USA Aerial Imaging Market size estimated valued at USD 1,693.7 million in 2025, and it is predicted to reach USD 5,851.8 million in 2035 and poised at a CAGR 9.2% over the forecast period. Rapidly increasing demand for geospatial data coupled with technological advances in aerial imaging and an increase in the use of unmanned aerial vehicles for various use-cases.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size in 2025 | USD 1,693.7 million |

| Projected USA Industry Size in 2035 | USD 5,851.8 million |

| Value-based CAGR from 2025 to 2035 | 9.2% |

The aerial imaging solutions are widely used for defense & security intelligence, urban planning, disaster management, and environmental monitoring and this is expected to drive the market growth owing to the rising demand for this technology. In aerial imaging, AI and automation can improve image processing, data analytics and decision-making with AR/AIR. With the benefits associated with cloud-based system that include scalability, flexible and sharing the data in real-time the aerial imaging platforms are aimed at adopting cloud-based system.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

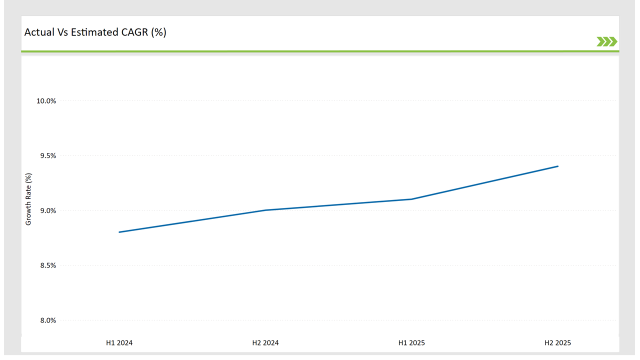

The following table highlights the compound annual growth rate (CAGR) trends for the USA Aerial Imaging Market over six-month intervals, providing insights into the market’s growth momentum.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 8.8% (2024 to 2034) |

| H2, 2024 | 9.0% (2024 to 2034) |

| H1, 2025 | 9.1% (2025 to 2035) |

| H2, 2025 | 9.4% (2025 to 2035) |

The market growth is attributed to the increasing deployment of UAVs and drones, speed of technology advancement, and surge in requirement for high-resolution imaging solutions. In fact, the statistics show that from H1 2024 the % grow by 8.8%, in H2 2025 it’ll be 9.4%, the gradual increase is due to the progress and adaptation of the industry for the aerial imaging technologies that evolved in time.

| Date | Development/M&A Activity & Details |

|---|---|

| Jan-25 | DJI launched an AI-powered drone imaging system for geospatial applications. |

| Oct-24 | Esri acquired an aerial analytics firm to enhance its geospatial imaging solutions. |

| Mar-24 | The USA Department of Defense increased investments in aerial surveillance technology. |

| Sep-24 | Google partnered with major UAV manufacturers to develop advanced aerial mapping solutions. |

| Dec-23 | Microsoft introduced cloud-based aerial imaging software for smart cities. |

As a result, technology providers are investing in AI-powered automation, cloud-based imaging solutions, and high-resolution satellite imagery to strengthen aerial intelligence capabilities. Government, defense, and private enterprise collaborations with imaging solution vendors are improving both the efficiency and accuracy of data collection from aerial sources.

AI and Automation Transform Aerial Imaging

Artificial intelligence (AI) in aerial imaging has become a growing field. Relying on AI-powered algorithms improves the velocity of data analysis while minimizing human intervention in order to boost geospatial analytics accuracy. Machine learning helps in finding patterns, categorizing items, and detecting anomalies in better accuracy. Such advancements help for further applications such as environmental monitoring, infrastructure assessment, disaster response, and more.

AI-driven aerial imaging is an important tool for security and defense forces; with the ability to analyze and interpret images instantly at a battlefield or sensitive site, such technology can provide for better situational awareness. The automation of aerial imaging workflows means that aerial operations can be carried out with minimal human error, whilst MATLAB238 facilitates resource optimization of both human and hardware resources. With the growing evolution of AI technologies, aerial imaging will become even more efficient and scalable across industries.

Cloud-Based Aerial Imaging Solutions Gain Traction

Cloud-based aerial imaging platforms are being increasingly adopted owing to their scalability, real-time availability, and compliance with GIS and remote sensing applications. These help users to store, process, and analyze massive amounts of aerial data with minimal to no on-premise infrastructure. Hence solution over cloud gives opportunity for collaborative geo spatial analysis which can enables multiple stakeholders attending and working on high resolution imagery collaboratively.

This is especially useful in sectors like urban planning and agriculture, where decision-making needs to be done in a timely manner (for example, disaster management). Moreover, the cloud computing and edge processing innovations increase the performance and efficiency of aerial imaging applications. At the same time with better data security and bandwidth capabilities, the cloud-based aerial imaging solutions will always remains the first choice of companies and government.

Government Investments Drive Market Growth

The investment of government and military agencies into aerial imaging solution for border surveillance, disaster response, and intelligence operations continues to increase. Such investments propel advancements in high-resolution imaging, real-time data processing, and AI-driven analytics. Border security agencies use aerial imaging to monitor unauthorized activities, and disaster response teams use it to help assess damage and coordinate relief efforts.

By combining aerial imaging with geospatial intelligence (GEOINT), defense organizations gain the advantage of increased battlefield awareness and strategic planning. Infrared images can also be used for public sector projects, including infrastructure development, environmental monitoring, and land management.

Meanwhile, Satellite-based and UAV-based imaging solutions availability is also providing an extra push for adoption. Funding for developments in aerial imaging technologies is set to increase considerably as governments emphasize national security and disaster readiness.

UAV and Drone Technology Revolutionizing the Industry

The use of Unmanned Aerial Vehicles (UAVs) or drones is possibly changing the world of aerial imaging, enabling you to get high-resolution imagery at lower pricing in a more widespread manner. Agriculture, construction, environmental monitoring, disaster management and other industries have been enabled to collect data in real time with these technologies. In agriculture, drones and multispectral sensors help analyze crop health and optimize yield predictions.

UAV-based imaging plays a vital role in site inspections, project monitoring, and structural assessments in the construction industry. The technology is being used by environmental agencies to track deforestation, monitor wildlife and assess the effects of climate changes.

The relative low cost and ease of deployment of UAVs compared to traditional aerial imaging methods have allowed for their use in a much wider variety of applications. With the evolution of drone regulations and the emergence of improved autonomous flight capabilities, UAV-driven aerial imaging will undoubtedly continue to reshape industry standards.

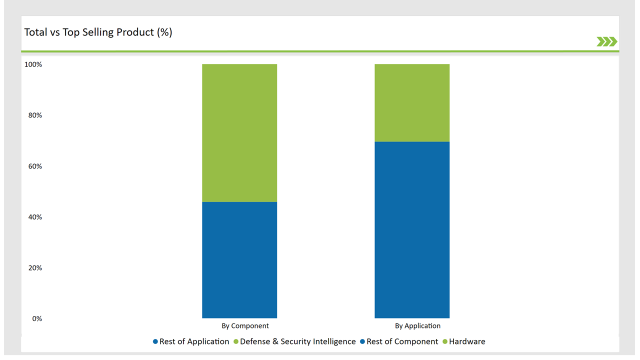

| Component | Market Share (2025) |

|---|---|

| Hardware | 54.20% |

| Others | 45.80% |

The aerial imaging market is mostly driven by hardware, comprising UAVs, cameras & sensors as imaging technologies provide adequate resolution through the introduction of high-resolution sensors, LiDAR & thermal imaging technologies. Such innovations improve the accuracy, efficiency and real-time imaging of data. On the other hand, the software segment is showing steady growth as the demand for AI-powered image processing, automation, and cloud-based GIS solutions continues to rise.

Aerial data proved invaluable for industries from agriculture to construction, and AI-fueled analytics and geospatial mapping software were boosting the ability to collate actionable data, making such technologies more accessible and useful across industries. AI-driven analytics and geospatial mapping software are improving data interpretation, driving more value from aerial imaging across a number of industries.

| Application | Market Share (2025) |

|---|---|

| Defense & Security Intelligence | 30.50% |

| Others | 69.50% |

The defence and security intelligence segment is primarily responsible for the maximum market income in the aerial imaging market as more government investments are made in surveillance, border security and military intelligence. The various types of imaging such as high resolution imaging, AI-powered data analytics and UAV based reconnaissance bolster threat identification, situational understanding, and real-time decision making.

Aerial imaging is widely used in identifying illicit activities, disaster management, and infrastructure protection. With increasing geopolitical tensions and national security threats, the defence agencies are also enhancing their aerial imaging capabilities and it will also help in further accelerating the market adoption and technology advancement in this segment.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

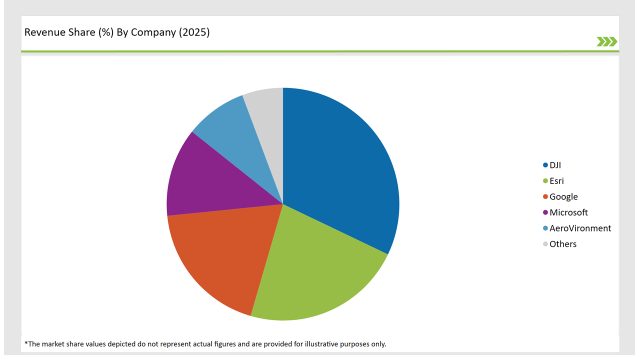

AI, Cloud and UAV technologies are being used by the key players in the USA Aerial Imaging Market to differentiate their offering. The players in this market include companies like DJI, Esri, Google, Microsoft and AeroVironment, who command considerable market shares due to their specialization in aerial imaging and geospatial intelligence.

| Vendors | Market Share (2025) |

|---|---|

| DJI | 32.1% |

| Esri | 22.4% |

| 18.9% | |

| Microsoft | 12.3% |

| AeroVironment | 8.6% |

| Others | 5.7% |

Hardware, Software, and Services. Hardware is leading segment due to advancements in UAV technology and high-resolution imaging sensors.

Defense & Security Intelligence, Geospatial Mapping, Urban Planning & Development, Disaster & Response Management, Energy & Natural Resource Management and Others.

Government, Military & Defense, Agriculture & Forestry, Energy & Mining, Media & Entertainment, Construction & Engineering and Others.

The USA Aerial Imaging Market will grow at a CAGR of 9.2% from 2025 to 2035.

By 2035, the industry is projected to reach USD 5,851.8 million.

Key drivers include AI-powered aerial imaging, increasing UAV adoption, and rising government investments in surveillance and security applications.

The Hardware segment holds the highest share at 54.2%, driven by technological advancements in UAVs and high-resolution imaging sensors.

Leading players include DJI, Esri, Google, Microsoft, and AeroVironment, along with emerging aerial imaging technology providers.

Explore Digital Transformation Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.