The Bubble Tea Industry Analysis in USA is projected to grow from USD 1,075.9 million in 2025 to USD 2,691.6 million by 2035, reflecting a CAGR of 9.6%. This growth is driven by the increasing popularity of Asian beverages among younger demographics, coupled with the expanding footprint of specialty tea cafés and bubble tea chains across major USA cities.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size in 2025 (USD Million) | USD 1,075.9 Million |

| Projected Global Value in 2035 (USD Million) | USD 2,691.6 Million |

| Value-based CAGR from 2025 to 2035 | 9.6% |

Consumer interest in customizable beverages and unique flavor experiences is contributing to widespread adoption. The growing demand for refreshing, low-caffeine alternatives to coffee also positions bubble tea as a rising segment in the beverage industry.

Innovations in bubble tea offerings are enhancing product appeal and driving customer engagement. New trends include the use of organic ingredients, alternative milk options (such as oat, almond, and soy), and creative toppings like cheese foam, fruit jelly, and popping boba.

Technological advancements such as automated tea brewing machines and digital ordering platforms are streamlining operations and improving consistency. Additionally, brands are embracing sustainability through biodegradable cups, eco-friendly straws, and locally sourced ingredients to meet the expectations of environmentally conscious consumers.

Regulations governing food safety and labeling play a crucial role in shaping the bubble tea market in the USA The Food and Drug Administration (FDA) enforces standards related to ingredient safety, nutritional labeling, and allergen disclosure. As the market grows, compliance with local health department regulations for beverage preparation and storage becomes increasingly important. Transparent labeling and adherence to hygiene protocols are critical to maintaining consumer trust and supporting the sector’s continued expansion.

The USA bubble tea market is projected to grow at a CAGR of 9.6% from 2025 to 2035. Ready-to-drink (RTD) formats will dominate the format segment, accounting for 65% of the market share. Flavored bubble tea will lead the flavor type category with a 62% share, while tapioca pearls will remain the most popular topping, representing 45% of the market.

American consumers in the bubble tea market prefer distinctive flavors together with low-sugar and organic varieties. The USA bubble tea market follows three principal trends by offering personalized drinks alongside sustainable manufacturing practices and transparent ingredient disclosure to match health-focused ethics of environmentally conscious consumers.

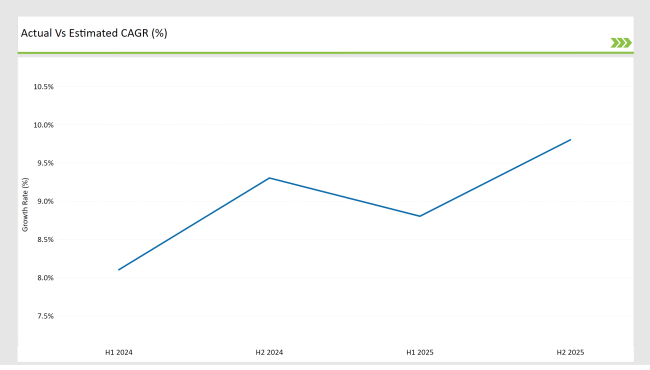

H1 signifies period from January to June, H2 Signifies period from July to December

The USA bubble tea market is segmented by format, flavor type, topping, and distribution channel. By format, it is divided into ready-to-drink (RTD) and ready-to-mix (RTM) options, catering to both convenience seekers and customizable home-prep consumers. By flavor type, the market includes flavored and unflavored bubble tea, with flavored variants dominating due to their appeal among younger consumers.

In terms of topping, popular choices include tapioca pearls, popping boba, taro balls, and coconut jelly-each offering varied textures and taste experiences that enhance the drink’s appeal. The distribution channel segmentation covers direct sales through bubble tea shops and specialty cafes, and indirect sales via retail stores and e-commerce platforms, reflecting both impulse purchases and at-home consumption trends.

The RTD segment holds 65% share. Ready-to-drink (RTD) bubble tea is popular in the USA because it offers convenience, portability, and instant consumption without the need for preparation. American consumers, especially millennials and Gen Z, value quick and hassle-free beverage options that fit into their fast-paced lifestyles.

RTD bubble tea meets this demand by providing a flavorful, indulgent drink that can be enjoyed on the go, whether at work, school, or during travel. The popularity of RTD formats is also driven by increasing shelf availability in supermarkets, convenience stores, and online retail platforms.

Flavored bubble tea is popular in the USA because it caters to diverse consumer taste preferences and enhances the drink's appeal through variety, creativity, and novelty. Unlike traditional unflavored milk or black tea bases, flavored options such as taro, mango, matcha, strawberry, lychee, and brown sugar offer vibrant taste experiences that attract a broad audience, especially among Gen Z and millennials who prioritize unique, indulgent beverage choices.

The customizability and visual appeal of flavored bubble tea also play a major role in its popularity. Bold colors and fruit-infused flavors create eye-catching drinks that are highly shareable on social media platforms, making them not only a refreshment but also a trend-driven lifestyle product. This has positioned flavored bubble tea as a fun, experiential beverage that resonates with younger demographics seeking more than just taste.

Tapioca pearl topping is popular in the USA bubble tea market because it offers a unique, chewy texture that enhances the sensory experience of the drink. Often referred to as “boba,” these pearls add an interactive and indulgent element, transforming bubble tea from a regular beverage into a fun, snack-like treat. Their soft, gummy consistency contrasts with the smoothness of the tea or milk base, creating a multi-layered consumption experience that appeals especially to younger consumers.

The cultural influence of Taiwanese bubble tea, where tapioca pearls originated, has played a significant role in their popularity. As bubble tea gained mainstream traction in the USA, tapioca pearls became a signature component and a recognizable symbol of authenticity. Most first-time consumers associate bubble tea directly with the presence of boba, making it the default and most widely chosen topping.

Bubble tea thrives in direct‐sale venues bubble tea shops and specialty cafés in the USA because they deliver the freshness, customization, and experience that consumers crave. Pearls and jellies are cooked and assembled to order, ensuring ideal texture and temperature, while patrons can tailor sweetness, ice level, and topping combinations on the spot.

These stores also function as social hubs, offering eye‐catching “Instagrammable” drink presentations and the satisfying ritual of watching baristas craft each cup. Finally, by controlling in‑house preparation, operators maintain quality consistency and higher profit margins, building brand loyalty as customers return for both the product and the immersive café atmosphere.

| Date | Development/M&A Activity & Details |

|---|---|

| January 2024 | Tea Zone USA : Launched a new line of organic ready-to-mix bubble tea powders , catering to health-conscious consumers. |

| March 2024 | Boba Guys : Expanded into supermarket retail , introducing bottled boba tea with dairy-free options. |

| April 2024 | Tapioca King : Developed a high-fiber tapioca pearl formula , addressing consumer concerns over digestive health. |

| July 2024 | Bubble Tea Supply : Partnered with foodservice distributors to enhance B2B availability of bubble tea ingredients. |

| September 2024 | Kung Fu Tea : Announced a new franchise expansion plan , adding 25 new locations across the USA. |

Ready-to-drink products along with a growing retail expansion pattern

The RTD market segment currently holds a 65% share and bottled bubble tea products have become the center of brand attention because they are stocked in convenience stores supermarkets and online retail outlets. The market demand for shelf-stable bubble tea has led manufacturers to innovate their products by creating sustainable formulations with long shelf life along with fewer preservatives and plant-derived contents.

Specialty tea houses as well as food service chains and boba-focused cafés have increased demand for instant bubble tea formats that allow customers to make personalized drinks at home.

Health-Conscious and Functional Ingredient Innovations

More people look for bubble tea products with low-calorie content and reduced sugar levels alongside ingredient-based functions in their beverages. Brands introduce products containing plant-based milk alternatives as well as organic tea bases and collagen and probiotic and antioxidant-rich formulations.

The market offers custom drink experiences as companies create boba beverages through product differentiation by using keto-friendly ingredients dairy-free elements and superfood components. Eco-friendly straws together with sustainable packaging have become dramatically important selling points as market awareness about environmental consciousness rises.

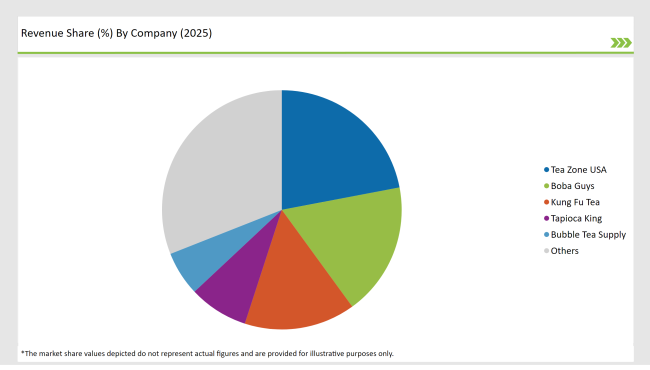

The USA bubble tea market is steadily expanding, led by both global chains and local franchises. Brands like Kung Fu Tea, Gong Cha, CoCo Fresh Tea & Juice, Boba Guys, Tapioca Express, and Tiger Sugar dominate. These brands stand out due to their diverse flavor offerings, customizable drink bases, and strong social media presence.

Smaller regional chains like Xing Fu Tang and Teaspoon are gaining traction through artisanal appeal and fresh ingredient sourcing. Major players invest heavily in R&D to create new flavors (e.g., popping boba, cheese foam) and low-sugar options. Online ordering and RTD (Ready-To-Drink) formats are being prioritized, along with health-conscious alternatives such as vegan milk and functional additions.

The USA Bubble Tea Market is segmented by format into ready-to-drink (RTD) and ready-to-mix (RTM) options.

By flavor, the market is categorized into flavored and unflavored bubble tea.

The topping segmentation includes tapioca pearls, popping boba, taro balls, and coconut jelly.

The distribution channel segmentation comprises indirect sales (retail, e-commerce) and direct sales (bubble tea shops, specialty cafes).

The market is projected to reach USD 2,691.6 million.

The market is expected to grow at 9.6% CAGR.

Ready-to-Drink (RTD) dominates with a 65% market share.

Expanding café culture, health-conscious product innovation, and rising demand for specialty beverages.

Tea Zone USA, Boba Guys, Kung Fu Tea, Tapioca King, and Bubble Tea Supply.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bubble Blower Market Size and Share Forecast Outlook 2025 to 2035

Bubble Tubes Market Size and Share Forecast Outlook 2025 to 2035

Bubble Lined Courier Bags Market Size and Share Forecast Outlook 2025 to 2035

Bubble Wrap Machine Market Size and Share Forecast Outlook 2025 to 2035

Bubble Wrap Packaging Market Size and Share Forecast Outlook 2025 to 2035

Competitive Breakdown of Bubble Tubes Suppliers

Market Share Distribution Among Bubble Wrap Packaging Manufacturers

Bubble Wrap Packaging Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Korea Bubble Wrap Packaging Market Growth – Trends & Forecast 2023-2033

Western Europe Bubble Wrap Packaging Market Analysis – Growth & Forecast 2023-2033

Bubble Tea Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Market Share Distribution Among Bubble Tea Providers

UK Bubble Tea Market Report – Trends, Demand & Industry Forecast 2025–2035

Air Bubble Bags Market Size and Share Forecast Outlook 2025 to 2035

Understanding Market Share Trends in the Air Bubble Bags Industry

Nano Bubble Generators Market Analysis – Size, Share & Forecast 2025-2035

Fine Bubble Diffuser Market Size and Share Forecast Outlook 2025 to 2035

Paper Bubble Wrap Market Trends - Demand, Innovations & Growth 2025 to 2035

Kraft Bubble Mailer Market from 2024 to 2034

Europe Bubble Tea Market Trends – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA