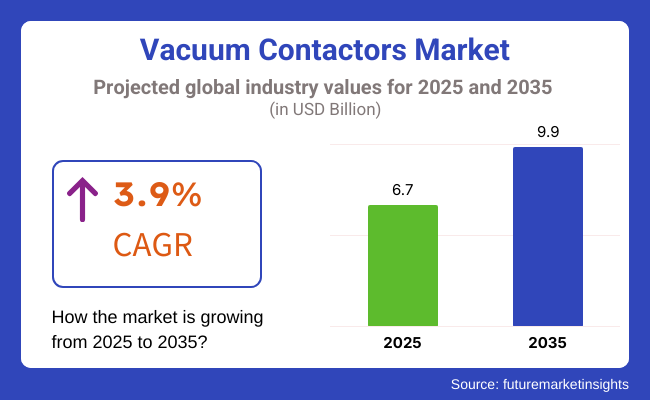

According to our estimates, the vacuum contactors market is expected to be around USD 6.7 Billion in 2025, and may even grow as high as USD 9.9 Billion in 2035. It represents a CAGR of 3.9% with the industry progressively shifting from contactors towards vacuum based alternative. This is largely due to advancements in industrial automation, the use of digital technologies that empower predictive maintenance, and increasing focus on energy efficiency and sustainability.

Vacuum contactors are becoming more common for applications requiring frequent switching, high reliability, and long life. As industries turn to smart grids and IoT-enabled systems, manufacturers are integrating vacuum contactors into automated monitoring platforms, enabling real-time diagnostics and minimizing the possibility of unplanned downtime. These deviations are increasingly validated by intelligent systems and data-driven operations and the ultimate value of vacuum contactors in modern electrical infrastructure.

As consumers and industries increasingly emphasize efficiency and sustainability, manufacturers have responded by advancing the technology and performance of vacuum contactors. Transitioning to a more energy efficient means of energy has resulted in new opportunities for vacuum contactor utilization due to renewable energy segments like wind and solar power stations. Furthermore, the growing infrastructure of electric vehicle (EV) charging stations and industrial automated solutions would create lucrative growth opportunities for the vacuum contactors market.

3.9% CAGR highlights the widespread adoption of vacuum contactors across industries. The demand for energy-efficient, durable, and sustainable electrical components will further boost the growth of the market. The next generation of power distribution and motor control systems is taking place at all levels as industries seek operational excellence and sustainability, and vacuum contactors are playing an increasingly critical role.

Explore FMI!

Book a free demo

North America accounts for a large share of the vacuum contactors market, aided by a strong industrial base as well as increasing investments in renewable energy projects. Parts of North America, especially the United States and Canada, contribute majorly to this scenario due to the existing power generation facilities, in addition to grid modernization schemes. As a result, demand for reliable and efficient vacuum contactors has been bolstered by the growing use of automation technologies in numerous industrial and commercial sectors.

Demand from renewable energy installations, particularly wind and solar farms, is also rising in the North American market. Vacuum contactors are the best solution for these applications that need fast and reliable switching solutions. The dynamism of hurricane season is expected to drive a sustained demand for vacuum contactors in the region, as manufacturers align their effort to bolster the reliability and efficiency of their electrical equipment.

In Europe, the industrial sector is the key market for vacuum contactors, as the region is focusing on sustainability and energy efficiency. With strict environmental regulations and increasing demands for grid reliability, nations like Germany, France and the United Kingdom lead the way of deploying innovative electrical solutions including vacuum contactors.

European factories are investing heavily in clean energy projects & industrial automation, both which depend on reliable electrical components. Vacuum contactors are identified as efficient switching devices with high performance and low environmental impact that are central to these endeavours. Hence, the Europe vacuum contactor market is anticipated to grow steadily during the forecast period.

Request now, Asia-Pacific Vacuum Contactors Market, due to industrial development, infrastructure creation, and rising electricity demand is also considered as top growing sector. Now, China, India, Japan, South Korea are pouring money into modernizing their electrical systems whilst adopting energy efficient technologies.

China, specifically, is at the forefront of the market, driven by significant industrial activity as well as government initiatives toward cleaner energy and smart grid technologies. Likewise, the economic initiatives of India to modernize its power distribution network to adapt to renewable energy have provided an inflated environment for the adoption of vacuum contactor. Given the increasing adoption of industrial automation and smart manufacturing in the region, the demand for the vacuum contactor is likely to grow substantially.

Challenge

Vacuum Contactors, Expensive and Complicated

They depend on the demand for electrical machines and its components in residential, commercial and industrial applications where some common issues for Vacuum Contactors Market include high initial investment costs, complex installation requirements and a need for specialized maintenance. They are commonly used in industrial applications including power distribution, motor control, and mining. Yet their use is often limited by prohibitive procurement and integration, especially in legacy-faithful sectors.

Moreover, to ensure the long-term reliability and performance of vacuum contactors, it requires frequent inspections and specialized maintenance which take up the operational costs. To improve adoption rates, manufacturers should focus on producing cost-efficient, modular systems with easy-to-install features and increased durability. Utilizing predictive maintenance technologies and providing extended service support are also methods that can minimize downtime and improve system reliability.

Opportunity

Elastration and Smart Power Distribution Growth

We expect significant developments in this market because of the growing global focus on electrification, energy efficiency, and industrial automation. Their excellent performance, arc-extinguishing capacity, and capacity to operate high-voltage applications with little upkeep have led to an increase in vacuum contactor adoption in many industries. Renewable energy projects, smart grids, and data centres are also driving the demand for efficient power switching solutions.

Demand for contactors with remote diagnostics and automated fault detection is also being driven by the integration of intelligent monitoring and real-time analytics in electrical systems to ensure optimal functioning. The industrial sector is undergoing a transformation, and companies that are willing to invest in digitalized vacuum contactor solutions, AI-driven predictive analytics, and sustainable manufacturing processes will be ready to take advantage of a bold new future.

The Vacuum Contactors Market also observed major adoption that was driven by modernization of electrical infrastructure as well as the transition towards energy efficient motor control solutions between the years 2020 to 2024. This surge was seen in industries like manufacturing, utilities, and mining, where scalable, always-on power can make or break an operation. Yet, lack of raw materials due to delays in import movements and less technical know-how among end-users were challenging factors for market growth.

To do this, companies developed form factor designs which are small and can be made durable. In addition, vacuum contactor was also benefitting from new registered usage applications of renewable energy and EV charging networks.

This observation should include the expected market-wide advances between 2025 and 2035 that will lead to rapid development of automation, predictive maintenance, and sustainable engineering. Industrial IoT (IIoT) one significant trend shaping the future of vacuum contactors is the integration of Industrial Internet of Things (IIoT) technologies in self-diagnosing vacuum contactors, equipped with AI-driven monitoring and predictive analytics will lead to increased operational efficiency and reduced system failure risks.

With the growing adoption of energy storage systems and grid stabilization solutions, the demand for high-performance contactors is expected to grow further. The focus on sustainability will result in highly recyclable and low-energy-loss vacuum contactor insulating materials to achieve global decarbonisation goals. Researching and developing intelligent switching solutions, coordinating with power grid operators, and improving product life-cycle management, will result in the next phase of market growth.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Increasing safety and efficiency standards in power switching |

| Technological Advancements | Growth in smart vacuum contactors with enhanced durability |

| Industry Adoption | Increased use in utilities, industrial automation, and transportation |

| Supply Chain and Sourcing | Dependence on specialized vacuum technology components |

| Market Competition | Dominance of established electrical equipment manufacturers |

| Market Growth Drivers | Rising electrification and modernization of power infrastructure |

| Sustainability and Energy Efficiency | Gradual shift toward eco-friendly switching solutions |

| Integration of Smart Technologies | Limited implementation of IoT-enabled contactors |

| Advancements in Industrial Applications | Traditional use in high-voltage industrial motor control |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter environmental regulations and incentives for low-energy vacuum contactors. |

| Technological Advancements | Widespread integration of AI-driven diagnostics, remote monitoring, and predictive analytics. |

