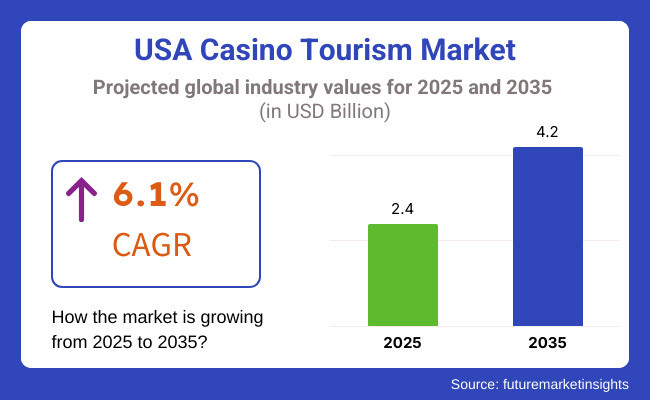

The US casino tourism industry will take a robust growth path, from an estimated USD 2.4 billion in 2025 to USD 4.2 billion in 2035, with a CAGR of 6.1% during the period 2025-2035. Increasing popularity of the integrated resort model, growing popularity of gambling as a leisure activity, and expansion of the appeal of casino tourism from gaming into entertainment, high-end dining, and luxury accommodation are driving growth. Both local and foreign tourists fuel the trend, as more tourists seek multi-faceted holiday experiences.

The growth in casino tourism is largely driven by the popularity of large-scale integrated resorts offering a variety of attractions beyond gaming, such as world-class entertainment, celebrity chefs, and spa services. These resorts, particularly in states like Nevada and New Jersey, are drawing a global audience of both leisure and business tourists. Additionally, the increasing disposable income of consumers and the expansion of online and mobile gambling are helping propel the market forward.

Explore FMI!

Book a free demo

The following chart compares the changes in CAGR for the base year, 2024, and the current year, 2025, reflecting shifts in market dynamics.

CAGR Values for US Casino Tourism Market (2024 - 2025)

The US casino tourism market is expected to grow at a CAGR of 5.6% in the first half of 2024, with a slight increase to 5.8% in the second half. Growth is expected to pick up to 5.9% in the first half of 2025 and continue climbing to 6.1% in the second half of 2025, as new resorts open and existing properties expand their entertainment and hospitality offerings.

| Category | Details |

|---|---|

| Market Value | The US casino tourism industry is projected to generate USD 2.2 billion in 2024, making up 70% of North America’s casino tourism market. |

| Domestic Market Share | Domestic tourists make up 65% of the market, with key destinations like Las Vegas (Nevada), Atlantic City (New Jersey), and Lake Tahoe (California/Nevada). |

| International Market Share | International tourists account for 35%, with major markets including visitors from Canada, Europe, and Asia flocking to Las Vegas and Macau-style resorts. |

| Key Destinations | Popular destinations include The Venetian and Bellagio in Las Vegas, Resorts World in New York, and the Borgata in Atlantic City. |

| Economic Impact | Generates billions annually in direct spending on accommodation, dining, and entertainment in cities like Las Vegas and Atlantic City. |

| Key Trends | Growth of luxury casinos with integrated resorts, tech-savvy gaming experiences, and multi-use spaces that combine casinos with shopping, dining, and live shows. |

| Top Travel Seasons | Summer and New Year’s Eve are peak seasons, especially in Las Vegas, with major events like the World Series of Poker and extravagant New Year's Eve celebrations. |

The US casino tourism industry anchors North American gambling, with Las Vegas leading as the undisputed epicenter and attracting millions of tourists each year. Domestic tourists continue to dominate the market, flocking to iconic destinations like the Bellagio and The Venetian in Las Vegas and the Borgata in Atlantic City, where they seek luxury and exclusivity. Las Vegas stands out with its diversity of experience, marrying high-stakes gaming with international-class entertainment, upscale dining, luxury retailing, and high-end accommodations. International tourists, particularly from Europe and Asia, increasingly visit US casinos, drawn by the unique blend of gambling, world-renowned shows, and upscale retail experiences. The draw of celebrity-chef restaurants, Broadway-type productions, and high-stakes game tables has cemented US casinos as top attractions for international tourists, cementing the nation's status as the leading destination for casino travel.

| Date | Development & Details |

|---|---|

| Jan 2025 | Launch of High-Roller Experience MGM Resorts unveiled a new “High-Roller Experience” package, offering exclusive VIP access to luxury suites, private gaming tables, and personalized entertainment options at The Venetian in Las Vegas. |

| Dec 2024 | Introduction of Family Casino Packages Caesars Entertainment launched new family-oriented vacation packages that include family-friendly hotel accommodations, child care services, and gaming education programs for beginners. |

| Nov 2024 | Opening of New Waterfront Casino The Ocean Resort Casino in Atlantic City opened a new oceanfront gaming area with stunning views and high-end amenities, expected to attract both domestic and international tourists. |

| Oct 2024 | Launch of Sports Betting Expansion DraftKings at Resorts World Las Vegas introduced new sports betting features, combining traditional casino gaming with a live sports bar experience. |

| Sept 2024 | Grand Reopening of The Mirage with New Luxury Offerings The Mirage Casino in Las Vegas completed its renovation, adding new luxury suites, a 5-star spa, and high-end dining options to enhance its appeal to high-rolling tourists. |

3 Card Poker provides tremendous revenue to casinos because it is easy to understand, speedy, and universally popular. The simplicity of the game makes it suitable for novices as well as experienced bettors. Players are able to play more hands in an hour with its simple gameplay, causing increased turnover as well as bet per unit. Such a fast pace keeps visitors active and stimulates higher spending over a shorter period.

