The United States swab and viral transport medium market is forecasted to earn an amount of USD 4,473.4 million in 2025 with a steady growth rate of 2.1% year on year, raising the total worth of the market up to USD 5,506.7 million by the end of 2035. For this period, the compound annual growth rate will be 2.1%.

| Attributes | Values |

|---|---|

| Estimated Industry Size 2025 | USD 4,473.4 million |

| Projected Value 2035 | USD 5,506.7 million |

| Value-based CAGR from 2025 to 2035 | 2.1% |

This particular market of swab and viral transport medium for the near term will grow significantly in United States, facilitated by solid public health initiatives. United States is one of the largest contributor in the expansion of the sector by 2025 in the North American market. The market is expected to gain a steady CAGR of 2.1% till 2035, and the opportunity reflects a sustainable growth and investment future.

Widespread use of quality swabs and VTMs has been encouraged with the well-developed healthcare infrastructures, with highly state-of-the-art laboratories and diagnostic centers of the USA. They attempt to minimize mistakes or failure in their tests, therefore having a much stronger desire for one-of-a-kind products that assure to achieve efficient sample collection and preservation essential to controlling infectious diseases well and better diagnoses.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

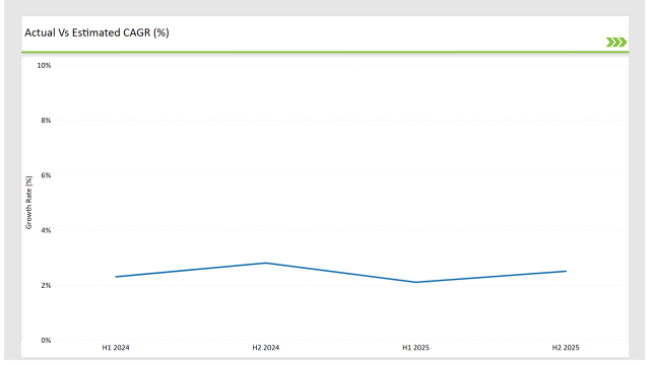

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the United States swab and viral transport medium market.

This semi-annual analysis reveals crucial turns in market dynamics and trace revenue realization patterns better with stakeholders to further understand the trajectory of growth within the course of the year. H1 refers to the period between January and June, while H2 is from July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

The swab and viral transport medium sector for the United States market is expected to grow at a CAGR of 2.3% in the first half of 2023, which will increase to 2.8% in the second half of the same year. In 2024, the growth rate is expected to slightly decline to 2.1% in H1 but is expected to increase to 2.5% in H2. This pattern shows a decline of 20 basis points from the first half of 2023 to the first half of 2024, while in the second half of 2024, it is lower by 25 basis points compared to the second half of 2023.

These figures represent a dynamic and fast-changing United States swab and viral transport medium market, largely influenced by high testing rates, advanced healthcare infrastructure, and strong R&D investments. This semestral breakup is crucial to businesses that chart their strategies, taking into consideration the growth trends and navigating market complexities.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Innovation: McKesson focus on creating advanced swabs and VTMs with improved sample preservation, faster diagnostic compatibility, and eco-friendly designs, addressing evolving healthcare needs and ensuring reliable results for infectious disease testing. |

| 2024 | Expansion: Thermo fisher strengthen its presence by entering new markets, building robust distribution networks, and forming partnerships with healthcare providers to cater to growing demand for diagnostic solutions across diverse regions. |

| 2024 | R&D: BD Company is focusing on Significant investments in research drive the development of cutting-edge technologies, including enhanced VTM formulations and swab materials, enabling precise and efficient sample collection for advanced diagnostic applications. |

High Testing Rates

The USA prioritizes extensive diagnostic testing for infectious diseases like COVID-19 and influenza, ensuring continuous demand for reliable swabs and VTMs to support large-scale, accurate testing initiatives.

Strong R&D Investments

Robust funding in research fosters innovation in diagnostic tools, resulting in advanced swab designs and improved VTM formulations that enhance sample preservation and testing accuracy, meeting evolving healthcare needs.

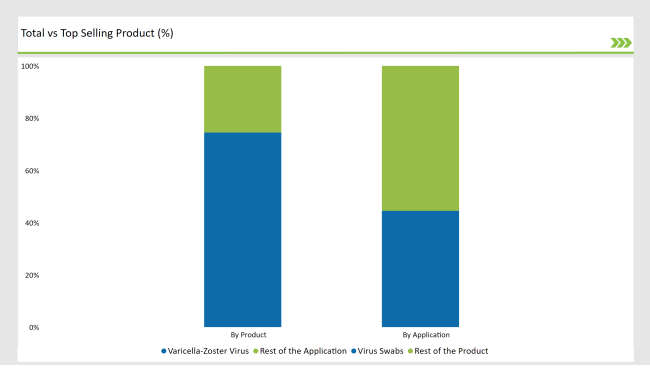

% share of Individual categories by Product Type and End User in 2025

Virus Swabs records significant surge in United States Swab and Viral Transport Medium applications

Virus swabs dominate due to their critical role in accurate sample collection for diagnostic tests. High demand for precision, efficiency, and compatibility with advanced testing methods drives their market leadership.

The varicella-zoster virus segment is likely to witness considerable growth in the market, primarily due to a rising demand for accurate diagnostic testing for VZV infections.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

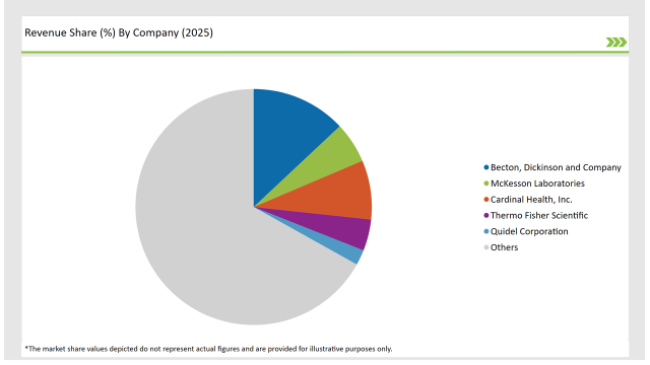

The United States swab and viral transport medium market presents a moderate degree of fragmentation, owing to the presence of both multinational players and regional companies; this drives fierce competition.

Multinationals have captured the marketplace with their groundbreaking technology, established infrastructure, and broad customer base. Local players are similarly taking up valuable market share for their customized approach, especially tailored for niche use such as for field hospitals, emergency response, and remote/underserved rurality areas.

The competitive landscape is more and more dominated by technological progress and the demand for fulfilling different needs of clients. Companies are concentrating on R&D activities to make swab and viral transport medium compact, energy efficient, and cheaper. With the German sustainability agenda, most of the players are now incorporating environment-friendly features into their products.

Add to this the prevalence of partnerships and joint ventures, where companies are co-developing innovative solutions while expanding their market reach. The interplay between the global leaders and the agile regional competitors fosters a culture of constant innovation and adaptability in United states’ swab and viral transport medium market.

2025 Market share of United States Swab and Viral Transport Medium suppliers

Note: above chart is indicative in nature

The industry includes various product type such as viral transport medium (tissue culture medium, glycerol transport medium) and virus swabs (nasopharyngeal swabs, deep nasal swabs, combined nasal & throat swabs, culture swabs, vaginal swabs).

Available in application like influenza, respiratory syncytial virus, mumps virus, adenovirus, rhinovirus, herpes simplex virus, varicella-zoster virus and other indication

By 2025, the United States swab and viral transport medium market is expected to grow at a CAGR of 2.1%.

By 2035, the sales value of the United States swab and viral transport medium industry is expected to reach United States is USD 5,506.7 million.

Key factors propelling the United States swab and viral transport medium market include advanced healthcare infrastructure, including cutting-edge laboratories and diagnostic centers, ensuring widespread adoption of high-quality swabs and VTMs.

Prominent players in the United States swab and viral transport medium manufacturing include Becton, Dickinson and Company, McKesson Laboratories, Cardinal Health, Inc., Thermo Fisher Scientific, Quidel Corporation, Copan Diagnostic, Inc., Deltalab, VIRCELL S.L., Titan Biotech, Inc., Medical wire & Equipment (MWE) and Others. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Explore Life Science & Biotechnology Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.