United States Protein A Resins Market Outlook of 2025 to 3035 is expected to be the highest volume until 2035. The market for the protein A resins industry in the United States is estimated to reach a value of USD 213.1 million by 2025 and is expected to grow at a CAGR of 1.5% to 243.3 million.

Market Overview

| Attributes | Values |

|---|---|

| Estimated United States Market Size 2025 | USD 213.1 Million |

| Projected United States Value 2035 | USD 243.3 Million |

| CAGR from 2025 to 2035 | 1.5% |

Highly selective purification resin for the biopharmaceutical industry is a rapidly growing market for the USA protein A resins market. Regulatory approvals of recombinant protein A resins, and advancement in chromatography techniques have improved efficiency in antibody purification processes.

Recent rapid technological advances in bioseparation technologies increase process scalability and reduce manufacturing costs. Regulatory support for biopharmaceutical advancements and the expansion of manufacturing facilities are driving further adoption of protein A resins across multiple applications.

Explore FMI!

Book a free demo

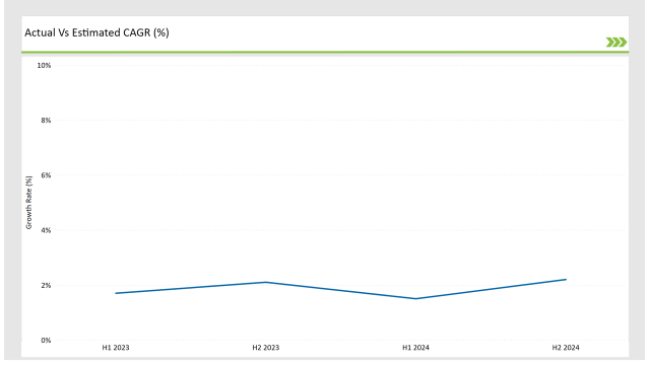

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the United States Protein A Resins Market.

| Year | 2024 |

|---|---|

| H1 Growth Rate (%) | 1.7 |

| H2 Growth Rate (%) | 2.1 |

| Year | 2025 |

|---|---|

| H1 Growth Rate (%) | 1.5 |

| H2 Growth Rate (%) | 2.2 |

This semi-annual analysis highlights all the critical shifts of market dynamics as well as details the revenue realization pattern, thus more precisely providing to the stakeholder’s insight into the trajectory of growth within a year. In other words, H1 contains January to June, and the other half H2 contains July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

Protein A Resins Market of the United States is expected to grow at 1.7% CAGR for the first half of 2024, followed by an upgradation to 2.1% in the same year's second half. For 2025 the growth is forecasted to go a little down and reach 1.5% in H1 and is expected to rise to 2.2% in H2. This pattern presents a decline of -20 basis points in the first half of 2024 through to the first half of 2025, whereas it is higher in the second half of 2024 by 13.4 basis points compared with the second half of 2025.

Driven by increasing adoption of recombinant protein A resins and innovations in bioseparation technologies. Rising investments in next-generation chromatography systems and automation in downstream processing are further fueling market expansion. The integration of AI-driven analytics for resin performance optimization is also enhancing process efficiency. Additionally, growing collaborations between biotech firms and academic institutions are leading to advancements in protein purification methodologies, further strengthening the market outlook for protein A resins.

| Date | Development/M&A Activity & Details |

|---|---|

| 2025 | Government Support: By endorsing widespread testing programs and pandemic preparedness, governments help ensure a steady demand for products. |

| 2024 | R&D: Pfizer Company is focusing on Significant investments in research drive the development of cutting-edge technologies |

| 2024 | Expansion: Cytiva strengthen its presence by entering new markets, building robust distribution networks, and forming partnerships with healthcare providers. |

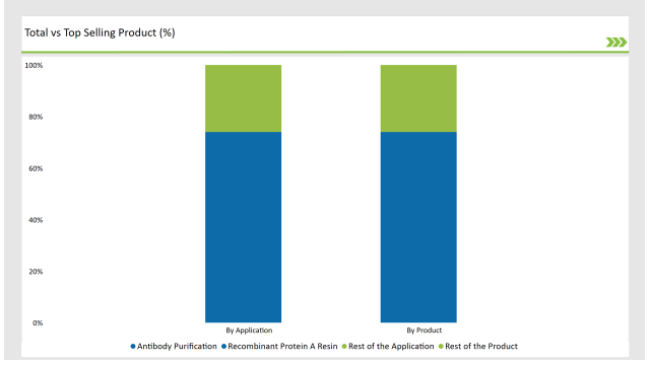

Natural protein A resins continue to be widely used for their high specificity in antibody purification. However, recombinant protein A resins are gaining traction due to their improved binding capacity and stability. By 2035, recombinant resins are expected to capture over 55% of the market share, driven by advancements in engineered ligands and enhanced resin durability.

Agarose-based matrices remain the most commonly used platform for protein A resins due to their superior binding efficiency and scalability. Glass or silica-based matrices are witnessing moderate growth, while organic polymer-based matrices are emerging as alternatives for enhanced purification efficiency and cost-effectiveness.

The largest application is antibody purification accounting for over 70% of the market. The rise in monoclonal antibody-based therapeutics requires the demand for higher-performance resins. Immnunoprecipitation techniques are also increasing because advances in precision medicine require highly selective purification methodologies.

The largest proportion of present protein A resin users are biological manufacturers. It is the most sensitive material to be fabricated in the USA. It has various applications in the production of antibody and downstream processing. It is being used in experimental and preclinical studies by more clinical research laboratories and academic institutes. Novel resin development and application research also occur in academic institutes within the academic institutions.

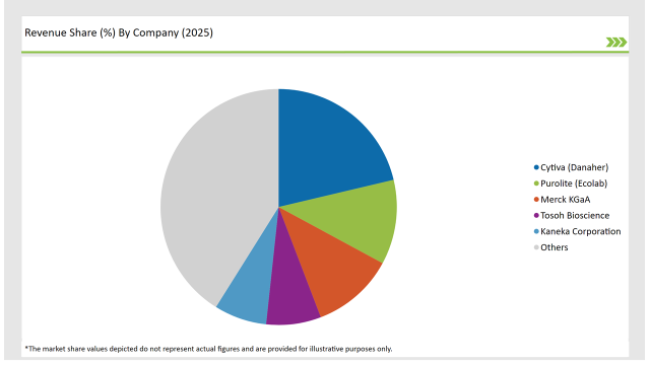

The market has a large number of protein A resins which are moderately consolidated with the presence of major players such as Merck KGaA Cytiva, Repligen Corporation and Tyson Energy. The companies are investing in the capacity expansion of resin production development, and the development of high-performance resins to enhance their market presence.

Other small biotechnology firms and academic research institutes are also entering the market by developing low-cost resin alternatives and improving bio separation techniques. Increasing government and private sector investments in bioprocessing infrastructure are expected to support market expansion and innovation in protein purification solutions.

By 2025 to 2035 , the United States Protein A resin market is expected to grow at a CAGR of 1.5%.

By 2035, the sales value of the United States protein A resin industry is expected to reach is 243.3 million.

Key factors propelling the United States protein A resin market include rising biosimilar development, cost-efficiency focus, investment in bioprocessing facilities, expansion in emerging economies, and personalized medicine demand.

The key players operating in the global protein A resin market include GE Healthcare,Thermo Fisher Scientific, Kaneka Corporation, JNC Corporation, Purolite Life Sciences, Bio-Rad Laboratories, Inc., JSR Corporation (JSR Life Sciences LLC), Repligen, Tosoh Bioscience, Merck Group (Merck Millipore), Novasep Holdings SAS, Agilent Technologies, Inc., GenScript, Abcam PLC (Expedeon Ltd.), Avantor Inc., Takara Bio, PerkinElmer, Inc., Suzhou Nanomicro Technology Co., Ltd

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Analysis by Product, Testing Methods, End User, and Region - Forecast for 2025 to 2035

Procalcitonin (PCT) Assay Market Analysis by Component, Type, and Region - Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.