The USA Knotless Surgical Sutures Market valued at USD 194.9 million in 2025. As per FMI's analysis, the industry will grow at a CAGR of 3.6% and reach USD 278.6 million by 2035. The knotless surgical sutures industry in the USA made notable progress in 2024.

The utilization of these sutures had a radical increase in minimally invasive approaches, particularly in orthopaedic and cardiovascular procedures. According to FMI research, hospital procurement trends shifted toward absorbable types, and with good reason: the demand for fewer surgical complications and better healing results. Advanced suture materials are steadily replacing conventional sutures, driven by innovations from manufacturers with better tensile strength and biocompatibility.

Advanced products became more widely available with regulatory clearance in 2024 and were incorporated into high-throughput technologies in outpatient surgical centers. FMI suggests adoption was driven by increased surgeon awareness of the reduced complications associated with knotless sutures.

Forward-looking towards 2025 and beyond, technological developments such as antimicrobial coatings and the adoption of bioengineered sutures will drive industry expansion. The demand for knotless offerings will be driven at a more accelerated rate with an increased number of robotic-assisted surgeries, as these lower the risk of human error and are easier to operate.

Strategic partnerships between device manufacturers and healthcare providers will expand product availability and catalyze greater adoption. The steadily increasing volume of procedures, particularly among geriatric patients, FMI projects a steady demand base, supporting consistent growth throughout the forecast period.

Industry Forecast Table

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 194.9 million |

| Industry Value (2035F) | USD 278.6 million |

| CAGR (2025 to 2035) | 3.6% |

Explore FMI!

Book a free demo

The growing acceptance of minimally invasive and robot-assisted surgery is driving the steady growth of the knotless surgical sutures industry in the USA.

Less complications and shorter procedure times benefit hospitals and surgery centers, while established suture producers face pressure to innovate. Greater improvement in bioengineered and antimicrobial sutures will increasingly boost industry growth.

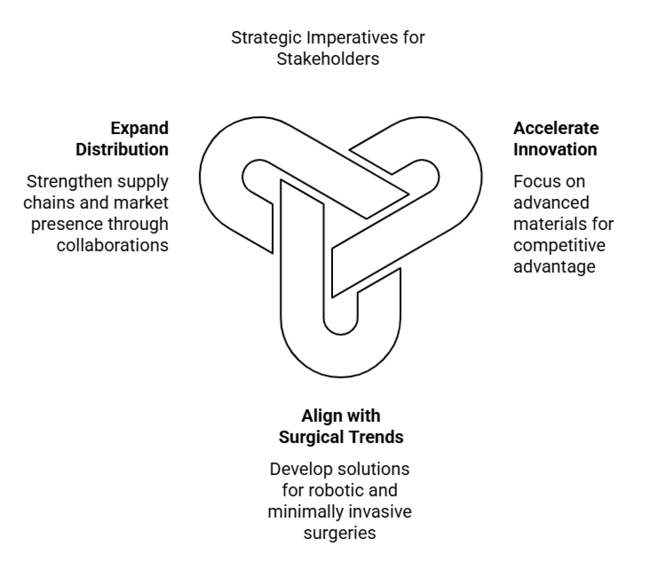

Accelerate Innovation in Suture Materials

Executives need to invest in antimicrobial-coated and bioengineered sutures to improve healing results and create a competitive advantage. High-precision surgeries will be driven by advanced materials and expand industry share.

Align with robotic and minimally invasive surgical trends

Firms need to create knotless suture solutions that are tailored to robotic-assisted and laparoscopic procedures. Joint ventures with surgical robotics companies and training for healthcare professionals will reinforce industry positioning.

Expand distribution and healthcare collaborations

Hospital supply contract strengthening and alignment with group purchasing organizations (GPOs) will enhance availability. Strategic buyouts of specialized suture manufacturers can speed portfolio diversification and penetration into regional industries.

| Risk | Probability & Impact |

|---|---|

| Regulatory Hurdles & Compliance Changes | High Probability - High Impact |

| Competition from Alternative Wound Closure Methods | Medium Probability - High Impact |

| Supply Chain Disruptions & Raw Material Shortages | Medium Probability - Medium Impact |

| Priority | Immediate Action |

|---|---|

| Advanced Suture Material Development | Accelerate R&D on bioengineered and antimicrobial sutures |

| Surgeon Training & Adoption Programs | Initiate partnerships with hospitals to provide hands-on training for robotic and minimally invasive procedures |

| Supply Chain Resilience | Secure alternative suppliers and evaluate nearshoring options for critical raw materials |

To stay ahead, executives need to focus on innovation in cutting-edge suture technologies and extend convergence with robotic and minimally invasive surgical systems in order to maintain a competitive edge. As regulatory reforms loom ahead, synchronization of product development according to changing standards of compliance will be imperative.

Hospital alliance solidification and maximizing supply chain buoyancy will build long-term security. This insight redefines the roadmap by prioritizing high-value product differentiation, speeding up go-to-industry approaches for future-generation sutures, and locking in strategic partnerships that future-proof growth.

Global Consensus:

Technological Changes at Lightning Speed:

Regional Variations in Adoption:

Consensus on Suture Material:

Application-specific Requirements:

Cost Considerations:

Bulk Buy & Supplier Reliability:

Impact of FDA & Surgical Guidelines:

Condition of Participation & Conditions of Payment (Hospital Accreditation & Reimbursement Policies):

R&D & Innovation Trends:

Industry Growth Outlook:

Strong Industry Drivers:

Most Important Industry Distinctions:

Strategic Insight:

Hospital type, surgical specialty, and price sensitivity segmentation are essential to capture a wide industry range.

| Region | Regulatory Impact & Certifications |

|---|---|

| Northeast | The FDA enforces strict regulations under 21 CFR Part 820, which include strict quality control mandates. Adherence to ISO 13485:2016 and The Joint Commission (TJC) standards affects hospital procurement. New York requires added state-level safety approvals. |

| Midwest | Manufacturers have to use FDA 510(k) or PMA routes for new products. Illinois mandates Good Manufacturing Practices (GMP), and Minnesota demands biocompatibility testing and post- industry surveillance for ensuring safety. |

| Southeast | The FDA Unique Device Identification (UDI) regulation is central for sutures' tracking. Alignment with CMS reimbursement guidelines influences procurement by hospitals, while ASTM F2118-14 requires tensile strength and absorption testing within North Carolina. |

| Southwest | Texas mandates TAC Title 25 for health standards and ISO 14971 for risk control. There is a growing interest in the EPA guidelines for biodegradable sutures. The Medical Device Excise Tax influences pricing approaches. |

| West | California is the most regulated state, with Proposition 65 for material safety and extra CDPH licensing requirements. Hospitals need EU MDR 2017/745 compliance for worldwide distribution. Robotic surgery needs special FDA approvals. |

During 2025 to 2035, absorbable surgical sutures will be the most remunerative product segment, buoyed by increased demand for rapid-healing, biocompatible materials in minimally invasive surgical procedures. Their ability to dissolve spontaneously eliminates the need for suture removal, lowering post-operative complications and enhancing patient outcomes.

Growing applications in cardiovascular, gynecologic, and orthopaedic surgery further enhance demand. Advancements in synthetic absorbable materials like polyglycolic acid and poliglecaprone have enhanced suture strength and reduced inflammation. Considering these aspects, the Absorbable Surgical Sutures segment is expected to expand at a CAGR of 8.5% during the period 2025 to 2035, which is higher than the overall industry growth of 6.9%.

Polyglycolic Acid (PGA) Absorbable Surgical Sutures will be the top choice among raw materials because they are very strong, absorb at a steady rate, and cause fewer tissue reactions. The growing adoption of laparoscopic and soft tissue surgeries is driving the preference for synthetic biodegradable sutures over traditional catgut alternatives.

The expanding use of robot-assisted surgery also increases the demand for top-grade sutures such as PGA. With these benefits in mind, we expect the Polyglycolic Acid Absorbable Surgical Sutures industry to grow at a CAGR of 9.1% between 2025 and 2035.

Synthetic sutures will be the dominant material type because they give greater control over the time of degradation and lower the inconsistency of absorption when compared with natural options. Advances in polymer chemistry are facilitating the development of futuristic synthetic materials with antibacterial films and higher biocompatibility.

Moreover, the shift toward synthetic monofilament sutures is picking up speed, as these have lower infection rates. The Synthetic Sutures segment is expected to grow at a CAGR of 8.3% during the 2025- 2035 forecast period.

The Cardiovascular Procedures segment should be the most profitable application area, driven by the growing incidence of cardiac diseases and the increasing number of coronary bypass and valve replacement procedures.

Knotless sutures are particularly useful in heart procedures because they provide steady tension, reducing problems related to sutures in delicate heart tissue. With continuous developments in suture coatings and bioresorbable materials, this segment is expected to witness significant growth, with a forecasted CAGR of 9.7% during the period 2025 to 2035.

Hospitals continue to be the largest users of knotless surgical sutures due to high patient volumes and growing adoption of advanced surgical techniques. The growth in multi-specialty hospitals and the increased investment in surgical facilities add to this.

Furthermore, procurement policies in hospitals focus on high-performance sutures, which may have antimicrobial features, to counter post-operative infection. These drivers predict a CAGR of 8.9% for the Hospital Laboratories segment between 2025 and 2035.

The Northeast industry for knotless surgical sutures is projected to grow at a CAGR of 12.5% during the period 2025 to 2035. The high presence of top-tier medical institutions, high density of specialized surgical centers, and rigorous hospital accreditation requirements fuel the demand for sophisticated suture technologies.

Massachusetts, New York, and Pennsylvania are the leaders in surgical procedure volumes, especially in cardiac, orthopaedic, and minimally invasive procedures. The Northeast also enjoys strong healthcare funding and research efforts, supporting quick uptake of new suturing methods. Compliance with regulation is strict, with institutions complying with both federal FDA regulations and state-level healthcare quality requirements.

Within the Midwest region, the industry for knotless surgery sutures is projected to grow at a CAGR of 11.9% between the years 2025 and 2035. The Midwest is a region where large medical device manufacturers and research institutes are based. Being a crucial region for surgical technology, the Midwest has states like Minnesota and Illinois that comprise the best healthcare centers and medical device companies that assist in speedy product development and implementation.

Moreover, the prevalence of chronic diseases that require surgery, such as cardiovascular diseases and joint replacements, is increasing. With less population density than the Northeast but a stable demand for quality surgical solutions, the region has advantages.

In the Southeast, the demand for knotless surgical sutures is projected to grow at a CAGR of 12.2% from 2025 to 2035. The region's aging population and the high rate of surgeries due to chronic diseases like diabetes and obesity drive the demand. Florida, Georgia, and North Carolina are major contributors owing to their extensive healthcare systems and medical research facilities.

The availability of a number of medical device manufacturing companies also increases industry accessibility. Although cost factors determine buying decisions in certain regions of the Southeast, top hospitals in major cities focus on cutting-edge surgical solutions, which fuel adoption.

In the Southwest, the knotless surgical sutures industry is forecast to grow at a CAGR of 11.5% from 2025 to 2035. The population growth, led by Texas and Arizona, is driving surgical volumes in this region. The demand for minimal invasiveness is especially high, and there is potential for absorbable and knotless suture technologies.

Furthermore, the prevalence of high numbers of military health centers and veteran hospitals increases the industry growth. Rural areas might, however, pose challenges regarding accessibility and affordability, where smaller hospitals would prefer cheaper alternatives over premium-quality knotless sutures.

In the West, the industry for knotless surgical sutures is projected to grow at 12.8% CAGR from 2025 to 2035. California leads with its vast array of superior hospitals, research centers, and medical device manufacturers. The superior concentration of experts in surgeries and early uptake of robotic and minimally invasive surgeries also drive industry demand.

