The USA Yeast Market is projected to reach USD 1,249.5 million in 2025, growing at a CAGR of 4.6% over the next decade to an estimated value of USD 1,950.5 million by 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size in 2025 | USD 1,249.5 Million |

| Projected USA Value in 2035 | USD 1,950.5 Million |

| Value-based CAGR from 2025 to 2035 | 4.6 % |

The increasing consumer demand for natural and clean-label ingredients, especially in the food, beverage, and dietary supplement industries is driving the growth of this sector.

The yeast market of the USA has manufacturers that are developing their production in spacious areas to be able to deliver the rise in demand. They are channeling money into the latest fermentation technologies and environmentally friendly production projects for improved efficiency and a more substantial yield. A few of the companies are either purchasing smaller enterprises or tying themselves into strategic contracts with other groups to bolster their market position.

The ongoing transition of consumers to plant-based and functional foods is yet another reason increasing demand for yeast-based ingredients which are adopted as a natural substitute for made additives. Moreover, organic and non-GMO yeast products are so attractive to the manufacturers that they are prompted to offer more expensive and better quality variants. Thereupon, the impacts of the clean-label trend on industries prompt test producers to adopt innovative processes to stay in line with the changing consumer choices; thus, they ensure constant market growth.

Explore FMI!

Book a free demo

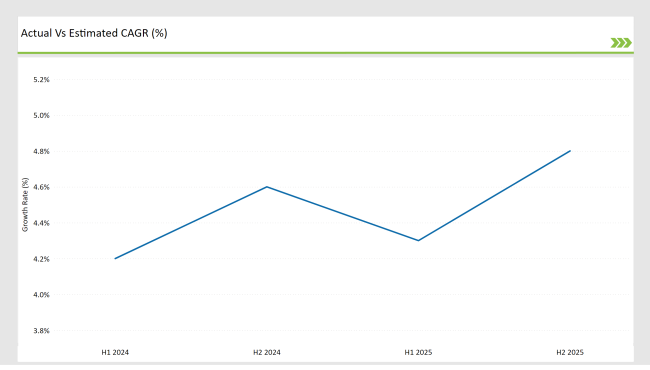

In the USA market, the yeast industry is foreseen to register a compound annual growth rate of 4.2% in the first half of 2024, with a slight rise to 4.6% in the second half of the same year. The growth rate is anticipated to hold the 4.3% rate in the first half of 2025, while it is likely to rise to 4.8% in the second half.

The figures show the changing trends in the USA yeast market resulting from the growing consumer demand for natural ingredients, enhanced production capacities, and breakthroughs in fermentation technologies. The bi-annual report is a valuable resource for companies providing them with a possibility to be equipped with effective strategies in coping with the market growth opportunities and trends.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| Jan-24 | Lesaffre Group : Launched sustainable yeast protein for alt-meat, reducing production emissions by 30%. |

| Feb-24 | ADM : Partnered with SynBio startup to develop yeast-based alt-dairy proteins, targeting Q3 commercialization. |

| Mar-24 | AB Mauri : Expanded Tennessee facility, boosting specialty yeast output 20% for craft breweries. |

| Apr-24 | Lallemand Inc : Introduced AI-driven yeast strain for precision fermentation in pharma applications. |

| May-24 | Angel Yeast : Opened USA R&D hub focusing on yeast extracts for clean-label savory snacks. |

Expansion of Yeast-Based Functional Ingredients

The fastest-growing product category in the yeast market is functional ingredients based on yeast. This is because there is an upsurge in enriched and gut-health foods, which fuels the idiosyncrasies of the yeast business in the USA. Dietary supplements, plant-based proteins, and immune-boosting products increasingly feature the utilization of yeast extracts containing beta-glucans, nucleotides, and peptides.

To keep up with the tide of demand for functional and clean-label foods, the firms are boosting their R&D investments in yeast-derived bioactive compounds. This trend is being embraced across all types of food manufacturing, from desserts and beverages to meat alternatives, with yeast becoming one of the major ingredients in the new landscape of the health-conscious consumer.

Sustainability-Driven Yeast Production Growth

Sustainability objectives are altering the USA market for yeast with the companies shifting to green manufacturing. The companies are making use of waste valorization by leveraging farm waste like molasses and corn-staked liquor as substrates in fermentation processes to enhance environmental contribution.

Additionally, bioreactor technology and methods for carbon capture are enhancing efficiency and reducing emissions from production. This heightened interest in sustainability aligns with the demand for bacteria, non-GMO, and organic yeast production under the principles of circular economy. The yeast industry, thus, secures a great place in sustainable fermentation and biotechnological development.

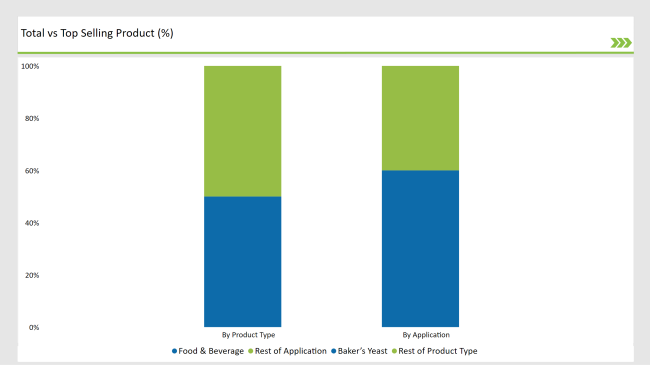

The food & beverage industry holds the highest percentage (60%) of the USA yeast market, primarily because of the increasing consumer demand for natural and functional ingredients. Yeast plays a central role in the baking, brewing, and fermented food manufacturing industries, while the clean-label and plant-based trends further drive its consumption.

The bakery segment continues to be the driving force with bread and baked foods having a consistent consumption rate, while craft brewing and plant-based dairy propel the range of applications even further. The manufacturers are progressing with the incorporation of yeast extracts into savory snacks, sauces, and meat alternatives, which have the benefits of enhancing flavor profiles as well as compliance with the rising health-conscious consumer trends.

Baker's yeast dominated the USA yeast market with a 50% share of the overall product consumption. The key reason behind the dominance is the wide use of the product by the bakery industry particularly in the instances of the rising demand for artisan and gluten-free bread.

Given the consumer preference change in towards fresh, organic, and preservative-free bakery foods, the demand for high-performance variants of yeast keeps going upward. In addition, the popularity of home baking, influenced significantly by health trends and social media, has led to a boom in retail sales of fresh baker's yeast and dry yeast. Also eyeing this direction, manufacturers are allocating a budget to develop fermentation technologies to enhance shelf life, improve flavor, and enhance overall baking efficiency.

The American yeast industry is defined as being moderately concentrated and having the profile of many main players dominating a large part of the market share. To illustrate, the top players in the market are the Lesaffre group through the Red Star Yeast brand, Associated British Foods plc under which there is the Fleishmann's Yeast brand, and the leading producer of yeast Archer Daniels Midland Company (ADM). These firms were able to create strong foundations by having a wide portfolio of products and wide distribution networks.

The competitive environment is dynamic, with firms concentrating on innovation, sustainable strategies, and strategic collaborations to enhance their position in the market. Things like investment in cutting-edge fermentation technology and building yeast-based functional ingredients are standard practices.

Besides, mergers and acquisitions are primarily the situation since firms attempt to advance their game and extend larger market regions. Overall, the USA yeast market leads the pack due to the leading players who never cease trying to find the means of becoming more popular and gaining a greater share in it.

2025 Market share of USA Yeast Market suppliers

.png)

The USA yeast market is expected to grow at a CAGR of 4.6% from 2025 to 2035.

The USA yeast market is projected to reach USD 1,950.5 million by 2035.

The food & beverage segment is expected to grow the fastest, driven by increasing demand for natural and functional ingredients.

Rising consumer demand for clean-label products, increased production capacities, and innovations in fermentation technology are key growth drivers.

Leading companies include Lesaffre Group, Associated British Foods plc, Lallemand Inc., Archer Daniels Midland Company (ADM), and Angel Yeast Co., Ltd.

The USA yeast market is segmented into food & beverage, animal feed, bioethanol & industrial use, pharmaceuticals & nutraceuticals, and others.

The market is categorized into fresh yeast, active dry yeast, instant yeast, and others.

The yeast market includes baker’s yeast, brewer’s yeast, wine yeast, bioethanol yeast, feed yeast, and others.

The key end-user industries are food & beverage, animal husbandry, biofuel industry, healthcare & pharmaceuticals, and others.

The market is segmented into direct sales to manufacturers, retail, online retail, and others.

USA Prenatal Vitamin Supplement Industry Analysis from 2025 to 2035

Curcumin Market Insights - Health Benefits & Industry Expansion 2025 to 2035

Microalgae in Fertilizers Market - Growth & Sustainability Trends 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Dinner Ready-to-Eat (RTE) Food Market - Trends & Consumer Insights 2025 to 2035

Potato Flakes Market Analysis Snack Foods, Ready Meals, Food Service, Bakery, Soups & Sauces, Others End Use Application Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.