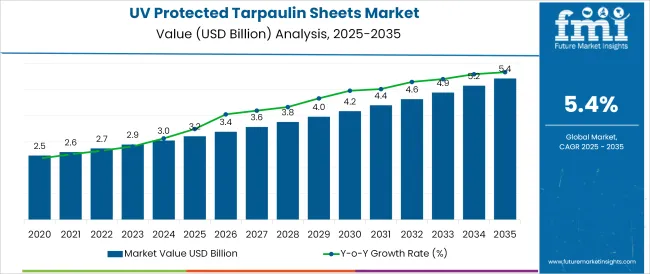

The UV Protected Tarpaulin Sheets Market is estimated to be valued at USD 3.2 billion in 2025 and is projected to reach USD 5.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

The UV protected tarpaulin sheets market is experiencing sustained momentum due to the increasing need for durable, weatherproof materials that provide long-term protection in outdoor applications. The growth is being supported by infrastructure development, expanding agricultural storage needs, and rising awareness around UV-induced material degradation.

Manufacturers are focusing on lightweight, high-strength materials that offer cost efficiency and resistance to environmental stressors. Government initiatives supporting climate-resilient infrastructure and smart farming practices are further fueling adoption. Additionally, advancements in polymer processing and coating technologies are improving the UV shielding performance, mechanical strength, and recyclability of tarpaulin sheets.

With sectors such as transportation, construction, and warehousing demanding high coverage and low-maintenance solutions, UV protected tarpaulin sheets are increasingly positioned as essential assets for protecting goods, crops, and equipment against harsh climatic conditions.

The market is segmented by Material, Thickness, Size, and End-Use and region. By Material, the market is divided into Polyethylene, Canvas, Vinyl, and Silnylon. In terms of Thickness, the market is classified into 100-200 GSM, Below 50 GSM, 50-100 GSM, and Above 200 GSM.

Based on Size, the market is segmented into 24 FT X 24 FT, 9 FT X 6 FT, 9 FT X 12 FT, and 8 FT X 16 FT. By End-Use, the market is divided into Building & Construction, Agriculture, Automobiles, Consumer Goods, Storage, Warehousing & Logistics, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

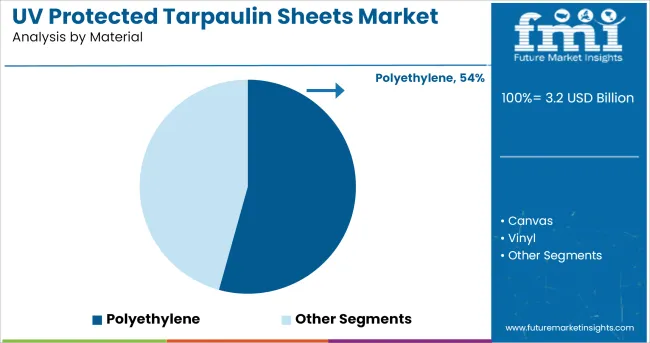

Polyethylene is projected to dominate the UV protected tarpaulin sheets market with a 54.3% revenue share in 2025. This leadership is attributed to the material’s excellent UV resistance, tensile strength, flexibility, and affordability. Polyethylene tarpaulins are widely used due to their lightweight nature and superior waterproof characteristics, which make them ideal for long-term outdoor use.

Their adaptability to different coatings and ease of fabrication enhance their suitability across multiple use cases such as covering equipment, shelters, or storage spaces. In addition, polyethylene offers strong resistance to tearing and environmental stress cracking, making it the material of choice in heavy-duty applications.

As sustainability gains importance, advancements in recyclable polyethylene variants are further strengthening its market dominance, aligning with evolving environmental compliance standards and corporate procurement policies.

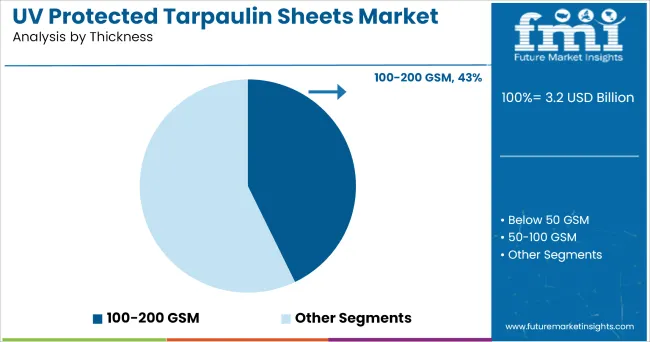

The 100-200 GSM thickness range is expected to account for 42.8% of the market revenue in 2025, positioning it as the most preferred thickness category. This range strikes a balance between strength, durability, and cost, which has made it popular in both commercial and agricultural applications.

Tarpaulin sheets within this thickness range provide adequate UV shielding, wind resistance, and flexibility for covering large areas without becoming overly cumbersome or expensive. Their ease of transport, handling, and installation supports wide-scale adoption in seasonal and semi-permanent structures.

Additionally, this GSM range offers sufficient lifespan and protection for mid-duty applications, reducing replacement frequency and enhancing overall lifecycle value. As industries seek standardized, performance-efficient covering solutions that are cost-effective and easy to deploy, demand for tarpaulins in this GSM band is expected to continue its upward trend.

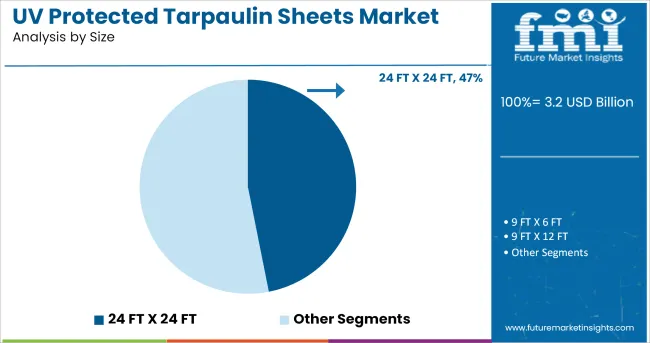

The 24 FT x 24 FT size segment is projected to hold a 46.9% revenue share in the UV protected tarpaulin sheets market by 2025, making it the most commonly utilized size configuration. This dominance is attributed to its versatility in covering medium-to-large equipment, goods, and agricultural produce.

The dimensions are optimal for providing sufficient coverage without excessive material usage, thereby offering a favorable balance between area, cost, and handling. Users benefit from reduced joins or seams during installation, minimizing leakage risks and improving protection in outdoor environments. The 24 FT x 24 FT size also aligns well with transport, farming, and warehouse needs where modular, foldable coverage is essential.

As users increasingly prioritize convenience, durability, and reusability in tarp solutions, this size format continues to gain traction across both individual and industrial consumers.

Due to global warming, huge fluctuation in the weather is witnessed, so customers would not prefer to have a different kind of Tarpaulin sheet for different purposes. Over the forecast period, revenue for the worldwide UV protected tarpaulin sheets market is expected to be driven by growth in end-use industries such as construction, agricultural, automotive, and other industries.

The global UV protected tarpaulin sheets market is likely to be fuelled by an increase in the number of UV protected tarpaulin sheet applications in transportation and logistics due to its robustness and durability.

The demand of UV protected tarpaulin sheet is high nowadays because it provides extra protection from any other kind of tarpaulin which are present in the market, which leads to the entry of new players in the market, and there is a high chance that it may degrade the quality of a UV protected tarpaulin Sheet.

The reason is to prepare a better quality of a UV protected tarpaulin sheets that needs high quality of a material and technology and if the new players entry takes place they will mislead the product’s quality which results in the shifting of product from UV protected tarpaulin to any other better tarpaulin options present in the market.

Unavailability of UV protected tarpaulin sheets in the South Asian region because of unawareness about the proper technology result in low quality of production. However, this region are importing UV protected sheets which leads to a higher cost for this region, and also leads to slow growth in the market capitalization.

China and USA are the leader in the consumption of a UV protected tarpaulin because these are well established economy. Activities like export of goods and construction of a buildings takes place in a large scale, so to strengthen these services countries are demanding the UV protected tarpaulin sheet, that’s the reason demands are high in both the countries.

Japan, is also major market for UV protected tarpaulin sheets because it is the leader in the automobiles sector, so to protect from the weather fluctuation it needs that quality of tarpaulin which is cost-effective and provides extra benefits. So for this reason UV protected tarpaulin sheets are a better option.

India, also the biggest market for the UV protected tarpaulin sheets because the Indian economy depends upon agriculture and it needs to protect from the harsh weather. So, UV-protected tarpaulin sheets are the better option to protect the crops or trees or daily needs products.

Other South Asian countries are adopting this UV-protected tarpaulin sheets for the safety of their products but because of less production and less number of major player in the South Asian region demand aren’t able to match the supply.

So, the big market player grabbing the opportunity by establishing the new plant in the region or by collaborating with the existing player to match the demand and supply of a UV protected tarpaulin sheets, by this manufacturers are focusing on earning huge profit margin as well.

Some of the following key players are considered in the report:

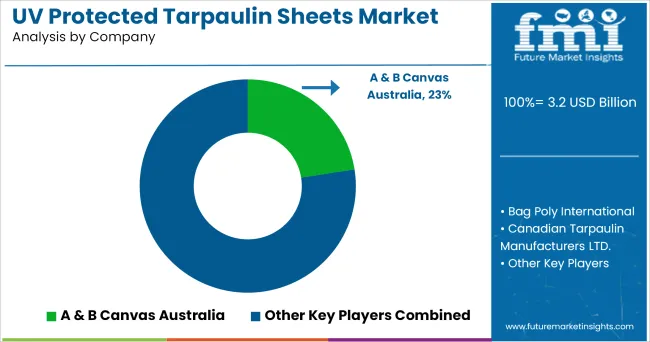

The global UV protected tarpaulin sheets market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the UV protected tarpaulin sheets market is projected to reach USD 5.4 billion by 2035.

The UV protected tarpaulin sheets market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in UV protected tarpaulin sheets market are polyethylene, canvas, vinyl and silnylon.

In terms of thickness, 100-200 gsm segment to command 42.8% share in the UV protected tarpaulin sheets market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UV Curable Resin and Formulated Products Market Size and Share Forecast Outlook 2025 to 2035

UV Stabilized Films Market Size and Share Forecast Outlook 2025 to 2035

UV Absorbers Market Size and Share Forecast Outlook 2025 to 2035

UV Cured Coatings Market Size and Share Forecast Outlook 2025 to 2035

UV-Protecting Polymers Market Size and Share Forecast Outlook 2025 to 2035

UV-C LED Market Size and Share Forecast Outlook 2025 to 2035

UV Adhesives Market Size and Share Forecast Outlook 2025 to 2035

UV and Light Sensitive Packaging Market Size and Share Forecast Outlook 2025 to 2035

UV-Blocking Transparent Film Market Size and Share Forecast Outlook 2025 to 2035

UV Curable Coatings Market Size and Share Forecast Outlook 2025 to 2035

UVI Stretch Films Market Size and Share Forecast Outlook 2025 to 2035

UV Tapes Market Growth - Trends & Forecast 2025 to 2035

UVC Disinfection Product Market Report – Demand, Trends & Forecast 2025–2035

Uveal Melanoma Treatment Market – Growth & Forecast 2025 to 2035

UV LED Printers Market Growth - Trends & Forecast 2025 to 2035

UV LED Market by Technology, Application, and Region – Growth, Trends, and Forecast through 2025 to 2035

UV Sensors Market Analysis by Type, End User, and Region from 2025 to 2035

UV Coatings Market Growth & Forecast 2025 to 2035

Market Share Insights of UV Stabilized Films Providers

UV Cured Acrylic Foam Tapes Market Insights - Trends & Growth Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA