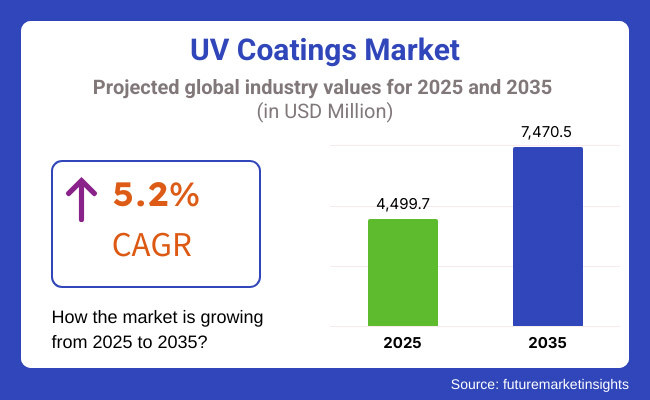

The global UV coatings market is projected to experience substantial growth, driven by increasing demand for eco-friendly coatings, advancements in UV-curable technologies, and rising industrial applications. The market is estimated to be valued at USD 4,499.7 million in 2025 and is expected to grow at a compound annual growth rate (CAGR) of 5.2%, reaching USD 7,470.5 million by 2035.

Key growth drivers include stringent environmental regulations promoting low-VOC coatings, expanding applications in the automotive and electronics industries, and technological innovations in curing processes.

The rate at which ultraviolet coatings are acquired is on the rise, thanks to their rapid drying rates, toughness, and low environmental impact. The automotive, electronics, packing, and construction industries are switching to UV coatings mainly because of their better performance and compliance with regulations. The tendency of manufacturers to produce solar-powered and energy-efficient products is the other factor that has taken the demand for UV-curable formulations up.

The growth of UV LED curing technology has resulted in higher energy efficiency and lower costs of operation, leading to more widespread adoption. Also, the increasing focus on high-performance coatings with better scratch resistance, chemical resistance, and good appearance is a propelling factor of the market.

The UV coatings market is at the forefront of gradual but stable progress due to the continuous upward trend in the demand for performance and environmentally friendly coatings from a variety of sectors. Sustainability and technology growth and following the rules set by the legal framework are the main characteristics of companies that will succeed in the long run.

As industrial applications expand and UV LED curing becomes more popular, the market can be expected to witness a constant stream of innovation and increased adoption across the globe.

Low-impact environmental contamination and alignment with VOC regulations make water-based UV coatings popular these days. The automotive and electronics sectors are reaching new heights quickly with their market inventory of durable and high-performing coatings. Brands in the packaging sector are also making use of these coatings as a way of providing better product boxes and at the same time improving the look of their merchandise.

Explore FMI!

Book a free demo

The North American UV coatings market is on a remarkable growth trajectory, with environmental regulations being strong motivators and a trend toward sustainable coating making it happen. The use of UV LED curing technologies, the trend that is gaining the momentum throughout various industries such as automotive, electronics, and industrial coatings, is accelerating in the USA and Canada. The region's target of green products, along with the regulatory infrastructure supporting the low-VOC formulation, is the driving force of market demand.

Focused on innovation and cutting-edge technologies in UV-curable coatings, North America not only adds coating manufacturers but also plays the role of the key innovation hub in the market, helping to reduce environmental impact. The ongoing development of these technologies serves as the additional reason for the region to be a prospective area for growth.

Europe is a significant participant in the global UV coatings market, which is backed by the government regulations to curtail VOC emissions and the promotion of sustainable coating alternatives. The automotive and packaging sectors are vital contributors to this, especially in Germany, France, and the UK, where the situation is getting better for UV technologies.

The construction segment also plays a major part, as there are numerous projects focused on the use of energy-efficient and eco-friendly building materials. European companies are creating new UV coating technology which allows them to comply with the environmental and performance standards. With sustainability as the primary force in the different industries, the European UV coatings market is likely to keep its consistent growth in the future.

The Asia-Pacific region continues to lead the world in the UV coatings market as a result of rapid industrialization, urbanization, and the tremendous growth of the automotive and electronics industries, with the main contributors being China, India, and Japan. The increasing needs for packaging and construction high-performance coatings which further push the market development.

Furthermore, the region’s investment in smart manufacturing and technological advancement is speeding up the adoption of UV-curable coatings. However, manufacturers are having challenges, including raw material costs that are unpredictable and regulatory requirements in some nations. Nevertheless, the region is still a strong contender, while the constant research and progress in UV LED curing technologies will fuel the future growth in the market.

The UV coatings sector in Latin America, the Middle East, and Africa continues to thrive with a steady pace, owing to the industrial development and infrastructure expansion. In Latin America, the sector that is leading the UV demand is packaging and automotive, while the Middle East focuses on construction and industrial coatings to provide for the needs of its growing cities.

Africa's evolving manufacturing industry gives the green light for the utilization of UV coating, despite obstacles like economic instability and the absence of technology. Although there are some problems to deal with, the right measures taken in the infrastructure and industrial sectors by keeping the process running will open a way for the demand of UV coatings to soar in those regions.

Challenges

High Initial Investment Costs

The initiation of UV coatings requires huge upfront costs, especially for specialized equipment and UV curing technologies, which can be a hurdle for small and medium-sized enterprises (SMEs).

Businesses have to weigh the immediate investment against long-term benefits like better performance, energy efficiency, and less environmental impact. While larger manufacturers may manage these costs, for SMEs it can be hard to justify the expense.

Nevertheless, the increased usage and accessibility of UV Coating technologies have the likelihood to lower the costs of joining over time. Companies can also consider financing options and partnerships to ease the burden, thus making the UV coatings a more viable option for smaller agents in the market.

Raw Material Price Fluctuations

The unstable prices of raw materials such as those derived from petrochemicals are some of the most significant challenges encountered by UV coating manufacturers. The effects of the cost fluctuations of key components like the monomer and resin used, in turn, affect production costs and eat into the manufacturer's profit margins.

The manufacturers have experienced issues with supply chains, geopolitical factors as well as changes in global demand which have only added to these cost troubles.

To deal with such issues, manufacturers will have to build sufficient stock of raw materials or diversify the suppliers to avoid unexpected hikes in price. Simultaneously, research in alternative raw materials or recyclable components could help mitigate these obstacles and give a more stable ground for producers in the long term.

Opportunities

The Rise of Sustainable Coatings

The shift towards 'green' products is being a catalyst for the growth of sustainable coatings, for instance, the introduction of bio-based and waterborne UV coatings. These eco-friendly blends reassure consumers while they are also less harmful to the environment and comply with regulatory demands for low-VOC and low-toxic options.

Companies which are focusing on this direction differentiating between themselves in the marketplace by having products that meet stricter environmental regulations and at the same time going with the market trend of green products.

When the regulations on VOCs get tougher and sustainability is at the forefront in the automotive, construction, and packaging sectors, the companies that adopt these changes will be the ones that win the competitive game. On the one and of course is the benefit for the environment, and on the other hand, the long-term strengthening market and consumer loyalty also leads to the rise.

The Developments Inside UV LED Technology

Switching over to UV LED is a big shot as it is a favorable opportunity for expanding the UV coatings market. In contrast to curing traditional UV, UV LED systems consume less energy, operate longer, and are quicker, making them more cost-effective and environmentally friendly. With such progress, manufacturers can improve their financial performance while trimming expenses.

The feature that allows lower-temperature curing also introduces new materials which are otherwise not applicable for UV usage. The costlessness and a greater availability of UV LED technology predict a successful implementation in different industries like automotive, packaging, and electronics. This departure is one of the key motives in the movement toward environmentally friendly energy-efficient coatings.

Due to the rising need for high-performance coatings that offer not only durability but also environmental accountability, and short curing times, the UV coatings market saw impressive progression over the period of 2020 through 2024.

The automotive, electronics, and packaging industries alongside wood coatings braved forward in the extensive market development. The trend for low-VOC and solvent-free formulations has redundantly contributed to the upsurge of UV coatings, which is termed as a green alternative to conventional coating processes.

With regards to the period of 2025 through 2035, the market is predicted to thrive based on the innovations in nanotechnology, bio-based UV coatings, and smart coatings featuring self-healing properties. The altering factors in the market will be the better performance characteristics, the pressure of regulations for the usage of eco-friendly products, and the introduction of Industry 4.0.

The UV coatings market is going to a massive change over the next 10 years due to the pragmatic shift caused by sustainability, technological advancements, and mainly by normative pressure. While the era from 2020 to 2024 was marked by steady development Industrial Coatings and UV-lamps by water evaporation, the period to come will witness radical advances in nanotechnology, smart coatings, and bio-based formulations.

The breakthrough into the advanced manufacturing modules, including aerospace, 3D printing, and medical applications, will be the key driver for the new growth opportunities. Players, who invest in next-generation technologies in UV curing, the materials that are eco-safe, and the operations which are run by AI, will be pioneers in a planet-friendly and performance-oriented business environment.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Increased restrictions on solvent-based coatings, promoting UV alternatives. |

| Technological Advancements | Growth in UV LED curing, improved adhesion, and scratch resistance. |

| Industry-Specific Demand | High demand from automotive, electronics, and packaging sectors. |

| Sustainability & Circular Economy | Rising adoption of low-VOC and solvent-free formulations. |

| Market Growth Drivers | Demand for rapid-curing, high-performance, and eco-friendly coatings. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter environmental mandates driving bio-based and low-energy UV curing systems. |

| Technological Advancements | Nanotechnology integration, self-healing UV coatings, and AI-driven quality control. |

| Industry-Specific Demand | Expansion into 3D printing, aerospace, and medical applications. |

| Sustainability & Circular Economy | Full-scale shift toward biodegradable, recyclable, and energy-efficient UV coatings. |

| Market Growth Drivers | Innovations in smart coatings, digital manufacturing, and enhanced material performance. |

The USA UV coatings market is witnessing rapid expansion, essentially due to the growing acceptance in automotive, electronics, and packaging sectors. Tough VOC emission rules from the EPA are making it imperative for the coating manufacturers to make the switch to low-emission, high-performance. The car manufacturing sector, in fact, is observing a concerning rise in the necessity of our UV-cured coatings for finishes, thereby, making our market develop.

Besides that, the wood and furniture sectors are adopting UV coatings not only for their scratch resistance but also because of the high-gloss finishes, which emphasizes another avenue for market development. On the flip side, challenges are still present even with the increased market potential, for instance, the solution of high initial investment costs and the complexity of curing processes are very difficult to manage.

Nevertheless, it is possible to find significant opportunities to solve them through a better understanding of nanotechnologies and development of bio-based UV coatings. This would allow the manufacturers to improve the overall performance of their products, diminish the environmental impact, and also cater to the changing consumer needs.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.7% |

The UK UV coatings market is experiencing steady growth, as a result of the implementation of stringent environmental policies and the increasing demand for such coatings in various industries. The car and electronics industries are the major sectors in need of them, as they are more and more starting to utilize UV-cured coatings for their protective and high-performance properties. Even though Brexit-related trade uncertainties have affected the raw material imports, the domestic production of eco-friendly coatings is gradually getting prominent.

Moreover, the flourishing of smart packaging solutions is further fuelling the requirement of UV coatings in printed labels and food packaging, thus expanding the market further. Notwithstanding, high energy consumption during the UV curing process still remains a worrying issue as the manufacturers are trying to improve energy efficiency alongside complying with the performance standards in the coatings.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.1% |

The UV coatings market in Germany experiences a reliable growth, which is driven mainly by the solid industrial infrastructure, the high demand for advanced coatings, and the tough EU environmental regulations. The car making sector is one of the major players, using UV coatings for glossy surfaces and for protecting parts. The electronics and packaging industries are also resorting more and more to UV-cured coatings for their durability and performance enhancement.

Furthermore, wood and furniture businesses are applying innovative coatings which are not only anti-bacterial but also resistant to scratches, thus, adding to the durability and attractiveness of the products. In spite of the encouraging signs, there are difficulties persist such as excessive costs and reliance on specially designed equipment for UV-curing.

However, explorations into bio-based and energy-efficient UV coatings are the main catalysts for solving these problems, which besides promoting the environmental sustainability, also give more affordable for manufacturers' solutions and hence, increase the market's profitability potential.

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 4.6% |

The Japanese UV coatings industry is on the path to development thanks to the innovations in technology, a solid electronics production base, and the increasing availability of low-cost high-performance coatings. The automotive sector has been utilizing UV coatings for better scratch resistance and weather-proofing purposes.

The thriving consumer electronics sector of Japan is a significant factor. Touchscreen displays and protective layers, which are gaining popularity among manufacturers, are among the coatings. Moreover, the country is highly focused on increasing sustainability and energy efficiency, making LED-based UV curing technologies a point of research.

Challenges like the high cost of raw materials as well as the reluctance to accept bio-based alternatives, have contributed to the slow market growth. However, despite such challenges, the company's continuous efforts in innovation and development of eco-friendly technologies act as a strong driving force behind the demand for advanced UV coatings in a spectrum of industries.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.3% |

The UV coatings sector in South Korea is experiencing rapid offshoot, propelled by development in sectors such as electronics, automotive and industrial coatings. The sizable print and electronics sectors that the county has are the most important users of UV-cured protective coatings.

Aside from that, the boom in smart packaging solutions is yet another factor to the UV coatings occurrence increased in printed labels and flexible packaging. The policy measures are directed at the promotion of the adoption of environmentally friendly production practices through low-VOC and water-based UV coatings, which are consistent with the social responsibility of sustainability.

However, the application of these coatings is limited by difficulties such as raw material price volatility and high ultraviolet curing equipment expenditures. Nevertheless, the increase in UV coating solutions is attributed to the realignment of priorities to technological progression and the backing of the government for organic growth in companies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.5% |

Monomer-Based UV Coatings Lead Due to Versatility and Rapid Curing:

Monomer-based UV coatings dominate the market due to their speedy curing time along with being very flexible. These coatings are used in a wide range of industries such as automotive refinishing, electronics, and wood coatings. The monomers that are included in these formulations help build a solid polymeric structure that leads to durable gone Through polymer, improved chemical resistance, and general excellent performance.

A fast production rate is the main requirement of industries in addition, the demand for low viscosity and high-performance monomers is increasing, especially in North America and Europe where environmental regulations promote the use of sustainability-oriented, energy-efficient coatings.

Oligomer-Based UV Coatings Gain Traction for High-Performance Applications:

The progress in monomer formulations not only develops the adhesion properties but also propels, these coatings to be used in high-performance applications in different sectors. Oligomer-based UV coatings are gaining traction in high-performance applications, thanks to their high molecular weight and superior mechanical properties. These coatings are particularly needed in industries where reliable and resistant coatings are crucial due to the adverse environment caused by the exposure to chemicals, wiping, and electrical machines.

Though the oligomer based coating has a slightly thick consistency, they provide longer lasting protection, better hardness, and adhesion, which makes them preferable to use in high stress situations. The need for these coatings in the Asia-Pacific region is high due to the rapid development of the electronic and packaging industries. As technology improves Oligomer-based UV coatings have started to be used even more in processes that have to meet high durability and performance.

Water-Based UV Coatings Gain Popularity for Eco-Friendly Benefits:

Water-based UV coatings are widely becoming popular for their eco-friendly features such as low volatile organic compound (VOC) emissions. These coatings are applied in places where sustainability and regulatory compliance are a must such as furniture, automotive interiors, and packaging. With the introduction of waterborne UV curing technology, these coatings have developed adhesion, durability, and chemical resistance thus making them widely used.

Waterborne UV coatings, in particular, are strong in North America and Europe where the strict environmental policies are prompting the manufacturers to go for low-emission and sustainable solutions. Along with the needs of consumers and regulators for greener products, the market for water-based UV coatings is anticipated to grow sales in a variety of sectors like packaging, and vehicular industries, and so on.

Solvent-Based UV Coatings Remain Relevant for High-Performance Needs:

Solvent-Based UV Coatings Remain Relevant for High-Performance Needs: Solvent-based UV coatings continue to play a crucial role in applications where high chemical resistance, gloss, and durability are essential.

These coatings are widely used in industries like aerospace, automotive exteriors, and electronics, where superior performance is required. Despite growing environmental concerns and regulations around VOC emissions, solvent-based UV coatings remain relevant, especially in regions with developing regulatory frameworks, such as parts of Asia and Latin America.

Manufacturers are adapting to the evolving market by developing low-VOC solvent-based coatings that maintain performance while addressing environmental concerns. These formulations strike a balance between meeting strict performance standards and complying with environmental regulations, ensuring that solvent-based UV coatings will continue to meet the needs of high-performance industries for years to come.

UV Coatings Market is among the fastest-growing segments in the coatings sector, promoting high-performance, environmentally safe, and energy-efficient options for various areas of application. These UV coatings have properties that are chemical resistant, more durable, and cure quickly, thus they are widely used in automotive, electronics, packaging, and wood coatings industries.

The development of the market is ensured by the increasing need for the eco-friendly coatings, strict environmental regulations, and advancement of technology. Global powerhouses are running the industry, but regional companies are inclined to prioritize cost-efficient and specific applications.

The UV Coatings Market is undergoing a fast-paced expansion phase which is wedged between the soaring demand for eco-friendly, technologically advanced, and high-performing coatings. Well-known entities are backing R&D, sustainability programs, and strategic acquisitions as a means to cement their positions on the market. New entrants are emphasizing cost-effective and niche applications to gain market share.

Thanks to an uptick in the automotive, electronics, and industrial uses, the sector is set on a path of growth. Future developments will include innovations like bio-based UV coatings, water-based formulations, and smart coating technologies, which will in turn, lead to more competition and innovation in the industryLeverage your time and sleep better with plan.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| AkzoNobel N.V. | 14-18% |

| PPG Industries Inc. | 12-16% |

| BASF SE | 10-14% |

| Axalta Coating Systems | 8-12% |

| Sherwin-Williams | 6-10% |

| Other Companies (Combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| AkzoNobel N.V. | Leading provider of UV-curable coatings for industrial, wood, and packaging applications. |

| PPG Industries Inc. | Develops high-performance UV coatings with advanced scratch resistance and fast curing properties. |

| BASF SE | Specializes in sustainable and low-VOC UV coatings for automotive and industrial applications. |

| Axalta Coating Systems | Offers UV coatings designed for improved durability, weather resistance, and eco-friendliness. |

| Sherwin-Williams | Manufactures advanced UV coatings for wood, furniture, and specialty coatings applications. |

Key Company Insights

AkzoNobel N.V.

AkzoNobel is the world leading manufacturer of UV-curable coatings, providing many solutions for industrial, wood, and packaging applications. The company is committed to sustainability by integrating low-VOC and high-performance formulations. AkzoNobel spends a lot on R&D, which helps the company to innovate in scratch-resistant, adhesion, and fast-curing technologies. With a powerful global presence and a variety of products, the company is on its way to grow its market leadership in UV coatings.

PPG Industries Inc.

PPG Industries is a one of the best companies in the market of UV coatings. It provides the most effective formulas for automotive, electronics, and industrial applications. The company prefers working on durable, resistant to chemicals, and quickly drying technical issues. PPG's strategic redo in nanotechnology and its development of water-based UV coatings place it in a central role as an innovator in environmentally friendly coatings. Thanks to its global distribution network and modern R&D facilities, PPG observes a stronghold in the UV coatings segment.

BASF SE

BASF SE is a company that mainly focuses on low-VOC and eco-friendly UV coatings for automotive, wood, and industrial sectors. The company incorporates ecological chemistry into its product development according to strict environmental standards. These UV coatings from BASF not only provide the surface with protection but also help it in resisting scratches and improving aesthetics. Advancements in technology and acquisitions have driven its business in high-performance coatings which make it durable for industrial manufacturers.

Axalta Coating Systems

Axalta Coating Systems manufactures weather and UV resistant coatings that are highly durable for automotive, packaging, and general industrial applications. The company aims to design high-gloss, fast-drying coatings that will be more cost and resource efficient. Axalta's persistent quest for customized UV capabilities has put it in a position to conquer minor sections in distinct markets. By developing advanced resources and growing its presence in new markets, Axalta is still a major player in the UV coatings sector.

Sherwin-Williams

Sherwin-Williams is the leading manufacturer of UV coatings for wood, furniture, and specialty coatings. The company's drive for technological advancements in curing and environmentally friendly coatings has been the reason for its long-lasting strong market presence. The company is involved in the production of high-performance UV solutions, which are more resistant, longer-lasting, and color insusceptible, and also resistant to chemicals. Due to the already established.

The global UV Coatings Market is projected to reach USD 4,499.7 million by the end of 2025.

The market is anticipated to grow at a CAGR of 5.2% over the assessment period.

By 2035, the UV Coatings Market is expected to reach USD 7,470.5 million.

In terms of end users, the automotive segment is expected to account for a dominant share of the global UV coatings market.

Major companies operating in the UV Coatings Market Hempel A/S, Nippon Paint Holdings, DSM Coatings, Axion Specialty Coatings, Sokan New Materials.

In terms of Composition: the industry is divided into Monomer, Oligomer, (Polyester, Polyether, Polyurethane, Epoxy), Photo Initiator, Additives

In terms of Type: the industry is divided into Water-Based, Solvent-Based

In terms of End Use: the industry is divided into Wood & Furniture, Electronics, Automotive, Paper & Packaging, Industrial Coatings, Building & Construction

The report covers key regions, including North America, Latin America, Western Europe, Eastern

Anti-seize Compounds Market Size & Growth 2025 to 2035

Industrial Pipe Insulation Market Trends 2025 to 2035

Colloidal Silica Market Demand & Trends 2025 to 2035

Perfluoropolyether (PFPE) Market Size & Trends 2025 to 2035

Cold Rolling Oils/Lubricants Market Size & Growth 2025 to 2035

Basic Methacrylate Copolymer Market Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.