Also, 3 Card Poker requires less strategy than games such as Texas Hold'em, allowing gamblers to sit down without lengthy background knowledge and opening up a wider potential pool of players. Casinos like Las Vegas' The Palazzo have been able to market 3 Card Poker as a mainstay on their casino floors. Its low entry cost attracts casual players who may not otherwise play other table games, generating traffic and eventually overall casino revenue.

Casinos also find 3 Card Poker's combination of poker and classic table game features appealing. The game's "Pair Plus" side wager and competitive nature make the game very engaging, with high player retention. Large casinos such as Caesars Palace and Aria add more to the engagement by featuring promotional tournaments and progressive jackpots linked with 3 Card Poker. These exclusive occasions bring in both domestic and global players who want to hit the jackpots or join private promotions, generating even more revenue on the game.

Commercial casinos continue to lead the US casino tourism market by offering comprehensive experiences and maintaining a strong reputation for luxury and entertainment. Gambling casinos like Las Vegas's Venetian and MGM Grand are tourism magnets as they offer luxurious amenities along with broad gaming offerings in addition to high-quality accommodation, dining, entertainment, and retail, representing the ultimate resort destination. In addition to games, tourists visit the places to indulge in full-scale vacation packages like celebrity dining options and marquee shows featuring big-name artists as at Caesars Palace or The Cosmopolitan.

One of the most significant reasons behind commercial casinos' dominance is their ability to host massive events and top-shelf entertainment. For example, MGM Grand will often play host to large boxing matches and concerts that draw thousands of visitors from around the world. These diverse experiences combine to make commercial casinos appealing to a broad range of visitors, from seasoned gamblers to families and sightseers seeking an upscale experience.

The commercial casino facility enables heavy investment in technology, which enhances the customer experience and yield. MGM Resorts, for instance, has included sophisticated mobile gaming platforms and cashless payment systems, making it easy for tourists to consume casino products and spend money. Such technologies particularly strike a chord with the younger generation that is technology-conscious, making commercial casinos relevant in the face of a shifting landscape.

Also, commercial casinos have established strong affiliations with hotels, airlines, and websites, providing a convenient experience for visitors. Wynn Las Vegas, for instance, partners with upscale hotel brands to appeal to high-net-worth individuals who are looking for a high-end casino experience with the comforts of a five-star resort.

Industry leaders like Las Vegas Sands Corp., MGM Resorts International, and Wynn Resorts, Limited fuel fierce competition in the US casino tourism sector. These behemoths occupy the market space, with local casinos creating niche experiences for certain tourist segments. Collectively, they offer a wide variety of choices, catering to high-rollers as well as casual tourists who are looking for distinctive gambling experiences.

2025 Market Share of US Casino Tourism Players

The US casino tourism market is dominated by major players, with Las Vegas Sands Corp. commanding a 30% market share, followed by MGM Resorts with 10%, and Wynn Resorts with 9%. Other major casinos, including The Venetian and The Borgata, contribute by delivering a wide variety of experiences across different demographic segments. These industry leaders offer a combination of luxury, entertainment, and gaming for high-rollers as well as tourists, diversifying and making the market competitive.

The US casino tourism market is expected to grow at a CAGR of 6.1% from 2025 to 2035.

The market is projected to reach USD 4.2 billion by 2035.

Key drivers include the growing demand for luxury integrated resorts, the expansion of sports betting, and the increasing popularity of casino destinations for leisure travel.

Major players include MGM Resorts, Las Vegas Sands Corp., Wynn Resorts, and other iconic US casinos offering a world-class gambling experience.

The industry is segmented into 3 Card Poker, American Roulette, Baccarat, and Other casino games.

The market is categorized into Commercial, Tribal, Limited Stakes, and I-Gaming casinos.

Segmentation includes Gambling Enthusiasts, Social Exuberants, and Others.

The industry includes Independent Travelers, Package Travelers, and Tour Groups.

Winning Strategies in Social Media and Destination Market Share Analysis: A Competitive Review

Winning Strategies in the Global Tourism Industry Loyalty Program Sector: A Competitive Review

Winning Strategies in the Global Animal Theme Parks Industry: A Competitive Review

Winning Strategies in the Global Spa Resorts Industry: A Competitive Review

Winning Strategies in the Global Winter Adventures Tourism Industry: A Competitive Review

Surrogacy Tourism Industry – Competitive Analysis and Market Share Outlook

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.