The USA Tortilla Market is projected to reach a value of USD 13,749.73 million in 2025, growing at a CAGR of 5.1% over the next decade to an estimated value of USD 22,714.56 million by 2035

| Attributes | Values |

|---|---|

| Estimated USA Industry Size in 2025 | USD 13,749.73 Million |

| Projected Global Value in 2035 | USD 22,714.56 Million |

| Value-based CAGR from 2025 to 2035 | 5.1 % |

The tortilla market is experiencing a structural change because of the increasing consumer demand for the product induced by fast-food lovers who want an easy-to-use, multi-purpose food item. One of the methods to catch up with the competition is that some of the manufacturers are boosting production capacities and concomitantly diversifying the product range.

Among the novelties are gluten-free, organic, and non-GMO tortillas to address the high demand for natural ingredients. In addition, manufacturers have also taken steps toward sustainability and clean-label production by including consumer worries about food transparency and sustainability in their products.

The movement toward more natural and less processed food has been at the forefront of the industry growth. People now are increasingly eating healthily, and thus the producers make use of new techniques for production to upgrade their products without compromising quality and avoid us.

Health. The orientation of the company towards healthier ingredients and the development of products for health-conscious customers are believed to be the reasons for the shift in market competition as well as the best ways of shaping the future of the USA Tortilla Market.

Explore FMI!

Book a free demo

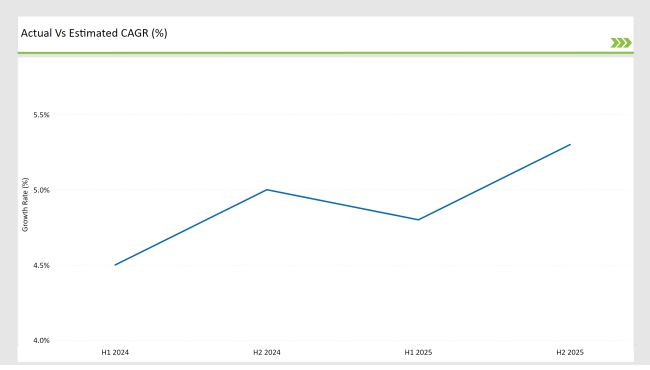

The USA Tortilla Market is anticipated to continue its upward growth trajectory for the sector at a compound annual growth rate of 4.5%, exceptionally rising to 5.0% in the second half of the year. A slight dimming of the growth rate forecast is in the picture due to the expected version of H1 with 4.8% for 2025; however, the jumping of H2 to 5.3% compensates for the loss.

H1 signifies period from January to June, H2 Signifies period from July to December

The market remains ever-evolving, with the main driver being the customers' priority shift to products that are low-fat, organic, and gluten-free. The growth patterns reveal that there are chances for manufacturers to discover and adjust to new consumer demands, regulatory changes, and the push for sustainability in the years to come.

| Date | Development/M&A Activity & Details |

|---|---|

| January 2024 | Azteca Foods: Introduced gluten-free tortillas from rescued corn, reducing food waste in supply chains. |

| February 2024 | Grupo Bimbo: Partnered with Perfect Day for plant-based protein tortillas using upcycled dairy ingredients. |

| April 2024 | Gruma: Launched keto-friendly tortillas with 3g net carbs, targeting health-conscious consumers. |

| May 2024 | Regulation: USDA updated labeling rules for whole-grain tortillas requiring ≥50% whole grains for claims. |

| September 2024 | PepsiCo's Acquisition of Siete Foods: In October 2024, PepsiCo agreed to acquire Siete Foods, a Texas-based maker of tortilla chips and Mexican-inspired products, for $1.2 billion. |

Surge in Health-Conscious Tortilla Demand

The demand for healthier tortilla options in the USA tortilla market has increased significantly according to the statistics presented. As organic, gluten-free, and non-GMO tortillas have been favored by most of the customers, this choice is greatly determined by the increasing desire of people to feel good and look good, as well as by the concerns over food safety.

The market has seen the adaptability of the manufacturers as a result of this trend, which is the introduction of new lines such as low-carb, high-protein, and even keto-friendly tortillas. Such moves not only increase competition but also the chances for companies to diversify and expand their client base, thus raising market growth perspectives.

Expansion of Sustainability Initiatives

The USA tortilla market has lately been driven by a focus on sustainability, with manufacturers pouring investments into eco-friendly packaging, ethical sourcing of raw materials, and waste minimization initiatives. Many tortilla manufacturers are going green by introducing recyclable or biodegradable packaging to satisfy the customer demand for environmentally responsible products.

Apart from that, there has been an increased interest in sourcing corn from farms that are friendly to the environment. With sustainability still being a priority for USA customers, the trend is expected to push for further product innovation and differentiation, thus giving companies the chance to catch eco-conscious buyers and in doing so build long-lasting growth prospects.

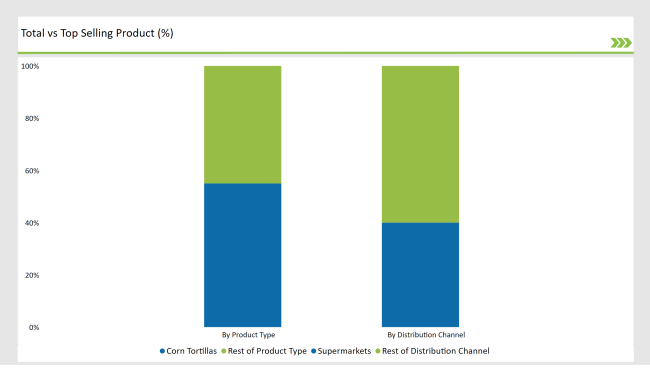

Tortillas Made of Corn tortillas have the biggest market share in the tortilla market in the USA with a figure of 55%. The matter-of-constitution along with demand by the Hispanic community is one reason for this success. Furthermore, health-conscious individuals have also been choosing corn tortillas over wheat due to the fewer calories and higher fiber content. The trend toward more natural and gluten-free options is one more factor that is boosting the consumption of corn tortillas making it a basic food not only in traditional but also in modern diets in the USA.

In the USA, the supermarket channel for tortillas sells 40% of the market share, making it the biggest seller. Buying in bulk from one store due to the huge variety of tortillas offered here makes it the most preferred retail outlet. It is possible to find a lot of different brands and styles of tortillas all in one place, making it convenient, particularly when they have attractive prices and promotional deals. Moreover, supermarkets' wide coverage in suburban and rural areas guarantees enough foot traffic, which would in turn push tortilla sales up and keep supermarkets as the prime shopping outlet in the USA market.

The USA Tortilla Market is not highly concentrated, with many leading brands accounting for the market share. The market is controlled largely by the Gruma, PepsiCo (Sabra Dipping Company), and Flowers Foods (Taco Bell) brands because they own massive distribution networks and provide a great selection of products.

To this end, these companies enhance their production capacity and budget for innovations like introducing gluten-free, organic, and low-carb tortillas in response to the public request for health-oriented products. Private-label brands such as those from Walmart and Kroger have also been gaining popularity and thus market share due to the low pricing strategy.

The competitive market also features regional brands and startups that target the niche market like artisanal or non-GMO tortillas. The expansion of the market will undoubtedly stimulate the suppliers' clean-label commitment and sustainability measures, thus resulting in intensifying competition. This will necessitate companies to keep ahead in the areas of product development and packaging. The dynamic character of the market is a result of ever-changing consumer desires and a rising trend towards healthier eating.

2025 Market share of USA Tortilla Market suppliers

.png)

The USA Tortilla Market is projected to grow at a CAGR of 5.1% from 2024 to 2034.

The USA Tortilla Market is estimated to reach a value of USD 22,714.56 million by 2035.

The demand for gluten-free and organic tortillas is expected to grow the fastest, driven by health-conscious consumers.

Health-conscious trends, innovation in product offerings, and increasing demand for convenient, ready-to-eat food options are driving market growth.

Key players include Gruma (Mission Foods), PepsiCo, Flowers Foods, Grupo Bimbo, and Azteca Foods, leading market share and innovation.

The market is segmented into tostadas, taco shells, corn tortillas, flour tortillas, and tortilla chips, each offering unique consumer preferences and culinary uses.

The market is categorized into corn and wheat-based tortillas, with corn being the dominant choice due to its cultural significance and health benefits.

Segmented into fresh and frozen tortillas, with fresh tortillas capturing higher consumer demand due to their perceived quality and convenience.

The market includes online, offline, supermarkets, convenience stores, and others, providing diverse purchasing options to cater to varying consumer shopping habits.

Calcium Caseinate Market Analysis by End Use Application and Functionality Through 2025 to2035

Aquafeed Enzymes Market Analysis by Enzyme Type, Form, Aquatic Animal, and Region Through 2035

Cattle Nutrition Market Analysis by Cattle Type, Nutrition Type, Application, Life Stage Through 2025 to 2035

Calorie Supplements Market Analysis by Form, Packaging, Flavor, Sales Channel and Region Through 2025 to 2035

Chickpea Milk Market Analysis by Category, Flavor and End Use Through 2025 to 2035

Children’s Health Supplement Market Analysis by Product Type, Application and Age Group Through 2025 to 2035.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.