| Industry Adoption | Expansion into smart grids, renewable energy storage, and high-power industrial sectors. |

| Supply Chain and Sourcing | Localization of component manufacturing and increased investment in sustainable materials. |

| Market Competition | Rise of digital-first electrical solution providers focusing on smart contactor innovations. |

| Market Growth Drivers | Increased adoption of AI-powered switching systems, energy-efficient motor controls, and grid optimization. |

| Sustainability and Energy Efficiency | Full-scale transition to low-loss, recyclable, and energy-optimized vacuum contactors. |

| Integration of Smart Technologies | AI-driven automation, cloud-based remote monitoring, and real-time fault detection. |

| Advancements in Industrial Applications | Expansion into smart city infrastructure, EV charging networks, and decentralized energy systems. |

The United States vacuum contactors market has steadily expanded, propelled by robust demand from manufacturing, utilities, and oil & gas sectors. Modernizing aging electrical grids and increasingly automated industrial applications are primary drivers for adopting vacuum contactors.

The oil and gas industry, especially in Texas and along the Gulf Coast, constitutes a sizable vacuum contactor consumer for regulating electric motors and pumps. Additionally, the push for energy-efficient infrastructure and integrating renewable energy is fuelling requirements for high-performing vacuum contactors in power distribution networks.

With proliferating expenditures in industrial intelligence and clever electrical systems, analysts anticipate that the USA vacuum contactors industry will continue growing smoothly. Long-term, as automation technologies and clean energy solutions become more advanced, the necessity for competent vacuum contactors should persist, ensuring ongoing commercial prospects.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.2% |

The United Kingdom vacuum contactors market has expanded drastically in recent years owing to a strong push towards sustainable energy practices and advanced automation systems nationwide. Strong investments in renewable resources and energy efficient infrastructure across industries have driven significant demand for vacuum contactors applications involving motor control and power switching.

The nation's unwavering commitment to reducing environmental impact through smart grid integration has precipitated widespread incorporation of vacuum contactors in next-generation renewable projects and modernized electrical substations. Meanwhile, exponential data centre expansion is fuelling requirement for vacuum contactors that guarantee emergency power backup and faultless switching systems

As the push for decreased carbon footprint and robotics-driven productivity gain momentum, analysts foresee the UK vacuum contactors sector maintaining consistent growth to support the ongoing transition towards sustainability and smarter automation at scale.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.7% |

The European Union vacuum contactors market has witnessed steady advancement, propelled by stringent energy efficiency policies, increasing industrial electrification, and a rising implementation in renewable energy applications. Nations such as Germany, France, and Italy are major adapters of vacuum contactors in power allocation and industrial automation.

The EU’s focus on the energy transition and carbon neutrality is hastening investment in clever grids, electric vehicle (EV) charging infrastructure, and automated industrialization, all of which necessitate proficient electrical switching remedies. Additionally, the expansion of wind and solar power initiatives is driving demand for vacuum contactors in renewable energy applications. The drive for more sustainable methods has also boosted the request for these contactors.

With strong governmental support for energy-efficient industrial remedies, analysts expect the EU vacuum contactors market to develop steadily. However, local market fluctuations and global economic troubles may potentially impact growth. Some areas within the industrial and commercial sectors are demonstrating increased adoption.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.8% |

The Japanese vacuum contactors market is growing steadily due to rising demand for energy-efficient industrial automation and advancements in smart grid technologies. Japan's robotics sector has seen strong growth in recent years, driving more complex needs for motor control and power management that vacuum contactors are well-suited to address.

The expansion of Japan's high-speed rail lines in addition to initiatives to modernize older cities with smart technologies has supported steady demand from electrical switching applications. As natural disasters remain an ongoing risk, focus has grown on building disaster-resilient critical infrastructure; this too has led to increased reliance on vacuum contactors for emergency backup power systems.

Continued investment in both smart grids and industrial automation points to a future of stable expansion for the Japanese vacuum contactors market. Advanced manufacturing practices are increasingly automation-intensive, relying on sophisticated motor control and power management like the capabilities vacuum contactors provide.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

The steadily growing vacuum contactors industry in South Korea has been propelled by expanding needs for energy-efficient industrial automation solutions, sizable investment in semiconductor manufacturing facilities, and nationwide execution of wise power grids. As a worldwide pioneer in high-tech sectors like electronics and automotive production, South Korea has seen widespread acceptance of vacuum contactors for diverse electric motor management and high-voltage switching uses.

Moreover, substantial federal support for renewable assets has also stimulated necessity for vacuum contactors in enormous solar farms and gigantic wind turbines. In the meantime, strengthening investment in green technology and electric vehicle infrastructure are complementing requirements for flexible energy storage systems. Additionally, the administration's strong backing of emerging industrial automation and initial smart factories are delivering significant momentum to market progress.

Experts anticipate the South Korean vacuum contactors market to preserve steady development far into the potential future as electrical safety standards and intelligent grid technologies persist in advancing at a fast pace. The considerable concentration on developing cutting-edge industries will linger in arousing widespread installation of vacuum contactors for their ability to skilfully regulate power flows while upholding operational safety.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.9% |

Motors and transformers accounted for a significant share of the vacuum contactors market, due to which industries are vigorously adopting advanced switching and power control solutions to enhanced operational efficiency, improved longevity of the electric equipment, and enhanced seamless electrical performance.

Featured: Vacuum Contactor for High-Performance Switching Whether in motor control, transformer switching, or power factor correction, high-performance vacuum contactors are critical to keeping operations reliant, efficient, and in the fast lane, making them an indispensable part of industrial automation, utilities, oil & gas, and mining.

One of the leading end-use segments for vacuum contactors is motors, as industries are looking for high-end switching solutions to optimize motor efficiency, reduce wear and tear, and increase energy efficiency. In contrast to traditional air contactors, vacuum contactors enable arc-free operation, diminished maintenance needs, and enhanced electrical insulation, increasing the reliability of high-power motor applications.

Growing demand for vacuum contactors in the industrial motor control sector, the surge in demand for efficient power switching and overload protection, and manufacturers' focus on uninterrupted operations and lower failure rates will enable rapid uptake of high-performance vacuum switching systems. Research shows that vacuum contactors can increase motor life by as much as 30 percent because of reduced inrush current and smooth transitions between power levels.

For heavy-duty industrial gear, conveyor applications, HVAC applications with MV contactors and HV contactors for heavy duty industrial motors, the widening penetration of vacuum contactors has bolstered market demand; subsequently fostering inertia towards higher penetration in the industrial machinery.

The inclusion of smart vacuum contactor technology with AI-driven real-time diagnostics and remote monitoring has further increased its use by enabling enhanced predictive maintenance and decreased downtime in automated manufacturing setups.

The market has also experienced optimizations by implementing low-power coil designs, hybrid switching technologies, and compact and energy-efficient vacuum contactors, contributing to enhanced energy savings and operational efficiency in variable-speed drive (VSD) and direct-on-line (DOL) applications.

Advent of vacuum contacts in high-reliability motor control systems with dual-circuit redundancy and improved arc-quenching has further bolstered market growth, owing to safety and reliability in mission-critical industrial applications.

However, the vacuum contactors for motors are limited to high costs for initial investment, difficulty in integrating into legacy systems, and limited scaling in ultra-high-voltage applications, despite having advantages such as arc-free switching, a longer lifespan, and low maintenance. However, newer technologies such as AI-powered fault detection techniques, IoT-based remote control capabilities, and next-gen vacuum interrupter designs are enhancing efficiency and reliability while being cost-effective over the long term, which will continue to spur growth in vacuum contactor use for motor control applications.

With companies leveraging vacuum contactors to increase the transformer efficiency, decrease the switching losses, and better voltage regulation, the transformers have resulted in robust market adoption, especially in power distribution networks, substations, and industrial power management system across the world. Vacuum contactors offer better dielectric strength, less contact erosion, and longer life, compared to their air-insulated counterparts, making them a more reliable option for transformer protection and load switching applications.

