The USA Snack Pellets Market is forecasted to achieve a market value of USD 266.8 million by 2025, with an anticipated expansion to USD 447.3 million by 2035. Over the forecast period (2025 to 2035), the market is expected to grow at a CAGR of 5.3%, fueled by advancements in extrusion technology, the introduction of multi-grain and vegetable-based snack pellets, and the expansion of online and food service distribution channels.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 266.8 million |

| Industry Value (2035F) | USD 447.3 million |

| CAGR (2025 to 2035) | 5.3% |

The USA Snack Pellets Market is witnessing steady expansion, driven by growing consumer demand for customizable, shelf-stable snack options and increasing interest in innovative flavors and textures. The introduction of healthy snack alternatives, such as multi-grain, high-protein, and air-puffed snack pellets, is further reshaping the market landscape.

One of the key trends influencing market dynamics is the increasing adoption of twin-screw extrusion technology, which enhances production efficiency and allows for multi-layered snack designs. Additionally, hot air expansion processing is gaining traction as it reduces oil content, catering to the growing preference for low-fat snack options.

Companies such as Limagrain Céréales Ingrédients, Liven, and Grupo Michel are focusing on product differentiation through new shapes, flavors, and healthier formulations. The market is moderately fragmented, with players competing on innovative ingredient combinations, processing techniques, and supply chain optimization to meet the evolving consumer demand.

Explore FMI!

Book a free demo

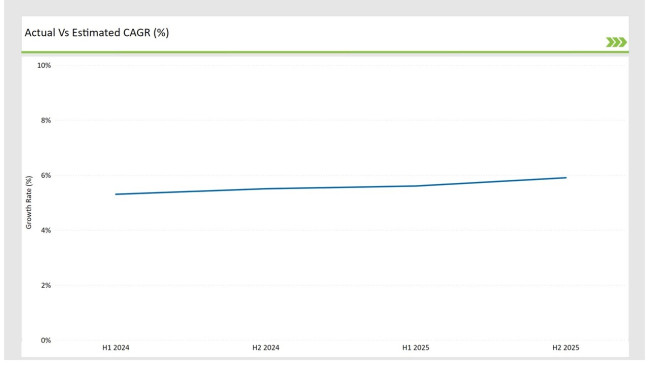

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the USA Snack Pellets market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Year | 2024 |

|---|---|

| H1 Growth Rate (%) | 5.3% |

| H2 Growth Rate (%) | 5.5% |

| Year | 2025 |

|---|---|

| H1 Growth Rate (%) | 5.6% |

| H2 Growth Rate (%) | 5.9% |

For the USA market, the Snack Pellets sector is projected to grow at a CAGR of 5.3% during the first half of 2024, with an increase to 5.6% in the second half of the same year. In 2025, the growth rate is anticipated to slightly rise to 5.9% in H1 and reach 5.5% in H2.

| Date | Details |

|---|---|

| Dec-2024 | Pasta Foods invested in new drying technology for enhanced pellet quality. The system reduces drying time while improving product consistency. |

| Oct-2024 | BGrade Food Ingredients launched clean-label snack pellets without artificial additives. The products use natural colorants and flavors while maintaining shelf stability. |

| Aug-2024 | JR Short developed protein-fortified pulse-based snack pellets. The innovative formulation achieves 25% protein content with excellent texture. |

| Jun-2024 | Quality Pellets expanded their production facility in Poland with new extrusion lines. The expansion increases capacity for specialty shaped pellets by 50%. |

| Apr-2024 | Liven SA introduced new vegetable-enriched pellets for healthy snacking. The pellets incorporate 30% vegetable content while maintaining excellent expansion properties. |

Growing Demand for Multi-Grain and Vegetable-Based Snack Pellets

As consumers become increasingly health-conscious, there is a noticeable shift towards multi-grain and vegetable-based snack pellets. These varieties incorporate whole grains, legumes, and vegetables, offering higher fiber content, better nutritional value, and gluten-free options.

Snack manufacturers are capitalizing on this trend by launching low-fat, air-expanded, and non-GMO snack pellets that appeal to health-conscious and diet-specific consumers. Companies such as Limagrain Céréales Ingrédients and Grupo Michel are expanding their portfolios to include snack pellets made from quinoa, lentils, sweet potatoes, and chickpeas, catering to the demand for functional and fortified snacks.

Technological Advancements in Twin-Screw Extrusion Enhancing Production Efficiency

The snack pellet industry is increasingly adopting twin-screw extrusion technology, which allows for higher efficiency, improved texture control, and the creation of complex, multi-layered snack pellets. This innovation is particularly beneficial for 3D and double-layered snack pellets, which are growing in popularity due to their unique texture and ability to retain flavors.

Twin-screw extrusion also enables the use of a wider range of ingredients, including fortified and protein-rich blends. Manufacturers such as Liven and Quality Pellets are leveraging advanced extrusion techniques to create snack pellets with enhanced crispiness, unique shapes, and better oil absorption properties for customized frying and baking methods.

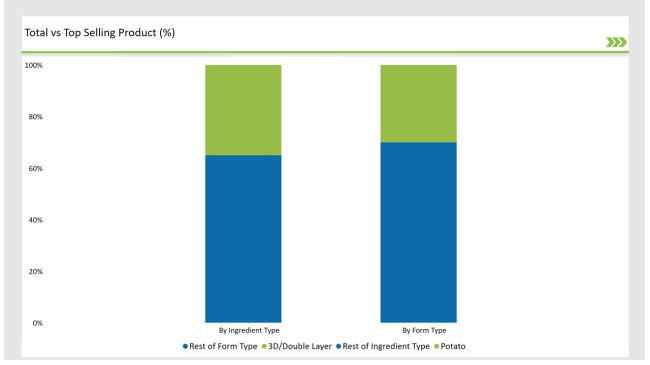

| By Ingredient Type | Market Share |

|---|---|

| Potato | 35% |

| Remaining segments | 65% |

Potato remains the leading ingredient in snack pellets due to its neutral flavor, crispy texture, and ability to blend well with seasonings. However, corn-based and mixed-grain snack pellets are growing steadily as manufacturers explore nutrient-rich and gluten-free alternatives.

The rising demand for low-fat and multi-grain snacks is fueling the expansion of rice and tapioca-based pellets, especially in the better-for-you snack category. Companies are investing in new formulations that mix grains, legumes, and vegetables to enhance the nutritional profile of snack pellets.

| By Processing Type | Market Share |

|---|---|

| Hot Air Expansion | 58% |

| Remaining segments | 42% |

Snack manufacturers are increasingly adopting hot air expansion technology, which allows snack pellets to retain crispiness without excessive oil absorption. This method supports the growing preference for baked and air-popped snacks, which appeal to health-conscious consumers looking for low-fat alternatives.

While hot oil frying remains relevant, particularly for traditional snack categories, the shift towards air-expanded pellets is expected to continue as brands focus on health-oriented product positioning and cleaner ingredient labels. As a result, companies are optimizing their production lines to accommodate both air-puffed and lightly fried snack pellet variations.

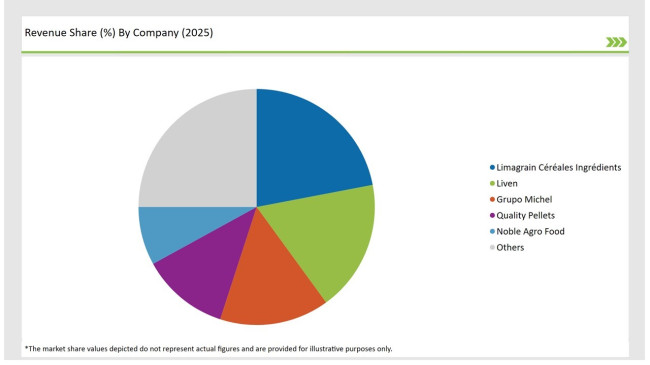

The USA Snack Pellets Market is moderately consolidated, with a mix of multinational corporations (MNCs) and regional manufacturers competing for market share. Limagrain Céréales Ingrédients, Liven, and Grupo Michel lead the market due to their extensive product portfolios, advanced processing techniques, and strong distribution networks.

While regional players like Noble Agro Food and Quality Pellets cater to niche markets such as organic and gluten-free snack pellets, larger companies dominate through R&D-driven innovation, strategic partnerships with food processors, and efficient global supply chains. The industry is becoming increasingly competitive as demand for healthier and multi-grain snack pellets rises.

| Company | Market Share (%) |

|---|---|

| Limagrain Céréales Ingrédients | 22% |

| Liven | 18% |

| Grupo Michel | 15% |

| Quality Pellets | 12% |

| Noble Agro Food | 8% |

| Other Players | 25% |

The leading snack pellet manufacturers are focusing on ingredient innovation, expansion of processing capabilities, and distribution partnerships to strengthen their market presence. Limagrain Céréales Ingrédients has invested in multi-grain and vegetable-based snack pellets, targeting health-conscious consumers. Liven and Grupo Michel are expanding their twin-screw extrusion technology to create customized, high-protein snack pellets.

Companies are also leveraging hot air expansion techniques to develop low-fat and clean-label snack options, aligning with the growing preference for minimally processed foods. Additionally, strong raw material sourcing and supply chain efficiency are critical factors in maintaining market dominance, with key players establishing regional production hubs and optimizing logistics networks.

By 2025, the USA Snack Pellets Market is expected to grow at a CAGR of 5.3%, driven by rising demand for convenient and healthier snacking options.

By 2035, the USA Snack Pellets Market is projected to reach USD 447.3 million, fueled by innovations in multi-grain formulations and expansion of foodservice applications.

Key growth drivers include technological advancements in twin-screw extrusion, increasing preference for air-expanded snacks, rising demand for gluten-free and high-protein snack options, and expansion of online snack retailing.

The Midwest and West Coast regions are key markets due to high demand from food processors, snack manufacturers, and growing interest in healthier snack alternatives.

Prominent players in the USA Snack Pellets Market include Limagrain Céréales Ingrédients, Liven, Grupo Michel, Quality Pellets, and Noble Agro Food, along with Balance Foods, Intersnack Group, Pasta Foods, J.R. Short Milling, and Le Caselle.

Includes Potato, Corn, Rice, Tapioca, Mixed Grains, and Others.

Comprises 3D/Double Layer, Pasta Shape, Chips, Micro-Pellets, and Others.

Categorized into Twin-Screw Extruder and Single-Screw Extruder.

Includes Hot Air Expansion and Hot Oil Frying.

Used in Food Processing Channels, Food Service and Catering Channels, Traditional Retail, and Online Retail.

Liqueurs Market Analysis by Type, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast from 2025 to 2035

Yeastless Dough Market Growth - Innovations & Consumer Preferences 2025 to 2035

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.