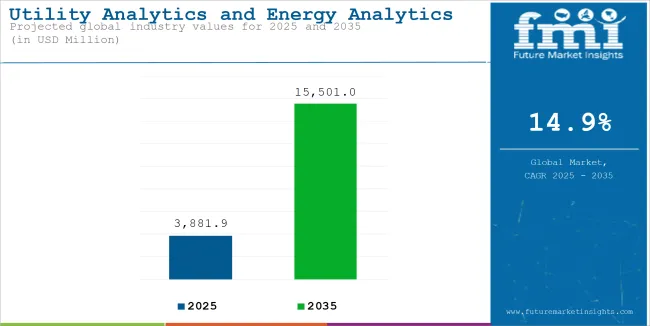

The global sales of Utility Analytics and Energy Analytics are estimated to be worth USD 3,881.9 million in 2025 and anticipated to reach a value of USD 15,500.99 million by 2035. Sales are projected to rise at a CAGR of 14.9% over the forecast period between 2025 and 2035. The revenue generated by Utility Analytics and Energy Analytics in 2024 was USD 3380.0 million. The market is anticipated to exhibit a Y-o-Y growth of 7.3% in 2025.

Utility analytics and energy analytics market encompasses superior data analytics solution that enables smart optimization in power generation, supply, and use. Big Data, AI, and IoT provide real-time intelligence on energy use. Predicting needs, maximizing productivity, and enabling grid resiliency and performance are enabled using utility and energy analytics to create cost efficiency as well as fulfillment of sustainability for these organizations with access to renewable integration into the utility grid.

Market provides an essential means to support the achievement of smarter, more efficient and sustainable energy management for energy providers, utilities and end-users alike.

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 17981.7 million |

| Estimated Size, 2025 | USD 3,881.9 million |

| Projected Size, 2035 | USD 15,500.99 million |

| Value-based CAGR (2025 to 2035) | 14.9% |

The two drivers of global markets are investment in renewable source energy and need to gain more efficient winds in energy. Development of this Utility Analytics and Energy Analytics Market has been assisted by SCADA systems, IoT-enabled sensors and predictive maintenance tools in the market. All of these would increase the efficiency of the turbines while decreasing the operating cost.

In that case, the first regions would be Europe and Asia-Pacific because such initiatives are supported through policies in those regions. North America maintains stability and follows an upward growth pattern. The integration of wind energy into smart grids and the growing global focus on carbon emissions reduction will also be an important driver for the expansion of the market.

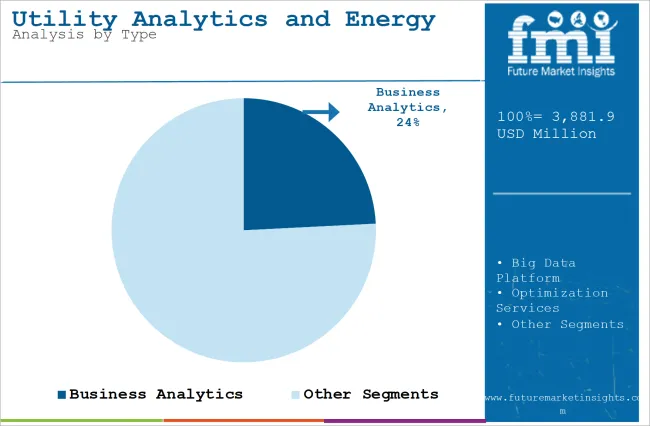

The section contains information about the leading segments in the utility analytics and energy analytics industry. by Deployment, the Cloud-based segment is estimated to grow at a CAGR of 16.7% during the forecasted period. moreover, By Type, the Business Analytics segment has holding the share of 61.1% in 2024.

| By Type | Business Analytics |

|---|---|

| Share (2025) | 24.2% |

Business Analytics holds the largest share in the Utility Analytics and Energy Analytics Market, as it is the critical enabler for the transformation of raw energy data into actionable insights. The business analytics uses business analytics to improve operational efficiency, enhance decision-making capabilities, and also enhance customer engagement.

The integration of predictive analytics, data visualization, and advanced reporting systems allows businesses to forecast energy demand, identify cost-saving opportunities, and ensure compliance with regulatory requirements. The dominance of this segment is further reinforced by the growing need for data-driven strategies in renewable energy integration, grid management, and competitive energy markets.