Wider adoption of high-performance vacuum switching systems in transformer switching, with the demand for transient suppression and arc mitigation, has been a significant driver for the adoption of vacuum contactor solutions, as utility operators and industrial power consumers demand higher grid stability and efficiency. Research shows that transformer switching losses using vacuum contactors are reduced by 20% or more, resulting in greater energy conservation and enhanced system reliability.

By virtue of automated switching of capacitor banks to maintain stable voltage, the application of vacuum contactors for correction of industrial power factors has increased the demand for vacuum contactors in the market, thereby promoting increased implementation of vacuum contactors in heavy industries, manufacturing plants and commercial power distribution network.

The previous implementation of AI-enabled voltage circuit analysis with real-time load balancing and fault prediction algorithm in distribution centres has been integrated, facilitating higher adoption rates due to greater grid stability and proactive transformer maintenance strategies.

Modular and high-voltage vacuum contactor designs with multi-stage contact arrangements for better electrical fills are on the market, and further expanded the market trends that would cultivate greater adaptability in power transmission and renewable energy grid applications.

Increasing adoption of vacuum contactors in smart grid applications such as automated load shedding and peak demand control, has further driven the market growth, ensuring enhanced energy efficiency and reduced downtime in power distribution networks.

Though vacuum contactors for transformers offer advantages such as admired high-reliability switching, minimum maintenance costs, and improved transformer protection, they face challenges related to high initial procurement costs, complex integration in multi-phase power systems, and limitations in ultra-high-frequency switching applications. New technologies in self-healing vacuum interrupters, transformer analytics based on AI and hybrid solid-state switching solutions are enhancing performance, sustainability and operational scalability and thus will ensure the growth of vacuum contactor applications in transformer switching and power distribution.

Two of these market drivers are the utility and oil & gas segments, as industries adopt vacuum contactor technology to maximize grid reliability, optimize energy management and provide safety to their power distribution.

They are like low-voltage new generation apparatus, and also address the power industry to provide better grid stability and operational efficiency, so the utility sector is one of the major markets for vacuum contactors. Vacuum contactors provide arc-free switching, unlike conventional electromechanical switches, which helps minimize switching losses and maintain long-term equipment life.

Growing demand for vacuum contactors in grid substations, wherein high-voltage vacuum interrupters play a crucial role for load balancing and short-circuit protection has positively influenced demand for the next-generation vacuum switching solutions, owing to uninterrupted power supply and lesser downtime as priority of utilities. Studies show that the use of smart vacuum contactors reduces the chances of grid failure by even as high 30%, which in turn makes the distribution of electricity more reliable.

As such, the demand is growing, introducing an environmental call to action, leading to increased deployment of vacuum contractor for renewable energy integration, representing automated switching solutions for solar and wind power systems ensuring the greater adoption of the energy transition initiates.

This has further driven adoption with the introduction of AI-driven smart grid contactors with real-time fault detection and self-healing automation, leading to improved energy efficiency and prediction maintenance abilities.

The introduction of hybrid vacuum contactors with solid state switching to provide ultra-fast response time has facilitated the market expansion by providing greater flexibility in dynamic load scenarios.

Although vacuum contactors have many benefits in terms of grid reliability, fault protection, and energy efficiency compared to traditional air contactors, high upfront implementation costs, complex retrofitting procedures, and limited standardization in hybrid power systems have limited their adoption in utility applications.

Nevertheless, new trends such as AI-based load optimization, IoT-based grid monitoring, next-generation vacuum arc suppression technology etc. for vacuum contactor applications in the utility industry, that promote multipliers like scalability, automation, cost-effectiveness, etc. are likely to sustain the growth of the vacuum contactor applications in utility sector.

Increasing demand for vacuum contactors in drilling operations with advanced generation of high-voltage motor control solutions in extraction and refining processes is pushing the usage of durable, corrosion-resistant vacuum switching technology, as oil & gas operators continue to focus on the uninterrupted power supply.

Growing adoption of vacuum contactors in LNG processing and petrochemical plants including arc-free switching for hazardous area compliance has supported market sales and ensured significant use in explosion-proof power distribution system.

In the oil & gas industry, despite the advantages of vacuum contactors for protection against explosions, durability, and high-efficiency switching, their high procurement costs as well as complex certification requirements and maintenance difficulties for offshore installations pose challenges.

Interestingly, Innovations in Artificial Intelligence-based Predictive Maintenance, Corrosion-resistant Vacuum Interrupters and Hybrid Gas-insulated Vacuum Contactor Technology are enhancing safety, reliability and operational efficiency, thus ensuring further growth opportunities for vacuum contactor applications in the oil & gas industry.

The Vacuum contactors market is witnessing growth due to the increasing demand for high-efficiency electrical switching with efficiency over 1000V industrial motor control and power distribution systems. The growing trend toward compact vacuum contactors, AI-based predictive maintenance, and advanced high-voltage circuit protection solutions that ensure operational safety, energy efficiency, and equipment longevity have been catching the attention of manufacturers.

Global electrical equipment producers and tailored industrial automation companies develop technologies of these products and the global vacuum container demand is divided into medium-voltage, high-voltage, and explosion-proof vacuum contactors.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Schneider Electric SE | 15-20% |

| ABB Ltd. | 12-16% |

| Eaton Corporation | 10-14% |

| Siemens AG | 8-12% |

| Rockwell Automation, Inc. | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Schneider Electric SE | Develops high-performance vacuum contactors for industrial motor control, power grids, and smart power distribution. |

| ABB Ltd. | Specializes in medium-voltage vacuum contactors with AI-driven predictive maintenance and energy-efficient switching. |

| Eaton Corporation | Manufactures high-voltage vacuum contactors for mining, oil & gas, and industrial automation applications. |

| Siemens AG | Provides compact vacuum contactors with real-time monitoring and overload protection for power distribution systems. |

| Rockwell Automation, Inc. | Offers intelligent motor control vacuum contactors for automation and high-efficiency manufacturing systems. |

Key Company Insights

Schneider Electric SE (15-20%)

Schneider Electric is the leader in the vacuum contactors market providing smart motor control solutions across industries and AI-integrated little power distribution technologies.

ABB Ltd. (12-16%)

ABB offers vacuum contactors and contactor systems for medium- and high-voltage switching solutions, providing safety and minimization of risk for industrial and commercial applications.

Eaton Corporation (10-14%)

Eaton manufactures heavy-duty, high-performance vacuum contactors for safe, energy-efficient operations in extreme conditions.

Siemens AG (8-12%)

Siemens compact vacuum contactors with a potential for remote diagnostics as well, bringing hassle virtualization to any power distribution network.

Rockwell Automation, Inc. (5-9%)

Rockwell Automation builds industrial vacuum contactors, adding IoT-enabled monitoring and real-time fault detection.

Other Key Players (40-50% Combined)

Several electrical equipment and automation companies contribute to next-generation vacuum contactor innovations, AI-powered predictive maintenance, and high-efficiency circuit switching solutions. These include:

The overall market size for Vacuum Contactors Market was USD 6.7 Billion in 2025.

The Vacuum Contactors Market expected to reach USD 9.9 Billion in 2035.

The demand for vacuum contactors will be driven by factors such as the growing need for reliable and efficient electrical systems, increasing industrial automation, rising demand for energy-efficient solutions, and the expansion of sectors like manufacturing, utilities, and construction that require safe, high-voltage control equipment.

The top 5 countries which drives the development of Vacuum Contactors Market are USA, UK, Europe Union, Japan and South Korea.

Motors and Transformers Drive Market Growth to command significant share over the assessment period.

Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

Air Quality Monitoring Equipment Market Growth - Trends & Forecast 2025 to 2035

Commercial Refrigeration Compressor Market Growth - Trends, Demand & Innovations 2025 to 2035

Dry Washer Market Insights - Demand, Size & Industry Trends 2025 to 2035

Composting Equipment Market Growth - Trends, Demand & Innovations 2025 to 2035

Automated Material Handling Systems Market - Market Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.