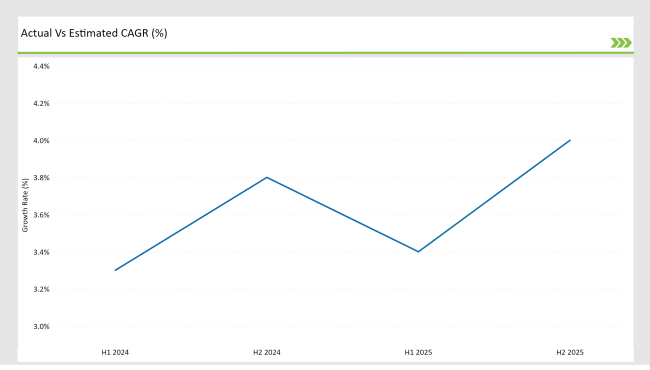

The USA Sourdough market is projected to reach USD 8.6 billion in 2025, growing at a CAGR of 3.9% over the next decade to an estimated value of USD 12.6 billion by 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size (2025) | USD 8.6 billion |

| Projected USA Value (2035) | USD 12.6 billion |

| Value-based CAGR from 2025 to 2035 | 3.9% |

The market for sourdough in the USA is showing impressive growth, the growth is particularly driven by the increasing consumer demand for artisanal bread products and naturally fermented bread.

A lot of people consider sourdough as a bread that is nutritious and good for health it is due to its low glycemic index (GI) and high digestibility that the bread is made through the process of natural fermentation. This assumption increases the interest of people in sourdough a lot among health-conscious people.

The growth of the organic, non-GMO, and gluten-free food market is also a big factor behind the success of companies that modify their current sourdough products to meet these preferences. Such products make sourdough more popular because they are available as pre-sliced frozen products. The solution makes sourdough products available to time-pressed consumers.

The retail market entry through baking packages creates new field participants which include expanding numbers of bakeries as well as supermarkets and e-commerce platforms that sell sourdough products. The release of additional flavors also has an affirmative impact on the popularity of sourdough and thanks to this, it is bought not only by foodies but also by people trying to be healthy.

Moreover, the market benefits from the progress of baked goods that use a different method such as pizza crusts, flatbreads, and bagels, especially with the investments made in sourdough fermentation technology and sustainability. The SACI report notes that the USA sourdough market is the most promising as it fulfills demands for high standards of quality, genuine production, and health aspects.

Explore FMI!

Book a free demo

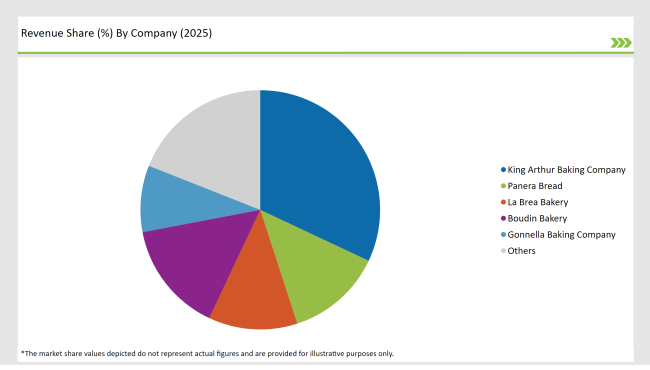

The sourdough market is moderately concentrated with leading players having strong market shares and at the same time providing an open environment for various artisanal bakers and small-scale producers.

Large commercial brands lead the commercial scene, but the small, local bakeries keep the market very active. This equilibrium helps innovation and variety flourish and serve growing demand from consumers who seek authentic, naturally fermented sourdough products.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| January 24 | King Arthur Baking Company: Launched a new organic sourdough bread mix to meet increasing consumer demand for at-home baking solutions. |

| March 24 | Boudin Bakery: Expanded its sourdough sandwich bread line, catering to foodservice and retail markets. |

| May 24 | Panera Bread: Introduced a high-fiber sourdough variant for health-conscious consumers. |

| August 24 | La Brea Bakery: Partnered with retailers to launch a frozen sourdough range for convenience-seeking shoppers. |

| November 24 | Gonnella Baking Company: Announced a new sourdough pizza crust targeting foodservice operators. |

The rising requirement for clean-label and functional sourdough

The rise in people's awareness regarding gut health and the counter of grains enabled consumers to actively seek natural, preservative-free, and fermented food products. Sourdough is largely recognized as a naturally fermented food that contains probiotics, is easier to digest, and is less gluten, thus it is mostly consumed by health-conscious and gluten-sensitive people.

Leading companies are also offering organic, non-GMO, and high-fiber sourdough varieties, thus further simplifying the clean-label food trend. The consumer interest in alternative flour-based sourdoughs has grown as suppliers of health-oriented products like whole wheat, rye, and ancient grains are becoming popular.

Frozen and Convenience Sourdough Products on the Rise

As customer's habits are changing, easy frozen and ready-to-bake sourdough has seen rapid growth lately. The brands are acting on this trend by launching easily digestible, high-quality pre-packaged, sourdough, majorly for supermarkets, bakeries, and e-commerce platforms.

The growth of the meal kit services market and online grocery shopping has caused a rise in the demand for sourdough solutions focused on convenience, ensuring that everyone has access to quality bread without the need to visit bakeries.

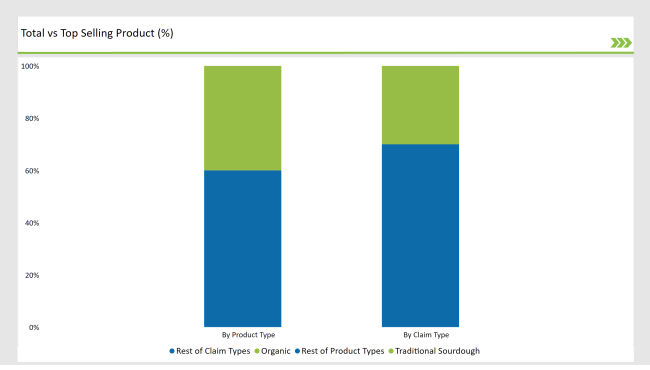

% share of Individual categories by Claim Type and Product Type in 2025

The most significant portion of the USA Sourdough market is under Traditional Sourdough (40%) which is secured through its authentic flavor profile, natural fermentation process, and health benefits. For its consumers, its strong tanginess, artisanal texture, and nutritional benefits come out as very important, especially when it boasts increased digestibility and lower gluten levels.

Applications include sandwiches, artisanal bread, and recipes that are ideal for home bakers and commercial kitchens alike. Its clean-label appeal is a nice fit with the rising demand for minimally processed, preservative-free foods, and cultural connections to heritage baking methods keep its relevance.

While flavored and convenience variants did detract from its market share, traditional sourdough continues to maintain market leadership with consumer loyalty and as a staple in health-conscious and culinary-centric lifestyles.

Research indicates Organic will occupy 30% of the USA sourdough market during the year 2025. The market growth stems from consumer desire for organic products which originates from cleanliness-preference and awareness about health.

People view organic sourdough as a straightforward fermented food that enhances both its ease of digestion and nutritional composition which attracts consumers focused on their wellness. The segment is multifaceted as it has uses in artisan breads, sandwich recipes, and home baking products.

Furthermore, the organic category aligns perfectly with the latest sustainability trends of consumers, allowing them to continue their loyalty to organic sourdough bread since it has become one of the prime ingredients in any healthy diet. This is in line with broader trends of health-conscious, minimally processed premium baked goods.

Note: above chart is indicative in nature

The USA sourdough market is moderately fragmented, with key players holding strong regional influence. Big manufacturers King Arthur Baking Company and Panera Bread have national networks and distribute sourdough bread all over the country while boutique bakeries such as Boudin Bakery and German Bakery provide sourdough products such as specialty pretzels and premium bread, respectively.

Regional bakeries and startups make the market much more innovative about sourdough, gluten-free, and a high-fiber product sold by direct-to-consumer and even online. The sale of frozen, prepackaged sourdough bread also factors in making it a dynamic marketplace.

Companies emphasizing research on fermentation, sustainable packaging, and digital marketing tactics are crucial factors that set them apart in the highly competitive yet enlarging market.

The market is projected to grow at a CAGR of 3.9% from 2025 to 2035.

The market is expected to reach USD 12.6 billion by 2035.

Increasing demand for clean-label, organic, and functional foods, along with frozen and convenience-based sourdough products.

Traditional sourdough leads (40%) followed by flavored sourdough (30%) dominates the USA Sourdough market.

Leading companies include King Arthur Baking Company, Panera Bread, La Brea Bakery, Boudin Bakery, and Gonnella Baking Company.

By product type, the market is segmented into Traditional Sourdough, Flavored Sourdough, Specialty Sourdough, and Convenience Sourdough.

By claim type, the market includes Organic, Non-GMO, Gluten-Free, High Fiber, and Others.

By packaging type, the market is categorized into Retail Packaging, Bulk Packaging, Frozen Packaging, and Others.

By distribution channel, the market encompasses Supermarkets, Specialty Bakeries, Online Retail, and Foodservice.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.