In addition, Washington and Oregon, for instance, focus on healthcare innovation and regulatory compliance, thereby presenting profitable industries. In some parts, though, price sensitivity becomes a concern; premium healthcare providers focus on high-end, cutting-edge suturing technology to provide high-quality surgeries with higher patient recovery rates.

The USA knotless surgical sutures industry is being driven by vigorous competition with key players concentrating on pricing models, innovation, alliances, and expansion to create a stronger presence. Firms are putting money into future-generation materials like antimicrobial-coated and bioresorbable sutures to create product differentiation.

Strategic mergers and acquisitions enable firms to increase industryshare and distribution networks, while alliances with hospitals and research centers speed up product advancement. Pricing remains a primary battleground for manufacturers, as they strive to balance affordability with high-end offerings. Global players also increase production centers in the USA in order to mitigate supply chain risks and enhance domestic industrypenetration.

Industry Share Analysis

Johnson & Johnson (Ethicon)

Share: ~35-40%

Largest share in the industrythrough its deep brand recognition, large product suite, and penetration across hospitals and surgery centers.

Medtronic

Share: ~20-25%

A significant player with its knotless sutures by virtue of the large network and partnerships in broad surgical solutions.

B. Braun Melsungen AG

Share: ~10-15%

Expanding further across USA regions with its absorbable innovative knotless sutures, specifically designed for a more cost-effective option for the outpatient surgeries.

Smith & Nephew

Share: ~8-12%

It is a leader in sports medicine and advanced wound closure, having found significant use in the area of orthopaedic knotless sutures.

Integra LifeSciences

Share: ~5-8%

Concentrates on niche applications such as neurosurgery and reconstructive surgery, providing specialized knotless suture products.

Stryker Corporation

Share: ~5-7%

Expanding in the segment via acquisitions and R&D, especially in minimally invasive surgical uses.

Growing demand for minimally invasive surgeries, rising surgical volumes, and technological progress in suture technology are driving growth.

Robust growth is expected on account of growing adoption in orthopaedic, cardiovascular, and cosmetic surgeries, as well as technological advancements in suture materials.

Top manufacturers in the USA knotless surgical sutures industry are Medtronic Plc, B. Braun Melsungen AG, Teleflex Incorporated, Johnson & Johnson (Ethicon), CONMED Corporation, Corza Medical, CP Medical, DemeTECH Corporation, Sutumed, DSI Dental Solution, Golnit Sutures, Vital Sutures. It also includes Atramat, Unilene, Hiossen, Advanced MedTech Solutions Pvt. Ltd, Dolphin Sutures, Arthrex, Inc., GMD Group, Dynek Pvt. Ltd., Kono Seisakusho Co., Ltd., Olimp-Surgical Sutures, Lotus Surgicals, Unisur Lifecare Pvt. Ltd., and Smith & Nephew.

Polyglycolic acid absorbable sutures are expected to be the most popular choice in the industry because they break down naturally, are very strong, and are widely used in general and orthopaedic surgery.

The industry is poised to exceed USD 278.6 million through 2035, led by increasing number of surgeries and technological evolution in sutures.

The industry is segmented intoabsorbable and non-absorbable surgical sutures.

The industry is segmented into polyglycolic acid, polyglactin, catgut, poliglecaprone, polydioxanone, polypropylene, nylon, polyester, pvdf, silk, and stainless-steel sutures.

The industry is categorized into natural, synthetic, monofilament, braided, coated, and uncoated sutures.

The industry is used in cardiovascular, general surgery, ophthalmic, orthopaedic, dental, gastroenterology, gynecology, plastic surgery, and veterinary procedures.

The industry is segmented into hospitals, specialized clinics, ambulatory surgical centers, veterinary hospitals, and veterinary clinics.

The industry is studied across Northeast, Midwest, Southeast, Southwest, and West.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.