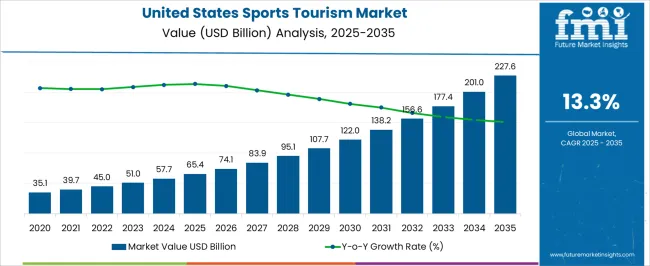

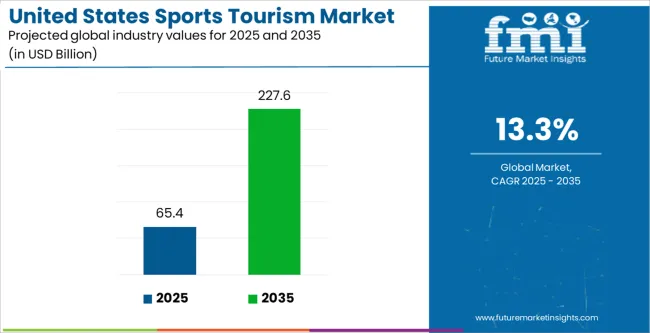

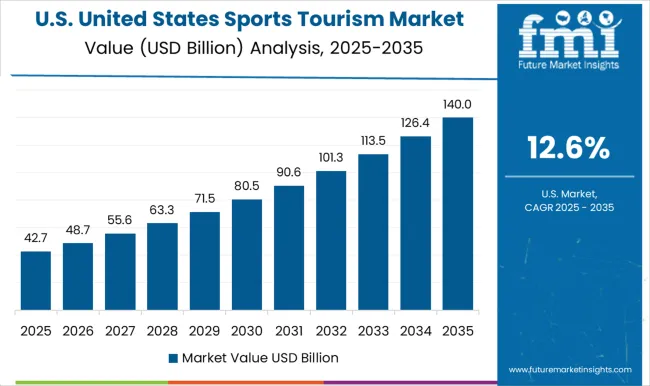

The United States Sports Tourism Market is estimated to be valued at USD 65.4 billion in 2025 and is projected to reach USD 227.6 billion by 2035, registering a compound annual growth rate (CAGR) of 13.3% over the forecast period.

| Metric | Value |

|---|---|

| United States Sports Tourism Market Estimated Value in (2025 E) | USD 65.4 billion |

| United States Sports Tourism Market Forecast Value in (2035 F) | USD 227.6 billion |

| Forecast CAGR (2025 to 2035) | 13.3% |

The United States sports tourism market is expanding at a strong pace, fueled by the rising popularity of domestic and international sporting events, increasing disposable income, and the growing integration of tourism with sports experiences. Cities across the country are leveraging major events to boost local economies, enhance infrastructure, and attract both domestic and international visitors.

Advances in digital engagement, ticketing platforms, and immersive fan experiences have amplified consumer participation in sports tourism. Additionally, the blending of leisure, travel, and sports has created new revenue opportunities for travel operators, stadiums, and host cities.

Sustainability measures and community-driven initiatives are also playing an important role, aligning sports tourism with broader economic and cultural development goals. The outlook remains positive as sports continue to serve as a key driver of tourism, offering unique experiential value and strong repeat visitation potential.

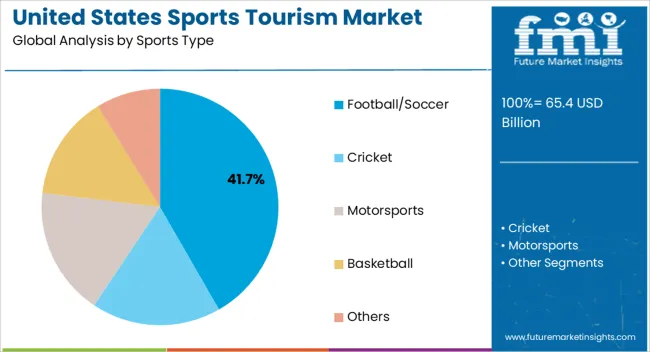

The football or soccer segment is expected to hold 41.70% of total revenue within the sports type category, making it the leading sport in the market. This leadership is attributed to the immense popularity of both domestic leagues and international tournaments hosted in the United States.

The sport’s extensive fan base, coupled with high attendance at live matches, has created sustained demand for travel, accommodation, and entertainment services associated with these events. Strong investments in stadiums and sports complexes, along with growing youth participation, have further supported its dominance.

The segment continues to benefit from the cultural influence of soccer and the rising profile of U.S. teams on the global stage, solidifying its position as a major driver of sports tourism.

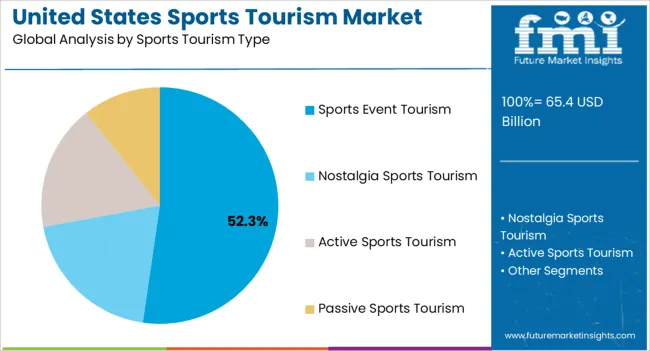

Sports event tourism accounts for 52.30% of the overall market revenue within the tourism type category, establishing it as the dominant subsegment. This growth is driven by the large-scale economic impact of tournaments, championships, and city-hosted events that attract both domestic and international tourists.

Fans are increasingly traveling to attend live matches, opening opportunities for hospitality, transportation, and retail businesses. Investments in event management infrastructure, combined with marketing campaigns promoting sports-driven travel experiences, have reinforced this segment’s prominence.

The cultural significance of marquee sports events has amplified repeat visitation and long-term brand loyalty for host cities, making sports event tourism a central pillar of the United States sports tourism market.

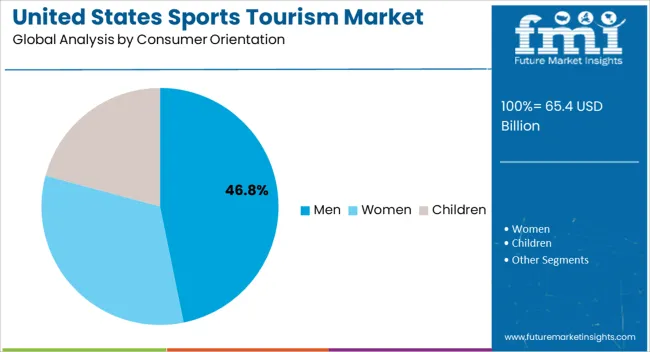

The men consumer orientation segment represents 46.80% of market revenue, marking it as the leading consumer group. This trend is influenced by higher levels of participation, attendance, and spending patterns among male sports enthusiasts.

Men are more likely to travel long distances to attend live matches and engage in complementary leisure activities such as merchandise purchases, hospitality experiences, and extended tourism packages. Sponsorship and marketing strategies targeting male audiences have further supported growth, alongside the strong influence of male-dominated sports leagues in the country.

While female sports tourism is rising steadily, men currently remain the primary contributors to revenue, underscoring their dominance in the consumer orientation category.

The United States sports tourism market grew significantly between 2020 and 2025, with more domestic and foreign visitors attending sporting events nationwide. The market saw an increase in demand for tickets, lodging, and travel services, boosting local economies.

Football, basketball, baseball, and soccer drew enormous crowds, and cities hosted significant tournaments and finals. Because of the 2024 pandemic, numerous events were canceled or held without spectators, causing short drop-in sports tourism.

Looking ahead, the sports tourism business in the United States is expected to rebound and maintain its upward trend from 2025 to 2035. The reintroduction of major sporting events and the gradual relaxation of travel restrictions are likely to boost visitor numbers.

Technological advancements, such as virtual reality experiences and improved stadium facilities, may attract more sports tourists. The United States' strong sports culture and world-class sporting infrastructure will continue to position the country as a prominent destination for sports enthusiasts, adding to the market's long-term growth.

The Upward Trend of Sporting Events in America

An increase in athletic events is expected to benefit the tourism industry by drawing more tourists to sporting facilities, fueling demand for the United States sports tourism. This is primarily driven by sporting events such as the NFL and NBA.

Increasing Seating Capacity in United States’ Sports Venues

Large seating capacities increase ticket sales and income production since sports event venues can accommodate more sports tourists. Increased revenue from ticket sales and sports packages is likely to increase the popularity of sports tourism in the United States.

Several sports clubs and events attempt to increase seating capacity to welcome sports tourists. As a result, new competitions staged in existing stadiums are expected to generate beneficial revenue for players in the sports tourism business.

From Obscurity to the Spotlight: Lesser-known Sports Gain Traction in the THE UNITED STATES

Certain sports, such as cricket, are not particularly popular in the region, but investments are also being made to establish infrastructure for such sports. The Major Cricket League (MCL) is scheduled to get a huge USD 120 million investment to build facilities in Philadelphia, New York, Miami, and San Francisco.

The Evolution of Technology

Due to technological advancements and widespread sports coverage, the demand for sports tourism in the United States is increasing. Live, and on-demand coverage is available everywhere.

The technology is also used in sports venues, where fans can observe the games in a larger format. Aside from that, athletes wear sensors, GPS is used to track the position in case the players commit a mistake, and various wearable technologies are utilized to avert accidents.

New online platforms have made checking in and handling the ticketing process easier and simpler, attracting a larger audience to sporting events.

This has fueled growth across E-Commerce websites and numerous social media handles, allowing fans to buy and sell tickets without going via ticketing services. As a result, the United States sports tourism market share is expected to increase rapidly between 2025 and 2035.

Everything from boots and outfits to helmets, pads, gloves, and sporting equipment is being updated with new high-tech and high-function features. Scoreboards are automated and linked to all global networks, and supporters can access wireless internet in stadiums. With such improvements, sports tourists are becoming more interested in traveling to see various sporting events, which is predicted to increase the adoption of sports tourism in the United States during the projection period.

Skyrocketing Ticket Prices Pose Challenges for the United States Sports Tourism

The high cost of tickets is one of the most significant difficulties linked with the sports tourism business in the United States. These tickets are only affordable to some, and people often hesitate to spend so much on an event that lasts only a few hours.

Seasonal Restrictions

Skiing and snowboarding, for example, are largely dependent on seasonal circumstances. While the United States provides various sports possibilities throughout the year, some places may be restricted due to weather conditions. This may impact the country's overall attractiveness as a sports tourism destination. Promoting alternate sports and events during off-peak seasons can help alleviate this problem.

Consumer Preferences Are Shifting

Sports tourists' interests and needs are continually changing. Visitors increasingly seek more engaging and experiential travel experiences, such as opportunities to engage with local communities, participate in sports activities, and attend sporting events. Adapting to these evolving preferences necessitates ongoing market research, innovation, and the provision of personalized experiences to diverse sectors of sports visitors.

According to Future Market Insights, North America will be one of the most appealing markets during the forecast period. The United States accounted for approximately 85.5% of the North American sports tourism market in 2025 and is predicted to increase rapidly.

Travel agencies and organizations are implementing clever business methods to attract customers and sports tourists to develop a stronger position in the sports tourism sector by offering enticing bargains, discounts, and a variety of other travel packages that visitors can't resist.

The THE UNITED STATES sports tourism market is dominated by the online booking segment.

| Segment | Booking Channel |

|---|---|

| Segment Name | Online Booking |

| Segment Share | 42.6% |

Due to the popularity of tourism and how well it has performed over time, tickets to such events can now be purchased and made available through Internet platforms.

Since using an online booking or mobile application platform offers a direct, hassle-free digital transaction, instant tracking, and increased security, tourists choose to do so. Online booking has become more commonplace all around the world as a result of the ability of travelers to utilize the internet to research and compare information on travel destinations, lodging options, restaurants, and other factors.

Active Sports Tourism is the most popular type of tourism in the United States sports tourism business.

| Segment | Tourism Type |

|---|---|

| Segment Name | Active Sports Tourism |

| Segment Share | 38.4% |

Active sports tourism has the largest market share in terms of total market share. Growth can be ascribed to millennials and younger adults' increased fondness for online games, as they have already had enough exposure to them. Active sports, as the name implies, entail active real-time participation of players in the arena and are more entertaining than online games.

Football is the most popular sport in the United States.

American football is the most watched spectator sport in the country. It is so popular that its championship tournament, the Super Bowl, is viewed by over half of all United States television homes and broadcast in over 150 countries worldwide.

People in America are not only watching football at home. In the United States, people flock to stadiums to watch games.

Package travel will dominate the United States sports tourism sector between 2025 and 2035.

Tourists frequently choose package travel because tour companies provide numerous package travel tours, some of which can be customized. Whereas in package tours, the operators even deliver some things not included in other types, such as lodging, significant discounts on package tours, etc.

The market share that belongs to men is supposed to be the leading.

The explanation is that there are currently more males than ever passionate about sports and willing to pay anything to see these events. The market share of the women's category has, however, also seen a dramatic increase. The cause is raising awareness and an increase in the number of working women compared to ten years ago. Therefore, in the upcoming years, the market can witness different figures.

In the United States sports tourism market, the age group of 26 to 35 has a significant market share.

People in this age group are working and strongly desire to travel and see new locations. People in this age group are better able to use the information that is accessible because they have a greater understanding of the world around them.

The majority of the market for tourists of all types is made up of domestic travelers.

The explanation is that domestic travelers know more about a location's history and game schedules. Additionally, booking a ticket and traveling to the site are more reasonably priced for domestic than foreign visitors. Domestic tourists encounter this kind of seamlessness more frequently, contributing to their larger market share.

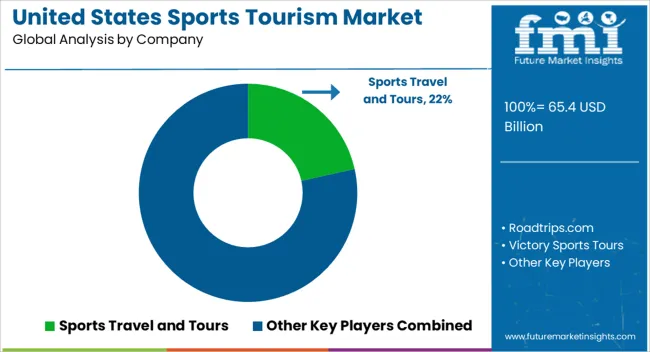

The United States sports tourism market is defined by a select group of established players and emerging entrants. A lot of major United States sports tourism players are putting more emphasis on the expanding trend of sports tourism. The major United States sports tourism players are diversifying their services to maintain market share.

Leading players in the United States and foreign businesses there concentrate on growth and new opportunities to extend their companies throughout the US islands. They have essentially started a pricing war to offer all services at reduced prices.

Key the United States Sports Tourism Market Players

| Company | Sports Group |

|---|---|

| Strategy | Sponsorship |

| Details | East Dean and Friston Cricket Club added Sports Group as a player sponsor in June 2025. |

| Company | Omega World Travel |

|---|---|

| Strategy | Awards |

| Details | Gloria Bohan of Omega World Travel was given the lifetime achievement award in November 2024. She received the honor for her outstanding contributions to the company and for helping to alter the industry as a whole. |

The global United States sports tourism market is estimated to be valued at USD 65.4 billion in 2025.

The market size for the United States sports tourism market is projected to reach USD 227.6 billion by 2035.

The United States sports tourism market is expected to grow at a 13.3% CAGR between 2025 and 2035.

The key product types in United States sports tourism market are football/soccer, cricket, motorsports, basketball and others.

In terms of sports tourism type, sports event tourism segment to command 52.3% share in the United States sports tourism market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

United Kingdom Interesterified Fats Market Size and Share Forecast Outlook 2025 to 2035

United Kingdom Car Rental Market Analysis – Growth, Applications & Outlook 2025–2035

United Kingdom (UK) Veneered Panels Market Analysis & Insights for 2025 to 2035

United Kingdom Women's Footwear Market Trends-Growth & Industry Outlook 2025 to 2035

United Kingdom Automotive Turbocharger Market Outlook – Share, Growth & Forecast 2025–2035

United Kingdom Yeast Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Green and Bio-based Polyol Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

United Kingdom Coated Fabrics Market Insights – Demand, Size & Industry Trends 2025–2035

United Kingdom Barite Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Compact Construction Equipment Market Growth – Trends, Demand & Innovations 2025–2035

UK Curtain Walling Market Report - Growth, Demand & Forecast 2025 to 2035

United Kingdom Flare Gas Recovery System Market Analysis – Size, Share & Forecast 2025–2035

United Kingdom Electric Golf Cart Market Growth – Demand, Trends & Forecast 2025–2035

United Kingdom Magnetic Separator Market Analysis – Size, Share & Forecast 2025-2035

UK River Cruise Market Analysis - Growth & Forecast 2025 to 2035

Competitive Breakdown of the United Kingdom Car Rental Market

United Kingdom Respiratory Inhaler Devices Market Growth – Demand, Trends & Forecast 2025 to 2035

United Kingdom Generic Injectable Market Trends – Size, Share & Growth 2025-2035

United Kingdom Zeolite for Detergent Market Analysis – Growth, Applications & Outlook 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA