As per FMI analysis, UV stabilized films find extensive applications in various industries like agriculture, construction, automotive, and packaging because they can withstand degradation caused by long-term exposure to UV. These films ensure greater durability, weather resistance, and longer lifespan, which is why they are best suited for outdoor use. The growing demand for high-performance materials that are capable of enduring extreme environmental conditions is expected to propel substantial market growth in the coming decade.

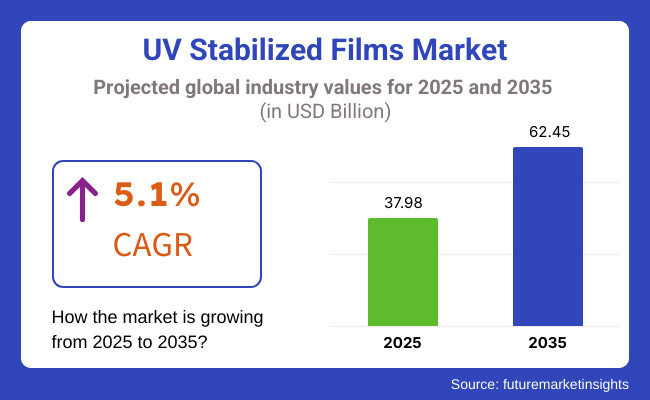

The market size is estimated to be USD 37.98 billion in 2025 and is expected to grow with a 5.1% CAGR rate in the years 2025 to 2035 and reach USD 62.45 billion. The market is being propelled by growing construction activities, increasing consumption of agricultural greenhouse films, and technological improvements in polymer stabilization technologies. Additionally, mounting environmental awareness and regulatory norms for long-lasting and sustainable materials are also propelling the market growth.

The industry growth is also being driven by increased innovation in multi-layer products, such as biodegradable and recyclable films. Solar energy project growth and improvements in weather-resistant packaging technologies are also driving market growth. Improvements in UV stabilization technology, such as nanotechnology-based stabilizers and high-barrier coatings, are expected to enhance product efficiency and shelf life.

Explore FMI!

Book a free demo

Asia-Pacific is expected to dominate the market on account of intense industrialization, increasing agricultural activity, and increasing application of UV-resistant construction materials. China, India, and Japan are among the key drivers, with huge investments in greenhouse films, solar panels, and protective coatings. Furthermore, increasing use in automobile applications further stimulates market growth.

The region's market growth is supported by government policies that promote energy efficiency and durable building materials. In addition, technological advancements in high-barrier UV films will drive industry growth. Increased presence of international companies in Asia-Pacific is also boosting local manufacturing capabilities. Further, R&D in biodegradable and recyclable UV stabilized film solutions will open new growth opportunities in the region.

North America remains a vibrant market with strong demand from the construction, renewable energy, and agriculture industries. The USA and Canada are leading the region in polymer stabilization technology advancements and eco-friendly UV film production. Growing industry interest in durable and high-performance material is also driving up market demand further.

The adoption of state-of-the-art UV stabilization technologies is gaining momentum, fueled by government regulations promoting green materials. Increased R&D investments in recyclable, bio-based, and high-performance UV stabilized films are also propelling market growth. Increased installation of solar energy equipment and smart greenhouse schemes is also driving demand for durable UV protection solutions.

Most North American companies are also focusing efforts towards making products more recyclable and functional for better product performance. Emerging trends in intelligent UV films such as self-healing coatings and temperature-sensitive films will also set the tone in the market over the next three years.

Europe dominates the market in terms of market share because of stringent regulatory environments supporting durable and eco-friendly products. Countries like Germany, France, and the UK, which are top economies, are at the forefront of sustainable material innovation.

Increased investments in circular economy initiatives as well as studies on high-performance weather-resistant films are further strengthening the region's hold on the market. Tight environmental regulations promoting the use of lower plastic waste and instituting long-term materials are leading the transition to sustainable UV stabilized film solutions.

Challenges

Opportunities

Between 2020 and 2024, the industry experienced gradual expansion owing to growth in greenhouse farming, construction, and protective exterior coatings. Other issues, like production expense, however, posed a challenge in being the foremost hurdle for firms.

Moreover, the market recorded rising investment into research that targets enhanced film recyclability, better UV resistance, and efficiency on energy use. Rising fears of climate change influenced regulatory agencies to promote the use of long-lasting UV-stable materials. In addition, improved UV protection technology with high-barrier protection helped enhance durability and functionality.

In the future, market growth will be influenced by developments in biodegradable UV stabilized films, AI-enabled film production, and enhanced weather-resistant solutions. Automation integration of film production and AI-based quality control systems will also enhance market competitiveness. Apart from this, rising demand for UV stabilized film solutions in premium applications like electric vehicles and smart agriculture will provide new growth opportunities.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Initial focus on improving UV resistance in materials. |

| Material and Formulation Innovations | Development of basic UV stabilization techniques. |

| Industry Adoption | Widely used in agriculture and construction. |

| Market Competition | Dominated by major UV film and packaging brands. |

| Market Growth Drivers | Growth driven by agricultural and construction demand. |

| Sustainability and Environmental Impact | Early-stage transition to recyclable UV film options. |

| Integration of AI and Process Optimization | Limited AI implementation in manufacturing. |

| Advancements in Adhesive Technology | Traditional adhesive formulations used in UV stabilized films. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global policies mandating eco-friendly and high-performance UV films. |

| Material and Formulation Innovations | Expansion of bio-based, recyclable, and nanotechnology-enhanced UV films. |

| Industry Adoption | Increased adoption in automotive, flexible electronics, and renewable energy. |

| Market Competition | Rise of sustainable material startups and collaborations with tech firms. |

| Market Growth Drivers | Market expansion fueled by AI-integrated solutions and eco-friendly designs. |

| Sustainability and Environmental Impact | Large-scale adoption of fully recyclable and compostable UV stabilized films. |

| Integration of AI and Process Optimization | AI-driven predictive modeling, automated quality control, and real-time monitoring. |

| Advancements in Adhesive Technology | Development of UV-resistant, eco-friendly, and high-strength adhesives for improved durability and performance. |

The USA holds the largest market share in the market, fueled by rising demand for weather-proof and durable packaging materials in agriculture, construction, automotive, and food packaging industries. The requirement for superior UV protection and longer product life has prompted the development of high-performance with improved resistance to sunlight and environmental degradation by manufacturers.

In addition, government regulations favoring sustainable materials and energy efficiency are forcing companies to employ recyclable and biodegradable UV stabilized films. Additionally, nanotechnology-based coating innovations are improving UV resistance and overall durability.

Multi-layered UV stabilized film structures are also being researched by companies to optimize performance in harsh outdoor conditions. Furthermore, the increasing adoption of products in greenhouse applications and solar energy industries is driving innovation in this sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.1% |

The UK market is growing as companies focus on sustainability and adherence to environmental policies. The growing need for weather-resistant and UV-resistant packaging materials has driven wider adoption across various industries such as agriculture, pharmaceuticals, and construction. Government policies encouraging energy-efficient and durable building materials are also driving companies to incorporate high-performance UV stabilized films.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.6% |

Japan's UV stabilized film market is expanding steadily with the rising demand for precision-engineered UV protection solutions in the electronics, automotive, and agricultural sectors. Firms are creating high-performance with advanced polymer blends to improve durability in outdoor conditions.

With stringent regulations on packaging waste reduction, firms are shifting towards biodegradable and recyclable UV stabilized materials. Moreover, innovations in smart UV stabilized films, including heat-reflective coating and self-healing behavior, are fueling demand for applications involving long-term exposure to sunlight. Companies are also investing in automation-compliant UV stabilized film solutions to enhance logistics and storage efficiency.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.4% |

The market of South Korea is growing rapidly through enhanced exports and industrial automation. Demand for inexpensive and high-performing UV protective solutions has stimulated manufacturers to provide improved barrier films with enhanced anti-aging capacity. Government measures encouraging energy-saving and sustainable packages also favor industry growth.

In addition, companies are incorporating smart tracking technologies like QR codes and RFID tags in products to enhance supply chain efficiency. Increasing demand for high-barrier packaging in agricultural and automotive applications is also contributing to increased adoption. Further, studies on self-repairing UV stabilized coatings are assisting companies in creating niche packaging specific to harsh environmental conditions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.8% |

Based on product type, the market is divided into optical films, adhesive films, conductive films, and others. Amongst optical films, adhesive films, conductive films, and UV-stabilized films, the adhesive films are most commonly applied because they can be used with high versatility and a wide range of applications.

Adhesive films find important applications in industries like packaging, automotive, electronics, and medical devices where they create strong adhesion, protection, and durability. Their capacity to stick on different surfaces, coupled with qualities such as heat resistance, transparency, and flexibility, renders them crucial in assembly and manufacturing processes.

Based on material, the market is divided into plastics and metals. UV-stabilized plastics are more popular than UV-stabilized metals because of their light weight, affordability, and general suitability for use in many applications.

Plastics tend to be more susceptible to UV degradation, resulting in discoloration, brittleness, and decreased mechanical properties over time. Thus, UV stabilizers are added to plastics to improve their durability, and they are easily used in outdoor uses like agricultural films, roofing sheets, automotive components, and packaging.

Based on technology, the market is divided into adhesion lamination and co-extrusion coating/lamination. Adhesion lamination is more prevalent compared to co-extrusion coating/lamination because it is cost-effective, versatile, and capable of bonding diverse materials.

Adhesion lamination uses adhesives (including solvent-based, water-based, or solvent-free adhesives) to bind various layers of substrates together, and as such, is well-suited for applications such as flexible packaging, medical, and automotive industries. It makes it possible to laminate various materials such as films, foils, and papers without the need for high processing temperatures, which is especially useful for heat-sensitive materials.

Based on thickness, the market is divided into up to 20 microns, 20 to 40 microns, 40 to 50 microns, and 50 microns & above. Of UV-stabilized films divided into 20 microns & below, 20 to 40 microns, 40 to 50 microns, and 50 microns & above, the 20 to 40-micron thickness is the most popular because of its optimized properties of toughness, flexibility, and affordability.

These films provide adequate UV protection without being heavy or rigid and are suitable for numerous applications, such as agricultural films, flexible packaging, outdoor labels, and protective coatings.

They offer superior mechanical strength compared to ultra-thin films (less than 20 microns), which can deteriorate more quickly under extended UV exposure. Although thicker films (40 microns and greater) provide increased durability, they are costlier and less conformable for applications where conformability is needed. The 20 to 40-micron range offers the best balance of UV resistance, cost, and flexibility and is the industry favorite in a variety of industries.

Based on application, the market is divided into printing, industrial use, and packaging. Between printing, industrial application, and packaging, packaging is the most common use of UV-stabilized films because of its enormous demand in different industries such as food, pharmaceuticals, consumer products, and agriculture.

UV-stabilized films in packaging prevent products from sun-induced degradation, increase shelf life, and preserve product integrity. UV-stabilized films are widely applied in flexible packaging, pouches, shrink wraps, and protective coverings for perishable items.

Based on end-use industry, the market is divided into non-packaging UV stabilized films, packaging UV stabilized films, UV stabilized films for chemicals, and UV stabilized films for pharmaceuticals. Among non-packaging UV-stabilized films, packaging UV-stabilized films, UV-stabilized chemical films, and UV-stabilized pharmaceutical films, packaging UV-stabilized films are utilized most extensively across various industries owing to their huge applications.

Packaging UV-stabilized films ensure the protection of packaged products against UV exposure, avoid product damage, and contribute to shelf-life extension. The films are heavily applied in food packaging, agricultural Films, and consumer product applications, giving them a controlling position in the market.

The UV stabilized films market is influenced by rising demand in agriculture, construction, packaging, and automotive applications. The market is witnessing innovation through new material formulations, such as bio-based polymers, high-performance stabilizers, and multi-layered protective films, addressing concerns about performance, sustainability, and efficiency. Additionally, advancements in automated production and AI-driven supply chain tracking are further shaping industry trends.

The rising preference for sustainable and high-durability UV stabilized films is also contributing to market growth. Furthermore, increased investments in eco-friendly film production technologies are improving product efficiency and expanding market opportunities.

Companies are also exploring hybrid UV stabilized films that integrate multiple layers of protective coatings to enhance durability. Additionally, collaborations between film manufacturers and renewable energy companies are driving the development of customized UV protection solutions tailored to specific industry needs.

Leading Companies & Market Share

3M Company

Berry Global Inc.

RKW Group (Part of Mitsui Chemicals)

Armando Alvarez Group

Plastika Kritis S.A.

DuPont Teijin Films (Now part of Celanese Corporation)

SKC Co. Ltd.

BASF SE

Eastman Chemical Company

AEP Industries Inc. (Acquired by Berry Global)

Other Big Players (50-60% Combined)

The overall market size for the UV stabilized films market was USD 37.98 billion in 2025.

The UV stabilized films market is expected to reach USD 62.45 billion in 2035.

The market will be spurred on by growing demand from the agricultural, construction, packaging, and automotive sectors. Sustainability trends, new developments in high-performance stabilizers, and enhancements in film durability will further drive market growth.

Some of the major challenges facing the market are volatile raw material prices, environmental issues over plastic waste, and regulatory challenges to new formulations. Nevertheless, continued research on biodegradable stabilizers and recyclable UV film designs will be able to reduce these challenges.

Nitrogen Flushing Machine Market Report – Trends, Size & Forecast 2025-2035

Pan Liner Market Insights – Demand, Growth & Industry Trends 2025-2035

Perfume Filling Machine Market Report – Trends, Demand & Industry Forecast 2025-2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Magnetic Closure Boxes Market Trends - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.