FMI Analysts project the USA market for Starch Derivatives to reach USD 5,019.6 million in 2025, potentially expanding to USD 8,335.1 million by 2035 at a CAGR of 5.2%, with growth predominantly fueled by rising demand from food, pharmaceutical, and industrial sectors, advancements in starch modification technologies, and the increasing application of starch derivatives in clean-label and sustainable products.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 5,019.6 million |

| Industry Value (2035F) | USD 8,335.1 million |

| CAGR (2025 to 2035) | 5.2% |

The USA Starch Derivatives market is expected to exhibit significant growth, and this is attributed to the increased demand for functional ingredients in food, pharmaceutical, and industrial applications. Such starch derivatives include modified starches, sweeteners, and cationic starches. These derivatives are highly valued for their versatile functionalities such as thickening, stabilizing, and binding.

As the food and beverage industry incorporates clean-label trends, starch derivatives play an increasingly significant role in producing natural, sustainable products which fit with what the consumers prefer. This also expands outside the scope of food applications through biodegradable packaging and industrial adhesives.

Market leaders such as Cargill, ADM, and Ingredion continue to maintain the reins of the market with high levels of R&D activities that yield starch derivatives especially for varied end-users. Emerging players seek out niche applications areas, like eco-friendly textiles and renewable energy solutions, which expand the competitive spectrum of starch derivatives in the future.

A strategic focus on sustainability and advanced technology in the USA keeps the starch derivatives market alive and vibrant throughout the coming decade.

Explore FMI!

Book a free demo

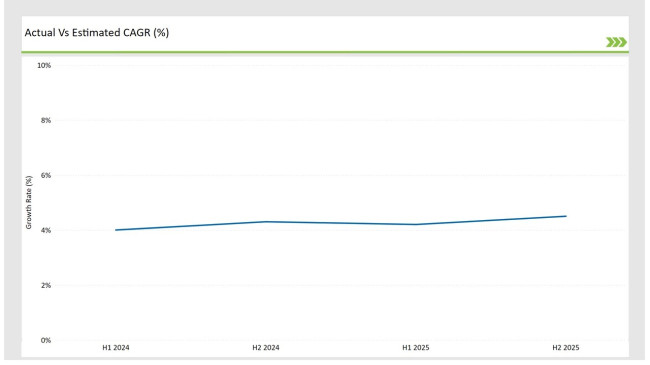

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the USA Starch Derivatives market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Year | 2024 |

|---|---|

| H1 Growth Rate (%) | 4.0% |

| H2 Growth Rate (%) | 4.3% |

| Year | 2025 |

|---|---|

| H1 Growth Rate (%) | 4.2% |

| H2 Growth Rate (%) | 4.5% |

For the USA market, the Starch Derivatives sector is projected to grow at a CAGR of 4.0% during the first half of 2023, with an increase to 4.3% in the second half of the same year. In 2024, the growth rate is anticipated to slightly rise to 4.2% in H1 and reach 4.5% in H2.

This growth trajectory is attributed to multiple factors, including advancements in starch modification technologies that enhance the versatility of derivatives across food and industrial applications. Clean-label initiatives, such as replacing synthetic additives with natural starch-based alternatives, are driving demand from the food and beverage sector.

Furthermore, the rising adoption of starch derivatives in bio-based and industrial products is creating new opportunities for stakeholders to innovate and expand their offerings.

| Date | Development/M&A Activity & Details |

|---|---|

| Oct-2024 | Cargill launched a new modified starch for improved emulsification in plant-based beverages. |

| Sep-2024 | Ingredion Incorporated expanded its range of clean-label starch derivatives with tapioca-based options. |

| Jul-2024 | ADM announced a strategic partnership with a leading pharmaceutical company to supply starch derivatives for drug formulations. |

| May-2024 | Roquette Frères introduced a new cationic starch for eco-friendly paperboard manufacturing. |

| Jan-2024 | Emsland-Stärke GmbH invested in a new production facility to meet the rising demand for functional starches. |

Expansion of Modified Starches for Clean-Label Products

Modified starches are becoming more and more inevitable as a clean label food ingredient, providing functionality without the use of synthetic additives. Such starches improve texture, stability, and shelf life while complying with increased consumer demand for natural ingredients.

Ingredion among other companies are revolutionizing this concept by producing innovative tapioca-based derivatives that provide the solutions for allergen-free and gluten-free demand.

Such modifications in starch derivatives allow food producers to develop healthy products for conscious consumers at reduced costs and without compromising the scalable nature of production. This is evidence that the market for starch derivatives is responding to consumer demands to be healthy and sustainable.

Growth in Industrial Applications of Starch Derivatives

More and more, the industrial sector is using starch derivatives in bio-based packaging, adhesives, and textiles. Of all, cationic starches are widely replacing others in paper and paperboard production because of enhanced strength, printability, and resistance to water. Eco-friendly cationic starch solutions from Roquette Frères reflect the thrust towards sustainability in the industry.

Starch derivatives are also being used in biodegradable plastics, where their renewable and compostable properties provide an eco-friendly alternative to petroleum-based materials. With the emphasis on renewable resources, starch derivatives are becoming integral to environmentally responsible production processes.

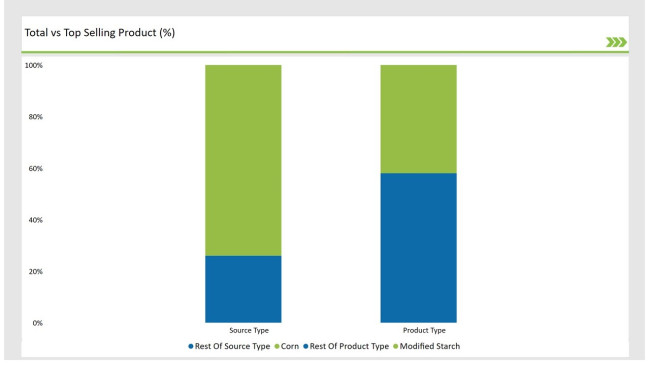

| Product Type | Market Share (2025) |

|---|---|

| Modified Starch | 42% |

| Remaining segments | 58% |

Modified starch remains the largest category in terms of product type as it is generally used in the food and industrial sectors. The demand for glucose and maltodextrin remains steady, although it is part of the broader sweetener trend, as this ingredient improves the texture and shelf life of final products.

Even though native starch is less modified, it is gaining some ground in the clean-label form, offering the unprocessed counterpart for minimally processed food. This segment for cationic starch is thus emerging in paper and textile, driven by effectiveness in durability enhancement as well as environmentally friendly properties for the products.

| Source Type | Market Share (2025) |

|---|---|

| Corn | 74% |

| Remaining segments | 26% |

The predominant source remains corn starch, due to the abundance and relative affordability of this resource in the United States. Its derivatives are most commonly used for sweeteners, adhesives, and biodegradable plastics. Potato starch becomes increasingly popular as a functional starch that can be included in gluten-free and allergen-free formulations and has natural appeal.

Wheat starch is applied for bakery and confectionery products where high elasticity and binding properties are necessary. While a relatively niche product, cassava starch is gaining ground in specialty applications, such as biodegradable packaging and vegan-friendly products, which resonate with sustainability and clean-label imperatives.

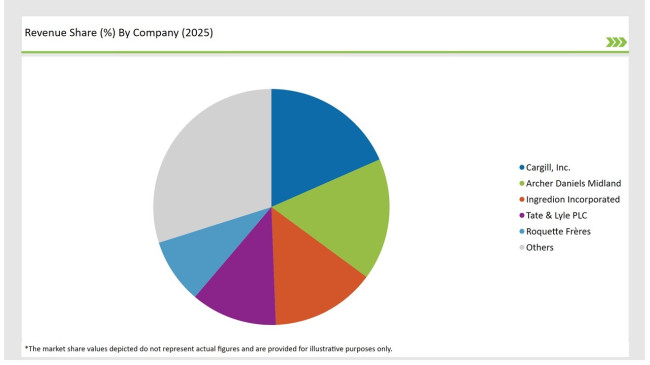

USA Starch Derivatives market is moderately consolidated and comprises Tier-1 players, namely Cargill, ADM, and Ingredion. This group has large market shares combined. Their position in the market is backed by advanced technology, strong supplier network, and strategic partnerships. For example, a focus by Cargill on developing sustainable, clean-label solutions clearly indicates that leadership in this area is key for the sector.

| Company Name | Market Share (%) |

|---|---|

| Cargill, Inc. | 18.4% |

| Archer Daniels Midland | 16.7% |

| Ingredion Incorporated | 14.3% |

| Tate & Lyle PLC | 11.8% |

| Roquette Frères | 8.9% |

| Others | 29.9% |

The specialty starch market is dominated by the Tier-2 players, like Tate & Lyle and Roquette Frères. Other players such as Grain Processing Corporation and Emsland-Stärke GmbH, which serve as Tier-3 players, are further penetrating niches through innovative offerings.

This distribution of players enhances the competitive environment and thereby promotes innovation while providing a constant flow of high-tech starch derivatives to the diversified markets.

By 2025, the USA Starch Derivatives market is expected to grow at a CAGR of 5.2%.

By 2035, the sales value of the USA Starch Derivatives industry is expected to reach USD 8,335.1 million.

Key factors include rising demand for functional food ingredients, advancements in starch modification technologies, and the growing application of starch derivatives in bio-based and sustainable products.

Regions with significant food processing and industrial activity, such as the Midwest, dominate consumption in the USA.

Prominent players include Cargill, ADM, Ingredion, Tate & Lyle, and Roquette Frères, noted for their innovative and sustainable product portfolios.

Modified Starch, Sweeteners, Native Starch, Cationic Starch.

Corn, Potato, Wheat, Cassava.

Food & Beverages, Paper & Paperboard, Feed Industry, Pharmaceuticals, Textiles.

Dry, Liquid.

Thickening, Stabilizing, Binding, Emulsifying.

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Comprehensive Analysis of Pet Dietary Supplement Market by Pet Type, by Product Type, By Application, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.