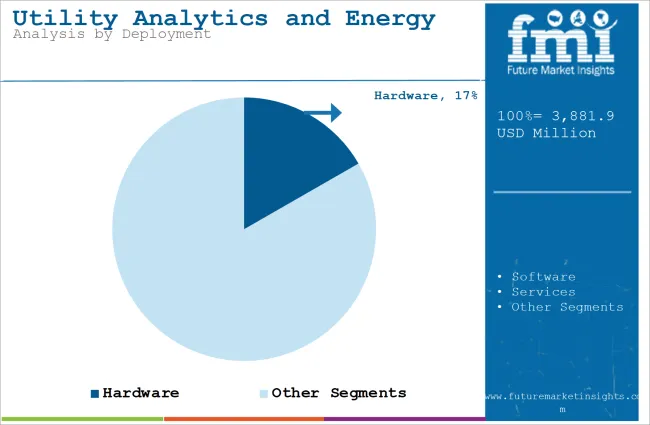

| By Deployment | Cloud-Based |

|---|---|

| CAGR (2025 to 2035) | 16.7% |

The cloud-based deployment segment in the Utility Analytics and Energy Analytics Market is leading with the highest CAGR owing to its flexibility, scalability, and cost-efficient nature. In this regard, cloud-based solutions allow utilities and energy providers to reach analytics tools and services without major on-premises infrastructure that makes them all the more preferable for small-to-medium-sized enterprises and emerging markets.

Such solutions also enable real-time data analysis, remote monitoring, and smooth integration with IoT-enabled devices. These are considered crucial in managing modern energy systems. This segment is expected to experience rapid growth over the forecast period with the rising adoption of renewable energy sources and smart grids coupled with advancements in cloud computing technologies.

The below table presents the expected CAGR for the global utility analytics and energy analytics market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the year from 2025 to 2035, the business is predicted to surge at a CAGR of 13.3%, followed by a slightly higher growth rate of 13.6% in the second half (H2) of the same year.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 13.3% (2024 to 2034) |

| H2, 2024 | 13.6% (2024 to 2034) |

| H1, 2025 | 14.9%(2025 to 2035) |

| H2, 2025 | 15.1% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 14.9% in the first half and remain relatively moderate at 15.1% in the second half. In the first half (H1) the market witnessed a decrease of 40 BPS while in the second half (H2), the market witnessed an increase of 50 BPS.

Rising Adoption of Smart Grids and Advanced Metering Infrastructure to Optimize Energy Distribution and Consumption

Growing adoption of smart grids and advanced metering infrastructure (AMI) is a significant driver for the Utility Analytics and Energy Analytics Market. Smart grids rely heavily on real-time data collection and analysis to monitor and optimize energy distribution, reduce outages, and improve overall grid reliability.

Advanced metering infrastructure further facilitates the collection of granular energy usage data from consumers, enabling utilities to implement demand-response programs and dynamic pricing strategies. This also empowers the energy providers to better manage their operational efficiency, minimize costs, and incorporate renewable sources of energy effectively, thus requiring advanced analytics solutions.

Increasing Emphasis on Renewable Energy Integration and Sustainable Energy Management

The drive toward renewable sources, such as wind, solar, and hydroelectric power, compels the industry to develop and deploy sophisticated analytics tools to ensure management of variability while ensuring grid stability. Utility analytics is used significantly in forecasting the demand for energy, balancing the supply, and connecting renewable energy into traditional energy systems.

With many governments and companies around the globe committing to reduction in carbon emissions with net-zero objectives, energy analytics solutions have gained importance in terms of optimizing generation and storage in energy. They help in good decision-making while reducing wastage of energy, thereby increasing efficiency in renewable energy, which helps drive the market growth.

Growing Need for Predictive Maintenance and Operational Efficiency in Utility Infrastructure

The demand for predictive maintenance solutions enabled by analytics is fueled by aging utility infrastructure and increasing operational complexities. Utility and energy analytics enable providers to monitor equipment health, predict failures, and schedule proactive maintenance, thereby reducing downtime and extending the lifespan of assets.

