Germany is known for its strong engineering prowess, which guarantees quality production.

FMI projects that Germany Valve Remote Control Systems sales will grow at nearly 6.9% CAGR through 2025 to 2035.

Italy's VRCS industry is driven by the expansion of oil & gas, shipbuilding and water treatment sectors. The Mediterranean's offshore oil & gas industry sector is a primary user of pneumatic & electro-hydraulic VRCS. Smart valve automation for fuelling efficiency in Italy’s shipbuilding industry including Fincantieri.

Further, in order to comply with EU water safety regulations, more of the country’s water and wastewater treatment facilities are investing in remote-controlled valve systems.

FMI projects Italy Valve Remote Control Systems sales will grow at nearly 6.4% CAGR through 2025 to 2035.

The growth of shipbuilding, petrochemicals, and smart factory automation in South Korea is expected to boost the country. South Korea, a global leader in the field of shipbuilding, is also rapidly adopting IIoT-based valve remote control systems in commercial, as well as naval, vessels (Hyundai Heavy Industries, Samsung Heavy Industries, Daewoo Shipbuilding).

The government is increasingly pushing for smart manufacturing (Industry 4.0), which accelerates the adoption of AI-enhanced VRCS for predictive maintenance in industrial plants. LNG terminals and other offshore energy projects in South Korea are installing high-performance electro-hydraulic VRCS.

FMI projects that the South Korea Valve Remote Control Systems sales will grow at nearly 6.3% CAGR through 2025 to 2035.

Japan’s VRCS industry is projected to grow moderately, due to the slower pace of digitalisation in traditional industries. Precision-controlled valve systems for safety applications have continued to be a large segment of the nuclear energy sector.

Japan’s shipbuilding giants Mitsubishi Heavy Industries and Kawasaki Shipbuilding have been widely adopting automated VRCS powered by emerging technologies to improve operational efficiency. High installation costs and cautious adoption of AI-based automation industry penetration, however.

Japan’s push for smart manufacturing with government initiatives is expected to increase demand for IIoT integrated VRCS, however, the industry is price-sensitive with a preference for hybrid pneumatic electro-hydraulic systems rather than going for full automation.

FMI projects that the Japan Valve Remote Control Systems sales will grow at nearly 6.1% CAGR through 2025 to 2035.

VRCS industry in China will become one of the ten mainstream regions in developing countries. Strong demand for economical, scalable VRCS solutions is being fueled by the country’s industrial automation, shipbuilding and energy sectors. China’s domestic production of high-tech valve control systems is being spearheaded by the Made in China 2025 initiative to minimize dependence on imports.

The maritime sector is deploying the latest electro-hydraulic VRCS in cargo vessels and naval ships, especially in Shanghai and Guangzhou.

FMI projects that the China Valve Remote Control Systems sales will grow at nearly 7.5% CAGR through 2025 to 2035.

The VRCS industry in Australia & New Zealand is anticipated to witness high growth due to support from mining, oil & gas, and water treatment industries. Australia’s LNG sector (led by Western Australia) is one of the most advanced users of remote-controlled valve networks for offshore platforms and refineries) The demand for smart valve automation in wastewater management is driven by water conservation policies in New Zealand. On the other hand, import dependency and low local manufacturing capacity represent challenges.

The Australian government’s focus on Industry 4.0 and AI-driven automation is set to create demand for VRCS in manufacturing and utilities. Growing renewable energy projects will further add to the demand for sustainable valve control technologies.

FMI projects that the Australia-NZ Valve Remote Control Systems sales will grow at nearly 6.8% CAGR through 2025 to 2035.

Pneumatic valve remote control systems will continue to be a top choice for industries where safety, reliability, and cost-effectiveness are the priorities. Their explosion-proof design makes them suitable for hazardous locations such as offshore drilling and industrial manufacturing. Competition from electric and electro-hydraulic systems could, however, slow their expansion in automation-intensive industries. It is likely to propel at 6.4% CAGR from 2025 to 2035.

Hydraulic systems will remain the leaders in marine and heavy industrial applications, providing high-force capability and longevity. They will be critical in the shipbuilding and offshore sector.

Electric systems will see speedy uptake as a result of energy efficiency, automation, and predictive maintenance. Sectors adopting smart manufacturing, water treatment, and power generation will prefer electric VRCS as they can be integrated with AI-based monitoring platforms.

Electro-hydraulic systems will grow as companies look for a balance between power, accuracy, and automation. They will be much preferred in marine, offshore, and sophisticated industrial applications, where the union of hydraulic power and electrical control guarantees efficiency, safety, and remote monitoring.

Offshore businesses will lead to substantial demand for tough, corrosion-resistant VRCS to provide safety on oil platforms, offshore wind turbines, and deepwater drilling operations. Smart monitoring and predictive maintenance will become integral features, enhancing operational efficiency. It is projected to rise at 6.2% CAGR through 2035.

Marine usage will experience increased automated, fuel-saving valve control systems due to strict emissions control regulations and efforts at modernization. Shipbuilders will more often use electro-hydraulic and electric VRCS to enhance efficiency, conformity, and remote monitoring.

Other sectors, such as water treatment, chemical processing, and power generation, will implement AI-powered, energy-saving VRCS. Water treatment facilities will invest in electrical and pneumatic VRCS for compliance purposes, whereas chemical and pharmaceutical manufacturing will prefer electro-hydraulic solutions for accurate control in corrosive situations. Renewable energy and nuclear facilities will make greater use of intelligent VRCS to ensure maximum safety and operational efficiency.

The industry for valve remote control systems is moderately concentrated, with major players commanding large industry shares. Major players compete on the basis of competitive pricing, ongoing innovation, strategic alliances, and geographic expansion to consolidate their industry positions.

In August 2024, Warren Controls Inc. was acquired by ARI-Armaturen to extend its USA presence and expand its range of products in the control valve industry.

May River Capital purchased Cashco, a supplier of pressure management solutions, in November 2024 to expand its portfolio for the industrial valve business. Besides, Siemens went ahead and purchased Altair Engineering Inc. in October 2024, something that would give it an uplift in its skills in industrial simulation and analysis software.

These are developments that capture the industry's emphasis on expansion through strategic acquisition and technological innovation.

Emerson Electric Co. leads the industry with approximately 22-25% market share in 2025, leveraging its strong portfolio of advanced valve control technologies and extensive industrial automation solutions.

Flowserve Corporation holds around 18-20% of the market, benefiting from its comprehensive range of valve actuation and control systems across multiple industries including oil & gas, power generation, and chemical processing.

Rotork plc maintains a significant industry position with roughly 15-17% market share, known for its innovative intelligent valve control solutions and global manufacturing presence.

ABB Ltd. commands approximately 12-14% of the market, with strong offerings in electric and pneumatic valve actuators for various industrial applications.

Honeywell International Inc. rounds out the top five players with about 10-12% market share, contributing advanced digital valve control technologies, particularly in process industries.

The remaining industry is fragmented among smaller regional manufacturers and niche specialized providers, collectively accounting for approximately 15-20% of the global valve remote control systems industry.

Automation, safety regulations, and offshore investments are key drivers.

Oil & gas, marine, water treatment, chemicals, and power generation.

IoT, AI diagnostics, and energy-efficient designs are enhancing efficiency.

High costs, integration issues, and regulatory compliance.

North America and Europe lead, while Asia-Pacific is expanding rapidly.

pneumatic, hydraulic, electric, electro-hydraulic

Offshore, Marine and Others

North America, Latin America, Europe, East Asia, South Asia, Oceania, Middle East and Africa

Power Generator for Military Market Growth – Trends & Forecast 2025 to 2035

Immersion Heater Market Growth - Trends & Forecast 2025 to 2035

Tire Curing Press Market Growth - Trends & Forecast 2025 to 2035

Turbidimeter Market Growth - Trends & Forecast 2025 to 2035

Marine Cranes Market Growth - Trends & Forecast 2025 to 2035

Industrial Exhaust System Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.