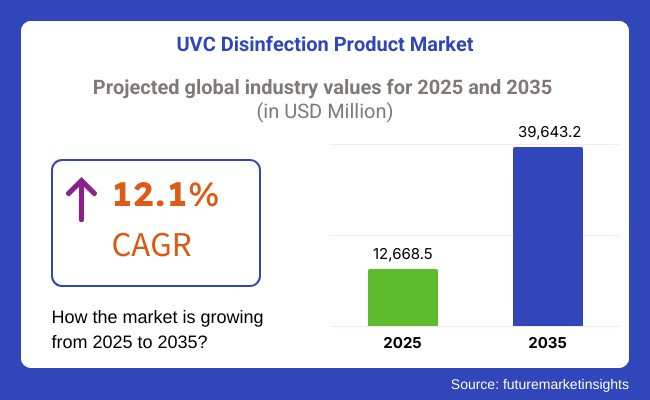

The UVC disinfection product market is projected to grow significantly, from USD 12,668.5 million in 2025 to USD 39,643.2 million by 2035 and it is reflecting a strong CAGR of 12.1%.

The UVC disinfection product market is experiencing significant growth due to the rising need for effective pathogen elimination across various sectors, including healthcare, retail, and public spaces. The increasing awareness of hygiene and infection control, especially in high-traffic areas, is driving the demand for UVC-based disinfection technologies. Businesses are investing in these solutions to ensure a safer environment for employees and customers.

Strict health and safety regulations, such as FDA and EPA guidelines, are mandating the use of certified disinfection solutions. This is pushing organizations to adopt UVC-based systems to comply with hygiene standards efficiently. Automated UVC disinfection products, such as mobile room sanitizers and robots, offer reliable, hands-free sterilization, reducing the risk of human error and ensuring comprehensive sanitation.

The integration of IoT and automation in UVC disinfection solutions is further fueling market growth. With businesses undertaking digital transformation, there is an increasing demand for smart UVC systems that can be remotely controlled and monitored. These advanced solutions enhance operational efficiency while ensuring effective and consistent disinfection in commercial and healthcare settings.

The growing threat of antimicrobial resistance and airborne diseases has heightened the importance of effective sterilization methods. UVC disinfection products provide continuous and real-time pathogen elimination, making them essential in medical centers, public transit systems, and corporate offices. As businesses strive to minimize contamination risks, the adoption of UVC technology continues to rise.

North America holds a dominant share in the UVC disinfection product market due to stringent hygiene regulations and the presence of major technology providers. Additionally, the increasing adoption of infection control measures in hospitals and commercial facilities is driving market expansion. Meanwhile, countries such as India and Australia are witnessing a surge in demand for UVC sanitization tools, fueled by growing healthcare infrastructure and heightened awareness of infection prevention.

Explore FMI!

Book a free demo

The UVC disinfection product market is experiencing considerable growth with the increasing need for hygienic surroundings in public spaces, residential areas, as well as healthcare.

Medical-grade UVC disinfection systems are the priority for healthcare facilities to effectively remove pathogens while adhering to regulatory safety guidelines. Commercial institutions such as offices, hotels, and retail outlets give more focus on automated UVC solutions to provide advance cleanliness and confidence among customers.

Industrial users use high-power UVC disinfection for production facilities, warehouses, and manufacturing facilities to have contamination-free processes. Home consumers need portable and easy-to-use UVC products for personal protection, especially in areas with frequent touching such as the kitchen and bathroom.

The transportation industry, such as airports, metro stations, and ride-sharing, incorporates sophisticated UVC technologies for mass disinfection of public spaces and vehicles. The market's future is fueled by AI-driven UVC systems, IoT-based automation, and green, chemical-free disinfection solutions to provide sustainable and efficient pathogen destruction.

| Company | Contract/Development Details |

|---|---|

| Philips Healthcare | Secured a contract with a major hospital network to supply UVC disinfection robots aimed at reducing hospital-acquired infections and enhancing patient safety. |

| Xenex Disinfection Services | Partnered with a chain of hotels to implement UVC room disinfection systems, aiming to enhance guest safety and confidence in cleanliness standards. |

During 2020 to 2024, the UVC disinfection product market witnessed a speedy growth based on increased awareness of hygiene and demand for efficient pathogen control during the COVID-19 outbreak. Hospitals, public areas, and transportation centers extensively used UVC-based disinfection systems for air, surface, and water purification.

Firms integrated UVC technology in air-conditioning units, escalators, and individual devices to prevent virus transfer. Portable UVC wands for consumer use and transportable UVC sterilizers were also favored. Producers considered effectiveness in UVC wavelength, lifespan, and auto-disinfection cycles in terms of enhancing performance and safety while counteracting concerns of regulatory clearance, safety, and cost of manufacture.

From 2025 to 2035, sustainable UVC technology, autonomous UVC robots, and AI-powered disinfection systems will drive market growth. AI-powered UVC products will provide real-time pathogen detection and adaptive disinfection according to environmental conditions. Autonomous UVC robots will carry out mass disinfection in hospitals, airports, and public areas with enhanced navigation and obstacle detection.

Low-power UVC LEDs technology will reduce energy consumption and extend operational life. Consumer acceptance will be enhanced by home automation and wearable UVC products. Improved compliance and increased safety features such as motion-sensing cut-offs and surface antimicrobial coatings will reduce safety issues and drive wider marketplace acceptance.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Governments made safety regulations on UVC disinfection units. | UVC sterilization compliance using AI ensures efficient pathogen control. |

| Technological advancements in LED-based UVC technology enhanced the efficiency of disinfection. | Quantum-boosted UVC sterilization assures instant pathogen removal. |

| Greater hospital, airport, and office building use. | Public hygiene becomes the standard with autonomous AI-driven disinfection robots. |

| Residential UVC product demand rose through the roof because of the pandemic. | AI-driven smart home UVC technology comes with IoT to enable self-disinfecting. |

| More focus on infection control and hygiene made for higher adoption. | AI-driven adaptive sterilization adapts based on actual-time environmental factors. |

Global UVC disinfection device market is under risk from key factors like regulatory problems, technical limits, and alternative disinfection techniques. Strict safety and compliance policies across different zones can lead to the procrastination of the product approvals and the market expansion making regulatory compliance the key risk factor.

Another risk is the performance of UVC technology against the mutation of pathogens. Though UVC is effectively used to kill bacteria and viruses; the duration of exposure, the angle of surfaces, and choice of material determines its performance. Any deviation from standard concentration can lead to distrust and ultimately, poor uptake.

Market saturation and the entrance of competitors are the other challenges. The recent entry of many companies to the UVC disinfection area after the pandemic prompts price wars and differentiation difficulties which can influence profitability.

The operational hazards that are at risk are the burnout of UVC bulbs, energy usage, and environmental issues. If the upkeep cost of UVC devices surpasses the anticipated rewards, consumers and industries may turn to other options. Moreover, the long-term use of UVC light can trigger the disintegration of materials, which in turn decreases the product lifespan.

Finally, the challenge still rocks on consumer cognizance and trust. Active UVC disinfection gets embraced widely but the effect of misinformation and lack of standardization turns it into a doubt about its efficacy, safety, and long-term state. Enlightenment and product clarity are vital keys to countering these problems.

Tier 1 vendors are manufacturers that operate on a large scale with global operations and deep financial resources, along with a comprehensive set of UVC disinfection products. All of these industry players are well known and have strong market presence. They continually research and develop to improve all their products and applications to meet the ever-growing needs of healthcare, municipal, industrial, and commercial. They operate in multiple countries across various geographical regions.

Tier 2 vendors are relatively medium sized corporations working regionally or nationally. Targeted toward specific geographies or product segments, Tier 2 companies together may not have the extensive global network of Tier 1 companies, but they still play an important role in the UVC disinfection market.

They, so often, have niche applications or sectors that they cater for and, so, proffer bespoke solutions that meet localised market needs. They are nimble when they need to change to customer demands and market conditions, making competing and cutting edge products within its target segments.

Tier 3 vendors are smaller companies, startups, or manufacturers operating in a specialized area or in a narrow housing market. These vendors specialize in particular applications or customer segments, enabling them to provide tailored solutions that meet specific requirements.

Because they operate on a more local scale, they can offer personalized services and create strong connections with their customers. Although they may have fewer resources than larger vendors, their expertise and specialization fill a niche they compete effectively within.

| Countries | CAGR |

|---|---|

| India | 16.2% |

| China | 14.5% |

| Germany | 9.8% |

| Japan | 12.2% |

| The USA | 11.0% |

India's extensive and busy public transport network, comprising buses, trains, and metro lines, elevates the possibility of infection spread. With millions of daily users, maintaining hygiene in these areas is a top priority. The Indian government has adopted UVC disinfection technologies to clean train coaches, metro stations, and bus terminals.

The Ministry of Railways has also provided UVC-based sanitizing tunnels for disinfecting passenger baggage to minimize surface contamination. More than 2,000 railway stations already have UVC technology installed for enhanced hygiene.

Mumbai Metro and Bangalore Metro are incorporating UVC disinfection systems as part of India's overall transition towards smart urban mobility solutions. Supported by government funding and increasing awareness, public transport system adoption of UVC is accelerating, enhancing infection control for millions of daily commuters.

FMI is of the opinion that the Indian UVC Disinfection Product market is slated to grow at 16.2% CAGR during the study period.

Growth Factors in India

| Key Drivers | Details |

|---|---|

| High public transport usage | Millions of passengers use public transport, thus creating a high demand for sanitization. |

| Government efforts | The government is financing UVC disinfection in public transport. |

In the USA, mounting health awareness and hygiene issues have fueled demand for portable UVC disinfecting devices. Retailers are buying increasingly more personal-use UVC devices, such as hand-held wands, sterilization boxes, and portable UVC lamps, for home disinfection. The USA Food and Drug Administration (FDA) has published guidelines for the safe use of UVC-based products for home consumers, which has encouraged manufacturers to improve product quality and safety features.

Since the pandemic broke out, nearly 40% of American homes have considered purchasing UVC sanitization devices. Web shopping platforms have recorded an extensive surge in sales of portable UVC devices.

FMI is of the opinion that the USA UVC Disinfection Product market is slated to grow at 11.0% CAGR during the study period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Higher consumer demand | Increased health awareness has led to higher adoption of UVC devices for home use. |

| Regulatory guidelines | The FDA and EPA have provided guidelines for the safe and effective application of UVC. |

China has led the way in employing autonomous UVC robots in crowded public spaces. Airports, hospitals, shopping malls, and railway stations in Beijing, Shanghai, and Guangzhou use robots for continuous sanitizing.

The Chinese government has promoted AI-based disinfection technologies, with the National Health Commission supporting automated systems to minimize human contact with pathogens. Beijing Daxing International Airport has used UVC robot fleets that can disinfect large areas in just minutes, saving labor costs and increasing efficiency.

Government-funded initiatives have accelerated the acceptance of UVC technology. Collaborations between government and private companies are developing advanced UVC disinfection robots, and over 5,000 units are installed in China's hospitals.

FMI is of the opinion that the Chinese market for UVC Disinfection Products is responsible for 45.8% of the global market and is still increasing at an accelerated CAGR for 2025 to 2035.

Growth Factors in China

| Key Drivers | Details |

|---|---|

| Government support | Authorities encourage AI-based UVC disinfection initiatives. |

| Automating disinfection | UVC robots are widely used in hospitals, shopping malls, and airports. |

Germany has made UVC disinfection solutions a priority in the healthcare and manufacturing sectors. UVC technology is now largely adopted for the maintenance of hygiene in pharmaceutical factories, food processing units, and hospitals. The medical industry in Germany has also integrated UVC-based air cleaners in order to prevent hospital-acquired infections and protect patients.

FMI is of the opinion that the German UVC Disinfection Product market is anticipated to advance at a 9.8% CAGR between 2025 and 2035.

Growth Factors in Germany

| Key Drivers | Details |

|---|---|

| Strong healthcare sector | Hospitals and healthcare centers adopt UVC technology as an infection control strategy. |

| Industrial cleanliness levels | The food and pharmaceutical industries implement UVC disinfection. |

Japan's UVC disinfection market is growing on the back of technological advancements in robotics and automation. Hospitals, aged-care centers, and public transport have incorporated UVC technology to enhance hygiene. Japan's increasing age population has driven infection control requirements for nursing homes and medical facilities, where the use of UVC disinfection makes the environment cleaner for elderly patients.

With focus given to technological advancements, FMI is of the opinion that Japan's UVC Disinfection Product market will be expanding at a CAGR of 12.2% during 2025 to 2035.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Aging population | Increased need for infection control in old age nursing homes. |

| Public transport sanitation | Bullet trains and subway trains use UVC disinfection for passenger safety. |

| By Product | CAGR (2025 to 2035) |

|---|---|

| UVC Disinfection Robots | 14.6% |

The market for UVC disinfection robots alone is expected to reach a CAGR 14.6%. The rapid rise in these robot operators is following a growing increase in infection control measures at hospitals, airports, and public spaces. Top manufacturers, including Xenex, UVD Robots, and Tru-D SmartUVC, are optimizing their worldwide presence while hospitals in America and Europe have adopted the UVC robot to cut hospital-acquired infections (HAIs) by as much as 30%.

UVC robotic solutions have also received significant government investment. China has deployed 5,000 in the medical field, and Los Angeles International Airport (LAX) and Singapore’s Changi Airport have added UVC disinfection robots to their settings to promote safer travel.

In 2025, the UVC mobile room sanitizers category is predicted to, by holding 28.5% of the by-product market share, be largely driven by the increasing use of UVC disinfection systems in hotels, corporate offices, and schools.

Follow-up inspections with the use of these mobile units allow for rapid spray-chemicals-free disinfection in high-traffic areas , often requiring more frequent sanitization. UVC room sanitization protocols have been rolled out by hospitality giants such as Marriott and Hilton, and government programs in Europe and North America support UVC-based solutions for public infrastructure.

Strong government support, improvements in AI-powered automation, and increased awareness of cleaning standards will ensure that UVC disinfection robots and mobile room sanitizers are an essential part of the future of automated disinfection.

| Commercial Application | Value Share (2025) |

|---|---|

| Hospital & Medical Centers | 28.4% |

Hospitals & Medical Centers segment holds a dominating market share of UVC disinfection product market of 28.4% in 2025. This dominance is driven by the need to combat healthcare-associated infections (HAIs) that impact more than 1.7 million patients each year in the United States alone. With 99,000 deaths in the United States due to HAIs each year, UVC-based disinfection systems are being implemented to enhance infection control within the hospital.

Government initiatives and strict hygiene regulations are driving adoption. In addition to antibiotic-resistant bacteria responding positively to this method, both the CDC and EPA recommend UVC disinfection, leading top-tier hospitals like Mayo Clinic and Johns Hopkins Hospital to embrace UVC robots in their advanced ICUs and operating rooms.

Germany’s Robert Koch Institute supports UVC deployment in hospitals in Europe, and healthcare budgets have been directed in France and the UK to integrate UVC sanitization. China’s National Health Commission has implemented over 5,000 UVC robots across their medical institutions, while pilot programs in India with the support of the country’s Ministry of Health place UVC robots in over 300 hospitals to test their effectiveness in high-risk regions.

Post-pandemic mandates for workplace hygiene have made corporate offices a top adopter as well, expected to account for an 18.7% share of the market in 2025.

In the USA, OSHA (Occupational Safety and Health Administration) and in Europe, ECDC (European Centre for Disease Prevention and Control) have issued workplace sanitization regulations that forced companies like Google, Amazon, and Microsoft to spend on UVC air purifiers as well as autonomous UVC disinfection robots. Germany, France, and the UK have implemented UVC systems in conference rooms, lobbies, and communal workspaces in response to new sanitation requirements.

The UVC disinfection product industry is booming with increasing hygiene awareness, healthcare regulations, and advanced technology. The demand for automation, AI integration, and energy-efficient UVC solutions is growing as their adoption increases in hospitals, commercial spaces, transport, and residential applications.

The advanced UVC germicidal solutions, hospital-grade disinfection systems, and IoT-enabled UV sanitation devices of the market's key players, such as Signify (Philips), XENEX, Steris PLC, and Atlantic Ultraviolet Corporation, dominate the market. Portable UVC devices, robotics-based disinfection, and smart-home applications have emerged as new market players and thus boosted competition.

Market evolution is driven by increased regulatory scrutiny, stringent safety standards, and the sustainability momentum. Investments in regulatory certifications, efficacy validation, and FDA, EPA, and CE compliance are the measures taken by the companies to gain credibility in the market.

Strategic concerns affecting competitiveness include product differentiation, pricing strategies, and integration into smart environments. Providers of automated, sensor-driven, and AI-enhanced disinfection solutions that comply with energy efficiency and safety will have a strong advantage in this evolving market.

Recent Industry Developments

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Signify (Philips Lighting) | 20-25% |

| Xenex Disinfection Services | 15-20% |

| Steris PLC | 10-15% |

| Atlantic Ultraviolet Corporation | 8-12% |

| Other Players | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Signify (Philips Lighting) | Leading in UVC LED and traditional UVC disinfection solutions for healthcare, air, and surface sterilization. |

| Xenex Disinfection Services | Expert in robotic UVC disinfection for hospitals, employing pulsed xenon UV technology for more effective sterilization. |

| Steris PLC | Delivers UVC disinfection tunnels, surface sanitizers, and room disinfection systems for deployment in healthcare and industrial settings. |

| Atlantic Ultraviolet Corporation | Supplies UVC water purifying, HVAC sterilizing, and surface disinfection systems across a wide range of industry sectors. |

Key Company Insights

Signify (Philips Lighting) (20-25%)

Market leader in the integration of UVC LEDs into smart solutions in healthcare, food safety, and HVAC disinfection.

Xenex Disinfection Services (15-20%)

Hospital-grade robotic disinfection that reduces healthcare-acquired infections (HCl).

Steris PLC (10-15%)

Engaged mainly in medical sterilization and industrial UVC solutions using FDA-cleared technologies.

Atlantic Ultraviolet Corporation (8-12%)

Specializes in commercial, residential, and industrial applications of UV sterilization, mostly for water as well as air purification.

Other Key Players (30-40% Combined)

The UVC Disinfection Product industry is projected to witness CAGR of 12.1% between 2025 and 2035.

The Global UVC Disinfection Product industry stood at USD 12,668.5 million in 2025.

The Global UVC Disinfection Product industry is anticipated to reach USD 39,643.2 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 14.7% in the assessment period.

The key players operating in the Global UVC Disinfection Product Industry Xenex Disinfection Services, UVD Robots, Tru-D SmartUVC, Skytron LLC, PURO Lighting, Finsen Tech, Acuity Brands, Inc., American Ultraviolet, Steris PLC, Signify (Philips).

In terms of Product, the segment is divided into UVC Sanitizing/Germicidal Lamps, Handheld Sanitizer Wands, UVC Sanitization Box/Containers, UVC Mobile Room Sanitizers Units and UVC Disinfection Robots.

In terms of commercial Application, the segment is segregated into Retail & Shopping Complexes, Hospital & Medical Centers, Corporate Offices, Entertainment Facilities & Parks, Public Transit, Public Assembly Facilities and Others.

A regional analysis has been carried out in key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East and Africa (MEA), and Europe.

Mid-infrared Lasers Market Analysis - Growth & Trends 2025 to 2035

Multi-Axis Sensors Market Insights - Trends & Forecast 2025 to 2035

Photonic Integrated Circuit & Quantum Computing Market - Trends & Forecast 2025 to 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.