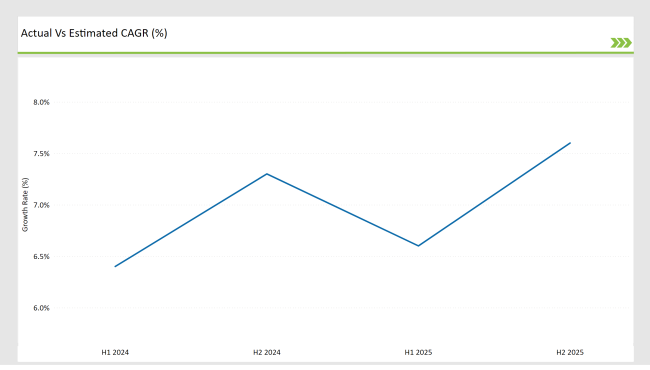

The Allergen-Free Food Market is projected to reach USD 14,074.3 million in 2025, growing at a CAGR of 7.3% over the next decade to an estimated value of USD 28,541.4 million by 2035.

| Attributes | Values |

|---|---|

| Market Size in 2025 | USD 14,074.3 Million |

| Market Value in 2035 | USD 28,541.4 Million |

| Value-based CAGR from 2025 to 2035 | 7.3% |

The surge in this market is largely propelled by the higher incidence of food allergies, dietary intolerances, and people's preference for functional and healthier food alternatives. The rising consciousness about allergen-free diets, particularly among people who have lactose intolerance, gluten sensitivity, nut allergies, and autoimmune disorders, is a major factor in the rapid market expansion.

Furthermore, plant-based and clean-label food products become more popular, which causes faster growth in the demand for allergen-free food options. Consumers are more often choosing GMO-free, sugar-free, and organic allergen-free foods, which in turn encourages product innovation across the boards, like chocolates, beverages, and processed meats. Alternative proteins and plant-based components and functional food development remain active components in industry discussions about trends.

Business entities monitor customer demand to achieve transparent labeling of ingredients sustainable sourcing methods and allergen-free certification requirements. Retail and e-commerce expansion enables direct-to-consumer brands to be more accessible to consumers through their sales models which include subscription-based operations.

Business obstacles in the allergen-free food market exist due to expensive production costs and strict regulatory requirements alongside competition against regular food options. The allergen-free market experiences progressive developments through modern food processing expertise and shelf-life extension solutions alongside flexible diagnostic approaches for allergens.

Explore FMI!

Book a free demo

The Allergen-Free Food Market demonstrates continuous expansion since consumers focus more on their health and the government supports allergen labeling requirements. New food technologies focused on gluten-free and dairy-free and nut-free product lines help brands establish stronger market positions and e-commerce expansion and health professional alliances accelerate consumer uptake.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| January 2024 | Noat Foods : Launched sugar-free, nut-free chocolates using sunflower seed butter, targeting allergy-conscious consumers. |

| March 2024 | Free2b Foods : Expanded its line with seed butter cups (free from top allergens), addressing cross-contamination risks in facilities. |

| May 2024 | MadeGood : Partnered with Costco to debut a new protein granola bar line, expanding its organic snack offerings. |

| August 2024 | Daiya Foods : Released upgraded dairy-free cheeses with enhanced melting capabilities and added gut-health probiotics |

| September 2024 | Schar : Introduced a new gluten-free bread line with extended shelf-life and improved texture, compliant with FDA gluten-free regulations. . |

Increasing Demand for Organic and GMO-Free Allergen-Free Foods

Personalized nutrition leads to changes in the USA Allergen-Free Food market as healthcare providers, as well as consumers, adopt personalized solutions. Improved genomic technologies along with biomarkers and artificial intelligence diagnostic systems enable formulators to develop customized nutrition products that match individual metabolic needs and medical profiles. Medical supplements made for cancer patients combine immune support elements with defense mechanisms for managing treatment responses.

The tailored solutions enhance patient adherence and lead to superior treatment results in people with distinct nutritional deficiencies. The implementation of wearable health technologies with mobile application-based real-time feedback systems by these companies stimulates greater acceptance of personalized clinical nutrition.

Technological Advancements in Allergen-Free Food Processing

The bioavailability, together with nutrient absorption, represents a primary concern to manufacturers of clinical nutrition supplements. Microencapsulation and nano emulsion technologies recently advanced through technological breakthroughs allowing manufacturers to develop nutritional supplements with increased stability, better solubility, and improved palatability. These new inventions achieve efficient delivery of important nutrients to patients with absorption problems stemming from surgical or ongoing health conditions.

Research on lipid-based delivery systems combined with slow-release formulations improved therapeutic outcomes by maintaining nutrient retention. The technological advancements encourage multiple patient groups to adopt advanced oral clinical nutrition supplements.

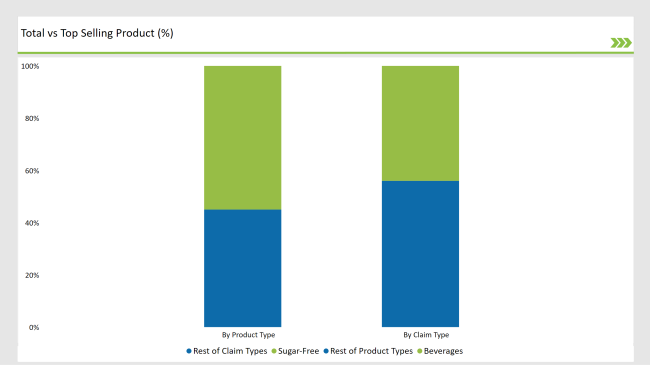

% share of Individual categories by Product Type and Claim in 2025

The beverage segment controls 55% of the USA allergen-free food market because customers now prefer dairy-free and nut-free as well as sugar-free beverage alternatives. People who have dietary limitations are continuously searching for products that comply with their restrictions and deliver attractive taste profiles with nutritional advantages.

The health-conscious market receives new expansions through plant-based milk innovations and protein shake fortifications along with functional beverages that exclude allergens. Allergen-free beverages serve both allergic customers and others who seek nutritious beverage alternatives.

The beverage segment of allergen-free foods shows no sign of losing its position of dominance because manufacturers keep developing new options that reflect shifting consumer demands for protected eating choices.

Sugar-free products are the primary contributor to the market leader in allergen-free foods, which regulate a 44% segment of the market via buyers' preferences for equally low glycemic with diabetes-friendly options. Increased consumer health awareness has spurred a quest for foods that can effectively meet the desired taste in addition to the nutritional support they might provide.

Companies now develop taste-conscious foods with natural sweeteners that combine good flavor with nutritional gains. People are embracing sugar-free options because they follow wider food and diabetes management movements that focus on lowering sugar consumption and blood sugar control. The sugar-free segment of allergen-free foods will continue to grow because preferences toward healthier options are evolving and this will promote more product development from brands.

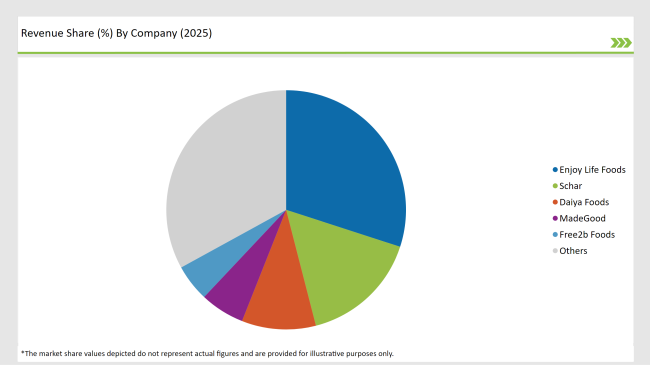

2025 Market share of USA Allergen-Free Food Market suppliers

Note: above chart is indicative in nature

The USA allergen-free food market comprises three company segments that differ according to their buying power and ability to innovate and distribute allergen-free products nationally. The three leading allergen-free companies are Enjoy Life Foods Daiya Foods and Schar because they freely engage in large production and widespread distribution of superior allergen-free product offerings. The popularity of their brands combined with their broad retail outlets enables them to gain substantial market control.

Free2b Foods Made Good and Amy's Kitchen represent Tier 2 brands that supply organic allergy-free solutions to health-focused customers who seek specialized nutritious food products. Tier 3 companies such as Banza, and No Nuts! Foods, Earth Balance, and 88 Acres focus on serving the localized by providing innovative, plant-based, or nut-free solutions.

These companies especially work on different formulations, which are particularly appealing to consumers looking for allergen-free food products. With growing awareness of food allergies, the market dynamics promote innovation at all tiers to result in a healthy diversity of products needed by a health-conscious consumer.

The market is projected to reach USD 28,541.4 million.

The market is expected to grow at 7.3% CAGR.

Beverages lead with a 55% market share.

Rising food allergies, demand for clean-label foods, and increased awareness of allergen-free diets.

Enjoy Life Foods, Schar, Daiya Foods, MadeGood, and Free2b Foods.

By product type, the market is categorized into chocolate, beverages, processed meat & poultry, and other allergen-free foods.

The Allergen-Free Food Market is segmented by nature into organic and conventional allergen-free products.

The segmentation by claim includes sugar-free, GMO-free, and other allergen-free certified products.

Aquafeed Enzymes Market Analysis by Enzyme Type, Form, Aquatic Animal, and Region Through 2035

Chickpea Milk Market Analysis by Category, Flavor and End Use Through 2025 to 2035

Coconut Butter Market Analysis by End-use Application Sales Channel Through 2025 to 2035

Hydrotreated Vegetable Oil Market Analysis by Type and Application Through 2035

Children’s Health Supplement Market Analysis by Product Type, Application and Age Group Through 2025 to 2035.

Hyaluronic Acid Supplement Market Product, Type, Application, Distribution Channel and Others Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.