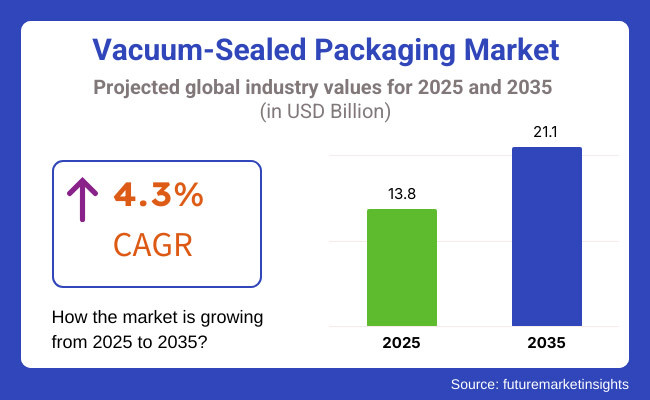

The vacuum-sealed packaging market is expected to be USD 13.8 billion in 2025. Sales of vacuum-sealed packaging are expected to exhibit a CAGR of 4.3% and reach USD 21.1 billion by 2035. Vacuum-sealed packaging demand is increasing as consumers are increasingly demanding longer product shelf life, improved freshness, and preservation.

The increasing exposure towards sustainability and minimizing the food waste is adding to the industry expansion. Furthermore, with the introduction of many new applications into electronics, pharmaceuticals, and industrial components has also accelerated the industrial growth.

The continuous refinements in packaging technology and materials produce affordable and sustainable solutions. Environmental concerns related to plastic materials, pose challenges in the growth landscape and hence compelling the sector to adopt sustainable alternatives.

Consumer confusions and misconceptions related to the demand and intricacy of vacuum-sealed packaging may act as a hurdle in its global adoption. Additionally, the rising competition from other packaging technologies that require significant developments may slow down the pace of an industry in establishing its brand image.

Nonetheless, the rising awareness related to food safety and meeting the safety standards will continue to drive the industry expansion.

Explore FMI!

Book a free demo

Between 2020 and 2024, the industry for vacuum-sealed packaging saw a huge transformation. With the growing desire among consumers for sustainable packaging options, businesses found themselves focusing more on sustainability.

The growth of e-commerce across this period generated an increased demand for effective packaging materials, including vacuum-sealed packaging, for maintaining product integrity while in transit. Moreover, the advancements in technology facilitated the creation of simplistic and economical packaging designs, matching the demand of consumers for simple and environmentally conscious packaging.

Pleasingly, future-looking to 2025 until 2035, the industry is set for further development. Artificial intelligence and machine learning are set to change packaging operations to make them more efficient and custom-fit. The use of circular economy principles, with a focus on reusable and returnable package solutions to avoid waste, will be embraced by companies.

In addition, the increasing focus on sustainability is expected to propel the use of plant-based plastics and other environmentally friendly materials in vacuum-sealed packaging. With growing environmental awareness among consumers, businesses will have to innovate continuously in order to keep up with these changing requirements, while packaging solutions need to be functional and sustainable.

| Key Drivers | Key Restraints |

|---|---|

| Rising Need for Increased Shelf Life: Customers' interest in fresh and durable products compels the use of vacuum-packaging, which serves to lock up food perfectly by eliminating air and preventing the growth of microorganisms. | Environmental Issues: The application of some of the plastic materials in vacuum packaging poses environmental sustainability concerns, hence resulting in high pressure for environmentally friendly substitutes. |

| Expansion in Logistics and E-commerce: The increasing popularity of online shopping creates the demand for strong packaging to preserve products during transportation, thus vacuum-sealing packaging emerges as the packaging of choice to maintain product quality. | High Initial Setup Costs: Vacuum-sealed packaging technology necessitates the use of specific equipment and materials, which creates high initial costs that might discourage small and medium-sized businesses. |

| Technological developments: New advancements in packaging technology have enabled faster and less expensive vacuum-sealing packaging alternatives that improve the look and shelf life of the product. | Consumer Misconceptions: Other consumers view vacuum-sealed packaging as excessive or unnecessary, perhaps slowing its broader acceptance. |

| Stricter Food Safety Laws: Adherence to food safety regulations inspires producers to use vacuum-sealed packaging to avoid contamination and spoilage and ensure the safety of their products. | Competition from Other Packaging Solutions: Presence of other packaging technologies that provide comparable advantages creates challenges, necessitating ongoing innovation to remain relevant in the industry. |

| Key Drivers | Impact Level |

|---|---|

| Increasing Demand for Extended Shelf Life | High |

| Growth in E-commerce and Logistics | High |

| Technological Advancements | Medium |

| Stringent Food Safety Regulations | High |

| Key Restraints | Impact Level |

|---|---|

| Environmental Concerns | High |

| High Initial Setup Costs | Medium |

| Consumer Misconceptions | Low |

| Competition from Alternative Packaging Solutions | Medium |

Polyethylene is the prominent aspect of vacuum-sealed packaging, holding almost 45% of the value share. It is a widely used material in the packaging purposes, appreciated for its properties like flexibility, toughness, and affordability. As sustainability is becoming a major concern of the society, producers are prioritizing recyclable and bio-based polyethylene alternatives to reduce the environmental impact.

Polypropylene continues to remain the dominant material in vacuum-packaging food and non-food products, mainly because of its strength and heat resistance properties. Polyamide with its efficient puncture resistance has improved the packaging of sharp and irregular products.

Ethylene Vinyl Alcohol comes with greater oxygen and gas barriers properties which makes him a crucial material for food preservation. Polyethylene terephthalate is also spreading its popularity as it is transparent and biodegradable. Other materials including as multi-layer films and biodegradable materials are still being improved and adopted as sustainability regulations transform packaging trends.

Pouches and bags continue to be the most popular product type in the vacuum-sealed packaging industry because of their convenience, light weight, and affordability. Companies more and more emphasize flexible packaging solutions that maximize storage space and minimize material loss.

The increasing demand for resealable and portion-controlled packaging solutions also increases the use of vacuum-sealed pouches. Food items, such as meat, dairy, and ready-to-eat foods, take advantage of the better protection these pouches provide against spoilage and contamination.

Films are becoming increasingly prominent as they are used in automated packaging lines, where efficient and high-speed sealing processes are critical. The trend towards sustainable packaging influences innovations in recyclable and biodegradable vacuum-sealed films.

Companies prefer high-barrier films that extend the product's life while minimizing preservative use. Non-food sectors such as pharmaceuticals and electronics increasingly use vacuum-sealed films for products sensitive to moisture.

With development in the vacuum-sealed packaging industry, the trend for multi-layer and flexible films is anticipated to increase. The demand for sustainable materials spurs the investigation of bio-based and compostable films. Progressive packaging technologies, including smart films with freshness markers, are likely to redefine industry trends during the forecasting period.

Food is the dominant end-use segment, accounting for almost 50% of the vacuum-sealed packaging industry. The demand for fresh and minimally processed foods fuels the use of vacuum-sealed packaging. Consumers want longer shelf life, better preservation of taste, and less food waste, and vacuum-sealing is the preferred option.

The growth in frozen and ready-to-eat meals also fuels industry growth, as these foods need effective packaging to preserve quality. Meat, seafood, dairy, and baked goods all stand to gain enormously from vacuum-packaging solutions that exclude contamination and oxidation.

Non-food uses continue to grow as sectors embrace the preservation advantages of vacuum-sealed packaging. Pharmaceuticals necessitate vacuum-sealed packaging for product stability and sterility. Electronics companies employ vacuum-sealed options to preserve sensitive parts from moisture and dust.

Industrial and automotive industries utilize vacuum-sealed packaging for expensive parts and machinery to avoid corrosion and physical destruction. The need for sustainable and tamper-resistant packaging solutions raises vacuum-sealed packaging use across non-food applications.

As companies value efficiency and sustainability, innovations in vacuum-sealed packaging will accentuate eco-friendly packaging materials, intelligent tracking technologies, and enhanced barrier characteristics. Increasing concern for food safety regulation and quality levels will keep pushing the growth of this industry segment.

The United States is still among the biggest sectors for vacuum-sealed packaging, spurred by robust demand in the food and non-food industries. Growing demand for fresh and minimally processed food drives the use of vacuum-sealed packaging in meat, dairy, and ready-to-eat meals. The rise of e-commerce also fuels industry growth, as companies look for dependable packaging solutions for product safety and longer shelf life.

Environmental sustainability issues compel manufacturers to create biodegradable and recyclable vacuum-sealed packaging solutions. Stringent packaging regulations by regulatory agencies promote innovation in biodegradable and high-barrier packaging materials.

Increasing automation in the packaging sector increases efficiency and cost savings, and thus vacuum-sealed solutions become increasingly attractive to companies. Ongoing technological developments in the USA industry are expected to experience steady growth during the forecast period.

The United Kingdom's vacuum-sealed packaging industry is constantly growing, driven by growing consumer interest in reducing food waste and environmentally friendly packaging solutions. The food sector is still the main driving force, with growing demand for vacuum-sealed packaging in fresh produce, dairy, and frozen foods. Retailers focus on longer shelf life and enhanced product safety, leading to increased vacuum-sealed packaging adoption.

The government pressure for sustainability forces a transition toward recyclable and biodegradable packaging. Specialized packaging techniques, including high-barrier films and modified atmosphere packaging, emerge as companies embrace efficiency.

Vacuum-sealed packaging is further assisted by the growing online grocery delivery, providing for safe and stable food storage. The non-food sector, comprised of pharmaceutical and electronics, plays its part as well, increasing industry demand by demonstrating the broad applicability of vacuum-sealed solutions.

China's vacuum-sealed packaging industry is anticipated to expand at a CAGR of 4.9%, spurred by the growth of the food processing sector in the country and urbanization. The expanding middle-class base demands convenient and durable packaged food, which stimulates the demand for vacuum-sealed packaging. Government initiatives towards ensuring food safety and stringent regulatory guidelines also fuel industry growth.

The development of e-commerce and online food delivery sites creates a higher demand for safe packaging materials to maintain product integrity. Concerns with sustainability encourage manufacturers to create biodegradable and recyclable vacuum-sealed packaging, which is in line with China's green packaging program.

The non-food industry, which includes pharmaceuticals and industrial products, also witnesses greater use of vacuum-sealed packaging to advance product protection. With ongoing innovations and changing consumer needs, China is still a major player in the international vacuum-sealed packaging industry.

India's vacuum-sealed packaging industry is expected to develop at a CAGR of 5.7%, ranking among the fastest-growing sectors. The food processing sector is growing at a fast pace, increasing disposable incomes, and shifting lifestyles drive demand for vacuum-sealed packaging.

Urbanization and the trend towards packaged and processed foods drive industry growth. Government programs focusing on food safety and packaging standards boost business towards vacuum-sealed solutions.

The growth in food ordering and food delivery platforms requires more efficient packaging that will maintain freshness and provide longer shelf life. Environment concerns propel companies to seek eco-friendly options, such as bio-based vacuum-sealed packaging. The non-food industry, such as pharmaceuticals and consumer electronics, also adds to the growth in the sector. As technology improves and consumer consciousness heightens, India's vacuum-sealed packaging sector will follow an upward trend.

Japan's vacuum-sealed packaging industry is expected to record a CAGR of 3.5% through its highly developed food sector and tremendous innovation focus. Japan's high demand for fresh and lightly processed food catalyzes the growth of vacuum-sealed packaging among meat, seafood, and convenience meals. Latest packaging technologies like high-barrier films and smart packaging solutions boost the sector attractiveness.

Rigid food safety policies and consumer expectation for high-quality products compel companies to embrace vacuum-sealed packaging for maximum protection. Sustainability is a prime consideration, and as a result, manufacturers are now coming up with recyclable and biodegradable packaging materials.

Non-food items, such as electronics and drugs, also stand to gain from vacuum-sealed solutions, keeping products stable and long-lasting. As technology progresses on a steady basis, the sector for vacuum-sealed packaging in Japan will continue to grow steadily.

Australia's vacuum-sealed packaging industry is anticipated to register a CAGR of 3.9% due to rising consumer interest in sustainable and high-quality packaging materials. The food sector is the largest domain, with vacuum-sealed packaging being extensively applied in fresh fruits and vegetables, dairy products, and meat. The nation's high emphasis on minimizing food waste and encouraging eco-friendly packaging materials fuels domain growth.

The rise in popularity of grocery shopping online and food delivery enhances the demand for effective and long-lasting vacuum-sealed packaging. Government policies push the use of environmentally friendly packaging materials, making manufacturers invest in biodegradable and recyclable packaging.

Non-food applications such as pharmaceuticals and industrial packaging also add to industry growth. With an increased focus on eco-friendliness, the Australian industry is likely to grow steadily during the forecast period.

Germany continues to be a leader in the vacuum-sealed packaging industry, with high demand from various industries. The advanced food processing industry in Germany fuels the usage of vacuum-sealed packaging for maintaining prolonged shelf life and quality.

The emphasis on sustainability promotes the generation of recyclable and compostable vacuum-sealed products. Tight packaging standards and customer demand for eco-friendly solutions drive companies to invest in high-barrier and light-weight packaging technologies.

Growth is further fueled by the growth of e-commerce, with companies focusing on protective packaging solutions for secure transportation of products. The non-food industry, such as automotive, pharmaceuticals, and electronics, increasingly uses vacuum-sealed packaging for better protection of products. With a focus on technological innovation and sustainability, Germany continues to influence the international vacuum-sealed packaging industry.

South Korea's vacuum-sealed packaging industry continues to grow with the support of a robust food industry and rising consumer demand for quality packaging solutions. The nation's inclination toward fresh and ready-to-consume meals drives the growth of vacuum-sealed packaging in food retail and food delivery services. Growth in online shopping and food delivery platforms enhances the demand for secure and efficient packaging.

Sustainability issues propel developments in biodegradable and recyclable vacuum-sealed packaging materials. The government's emphasis on food safety and packaging regulations also pushes companies to implement sophisticated vacuum-sealing technologies.

The non-food industry, such as cosmetics, pharmaceuticals, and industrial uses, also experiences increasing demand for vacuum-sealed products. As South Korea continues to adopt smart and sustainable packaging technologies, the vacuum-sealed packaging industry is likely to experience steady growth.

The industry for vacuum-sealed packaging is fairly concentrated with a combination of powerful global players and a large number of regional producers. Dominant players have a strong hold on the sector with their sophisticated technology, well-established distribution channels, and strong R&D facilities. The sector is also fragmented in some regions, where small producers meet local demand with low-cost solutions.

Consolidation in the industry is fueled by high upfront costs of investment in specialized technology and equipment. The big companies achieve economies of scale, which help them provide low prices and new solutions. Regulatory requirements for high food safety standards and eco-friendly packaging also pressure smaller companies to merge with the big players or get out of business.

Fragmentation remains in countries with relatively lower entry barriers where small players are able to maintain profitability efficiently through concentration in specialized applications or geographies.

Funds available to financing packaging start-ups, especially in emerging countries, enable the existence of new competitors. However, accelerating rates in automation technology and eco-friendliness offer technical barriers benefiting well-established corporations.

With demand for environmentally friendly and high-performance packaging increasing, concentration in the sector will probably rise, as large companies acquire innovative firms to develop their strengths.

From 2025 to 2035, incumbent players emphasize technological innovation, sustainability, and strategic mergers and acquisitions to consolidate market leadership. They heavily invest in automation, high-barrier materials, and intelligent packaging solutions to improve efficiency and address changing regulatory requirements.

Widening distribution networks globally and partnerships with retailers and e-commerce platforms reinforce their competitiveness. Sustainability is prioritized through investments in biodegradable and recyclable materials to adapt to environmental rules and consumer preference.

Upcoming startups shake up the industry with creative, low-cost solutions designed for niche sectors. They focus on sustainable packaging, using bio-based materials and simple designs to resonate with consumers concerned about the environment.

Digitalization is important, with startups using AI-powered manufacturing methods and direct-to-consumer platforms to keep costs down and make products more accessible.

Several new entrants are able to attract venture capital funding, allowing them to expand operations and take on bigger players. The sector witnesses greater interplays among startups and large firms to expedite innovation.

Growing consumer preference for longer shelf life, food freshness, and sustainability is fueling demand across various industries.

The food industry dominates, followed by pharmaceuticals, electronics, and industrial components.

Companies are investing in recyclable materials, biodegradable films, and energy-efficient production to meet environmental regulations and consumer expectations.

High initial costs, evolving regulatory standards, and competition from alternative packaging solutions pose key challenges.

Kraft Packaging Market Trends - Growth & Forecast 2025 to 2035

Flexible Frozen Food Packaging Market Growth - Forecast 2025 to 2035

Flexible Thin Film Market Trends - Growth & Forecast 2025 to 2035

Hydrogel Market Demand & Technological Advances 2025-2035

Industrial Filling Machine Market Trends – Growth & Demand 2025 to 2035

Insulated Cup Sleeves Market Analysis – Size, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.