The USA connected TVs market will reach USD 5,377.9 million in 2025 and grow at a CAGR of 11.0%, reaching USD 15,270.3 million by 2035.

| Attributes | Values |

|---|---|

| Estimated USA Market Size 2025 | USD 5,377.9 million |

| Projected USA Market Size 2035 | USD 15,270.3 million |

| Value-based CAGR from 2025 to 2035 | 11.0% |

Rising consumer success for HD content, the increase of smart home devices alongside increasing penetration of excessive-velocity net in urban and suburban areas are the main factors galvanizing the growth of the market.

Traditional TV has been replaced by connected TV as USA consumers turn to subscription from unsubscribe services, ad-joined platforms and gaming applications. Artificial intelligence powered voice control and personalized recommendations for content and connections to smart home devices all play a role in driving the industry.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

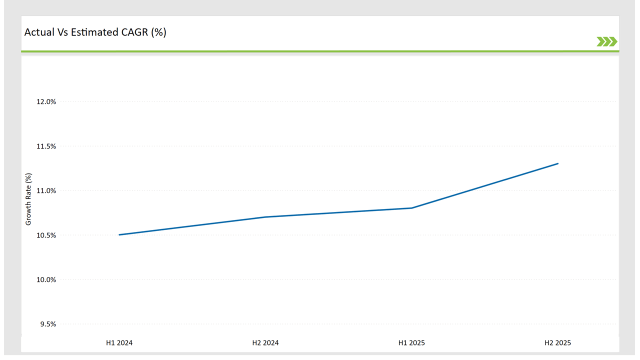

The following table provides a semi-annual update on the compound annual growth rate (CAGR), reflecting trends that influence decision-making among industry stakeholders.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 10.5% |

| H2, 2024 | 10.7% |

| H1, 2025 | 10.8% |

| H2, 2025 | 11.3% |

The adoption of high-speed internet, increasing streaming platforms, and emergence of 8K displays added steady traction to the market. For H1 2024, the CAGR rises to 10.5% and 11.3% for H2 2025, reflecting a stable industry momentum.

| Date | Development/M&A Activity & Details |

|---|---|

| Jan-2025 | Samsung introduced AI-powered OLED smart TVs with advanced gaming modes. |

| Oct-2024 | Roku partnered with major USA TV manufacturers to integrate native streaming software. |

| Mar-2024 | Amazon Fire TV focused on expanding its content library with exclusive partnerships. |

| Sep-2024 | LG introduced QNED technology in the USA market to compete with QLED TVs. |

| Dec-2023 | Sony announced cloud-based gaming service for its Bravia connected TV lineup. |

The major players in the connected TV ecosystem are focused on content integration, partnerships with streaming service providers and AI-driven personalization. It helps for emphasizing immersive experiences, gaming compatibility and help for interactive TV content continues shaping the industry.

Smart TVs and Streaming Devices Drive Market Expansion

The global smart TV and streaming device markets are led by major brands including Samsung, LG, Sony, Roku, and Amazon, all of which harness advanced technology and are recognized by consumers worldwide. These companies are one of the top investments for improving smart features, user experience, and connectivity to stand out from the competition.

In addition, they also broaden their product line with new displays that deliver high dynamic range (HDR) capabilities, fast refresh rates and more processing power. Next-gen smart TVs demand the inclusion of in-built voice assistants, AI-integrated content recommendations, and easy compatibility with smart home ecosystems.

Devices like Amazon Fire TV Stick, Apple TV, and Roku streaming players are key in improving digital product access, giving consumers the ability to upgrade their entertainment experience without having to get rid of their existing TVs.

Cloud and AI Integration Enhance User Experience

The tech companies are combining cloud-based software and artificial intelligence voice assistants - like Google Assistant, Alexa, and Siri - to change the way consumers engage with connected televisions. Algorithms use machine learning to analyze a viewer’s previous watching habits and suggest similar shows or movies.

Voice control also serves as an accessibility tool; for those able-bodied enough to have fully functional hands, voice control makes it easier to browse your streaming platform of choice hands-free, adjusting settings or searching for specific content by saying rather than typing it out.

Cloud gaming services, like NVIDIA GeForce Now and Xbox Cloud Gaming, offer a new level of entertainment, as they empower you to play in cutting-edge resolutions without needing to invest money in high-end gaming hardware. Cloud storage solutions further enhance this by providing smooth access to the media libraries on various devices and allowing users to continue their experience from any place and any device.

Ad-Supported and Subscription-Based Streaming Booms

Expansion of subscription-based (SVOD) and ad-supported (AVOD) video on demand on streaming platforms speeds up connected TV adoption. Netflix, Hulu, Disney+ and HBO Max reign over the subscription-based landscape, offering exclusive movies, TV shows and all-original productions that win over global audiences.

Meanwhile, free, ad-supported platforms like Pluto TV, Tubi and Freevee serve cost-conscious consumers who want content without a monthly subscription. Streaming companies are increasingly embracing hybrid models, meshing premium and ad-supported content and testing tiered subscription plans to drive user engagement and revenue. The monetization evolution of content providers has enormous consequences for the digital entertainment ecosystem, where affordability and high-quality are balanced.

Investments in 8K and Next-Gen Display Technologies

Market leaders push the development of display technologies like OLED, QLED, and mini-LED panels that offer far greater picture fidelity and immersive viewing experiences. OLED, with its inky blacks and stunning colors, appeals to premium TV shoppers, while QLED screens provide better brightness and color accuracy.

Mini-LED technology is pitched as a lower-cost competitor that offers superior contrast and backlight management but without the eye-watering prices of OLED panels. The latest innovation from manufacturers, 8K TVs offer ultra-high-concept display with extreme details and sharpness.

While still in the early stages of adoption due to content availability and pricing challenges, 8K is the next frontier in the evolution of television. Brands are constantly innovating to provide ultra-dark blacks, ultra-high brightness, energy-efficient displays, an extensive screen real estate, fast refresh rates to cater to modern consumer habits.

| Device Type | Market Share (2025) |

|---|---|

| Smart TVs | 58.3% |

| Others | 41.7% |

The Smart TV segment leads as consumers prefer built-in connectivity and seamless integration with streaming services. Streaming devices maintain a strong presence, especially among users seeking affordability and flexibility in content consumption.

| Technology | Market Share (2025) |

|---|---|

| LED | 45.2% |

| QLED | 54.8% |

LED and LCD technologies lead due to their affordability and widespread availability. However, OLED and QLED displays are gaining traction, offering better color accuracy, deeper blacks, and energy efficiency.

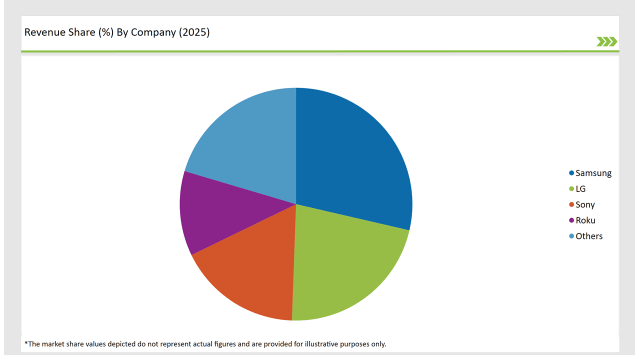

Major players drive innovation and competition through strategic partnerships, R&D investments, and content distribution alliances.

| Vendor | Market Share (2025) |

|---|---|

| Samsung | 27.9% |

| LG | 21.4% |

| Sony | 16.8% |

| Roku | 11.5% |

| Amazon (Fire TV) | 9.2% |

| Others | 13.2% |

Samsung and LG lead with premium smart TV offerings, while Sony integrates gaming features and AI-powered functionalities. Roku and Amazon dominate the streaming device segment, offering extensive content ecosystems.

Smart TVs, streaming devices, and others.

LED, LCD, OLED, and QLED.

Residential and commercial sectors.

The market will grow at a CAGR of 11.0% from 2025 to 2035.

By 2035, the industry will reach USD 15,270.3 million.

Key drivers include increasing adoption of smart TVs, rapid growth in streaming services, advancements in AI-powered features, and next-gen display technologies.

The West Coast and Northeast USA lead in connected TV adoption due to high-speed internet availability, urbanization, and tech-savvy consumers.

Samsung, LG, Sony, Roku, and Amazon dominate, with streaming service providers contributing to the competitive landscape.

| Estimated Size, 2025 | USD 16,978.4 million |

| Projected Size, 2035 | USD 60,110.2 million |

| Value-based CAGR (2025 to 2035) | 13.5% CAGR |

Explore Electronics & Components Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.