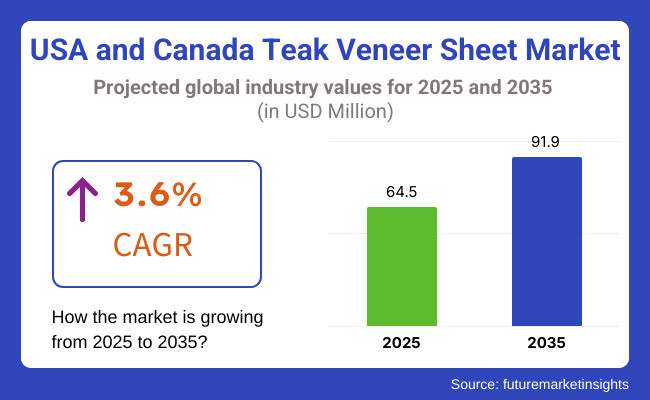

The USA and Canada teak veneer sheet market is anticipated to be valued at USD 64.5 million in 2025. It is expected to grow at a CAGR of 3.6% during the forecast period and reach a value of USD 91.9 million in 2035.

The USA and Canada teak veneer sheet market continued its steady expansion in 2024, driven by rising applications in boatbuilding and home décor. This growth was driven by increased usage in boatbuilding and home decor. Demand from the yacht and marine industries has surged due to teak veneer’s superior water resistance and aesthetic appeal, particularly for decks, cabinetry, and interiors.

It also drove demand in the residential and commercial building industry with large-scale renovations, as well as homeowners and designers who like to use teak veneer sheets to update interiors and furniture. Luxury furniture makers increased the use of teak veneers for enhanced durability and premium appeal.

However, high teak prices and supply chain issues have hindered market expansion. Despite Burmese teak's superior quality, its high cost has increased the demand for alternative teak sources. Demand is expected to grow beyond 2025, driven by expanding boat manufacturing, residential construction, and advancements in sustainable teak veneer. Reduced prices and better supply chain optimization may also spur adoption further.

Explore FMI!

Book a free demo

The results of a recent survey conducted by FMI with the key stakeholders in the USA and Canada teak veneer sheet industry have also elucidated important trends. Furniture makers and boat builders reported that teak veneer sheets have become more popular for their durability, water resistance, and pleasing appearance.

Most noted was a shift from marine applications to upscale furniture and home furnishings, reflecting changing consumer preferences. Price fluctuation and supply chain issues became major issues for retailers and distributors.

Respondents cited that price fluctuations in teak, particularly Burmese teak, increased the cost of sourcing the respective types, thus lowering the overall profit margins. To counter this, several companies are researching alternate sources of teak and engineered veneer that help to achieve property challenges while being economically viable.

Over the past years, the increasingly demanding requirement has been towards sustainability as a purchase driver. This has brought about demands from manufacturers even to end-users for teak veneer sheet from more responsible sources and calls for improvement in supply chain tracing and transparency, as well as certification systems.

Increasing regulatory pressure coupled with increasing consumer awareness will push companies to invest in sustainable forestry and environmentally friendly production modes to fall in line with industry norms.

Given the rise in residential and commercial renovations, most respondents expect advancements in veneer production technology to enhance customization, expanding the applications of teak veneer sheets. Companies delivering cost-effective innovation, along with sustainability, are set to gain a competitive lead in years to come.

Government regulations and certifications play a crucial role in shaping the USA and Canada teak veneer sheet industry. Policies focus on responsible sourcing, emissions control, and product safety, ensuring compliance with environmental and trade laws. Companies must meet specific standards to operate, impacting sourcing strategies, production processes, and industry competitiveness.

| Countries | Government Regulations & Mandatory Certifications |

|---|---|

| USA | Lacey Act Compliance: Companies must ensure teak veneer sheets are legally sourced and imported, with proper documentation proving sustainable harvesting. - EPA Formaldehyde Standards (TSCA Title VI): Manufacturers must comply with formaldehyde emission standards for composite wood products, including veneer sheets. - Forest Stewardship Council (FSC) Certification: While not mandatory, FSC certification helps companies demonstrate responsible sourcing, improving industry credibility. - California Air Resources Board (CARB) Compliance: Strict formaldehyde emission limits apply, affecting veneer sheet manufacturing and imports. |

| Canada | Canadian Environmental Protection Act (CEPA): Regulates emissions from wood-based products, including teak veneer sheets, ensuring compliance with environmental safety standards. - Controlled Goods Program (CGP): Required for businesses involved in defense-related teak veneer applications, ensuring strict security compliance. - Sustainable Forestry Initiative (SFI) Certification: Encourages the use of responsibly sourced wood veneer, gaining preference in eco-conscious sector. - Health Canada Emission Standards: Sets limits on volatile organic compounds (VOCs) and formaldehyde emissions for indoor wood products, impacting teak veneer sheet imports and production. |

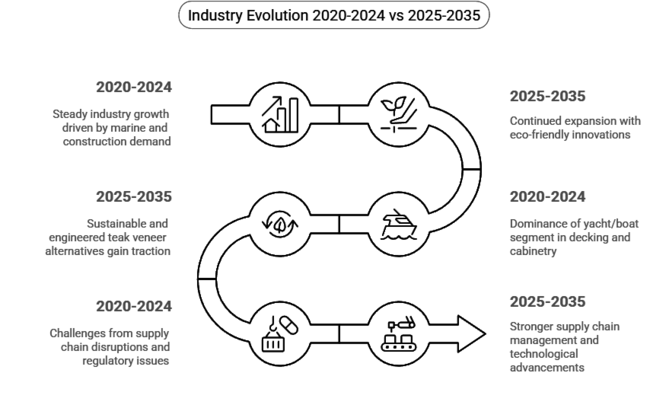

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Steady industry growth driven by increasing demand from the marine and construction sectors, despite challenges like high teak prices and supply chain disruptions. | Continued expansion, supported by rising boat production, luxury home renovations, and eco-friendly innovations in teak veneer sheets. |

| The yacht/boat segment remained dominant, with decking and cabinetry applications leading demand due to teak's durability and water resistance. | The yacht/boat segment will maintain its lead, but growing teak veneer adoption in high-end furniture and interior décor will drive additional industry growth. |

| A Grade teak veneer saw the highest demand due to its premium quality and marine suitability, while lower-grade veneers were used in cost-sensitive applications. | A Grade will continue leading, but sustainable and engineered teak veneer alternatives may gain traction amid rising environmental concerns and price fluctuations. |

| Challenges included supply chain disruptions, fluctuating raw material costs, and regulatory compliance issues impacting teak imports. | Stronger supply chain management, improved sourcing strategies, and technological advancements will help overcome past challenges, ensuring stable industry growth. |

| Demand from residential and commercial construction increased, particularly for flooring, cabinetry, and decorative elements. | Expanding luxury construction and renovation activities will further boost demand, with greater emphasis on customization and sustainability. |

A Grade teak veneer holds the largest share due to its superior quality, uniform texture, and zero defects. It is highly preferred in marine applications for its exceptional durability and weather resistance. B Grade teak veneer is used where minor imperfections are acceptable, while SB and C Grades are chosen for cost-sensitive applications. However, A Grade remains dominant, particularly among yacht builders and high-end furniture manufacturers.

The yacht/boat sector dominates as teak veneer’s durability, water resistance, and anti-slip properties make it ideal for decks, cabinets, and interiors. Increasing yacht and boat production is further boosting demand. The building sector is also expanding, with teak veneer widely used in flooring, kitchen cabinets, staircases, and pillars, driven by the rising demand for luxury home renovations and premium interior designs.

The commercial sector is a key consumer, with teak veneer in luxury hotels, office spaces, and high-end retail interiors. Its use in furniture, wall panels, and decorative elements is rising. The residential sector is also growing, driven by demand for luxury home renovations. Homeowners prefer teak veneer for flooring, cabinetry, and wall paneling, as it enhances aesthetic appeal, durability, and property value.

As of 2024, the USA and Canada teak veneer sheet market has experienced steady growth, driven by increasing demand from the furniture, marine, and interior design industries. Leading players such as Oakwood Veneer Company, Veneer Technologies Inc., Certainly Wood, Columbia Forest Products, FormWood Industries, and M. Bohlke Veneer Corp. have been actively implementing strategies to strengthen their positions and cater to the growing demand for high-quality teak veneer sheets.

Oakwood Veneer Company continues to lead with an estimated 20-25% share in 2024. The company has focused on innovation and sustainability, launching a new line of eco-friendly teak veneer sheets in early 2024. These products, designed for high-end furniture and marine applications, have been well-received for their durability and aesthetic appeal.

Oakwood Veneer's strong distribution network and commitment to quality have further solidified its leadership. Veneer Technologies Inc. holds approximately 18-20% of the share in 2024. The company has prioritized technological advancements, introducing a new range of precision-cut teak veneer sheets with enhanced consistency and finish.

These products, launched in mid-2024, have gained traction in the interior design and architectural sectors due to their superior quality and ease of application. Veneer Technologies' focus on innovation and customer satisfaction has helped it maintain a competitive edge and expand its customer base.

Certainly Wood accounts for roughly 15-18% of the share in 2024. The company has invested heavily in R&D, launching a new series of teak veneer sheets with improved moisture resistance and durability. These products, designed for high-humidity environments, have been well-received for their performance and longevity. Certainly Wood's emphasis on innovation and sustainability has enabled it to capture a significant portion of the industry.

Columbia Forest Products has seen its share grow to around 12-15% in 2024. The company has focused on developing sustainable teak veneer solutions, introducing a new line of FSC-certified teak veneer sheets in collaboration with environmental organizations. Columbia Forest Products' commitment to sustainability and strong R&D capabilities have positioned it as a key player.

FormWood Industries holds an estimated 10-12% share in 2024. The company has expanded its product portfolio by launching a new series of textured teak veneer sheets for decorative applications. These products, designed for use in high-end interiors, have been well-received for their unique aesthetic and versatility. FormWood's focus on specialized solutions has helped it carve out a niche.

M. Bohlke Veneer Corp. has maintained a share of approximately 8-10% in 2024. The company has focused on strategic partnerships, collaborating with luxury yacht manufacturers to develop customized teak veneer solutions for marine applications. M. Bohlke's emphasis on innovation and collaboration has strengthened its reputation as a trusted provider of high-quality teak veneer.

In 2024, the industry has also witnessed strategic collaborations and partnerships aimed at addressing emerging challenges in quality and sustainability. For instance, Oakwood Veneer Company partnered with a leading furniture manufacturer to develop a new line of teak veneer sheets for eco-friendly furniture. This collaboration has enhanced Oakwood's credibility and reach.

Overall, 2024 has been characterized by intense competition, with the top six players collectively accounting for over 85% of the share. These companies are leveraging innovation, sustainability, and technology to meet the growing demand for high-quality teak veneer sheets.

The USA and Canada teak veneer sheet market falls under the wood veneer, construction, and marine materials industry, catering to luxury home interiors, furniture, and boatbuilding. Growth in this industry depends on macroeconomic conditions such as real estate trends, the marine industry, trade policies as well as environmental regulations.

Rising incomes are fueling high-end home renovations, boosting demand for teak veneer. The furniture sector is expanding in both high-end commercial and residential spaces. Teak veneer sheets are increasingly preferred for high-end furniture due to their aesthetics and durability. The residential segment is expected to continue growing owing to urbanization, rising disposable incomes, and sustainability-minded customers.

Indeed, steady growth in production of boats and yachts has been placing more demand for teak veneer sheets in decking and cabinetry within the marine industry. The USA happens to be one of the important yacht hubs, and with the popularization of leisure boating, veneer demand will correctly increase. At the same time, import restrictions such as the Lacey Act along with environmental restrictions on the sourcing of teak will affect this industry and lead to encouraging sustainable alternatives.

Despite challenges such as global teak price fluctuations, supply disruptions, and trade restrictions, innovations in eco-friendly veneers and local sourcing efforts are stabilizing the industry. Overall, the outlook remains bright due to the luxury consumer drift, development in technology for veneer production, and the increasing initiatives toward sustainability.

Growth Opportunities

Broadening the Sustainable Teak Veneer Offerings

Consider investing in FSC-certified, reclaimed, or engineered teak veneer since all of the above will make the industry more attractive in the face of increasing environmental concerns and stricter import regulations.

An eco-friendly campaign will go a long way in attracting builders, furniture makers, yacht manufacturers, etc., who are more than willing to patronize firms promoting material alternatives for sustainable use. Developing low-impact processing and responsible sourcing will improve brand positioning in the growing eco-conscious market.

Target Premium Luxury Yachts and High-End Homes

The booming yacht and luxury residential industry in the USA and Canada hold huge potential to grow further. Manufacturers are best advised to approach boatbuilders, architects, and designers to develop necessary and customized veneer solutions for high-end interiors. Exotic veneer designs, fine finishes, and tailor-made offerings can significantly help organizations establish a good foothold in the luxury marine and residential construction sectors.

Utilization of Technological Advances in Veneer Production

Such innovations include digital printing, UV-resistant coatings, and pre-finished veneer sheets, enhancing the long-term appeal and durability of the products manufactured. Developing ready-to-install veneer sheets would be an attractive value proposition for time-sensitive projects in yacht interiors and home renovations. Companies will explore engineered veneer approaches combined with advanced treatments of the facing surfaces to improve their resistance to moisture, wear, and environmental damage.

Strategic Recommendations

Compliance-Driven Sourcing & Certification Strategy

Companies should secure Lacey Act compliance, FSC certification, and CARB/EPA approvals to meet strict regulatory requirements. Ensuring ethical sourcing and sustainable practices will enhance brand reputation and industry access. Certifications will also help manufacturers gain trust among marine construction firms and luxury interior designers, positioning them as preferred suppliers in highly regulated industries.

Product Diversification & Customization

Expanding veneer offerings with varied sizes, backer options, and textured finishes can help manufacturers cater to yacht interiors, high-end furniture, and commercial décor. Providing pre-finished or UV-resistant veneer sheets can attract time-sensitive projects. Customization in color tones, wood grain patterns, and engineered veneer alternatives will also allow businesses to differentiate their products and capture niche industry.

Targeted Branding & B2B Partnerships

Collaborating with boat manufacturers, luxury home builders, and high-end furniture brands can secure stable demand. Engaging in marine expos, architectural fairs, and designer trade shows will increase visibility among key buyers. Developing exclusive product lines for yacht builders or boutique furniture makers can create a competitive edge and drive long-term partnerships in premium industry segments.

Teak veneer sheets are used in yacht interiors, home décor, furniture, cabinetry, and wall paneling due to their durability and aesthetic appeal.

Its moisture resistance, natural oils, and anti-slip surface make teak veneer ideal for decks, cabinets, and paneling in marine environments.

Strict import laws and sustainability policies have led to a rise in FSC-certified, reclaimed, and engineered veneer alternatives.

Teak veneer is available in A, B, SB, and C grades, with Grade A offering superior durability, oil content, and an even texture.

Buyers should check for FSC certification, Lacey Act compliance, and uniform grain patterns to ensure authenticity and durability.

By grade, the industry is segmented into A grade, B grade, SB grade, and C grade.

Based on application, the sector is segmented into yacht/boat, building, and others.

Based on end use, the industry is segmented into commercial and residential.

Anti-seize Compounds Market Size & Growth 2025 to 2035

Phosphate Conversion Coatings Market 2025 to 2035

Technical Coil Coatings Market Growth 2025 to 2035

Perfluoropolyether (PFPE) Market Size & Trends 2025 to 2035

Cold Rolling Oils/Lubricants Market Size & Growth 2025 to 2035

Basic Methacrylate Copolymer Market Growth 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.