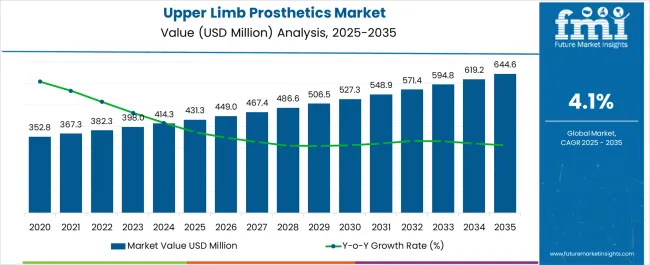

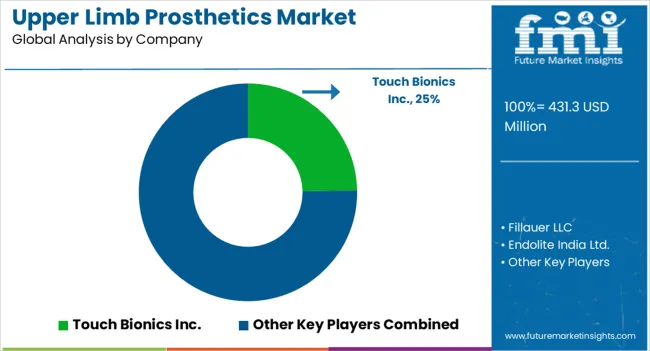

The Upper Limb Prosthetics Market is estimated to be valued at USD 431.3 million in 2025 and is projected to reach USD 644.6 million by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period.

Healthcare delivery systems present complex coordination challenges between multiple stakeholder groups operating under different reimbursement frameworks and clinical protocols. Rehabilitation physicians require prosthetic solutions that optimize functional outcomes while insurance medical directors evaluate coverage based on medical necessity criteria that may not align with patient quality-of-life objectives. Occupational therapists specify device requirements supporting vocational goals while case managers negotiate coverage limitations that affect technology selection and training duration, creating treatment planning complications where clinical recommendations conflict with administrative constraints.

Clinical fitting environments reveal fundamental tensions between technology optimization and reimbursement compliance requirements that prosthetists must navigate carefully. Advanced myoelectric systems provide superior functionality and user satisfaction while insurance protocols favor basic mechanical devices that meet minimum mobility requirements. Fitting procedures require extensive customization and adjustment sessions that reimbursement schedules may not adequately cover, affecting practice economics where specialized expertise commands professional fees that healthcare systems struggle to support consistently.

Manufacturing operations demonstrate cross-functional tensions where research and development teams pursue technological advancement while regulatory affairs departments ensure compliance with evolving medical device standards. FDA premarket approval processes require extensive clinical testing and documentation that extends development timelines while competitive pressures demand rapid innovation cycles. Quality management systems must accommodate both standard manufacturing protocols and custom fabrication requirements that individual patient anatomies demand, creating production complexity where regulatory consistency conflicts with personalization needs.

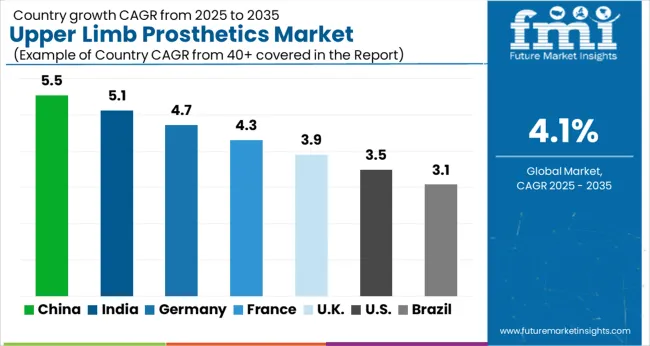

International market access creates regulatory coordination challenges where medical device approvals vary significantly across major healthcare systems. European CE marking requirements differ from FDA classification standards, creating product development complexity where global manufacturers must navigate multiple regulatory pathways. Emerging markets present growth opportunities complicated by limited prosthetist training infrastructure and healthcare funding constraints that affect market development strategies and patient access programs.

Technology integration challenges emerge where advanced prosthetic systems require ongoing technical support and maintenance capabilities that traditional healthcare delivery networks may not provide adequately. Software updates and calibration procedures demand specialized expertise while user training programs require coordination between clinical teams and technology suppliers. Remote monitoring capabilities create data privacy considerations that healthcare organizations must address through additional compliance protocols and security measures.

Research partnerships between academic institutions, technology companies, and healthcare providers drive innovation development yet require intellectual property management and clinical trial coordination that regulatory frameworks must accommodate. Patient-centered design approaches increasingly influence product development while traditional engineering metrics may not adequately capture user experience factors that determine long-term adoption success and clinical outcomes.

| Metric | Value |

|---|---|

| Upper Limb Prosthetics Market Estimated Value in (2025 E) | USD 431.3 million |

| Upper Limb Prosthetics Market Forecast Value in (2035 F) | USD 644.6 million |

| Forecast CAGR (2025 to 2035) | 4.1% |

The upper limb prosthetics market is expanding steadily, supported by technological advancements in bionic systems, rising awareness of rehabilitation solutions, and increasing healthcare expenditure across developed and emerging economies. Growing incidences of trauma, congenital limb deficiencies, and medical conditions requiring amputation are driving demand for advanced prosthetic solutions.

Innovations in lightweight materials, sensor technologies, and user-friendly designs are enhancing patient adoption and improving quality of life. Healthcare systems and rehabilitation centers are also focusing on accessibility, patient-centered care, and faster integration of prosthetics into everyday life.

Additionally, supportive reimbursement frameworks and collaborative research between medical device companies and clinical institutions are contributing to strong growth momentum. The market outlook remains positive as investments in digital integration, custom fitting, and neuro-controlled prosthetic devices continue to redefine the prosthetics landscape.

The passive prosthetic devices segment is expected to account for 41.60% of market revenue by 2025 within the product category, making it the leading segment. Growth is being driven by the affordability, simplicity, and lightweight design of these devices, which are preferred by patients requiring basic functional support.

Their lower maintenance requirements, durability, and ability to provide cosmetic restoration have also contributed to widespread adoption.

Passive prosthetics are especially favored in regions with limited access to advanced healthcare facilities, where functional restoration and cost-effectiveness are prioritized.

The prosthetic wrists segment is projected to contribute 38.90% of total revenue by 2025 in the component category, highlighting its dominance. This is attributed to the critical role of wrist articulation in enabling natural movement, grip, and improved dexterity in upper limb prosthetics.

Prosthetic wrists offer enhanced functionality and are increasingly integrated into both myoelectric and mechanical prosthetic systems.

Continuous innovations in joint flexibility and adaptive wrist technologies are further supporting their widespread adoption.

The forequarter amputations segment is anticipated to hold 36.40% of overall market revenue by 2025 under the indication category, positioning it as the largest segment. High adoption is being driven by the extensive functional loss experienced in such amputations, which necessitates the integration of advanced prosthetic devices.

Patients in this category often require specialized, multi-component prosthetics designed to restore both functional ability and cosmetic appearance.

Advances in modular prosthetic systems have enhanced rehabilitation outcomes, supporting stronger demand in this segment.

Global sales of upper limb prosthetics have risen at a 4.3% CAGR between 2020 and 2025. Sales of upper limb prosthetics are projected to grow at a 4.1% CAGR between 2025 and 2035. One of the main factors driving the growth of the upper limb prosthetics market is the surging geriatric population across the world.

Passive prosthetic, body-powered prosthetic, externally powered myoelectric prosthetic, hybrid prosthetic, and activity-specific prosthetic are the five general upper limb prosthetic types. To increase a person's functional abilities, hybrid devices integrate body-powered and myoelectric components in one prosthetic.

The majority of these designs are for transhumeral, shoulder-level, or forequarter amputees, and comprise body-powered prosthetic arms and myoelectric hands that may be manipulated simultaneously.

Body-powered prosthetic devices are expected to account for a market share of around 30.9% in the global landscape. Furthermore, passive prosthetic devices and hybrid prosthetic devices together are set to account for 31.1% of the global market share in 2025. Due to deteriorating bones, older adults are more prone to orthopedic illnesses, which is another key factor driving global demand for upper limb prosthetics.

The rise in the number of road accidents is due to rapid modernization and increasing sales of high-performance vehicles. In addition, rash and drunk driving are contributing to an increase in the number of road accidents around the world. This is predicted to contribute to the upper limb prosthetics industry's enhanced growth.

Even among amputees, there is a rising emphasis on physical fitness, leisure sports, and other physical activities such as aerobics and jogging, which has increased the demand for upper limb prosthetics for sports and recreation. These amputees can return to the sports and recreational activities that they enjoyed before their injuries with the help of upper limb prosthetic rehabilitation.

Prosthetic limbs and other prosthetics are predicted to expand in popularity as the prevalence of bone illnesses such as osteoporosis, osteosarcoma, osteonecrosis, and osteopenia rises.

| Historical CAGR | 4.3% |

|---|---|

| Historical Market Value (2025) | USD 379.0 million |

| Forecast CAGR | 4.1% |

Rising Sports Injuries & Road Accidents Driving Need for Upper Limb Prosthetic Devices

The upper limb prosthetic products market is predicted to grow due to an increase in the number of unintentional accidents and trauma cases. Sports injuries have also increased as adults and children engage in more physical exercise. This also includes injuries to the upper and lower limbs, which, in some cases, need an amputation.

Furthermore, the rising number of vehicle accidents across the world has increased the demand for upper limb prosthetic devices. The rise in the frequency of traffic accidents and injuries is expected to drive upper limb prosthetics usage in arm amputation procedures, supporting the types of prosthesis market growth.

In the upper limb prosthetics market, the growing number of limb amputation procedures is expected to lead to significant growth opportunities. For example, an amputation involves removing all or part of a limb or extremity, such as an arm.

It was announced in July 2024 that Ossur would release the Rebound Post-Op Elbow Brace. It is a non-invasive, lightweight, adjustable brace designed with intuitive design features to optimize clinicians' fitting experience as well as patient use following severe elbow injuries or surgeries.

An upper limb amputation involves the removal of all or part of the upper extremity by surgery. Global upper limb prosthetics market players are expected to enjoy lucrative growth opportunities as a result of growing research and development.

Amputations are on the rise around the world, and the demand for upper limb prosthetics is also on the rise. This has led to market players focusing on developing new products. Ossur, for instance, invested USD 352.8 million in Touch Bionics' facility in May 2020 to design advanced myoelectric prosthetic solutions. This investment assisted the company in driving innovation and research and development.

High Cost of Upper Limb Prosthetic Devices May Stunt Market Growth

Prosthetics are quite costly due to the time it takes to manufacture and install them. They are custom-made, which means that they are built to order and are unique to each individual. Prosthetic devices cannot be mass-produced, and, as a result, the cost increases and they become quite expensive.

Market growth is slightly hampered by the high cost and maintenance associated with prosthetic devices, as well as the lack of reimbursement schemes across many regions.

| Segment | Product Type |

|---|---|

| Attributes | Myoelectric Prosthetic Devices |

| Historic CAGR | 4.7% |

| Forecasted CAGR | 4.2% |

| Segment | End User |

|---|---|

| Attributes | Hospitals |

| Historic CAGR | 4.1% |

| Forecasted CAGR | 3.6% |

Prosthetic arms currently hold a small market share but are expected to see an increase in demand over the decade. Biomedical engineers are assisting in the development of prosthetic arms for amputees that can move in tandem with users’ thoughts and sense touch via an array of electrodes implanted in the patient's muscles.

Increased healthcare spending in emerging market economies, the growing relevance of the public-private partnership (PPP) concept across various regions, the rise in the prevalence of inflammatory arthritis, and an aging population have all contributed to the market for prosthetic arms growing rapidly in recent years.

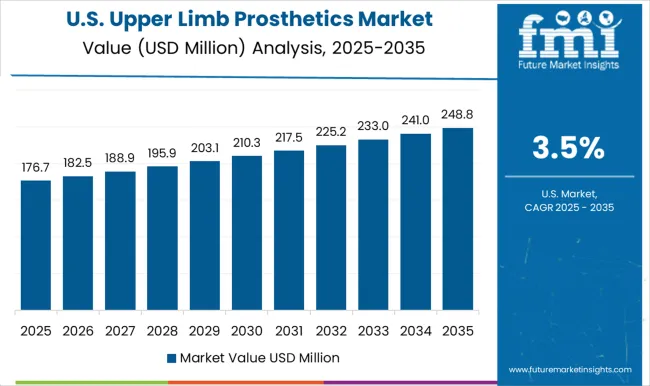

North America to Dominate Demand for Upper Limb Prosthetic Devices

North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa are among the regions included in these upper limb prosthetics market insights.

North America, followed by Europe, is likely to lead the global market, and this trend is expected to continue throughout the forecast period. This is due to growth in the number of accidents and injuries among adults, increased patient knowledge regarding prosthetic surgeries, rising demand for prosthetic devices, availability of modern healthcare facilities with skilled medical personnel, and the presence of prominent market players in these regions.

The market for upper limb prostheses in Latin America is predicted to develop steadily. Due to an increase in the number of amputations related to diabetes and rising government initiatives, the Asia Pacific market is predicted to grow at a rapid pace.

| Region | North America |

|---|---|

| Country | United States |

| Historic CAGR | 4.8% |

| Forecasted CAGR | 4.9% |

| Absolute Dollar Growth | USD 7.8 million |

| Market Value (2035) | USD 221.2 million |

| Region | North America |

|---|---|

| Country | Canada |

| Historic CAGR | 3.3% |

| Forecasted CAGR | 3.7% |

| Absolute Dollar Growth | USD 0.6 million |

| Market Value (2035) | USD 20.6 million |

| Region | Europe |

|---|---|

| Country | Germany |

| Historic CAGR | 5.4% |

| Forecasted CAGR | 5.5% |

| Absolute Dollar Growth | USD 1.3 million |

| Market Value (2035) | USD 34.9 million |

| Region | Europe |

|---|---|

| Country | United Kingdom |

| Historic CAGR | 4.7% |

| Forecasted CAGR | 4.0% |

| Absolute Dollar Growth | USD 0.6 million |

| Market Value (2035) | USD 16.9 million |

| Region | Asia Pacific |

|---|---|

| Country | China |

| Historic CAGR | 4.3% |

| Forecasted CAGR | 3.8% |

| Absolute Dollar Growth | USD 1.2 million |

| Market Value (2035) | USD 37.3 million |

Rapidly advancing Technologies Driving Sales of Upper Limb Prosthetic Devices

The United States leads the market for upper limb prosthetics in North America. High acceptability of sophisticated upper limb prosthetics, rise in the occurrence of accidental incidents, and increasing senior population across the country all contribute to this dominant market share.

Upper limb prosthetic device manufacturing companies are also focusing on advancing technologies to reduce trauma among amputees. Upper extremities have a healthier share of the entire orthopedic prosthetics sector, which is expected to increase at a rapid rate in the future.

In the United States, upper limb prosthetics are still a fairly young market. However, with the increased acceptance of upper limb prosthetic devices among amputees due to rapidly advancing technologies, the market growth potential is enormous.

Surging Number of Diabetic Patients Driving Need for Lower Limb and Upper Arm Prosthetics

According to the Asian Diabetes Prevention Initiative, Asia is home to 60% of the world's diabetics. It also claims that by 2035, China and India will have nearly half a million patients between them. This rise is projected to drive the need for prosthetic devices, including upper limb prosthetics.

According to the Union Ministry of Health and Family Welfare India, the number of diabetes patients in the 20-79 age groups was 414.3 million in 2024 which is expected to rise to 124.8 million by 2045.

Even though the rate of lower limb amputation in diabetic patients is declining, amputation remains a prominent consequence of diabetes. Diabetes, on the other hand, can cause damage to the upper limb and the nervous system. Considering the above factors, there has been an increase in the sales of lower limb prosthetics and upper arm prosthetics.

The Upper Limb Prosthetics Market is growing steadily, driven by advancements in prosthetic technology, increasing rates of traumatic injuries, and rising adoption of bionic and myoelectric prosthetic solutions. Upper limb prosthetics are designed to restore function and mobility for individuals with partial or full limb loss, incorporating mechanical, electrical, and digital components that mimic natural movement. Market expansion is being supported by growing healthcare access, government rehabilitation initiatives, and technological integration of robotics, AI, and sensory feedback systems in prosthetic design.

Leading companies such as Touch Bionics Inc., Ottobock SE & Co. KGaA, and Fillauer LLC dominate the market through innovation in advanced myoelectric and modular prosthetic systems. Touch Bionics, a pioneer in bionic hand technology, continues to lead with its i-Limb series, offering multi-articulating, sensor-driven prosthetic hands with customizable grip patterns and adaptive control. Ottobock maintains a strong presence globally with high-precision prosthetic solutions that combine lightweight materials, improved comfort, and neural interface integration. Fillauer LLC focuses on high-durability mechanical and hybrid prosthetic components tailored for everyday and athletic use.

Endolite India Ltd. and Steeper Inc. are expanding access to cost-efficient, high-performance prosthetic systems in emerging markets, ensuring broader rehabilitation availability. College Park Industries Inc. is recognized for its ergonomic and biomimetic prosthetic designs that closely replicate natural joint movement, enhancing functionality and comfort. TRS Inc. specializes in upper limb activity-specific prostheses designed for sports and occupational applications, promoting adaptability and patient empowerment.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million for Value and MT for Volume |

| Key Regions Covered | North America; Latin America; Europe; The Middle East and Africa; East Asia |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Chile, Peru, Germany, United Kingdom, Spain, Italy, France, Russia, Poland, China, India, Japan, Australia, New Zealand, GCC Countries, North Africa, South Africa, and Turkey |

| Key Segments Covered | Product, Component, Indication, End-user, Region |

| Key Companies Profiled |

Touch Bionics Inc., Fillauer LLC, Endolite India Ltd., Ottobock SE & Co. KGaA, College Park Industries Inc., Steeper Inc., TRS Inc. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global upper limb prosthetics market is estimated to be valued at USD 431.3 million in 2025.

The market size for the upper limb prosthetics market is projected to reach USD 644.6 million by 2035.

The upper limb prosthetics market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in upper limb prosthetics market are passive prosthetic devices, body-powered prosthetic devices, myoelectric prosthetic devices and hybrid prosthetic devices.

In terms of component, prosthetic wrists segment to command 38.9% share in the upper limb prosthetics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Upper Respiratory Tract Infection Treatment Market

Limb Salvage Systems Market Size and Share Forecast Outlook 2025 to 2035

Stair Lifts and Climbing Devices Market Analysis - Size, Share & Forecast 2025 to 2035

Prosthetics and Orthotics Market - Growth & Future Trends 2025 to 2035

Competitive Overview of Neuroprosthetics Companies

Passive Prosthetics Market

Orthopedic Prosthetics Market Size and Share Forecast Outlook 2025 to 2035

3D Printed Prosthetics Market Size and Share Forecast Outlook 2025 to 2035

Intelligent Prosthetics Market Analysis - Size, Share, and Forecast 2025 to 2035

Implant-Borne Prosthetics Market Size and Share Forecast Outlook 2025 to 2035

Genitourinary Prosthetics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Orthotics-Prosthetics Market Growth – Trends & Forecast 2025 to 2035

Carbon Fiber Composites for Prosthetics Market 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA