The USA sports nutrition market is projected to reach a value of USD 8,119.8 Million in 2025, growing at a CAGR of 8.2% over the next decade to an estimated value of USD 17,885.5 Million by 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size in 2025 | USD 8,119.8 Million |

| Projected USA Value in 2035 | USD 17,885.5 Million |

| Value-based CAGR from 2025 to 2035 | 8.2% |

The need for high-performance nutrition, fitness supplements, and clean-label sports nutrition products is the decisive factor for the market to flourish.

The health-ensuring factors like more physically active people, and of course, the production of functional foods and drinks lead to the fact that sports nutrition is no longer just for bodybuilders and professional athletes but also includes casual fitness enthusiasts, endurance athletes, and people who want overall wellness. The plant-based ingredient demand is increasing largely due to the transition to protein sources that are both sustainable and less or not dairy-related.

Furthermore, the portability of the RTD ready-to-drink beverages, energy & protein bars, and pre-workout formulas has made sports nutrition available even for the average consumer. The sport nutrition sector is presented with progressive formulations, such as the addition of natural sweeteners, probiotics, amino acids, and hydration boosters, which meet the changing consumer demands regarding the clean, functional, and personalized sports nutrition.

Explore FMI!

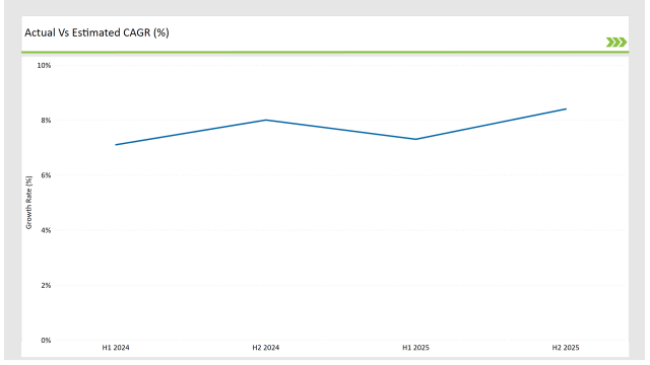

Book a free demo

Comparative to the detailed statistics, CAGR and revenues are the two main metrics showing the USA Sports Nutrition market. Thus, apart from the significant average, these two metrics also reveal the upward trend for CAGR over the years. Besides, the market's terrific speed to the changes reflecting the customer demand for the fitness and wellness trend is the only position the research can conclude.

H1 signifies period from January to June, H2 Signifies period from July to December

The company has introduced new products that are designed specifically for the needs of the consumer besides the distribution of already existing ones. Moreover, the introduction of ready-to-drink packages and single-serving sachets in the packaging sector has not only made the products more accessible but has also contributed to their adoption in all market segments.

| Date | Development/M&A Activity & Details |

|---|---|

| February 25 | Glanbia Performance Nutrition: Launched a plant-based protein powder formulated with essential amino acids for muscle recovery. |

| March 24 | Abbott Laboratories: Expanded its sports hydration range, introducing an electrolyte-rich RTD beverage targeting endurance athletes. |

| May 24 | PepsiCo (Gatorade): Developed a pre-workout energy drink infused with BCAAs and natural caffeine. |

| July 24 | Clif Bar & Company: Introduced a high-protein energy bar with organic plant-based ingredients. |

| September 24 | Nestlé Health Science: Partnered with fitness influencers to promote its recovery and weight management supplements. |

Rise of Plant-Based Sports Nutrition

Sport nutrition companies have extended their product lines to include dairy-free and soy-free and gluten-free offerings which control 62% of the market share. People who follow vegan diets look for protein alternatives made from pea combined with pumpkin seeds and hemp proteins and rice proteins because of their superior biological value.

Plant-based sports nutrition expands in popularity because it meets consumer values for sustainability as well as offers allergen-free formulations and follows ethical buying preferences. Major brands combine plant proteins into blended products that establish complete amino acid profiles which ensures perfect muscle healing and endurance enhancement.

Innovations in Sports Hydration and Recovery Solutions

The sports nutrition market is expanding because athletes together with active people require electrolyte enriched fast-absorbing post-workout and functional hydration solutions. To match this emerging need brands, produce low-sugar electrolyte beverages alongside coconut water hydro products and amino acid drinks as recovery shakes.

Resorting athletes to their active lifestyles through on-the-go nutrition has prompted manufacturers to create dual-action products using time-release technology alongside fast-mixing hydration capsules with adapt genic recovery benefits for athletes. The post-workout formula innovation gets an extra boost from the inclusion of collagen peptides and the combination of L-glutamine together with curcumin extracts.

% share of Individual categories by Ingredient Type and Product Form in 2025

Plant-based ingredients are leading the sports nutrition market, with a 62% share, shedding light on the vegan and dairy-free protein source trend. Consumers are looking for the best protein sources such as pea, soy, and brown rice, which are easily digestible, and help health disciples with muscle injuries, as well as provide them with allergen-free options.

The growing popularity of organic and minimally processed protein powders has led to the development of plant-based pre-workout and recovery supplements.

The energy and protein bar market represents a sizable portion of overall sales at 32%. During workouts, protein-based snacks are among the items that should be packed by athletes.

It provides basketball players with crucial nutrients to sustain energy and help post-exercise recovery. In addition to that, their trend is climbing as they are now an indispensable widget in the fitness nutrition sector, targeted to the market of people searching for fast and efficient ways of having an active life.

Note: above chart is indicative in nature

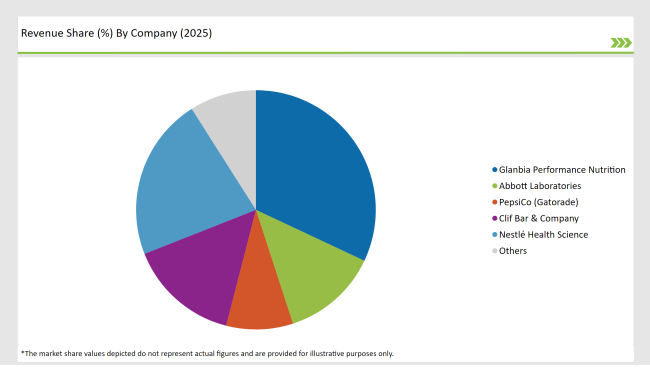

The USA sports nutrition market maintains high competition based on improved ingredients alongside sustainable packaging solutions and additional plant-based product development.

The sports nutrition industry is controlled by Glanbia Performance Nutrition Abbott Laboratories PepsiCo (Gatorade) Clif Bar & Company and Nestlé Health Science because they lead the market with scientific formulations and established brand recognition coupled with extensive sales networks.

Manufacturers advance natural ingredient formulations as an effect of consumer demand for sports nutrition products with clean labels, sugar-free, and non-GMO characteristics. Consumer buying habits have transformed through the growth of online sports nutrition solutions direct-to-consumer sales and e-commerce channels.

Manufacturers serving the growing market for pre-workout recovery and hydration solutions prioritize developing protein powders containing probiotics and amino acid-fortified energy bars and collagen powder sports supplements. The expanding consumer adoption of flexitarian living together with hybrid protein composites leads companies to modify their product development approaches.

The market is expected to grow at a CAGR of 8.2% from 2025 to 2035.

The USA sports nutrition market is projected to reach USD 17,885.5 Million by 2035.

Key drivers include rising consumer focus on fitness, growing demand for plant-based sports nutrition, and advancements in hydration and recovery formulations.

Plant-based ingredients lead by ingredient type, while energy & protein bars dominate the product form segment in 2025.

Top manufacturers include Glanbia Performance Nutrition, Abbott Laboratories, PepsiCo (Gatorade), Clif Bar & Company, and Nestlé Health Science.

By product form, the industry is segmented into ready-to-drink, energy & protein bars, powders, and tablets/capsules.

By ingredient type, the market includes plant-based and animal-based ingredients.

By function, the market is divided into energizing products, rehydration, pre-workout, and recovery & weight management.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.