The USA wireless telecommunication services industry will reach a market value of USD 4,50,213.5 million in 2025 and grow steadily at a CAGR of 7.9%, reaching USD 9,60,785.9 million by 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size in 2025 | USD 4,50,213.5 million |

| Projected USA Industry Size in 2035 | USD 9,60,785.9 million |

| Value-based CAGR from 2025 to 2035 | 7.9% |

The growth in the USA wireless telecommunication services market is positive, attributed to growing demand for flawless connectivity by end-users, fast urbanization, and rapid uptake of smart devices. In this respect, increased deployment of 5G across the country is significantly contributing, thus providing faster and more reliable connectivity.

Such technological growth has been altering various industries, such as BFSI, healthcare, and IT & telecom, that are also growing their dependence on wireless communication for data transfer, remote monitoring, and cloud integration of several mission-critical applications.

The demand for better connectivity in urban areas with the help of smart city projects and IoT applications further fuels the market. Wireless solution adoption, which enables digital transformation in sectors, adds strength to the importance of the market in USA digital infrastructure. This has placed the market in a continuously growing curve and made it one of the backbones of the evolving communication and operational needs of businesses and consumers alike.

Explore FMI!

Book a free demo

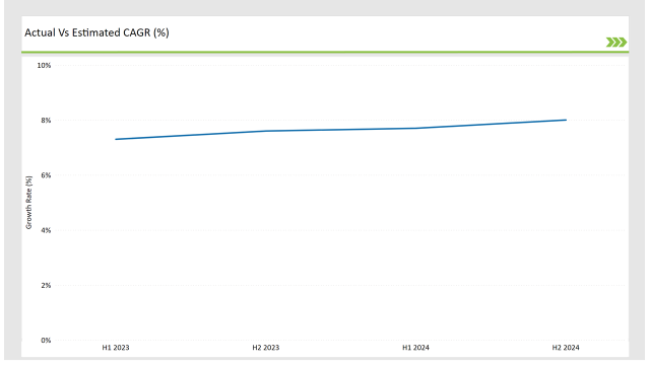

The table below compares the compound annual growth rate (CAGR) for the USA market over six-month intervals, providing stakeholders with precise trends to guide decision-making.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 7.3% |

| H2, 2024 | 7.6% |

| H1, 2025 | 7.7% |

| H2, 2025 | 8.0% |

H1 signifies January to June, while July to December analysis is signified through H2

Accelerated 5G rollouts and increased demand for cloud-based telecom services spur this growth across various industries. The incremental growth reflects the market’s adaptation to evolving consumer and enterprise needs. The industry will grow at a 7.3% CAGR in H1 2024, rising to 8.0% in H2 2025, showing consistent momentum.

| Date | Development/M&A Activity & Details |

|---|---|

| Jan-25 | Verizon expands its 5G Ultra Wideband coverage to over 85% of urban areas in the USA |

| Oct-24 | T-Mobile partnered with AWS to develop edge computing solutions for enterprises. |

| Mar-24 | AT&T launches "CloudConnect," a dedicated cloud service targeting BFSI and healthcare sectors. |

| Sep-24 | Sprint merges with a regional telecom player to expand its service offerings in rural areas. |

| Dec-23 | FCC introduces new spectrum auction policies to encourage small businesses to participate in 5G deployments. |

The providers are partnering through strategic investments in advanced technologies, thus allowing themselves to remain competitive in the market. It is also being addressed with partnerships with leading cloud and IT service providers, responding to growing demand for managed services and cloud connectivity solutions. This also enables the provider to expand their service portfolios into secure and scalable solutions tailored to business needs.

Cloud integration helps the company become operationally efficient and enables remote work, all in a seamlessly controlled data environment. Such alliances enable telecom players to leverage the power of new technologies while meeting changing customer expectations amidst competition in this transforming digital and connected ecosystem.

5G Revolutionizes Connectivity

Mainstreaming from Verizon, T-Mobile, and AT&T carries in-building 5G deployment across major USA markets that include ultra-fast speeds and low latency capable of connecting to several devices. Consecutively helping the use of enabling technologies such as autonomous vehicles and enterprise immersive AR and VR applications, the definition of 5G also redefines how consumers and businesses alike can communicate.

Such developments not only let businesses be more productive and offer new services but also improve user experience. For consumers, 5G means smoother streaming, quicker downloads, and the ability to seamlessly connect multiple smart devices, opening up new avenues toward improved living and advanced digital ecosystems.

Cloud Services Dominate the Market

Cloud-managed solutions transform industrial operations through simplifying processes, enhancing security, and thus enabling seamless remote work. These solutions ensure real-time access to secure data and thus are irreplaceable in sectors like BFSI and healthcare, where privacy and connectivity are of the essence. Financial institutions use cloud services for secure transactions and fraud detection, while healthcare providers utilize them for the secure storing and accessing of patient records.

With businesses increasingly prioritizing agility and data protection, cloud adoption accelerates accordingly, which is expected to drive the telecom-managed services market at a growth rate of 8.5% CAGR, significantly faster than that of traditional services in the years to come.

IoT and Smart Cities Expand Opportunities

The idea of smart city projects and Internet of Things applications is revolutionizing urban lifestyles and increasing the need for wireless connectivity. IoT-enabled devices in industries such as healthcare, manufacturing, and transportation further optimize processes, enhance decision-making, and build efficiency. Smart city initiatives put together energy-efficient systems, automated public services, and connected devices that upgrade infrastructure and improve the lives of citizens.

For example, connected traffic systems reduce congestion, while IoT sensors in manufacturing boost productivity. These technologies rely on faultless wireless networks, placing telecom providers at the heart of digital transformation for cities and industries seeking to embrace IoT-driven changes.

Investments in Rural Connectivity Increase

Major investments in high-speed wireless infrastructure are closing the digital divide in rural areas. Government initiatives and funding by the private sector strive to make reliable connectivity available to these areas, opening up hitherto-untapped markets and spurring economic growth. In turn, high-speed internet access supports remote education, telemedicine, and small business growth, creating opportunities for rural communities comparable to those in urban areas.

The expansion of coverage and infrastructure by telecom companies involves collaboration with policymakers in order to assure inclusion in the digital economy. Beyond connectivity that spurs economic growth, these efforts enable the rural population to participate in the wider digital transformation.

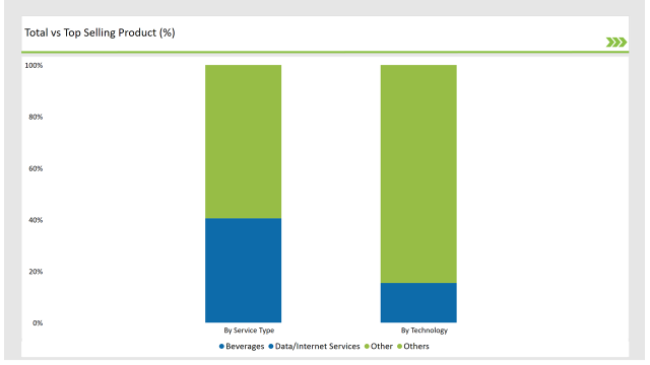

| Service Type | Market Share (2025) |

|---|---|

| Data/Internet Services | 40.5% |

| Fixed Voice Services & Messaging | 22.3% |

| Telecom Managed Services | 20.7% |

| Cloud Services | 16.5% |

The data/internet services segment dominates as reliance on high-speed internet grows for remote work, online education, and digital content consumption. Telecom managed services and cloud services see rapid growth as industries like BFSI, retail, and IT & telecom optimize operations and enhance customer experience.

| Technology | Market Share (2025) |

|---|---|

| 3G | 15.4% |

| 4G | 54.6% |

| 5G | 30.0% |

4G dominates, but 5G adoption will grow exponentially due to its faster and more reliable connectivity. Providers phase out 3G, upgrading infrastructure for modern applications. 5G, integrated with edge computing and IoT platforms, accelerates growth.

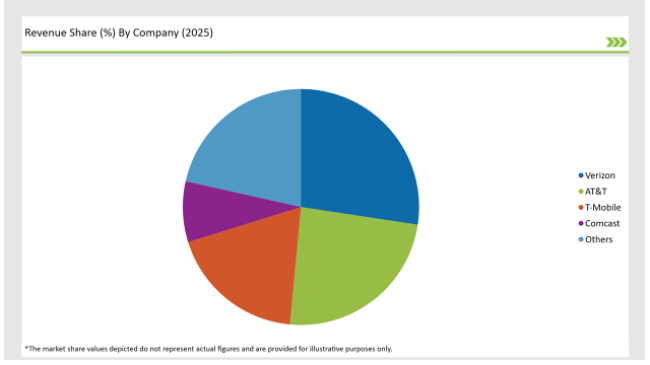

Major players drive competition through innovation and strategic partnerships. Verizon and AT&T hold leading market shares, benefiting from strong R&D and infrastructure. T-Mobile expands its 5G network aggressively, while Comcast diversifies offerings to include IoT solutions and enterprise connectivity.

| Vendors | Market Share (2025) |

|---|---|

| Verizon | 27.4% |

| AT&T | 24.1% |

| T-Mobile | 18.7% |

| Comcast | 8.3% |

| Others | 21.5% |

The market will grow at a CAGR of 7.9% from 2025 to 2035.

By 2035, the industry will reach USD 9,60,785.9 million.

Key drivers are 5G technology adoption, reliance on cloud services, and increasing IoT device proliferation.

The West Coast and Northeast USA lead in wireless service adoption due to urbanization and tech-savvy populations.

Prominent players include Verizon, AT&T, T-Mobile, and Comcast, along with regional providers contributing to the competitive landscape.

Data/internet services, fixed voice services & messaging, telecom-managed services, and cloud services dominate. Data services lead due to high-speed internet reliance.

The market spans 3G, 4G, and 5G technologies. The rapid shift from 4G to 5G highlights growing connectivity and smart device usage.

BFSI, healthcare, retail & eCommerce, IT & telecom, travel & hospitality and government are key industries. BFSI and healthcare dominate, needing robust wireless solutions.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.