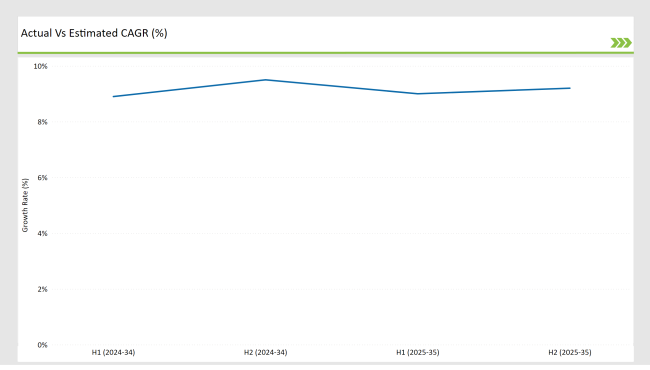

The USA prenatal vitamin supplement market is projected to reach a value of USD 189.7 Million in 2025, growing at a CAGR of 10.0% over the next decade to an estimated value of USD 492.1 Million by 2035.

This strong growth is due to factors such as the increasing awareness about maternal health, the growing adoption of prenatal supplements among expectant mothers, and the technological advancement in formulation.

Prenatal vitamin supplements are the basic building blocks for both mothers and developing babies to be in good health condition. These supplements are the richest sources of vitamins such as folic acid, iron, calcium, and omega-3 fatty acids that are needed for the pregnancy to be free from complications and fetal growth to be normal. The rise in popularity of the supplements of prenatal vitamins has been coupled with the increasing recognition of nutrition before and during pregnancy.

The market is navigating through a personalized nutrition trend, as companies make it possible to have tailor-made and blended supplement mixtures for each stage of pregnancy. Also, the popularity of plant-based and organic products has diversified the choice of consumers. The distribution channels of pharmacies, hospitals, and online retailers are the means through which these supplements reach out to women from various demographics thus further driving the market.

Amply-researched and the advent of new types like gummies, powders, and liquid prenatal supplements will bring the manufacturing sector profitably. Moreover, the increase in specialty health stores and retail outlets concentrating on health and wellness has made product availability conspicuous and customer relations palpable.

Explore FMI!

Book a free demo

The semiannual market update portrays consistent demand and increases in prenatal vitamin supplement use because health consciousness is developing among the customers and improved online as well as offline platforms.

H1 signifies period from January to June, H2 Signifies period from July to December

Growing preference for organic and non-GMO prenatal supplements along with recommendations by physicians have led to considerable market expansion. Increasing digital marketing influence and influencer-driven promotions also are important drivers for increasing adoption.

| Date | Development/M&A Activity & Details |

|---|---|

| January 24 | Bayer : Partnered with hospitals to distribute free prenatal vitamin samples to expectant mothers, improving accessibility and awareness of maternal nutrition. |

| March 24 | Nature Made: Launched a new DHA-enriched prenatal vitamin with improved absorption technology to support fetal brain and eye development. |

| May 24 | Garden of Life: Expanded its organic prenatal supplement line, introducing a plant-based formula with added choline for cognitive health. |

| July 24 | Smarty Pants Vitamins: Introduced a sugar-free prenatal gummy supplement fortified with methylated folate for better absorption and increased nutrient bioavailability. |

| September 24 | Rainbow Light: Developed a vegan-friendly prenatal multivitamin with added probiotics to enhance gut health and digestion for pregnant women. |

There is increasing demand for Prenatal Vitamin supplement in plant-based food formulations.

Growing Demand for Gummy and Liquid Prenatal Supplements

The transition of the market to gummy and liquid prenatal supplements is mainly a result of the customer's preference for easy-to-take forms. Traditionally, gummy and liquid prenatal supplements are often thought of as means for those women who find it hard to take pills or who are nauseated by taking them.

Gummy supplements have become the sweet and easy choice that people tend to pick first for the sake of their taste and being easy to carry. This has been helpful for patients who are depressed because of being forced to take tablets. Women who are thinking of conceiving are also learning about it as well and considering it as a solution.

These include essential acids like DHA, synthetic folate, and iron that are not found in basic liquid and gummy formats. The incorporation of new technologies in the formulations has made it.

Increased Emphasis on Personalized and Functional Prenatal Nutrition

The demand for customized healthcare requires a broader availability of customized prenatal vitamin supplements. Prenatal nutrition recommendations for pregnant women use data from genetic examinations along with information about the mother and tailored supplement guidance.

Also, functional prenatal with probiotics, collagen, and omega-3 derived from plants are gaining a new space in the market because, besides the essential vitamins, they also give other benefits. This will be a major force for the differentiation of the market and an agent for the expansion of the consumer's choice in the coming years.

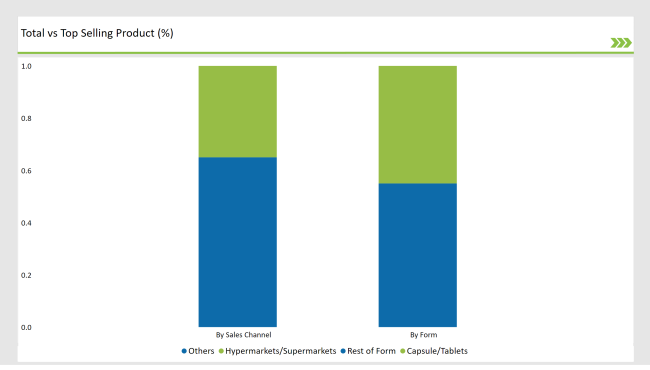

% share of Individual categories by Sales Channel and Forms in 2025

Capsules and Tablets Dominate the Market

For this year 2025, capsule and tablet prenatal supplements again dominated at 45% market share. This was still the most-used format mainly because this format is prescribed by healthcare professionals the most. These supplements were popular in being stable, long-shelf-life products, with precise dosing that provides the constant nutrient supply expected to be needed by the pregnant female.

Manufacturers are making formulation improvements in terms of improving the absorption, taste, and digestibility of these nutraceuticals. These are further driving the preferences of consumers towards a wider variety of prenatal supplement formats. But this is the evolution that better represents the knowledge of what people value in their health choices.

Food & Beverage Processing Drives Market Demand

Hypermarkets and supermarkets are projected to represent roughly 35% of the sales share by 2025, thus establishing themselves as a vital distribution channel for prenatal vitamin supplements.

Their widespread presence in urban and suburban regions greatly improves consumer convenience (because they showcase a broad array of prenatal supplements), which encompasses both prescription and over-the-counter (OTC) alternatives.

These supermarkets allow pregnant women to purchase merchandise in person; in-store pharmacy staff often guide selecting products. Still, hypermarkets and supermarkets offer competitive pricing as well as engaging promotions and discounts for bulk buying, which resonates with low-price shoppers.

Note: above chart is indicative in nature

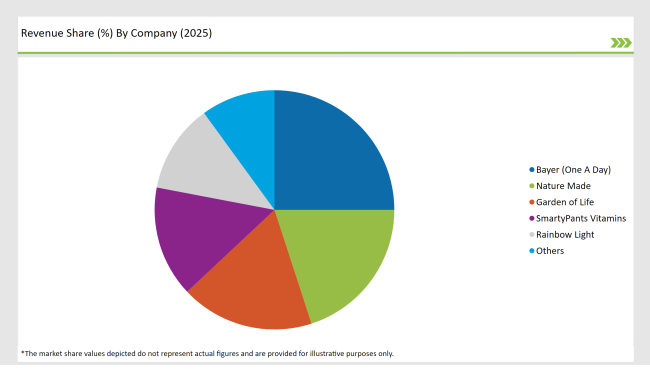

In the USA, prenatal vitamin supplements are mostly under proven brands, including Bayer, Nature Made, and Garden of Life which deliver various excellent formulations. They account for most of the market share due to good brand reputation, broad retail distribution, and funding in clinical trials mainly aimed at the improvement of efficacy.

Observable is the turn of organic, non-GMO, and vegan prenatal supplements, to the market, thus; the new entrants and niche bands are moving through the health-conscious customers. The emergence of e-commerce platforms has also facilitated small firms to compete with home deliveries and subscription-based supplement plans.

The increasing presence of healthcare professionals in the distribution of information on the advantages of prenatal vitamins to pregnant women has in conjunction with the aforementioned increased the rate of prescriptions and pharmacy sales of these products. However, the development of online retailers and specialty health stores made it accessible to people to find premium prenatal vitamins without the need for a prescription

The market is expected to grow at a CAGR of 10% from 2025 to 2035.

The USA Prenatal Vitamin supplement market is projected to reach USD 492.1 Million by 2035.

Capsules and tablets account for 45% of the market share, followed by gummies and liquid supplements.

The market is expanding due to increased maternal health awareness, growing adoption of prenatal supplements, and advancements in formulation technology.

Top manufacturers include Bayer (One A Day), Nature Made, Garden of Life, SmartyPants Vitamins, and Rainbow Light.

By form, the market includes capsule/tablets, gummies, powders, liquids, and other alternative formats.

By sales channel, the market is segmented into online, drug stores and pharmacies, hospitals and clinics, hypermarkets/supermarkets, convenience stores, health and wellness stores, specialty stores, and departmental stores.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Vegan DHA Market Outlook - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.