The USA Products from Food Waste market is projected to reach a value of USD 17,885.89 million in 2025, growing at a CAGR of 8.0% over the next decade to an estimated value of USD 38,614.29 million by 2035.

| Attributes | Values |

|---|---|

| Estimated USA Industry Size in 2025 | USD 17,885.89 Million |

| Projected USA Value in 2035 | USD 38,614.29 Million |

| Value-based CAGR from 2025 to 2035 | 8.0 % |

This growth is the result of a major change in the market, which is mostly caused by the increasing consumer interest in sustainable and environmentally friendly options. To take advantage of this opportunity, manufacturers are first increasing their production capacities, second, they are investing in more advanced processes, and third they are bringing to the market new products that come from the development of food waste reduction technologies. Through the process of adding products and the use of processing techniques, they are raising their market share and at the same time helping in the case of Products from Food Waste in the supply chain.

The growing consumer preference for natural substances in products is changing the industry standards, as many people are choosing for the first time products that are labeled as being made from renewable materials. This is thereby encouraging companies to use more and more natural, plant-based components instead of synthetics in the food products they sell, which again drives the demand for the Products from the Food Waste business.

The growing cognizance of environmental issues has led companies to involve both themselves and consumers in eco-friendly operations. Thus, the market has added its ambitious trajectory. Consequently, the USA Products from the Food Waste market are undergoing a considerable increase.

Explore FMI!

Book a free demo

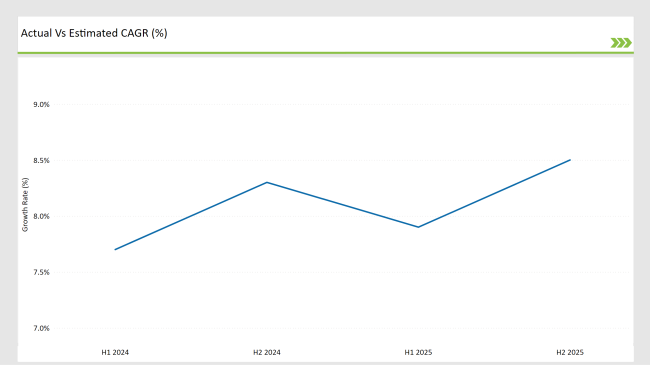

According to market predictions, the USA Products from Food Waste sector will record a spectacular development rate of 7.7% in the first half of 2024 and an increment to 8.3% in the subsequent half of the year. In the coming year, the growth range will likely neither go up nor down achieving a 7.9% increase in H1, but it is believed to shoot up to 8.5% in H2.

H1 signifies period from January to June, H2 Signifies period from July to December

The main factors for the high performance of this market are new rules that were passed in legislation, the need for more green products from Food Waste, and the trend of consumers favoring eco-friendly products. The positive slope of the market innovation is the clue for companies that they must be inventive and flexible to utilize this rising business chance.

| Date | Development/M&A Activity & Details |

|---|---|

| January 2024 | Rubicon Global: Rolled out blockchain platform for retail food waste tracking, partnering with Kroger and Walmart. |

| March 2024 | Divert, Inc.: Opened California facility converting food waste to renewable energy, targeting 50K tons/year processing. |

| April 2024 | Waste Management Inc.: Partnered with Replate for AI-driven food waste sorting, boosting donation efficiency by 35%. |

| May 2024 | Veolia North America: Secured USDA grant for anaerobic digestion projects, converting grocery waste to organic fertilizer. |

| Mar 2024 | EPA finalized stricter food waste diversion mandates for supermarkets, effective 2025. |

Increased Focus on Circular Economy Models

One of the most remarkable changes in the food waste market in the USA is the rising adoption of circular economy models. A plethora of companies have initiated the process of upcycling food waste that can be used for other purposes such as biodegradable packaging, renewable energy, and even alternative protein sources. The transition has been thanks to consumer pressure for eco-friendly solutions and stricter environmental regulations. For instance, processing waste from food is now being turned into biofuels and compost, which helps to reduce landfills and carbon emissions. Today the brands are setting sustainability goals, and this kind of business model is becoming the backbone of their business processes, thus, supporting the market growth.

Advances in AI and Technology for Products from Food Waste Management

The technological leap in the United States has been achieved using the combination of artificial intelligence (AI) and technology for thriving food waste management. The companies take advantage of AI to the full by operating it to predict food demand accurately, decrease overproduction and reduce waste. Besides, sensor and data analytics have played a huge role in figuring out the failure in the supply chain, which has led to better inventory control. Moreover, machine learning predicts shelf life more accurately, and also helps in the management of materials more effectively. As such, these new methods are going to streamline operations and lessen waste, and in the end, the whole market is going to grow as enterprises are changing to being more efficient and data-led with sustainable practices.

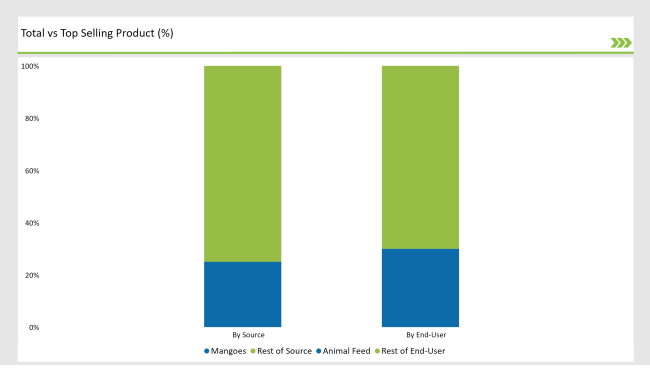

The mango is the number one source sub-segment in the United States food waste market. Given their fragile nature and brief shelf life, a large portion of mangoes are wasted during harvesting, transportation, and retail. Skin damage accounts for around 25% of the total fruit waste in the USA Mangoes are the most perishable and loss-fighting ones. The market trend for products with added value, such as mango juices, purees, and dried mangoes, is strongly rising, which led to the riper mangoes turning into these products instead of being wasted.

In terms of end-user sub-segments, animal feed is the one that commands the largest market share, with about 30% of the food waste being used for this purpose. The trend to be eco-friendly and the necessity to cut down on food waste has led to the increase of fruits and vegetables that are unsold and are transformed into feed for animals.

Animal production is gaining from the food scraps including mangoes and other fruits by using them as a nutritious resource for animals. The animal nutrition aspect is the main reason the sub-segment is evolving in this way, and thus, it has been responsible for the overall market growth.

The USA Product from Food Waste Market is made up of many players, with some operators being at the forefront of sustainable-driven breakthroughs. Prominent brands like Divert, Inc., and Loop Industries, as well as Waste Management Inc., are milliseconds in the areas of energy through technology propagation, such as food waste/biomass/composting, plastic, and product energy. Rubicon Global's focus on the circular economy model through the provision of comprehensive waste management services means that it also has a vital role to play.

The competitive arena is chiefly driven by the need for the greenway, improving business efficiency, as a result, more capacities are available, and high-end technologies are incorporated. In addition to targeting the sector, the newcomers are also into the fun part of R&D with such innovative ideas as waste-to-animal feeds and biofuels, while the old hands are pouring cash into AI and automation to make supply chain food waste management more effective. Financing from regulatory bodies and growing public awareness about climate change are contributing factors for companies to ramp up collaboration and partnership proposals to get competitive advantages and meet sustainability objectives.

2025 Market share of USA Products from Food Waste Market suppliers

.png)

The USA Products from Food Waste market is projected to grow at a CAGR of 8.0% from 2024 to 2034.

The market value is expected to reach USD 38,614.29 million by 2035, driven by sustainable innovations.

The Animal Feed segment is expected to grow the fastest, fueled by increasing demand for eco-friendly waste solutions.

Rising sustainability awareness, regulatory support, technological advancements, and the shift toward circular economy models are key growth drivers.

Dominant players include Divert, Inc., Waste Management Inc., Loop Industries, Rubicon Global, and Veolia North America.

The market is segmented into Mangoes, Apples, Grapes, Citrus Fruits, Carrots, Beetroot, Berries, and Other fruits/vegetables.

The market is segmented into Food Processing, Beverage Processing, Cosmetics & Personal Care, Dietary Supplements & Nutraceuticals, Animal Feed, and Other industries.

Vegan Bacon Market Growth - Plant-Based Protein Trends 2025 to 2035

Tapioca Market Trends - Starch Solutions & Global Demand 2025 to 2035

Chickpea Market Trends - Nutrition & Global Trade Insights 2025 to 2035

Botanical Supplements Market Growth - Herbal Wellness & Industry Demand 2025 to 2035

Vegetable Carbon Market Trends - Functional Uses & Industry Demand 2025 to 2035

Plant-Based Nuggets Market Insights - Growth & Innovation 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.