Analytics solutions also streamline energy distribution and consumption processes, optimize workforce deployment, and improve customer satisfaction through data-driven insights. This increasing emphasis on the improvement of operational efficiency and ensuring reliability in energy systems is an important growth driver for the market.

High Implementation Costs and Data Integration Challenges in Legacy Systems

The initial investments required for implementing advanced utility and energy analytics solutions are a significant barrier to market growth. Utilities in developing regions are often limited by budget and cannot easily justify investing in analytics tools. Modern analytics solutions also pose technical and operational integration challenges with legacy systems and infrastructure.

These are data silos, lack of standardization, and compatibility concerns that can hamper the seamless adoption of analytics technologies. Therefore, smaller utilities and those in resource-constrained regions might delay or limit their adoption of advanced analytics, thus affecting market growth.

The global Utility Analytics and Energy Analytics industry recorded a CAGR of 14.9% during the historical period between 2020 and 2024. The growth of Utility Analytics and Energy Analytics industry was positive as it reached a value of USD 17981.7 million in 2024 from USD 1942.6 million in 2020.

From 2020 to 2024, the Utility Analytics and Energy Analytics Market experienced steady growth, driven by the increasing adoption of smart grids, advanced metering infrastructure, and IoT technologies. During this period, the focus was primarily on digital transformation in utilities, optimizing energy distribution, and managing growing renewable energy inputs into grids. However, the regional adoption was delayed due to relatively high implementation cost and integration complexities related to legacy system issues.

Therefore, from 2025 onwards up to 2035, the market is to grow at a rapid pace owing to the improvements in AI, machine learning, and big data analytics becoming cheap and affordable by many. Governments and organizations worldwide are projected to intensify investments in grid modernization, predictive maintenance, and sustainable energy management to meet rising energy demand and carbon neutrality goals.

This period will also see rapid growth in emerging economies, where urbanization and infrastructure development will drive the adoption of energy analytics, leading to a significantly higher CAGR compared to the earlier phase.

Tier 1 players include IBM Corporation, Siemens AG, Schneider Electric, Oracle Corporation, and General Electric (GE), which dominate the market with their extensive portfolios in utility and energy analytics. These companies are global leaders, leveraging their expertise in advanced technologies like AI, big data, and IoT to offer end-to-end analytics solutions for utilities. Their strong market presence, wide customer base, and ability to cater to large-scale projects position them as key influencers driving innovation and market trends.

Tier 2 players like ABB Ltd, SAP SE, Hitachi Energy, SAS Institute, and Microsoft Corporation are specialized in providing energy analytics solutions and leveraging regional expertise. These companies are known for their ability to integrate analytics into renewable energy management, smart grids, and operational efficiency tools. They are not at the same level as Tier 1 players, but their targeted offerings and strategic collaborations with utility companies make them a significant contributor to market growth.

Tier 3 companies include Teradata Corporation, TIBCO Software Inc., Itron Inc., AutoGrid Systems Inc., and EnergyHub. They specialize on niche applications or regional markets, often targeting specific niche areas, such as demand response, distributed energy resource management, and customer engagement analytics. Their agile operations, cost-effective solutions, and innovation in targeted areas create a competitive edge over larger players, especially in underserved or emerging markets.

The section below covers the industry analysis for the Utility Analytics and Energy Analytics market for different countries. The market demand analysis on key countries in several countries of the globe, including USA, France, Italy, China and India are provided.

The united states are expected to remains at the forefront in North America, with a value share of 65.8% in 2025. In South Asia & Pacific, India is projected to witness a CAGR of 17.2% during the forecasted period.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 12.6% |

| Germany | 11.8% |

| France | 13.6% |

| China | 14.8% |

| India | 15.3% |

The United States is one of the most promising markets for utility and energy analytics, due to its developed energy infrastructure and broad implementation of smart grid technologies. Federal and state initiatives, including grid modernization programs and renewable energy mandates, have led to a heightened demand for advanced analytics in order to optimize the distribution of energy and ensure reliability in the grid.

The increasing trend in integrating renewable sources, such as wind and solar power, into the grid in the country makes the integration even more demanding and calls for analytics solutions to address variability and stability issues.

High penetration of IoT-enabled devices and smart meters in utilities enable the collection of massive data volumes, and utilities start using analytics tools to analyze demand, predictive maintenance, and energy efficiency. Strong R&D investments and the presence of global technology leaders further contribute to the United States' growth in this market.

Growth in the utility and energy analytics market in France is tremendous due to strong governmental support for a renewable energy transition and ambitious decarbonization targets. This is seen through its country-wide energy strategy involving phasing out fossil fuels, which calls for a strong presence of wind and solar and more reliance on nuclear power.

Thus, it's in the dire need for developed analytics in its energy management operations. France's commitment to modernizing its grid infrastructure, for example through the Linky smart meter rollout, has furthered the adoption of analytics tools to monitor and optimize real-time energy use.

Integrating renewable sources into the European energy grid also calls for robust analytics in balancing supply and demand in a reliable and sustainable manner. Another driver of growth in the energy analytics market in France is the presence of leading energy companies and innovative startups.

Growth of the Indian utility and energy analytics market is fuelled by rising energy demand in India, growing urbanization, and aggressive renewable energy targets. The country aims for 500 GW of renewable energy capacity by 2030 and is driving massive investments in solar and wind energy projects, which require advanced analytics to manage variability and optimize grid integration.

An improvement in the living standards of people has led to high electricity consumption, thereby encouraging utilities to adopt analytics-based solutions for demand forecasting, load balancing, and energy efficiency.

Government initiatives such as smart grid projects and the deployment of smart meters under the National Smart Grid Mission (NSGM) further accelerate the adoption of analytics tools. Moreover, the focus of India on improving grid reliability and reducing transmission losses through data-driven insights positions it as a high-growth market for utility and energy analytics.

The competition landscape of Utility Analytics and Energy Analytics Market is primarily dominated by global players, specialized companies within the domain of wind energy, and upcoming regional players. Leaders include Siemens AG, General Electric (GE), ABB Ltd., Schneider Electric, and Rockwell Automation, having a strong control over the automation market with deep portfolios and wider global distribution channels.

Specialized players include Vestas Wind Systems, Nordex SE, and Suzlon Energy- focusing on dedicated wind energy-related solutions. A part of the localized competition also results from supplying efficient and niche-based solutions, particularly through players like Ingeteam and Delta Electronics.

Such keen competition fosters speed in innovation in more investments that go into Research and Development by leveraging the implementation of technologies advanced to AI and IoT, followed by predictive maintenance. Some other common strategies for expanding market presence and capability include strategic partnerships and acquisitions.

Recent Industry Developments in Utility Analytics and Energy Analytics Market

In terms of Type is segregated Business Analytics, Big Data Platform, Optimization Services and Information Integration and Governance.

In terms of Component, is distributed into On-Premise and Cloud.

In terms of Application, is segregated Billing Support, Energy Efficiency, Revenue Protection, Load Research and Forecasting, Distribution Planning and Operation and Others.

In terms of Industry, is segregated Oil & Gas, Energy, Utilities, Electricity, Water and Waste and Recycle.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & pacific, Middle East and Africa (MEA) have been covered in the report.

The global utility analytics and energy analytics industry is projected to witness CAGR of 14.9% between 2025 and 2035.

The global utility analytics and energy analytics industry stood at USD 17981.7 million in 2024.

The global Utility Analytics and Energy Analytics industry is anticipated to reach USD 15500.99 million by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 11.9% in the assessment period.

The key players operating in the global utility analytics and energy analytics industry include IBM Corporation, Siemens AG, Schneider Electric, General Electric (GE), Oracle Corporation and others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Utility-Scale Low Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Markers Market Size and Share Forecast Outlook 2025 to 2035

Utility Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Utility Based Medium Voltage Switchgear Market Size and Share Forecast Outlook 2025 to 2035

Utility Based Shunt Reactor Market Size and Share Forecast Outlook 2025 to 2035

Utility Terrain Vehicles Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Open Loop Current Transducer Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Transmission Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Low Voltage Distribution Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Power Optimizer Market Size and Share Forecast Outlook 2025 to 2035

Utility Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale High Voltage Digital Substation Market Size and Share Forecast Outlook 2025 to 2035

Utility Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar PV EPC Market Size and Share Forecast Outlook 2025 to 2035

Utility Scale High Voltage Power Transformer Market Size and Share Forecast Outlook 2025 to 2035

Utility Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA