The USA SPL management market is anticipated to be valued at USD 23,491.3 million by 2025 and USD 80,629.4 Million by the end of 2035 and poised at a CAGR of 13.1% from the period 2025 to 2035. Increased regulatory requirement, growing adoption of cloud-based SPL management solutions and rising complexity of labelling of pharmaceutical and biotechnology products are propelling the market.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size 2025 | USD 23,491.3 million |

| Projected USA Industry Size 2035 | USD 80,629.4 million |

| Value-based CAGR from 2025 to 2035 | 13.1% |

The severe FDA regulations such as electronic submission of labelling content for pharmaceuticals and medical device; the need for structured product label management is also rising. The quality, compliance and productivity provided by AI and automation propel by SPL systems will guide in a more prominent and faster adoption across industry groups. Multi-Cloud Based data solutions continue to grow in a modern fast-paced world of agile, API-driven, real-time regulatory updates.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

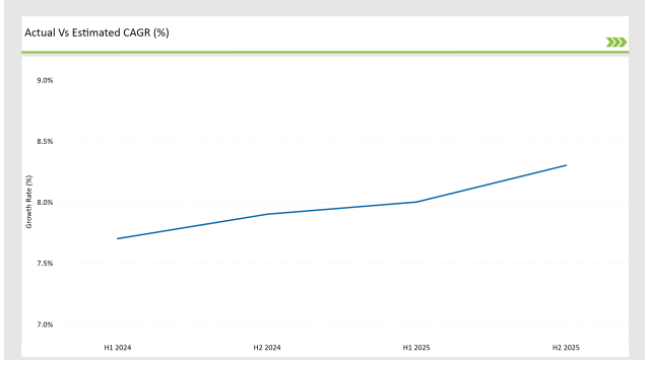

The following table highlights the compound annual growth rate (CAGR) trends for the USA SPL market over six-month intervals, providing insights into the market’s growth momentum.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 12.7% |

| H2, 2024 | 12.9% |

| H1, 2025 | 13.0% |

| H2, 2025 | 13.3% |

H1 signifies January to June, while July to December analysis is signified through H2.

Market growth is driven by the accelerated digital transformation of regulatory processes, increased adoption of cloud-based SPL platforms, and regulatory compliance pressures. The incremental growth from 12.7% in H1 2024 to 13.3% in H2 2025 reflects the industry's rapid evolution and adaptation to new regulatory challenges.

| Date | Development/M&A Activity & Details |

|---|---|

| Jan-2025 | Veeva Systems launched an AI-driven SPL management tool for pharmaceutical companies. |

| Oct-2024 | Oracle acquired a regulatory software firm to strengthen its SPL compliance offerings. |

| Mar-2024 | FDA updated SPL submission guidelines, requiring real-time compliance reporting. |

| Sep-2024 | Medidata partnered with leading CROs to integrate SPL automation in clinical trials. |

| Dec-2023 | IBM introduced blockchain-based SPL tracking for enhanced security and compliance. |

Regulatory providers are focused on investing in AI-driven automation, cloud-based label management, and block-chain solutions to enhance compliance and efficiency. SPL vendors partnership with pharmaceutical, biotech and CRO companies are facilitating regulatory process and making product information dissemination simpler.

Automation Enhances SPL Compliance

Pharmaceutical companies increasingly integrate automation and AI into SPL management to improve compliance accuracy. AI-based SPL solutions reduce manual errors, enhance efficiency, and enable faster regulatory submissions. These innovations ensure that structured product labels comply with evolving FDA and global regulatory standards.

Cloud-Based SPL Management Solutions Gain Popularity

Cloud SPL solutions capture the market due to their scalability, remote comprehensive overview, and real-time update. These solutions help meet rising demand for collaborative regulatory workflows, while streamlining compliance across pharmaceutical and medical device companies.

Regulatory Authorities Push for Digital Submissions

The FDA and other regulatory bodies are accelerating the shift toward electronic SPL submissions, compelling life sciences companies to invest in digital labeling solutions. These regulations enhance transparency, reduce approval times, and minimize compliance risks.

Integration of Blockchain for SPL Security

Leading SPL vendors are exploring blockchain technology to ensure data integrity, track label changes, and prevent counterfeiting. Blockchain-enabled SPL solutions provide a tamper-proof digital record, ensuring compliance with stringent regulatory requirements.

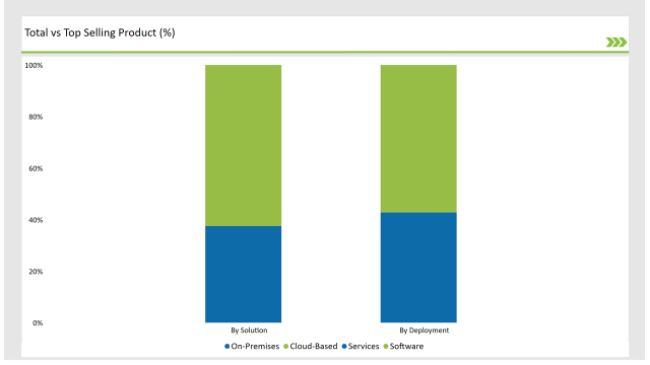

| Solution | Market Share (2025) |

|---|---|

| Software | 62.5% |

| Services | 37.5% |

Software solutions dominate the SPL market due to their automation capabilities, regulatory compliance features, and integration with enterprise IT systems. The services segment is growing steadily, driven by increasing demand for regulatory consulting, implementation support, and managed SPL solutions.

| Deployment Type | Market Share (2025) |

|---|---|

| Cloud-Based | 57.2% |

| On-Premises | 42.8% |

Cloud-based SPL solutions lead due to their cost-effectiveness, security, and ease of scalability. On-premises deployment remains significant among large pharmaceutical companies requiring customized compliance workflows and data control.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

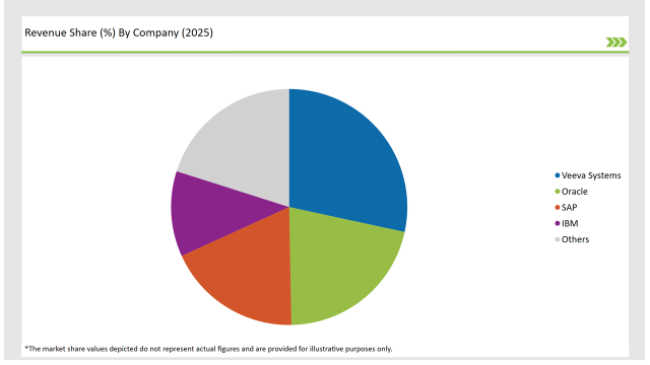

The major players in the market are focused on leveraging AI, cloud, and blockchain technologies to differentiate their SPL solutions from others. Vendors such as Veeva Systems, Oracle, SAP and IBM are dominating due to their strong regulatory expertise and digital capabilities.

| Vendors | Market Share (2025) |

|---|---|

| Veeva Systems | 28.4% |

| Oracle | 21.3% |

| SAP | 18.5% |

| IBM | 11.7% |

| Others | 20.1% |

Software and Services. Software leads due to automation, compliance, and integration features.

Cloud-Based and On-Premises. Cloud adoption is accelerating due to its scalability and efficiency.

Pharmaceutical Companies, Biotechnology Companies, Medical Device Companies, Regulatory Authorities, and CROs. Pharmaceuticals and biotechnology lead SPL adoption.

The USA Structured Product Label Management Market will grow at a CAGR of 13.1% from 2025 to 2035.

By 2035, the industry is projected to reach USD 80,629.4 million.

Key drivers include regulatory compliance mandates, AI-driven SPL automation, and increased cloud adoption.

The Software segment holds the highest share at 62.5%, driven by automation and compliance requirements.

Leading players include Veeva Systems, Oracle, SAP, and IBM, along with emerging regulatory technology providers.

| Estimated Size, 2025 | USD 64,983.6 million |

| Projected Size, 2035 | USD 210,576.2 million |

| Value-based CAGR (2025 to 2035) | 12.5% CAGR |

Explore Vertical Solution Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.