The USA probiotic supplements market is projected to reach a value of USD 3,652.9 Million in 2025, growing at a CAGR of 8.3% over the next decade to an estimated value of USD 8052.3 Million by 2035.

| Attributes | Description |

|---|---|

| Estimated USA Probiotic Supplements Industry Size (2025E) | USD 3,652.9 million |

| Projected USA Probiotic Supplements Industry Value (2035F) | USD 8052.3 million |

| Value-based CAGR (2025 to 2035) | 8.3% |

The swift expansion of the market is attributed to better consumer knowledge of gut health, the growing need for functional foods, and the progress in probiotic development.

Likewise, probiotics are more popular for many people who have digestive issues and would like to balance their gut health for effective immune function and general wellness. The rising market popularity of foods with probiotics functions as supplements because consumers find them both easy to use and enduring in stored conditions. The rising number of available liquid and powder probiotic formulations signifies increasing consumer demand for these products.

The online retail store is recognized as the prime distribution channel, facilitating the easy acquisition of a variety of probiotic goods. The advent of custom-made probiotic formulations, specified bacterial strains, and combination probiotics is also propelling the market upward. Additionally, the discovery of polyvalent strains as carriers and the development of the intestinally reluctant probiotic transfer systems only add to the overall superiority of the products.

The broadening of probiotic functionalities from only being digestive health promoters to including aspects like mental, skin, and metabolic health fosters an incredible amount of profit. On account of continuous investment in clinical studies coupled with a microbiome-based approach to the treatments, the probiotic supplements market will certainly gain strength over the long haul.

Explore FMI!

Book a free demo

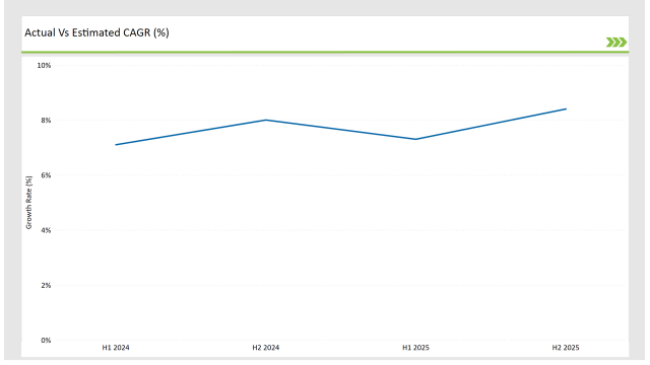

The table shows the semi-annual growth routes of the probiotics supplements market in the USA, which every year indicates the constant rise in CAGR. The analysis points to the fact that the market has been highly receptive to the changes in the lifestyle of consumers and the continued emphasis on gut health.

H1 signifies period from January to June, H2 Signifies period from July to December

Creative compositions and a focused distribution structure are the two alternative methods of achieving the objective of diversification in response to consumer demands. Apart from that, there has been an innovation in packaging, with single servings and powdered packs to be mixed with other liquids, which make the products accessible and convenient to a greater extent, thus adopting the products widely in all the market segments.

| Date | Development/M&A Activity & Details |

|---|---|

| January 2024 | Danone: Introduced a new probiotic supplement targeted at gut-brain health, enhancing cognitive function through microbiome support. |

| March 2024 | Yakult Honsha: Expanded its liquid probiotic line with new bacterial strains aimed at supporting immune health. |

| May 2024 | NOW Foods: Launched a high-potency multi-strain probiotic blend designed for optimal digestive health and nutrient absorption. |

| July 2024 | General Mills: Partnered with health food stores to distribute probiotic-fortified food products, increasing accessibility. |

| September 2024 | BioGaia: Developed a probiotic supplement for infant colic relief, gaining regulatory approval for the USA market. |

Expansion of Probiotics Beyond Digestive Health

Medical experts now acknowledge the growing applications of probiotics which extend past gastro-intestinal health management. The initial identification of probiotics primarily focused on gastrointestinal health but researchers have proved their connection to mental health weight control and skin health maintenance.

The development of psychobiotics as gut-brain axis mood enhancers has led to increased market demand for these formulations. The skin-care industry includes probiotics as active ingredients that enhance skin microbiome health while treating acne and reducing signs of skin aging. Interest has increased in purposed probiotic strains for individual health needs because personalized nutrition has become more prevalent.

Innovations in Probiotic Strain Stability and Delivery Systems

The development of modern techniques to preserve and deliver probiotic strains improves both product stability and effectiveness in supplements. Through freeze-drying and lipid-coating methods the survival of beneficial bacteria becomes better protected from exposure to stomach acid and environmental challenges.

Officially available time-release capsules pace out the delivery of probiotics so that a higher number of living bacteria successfully reach the intestine. Synbiotic products which unite prebiotic substances with probiotics represent another option to promote gut health. The technological improvements result in better-functioning products which simultaneously respond to market needs for diversified offerings thus indicating market expansion prospects for probiotics within the next ten years.

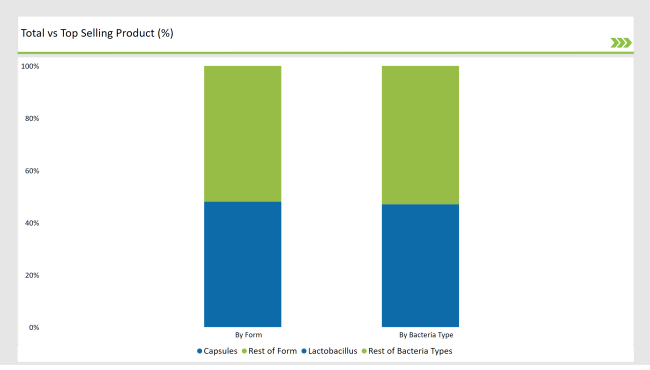

Capsules Dominate the Market

The majority of consumers choose probiotic supplements in capsule form because such products represent 48% of the market segment. The precise dosage together with extended shelf life and effective strain viability makes capsules suitable for delivering probiotic bacteria through the digestive system in their active form.

The protective capsules enhance bacterial survival rates and absorption efficiency because they shield bacteria from stomach acids. Consumer preference for capsules exists because these products provide easy swallowability combined with low additional ingredients and delayed-release capabilities.

The increasing customer need for potent multi-strain probiotics triggered companies to develop new capsule products using prebiotic mixes and synbiotic blends with innovative targeted-release delivery systems. The health-conscious population combined with doctor recommendations is causing capsule sales to become dominant as the premier form of probiotic supplements.

Lactobacillus Leads the Market

Lactobacillus represents 47% of total bacteria type usage in the market because doctors widely favor this extensive research-backed strain to conduct probiotic-related studies. The human gut organism Lactobacillus maintains extensive popularity in the field of probiotics because of its demonstrated advantages for digestion and immune health.

The essential function of Lactobacillus includes its ability to regulate gut bacteria along with helping digest lactose while stopping stomach-related infections. Research findings show that Lactobacillus strains have effects on mental health as well as weight control and skin wellness which extends its medical uses beyond digestive health. Manufacturers focus their innovation efforts on Lactobacillus since consumer demand increases for specific-strain and multi-strain probiotic formulations.

The USA probiotic supplements market remains intensely competitive due to extensive manufacturer investments in research and development activities and strain optimization while extending their product lines into fresh health applications. The expansion of the USA probiotic supplements market is facilitated by major companies such as Danone, PepsiCo, NOW Foods, Yakult Honsha and Lifeway Foods through clinical-based formulation advancement and healthcare professional collaborations.

Manufacturers are developing specialized probiotic supplements that are designed to address specific health conditions including digestive issues and immunological defense together with mental health benefits. AI along with gut microbiome testing enables companies to personalize their probiotic development process which results in better market offerings.

The 35% market share of online retail leads to better accessibility of probiotics. The market expansion relies heavily on e-commerce because customers choose direct deliveries of probiotics alongside specialty drink innovations.

2025 Market share of USA Probiotic Supplements suppliers

.png)

The market is expected to grow at a CAGR of 8.3% from 2025 to 2035.

The USA probiotic supplements market is projected to reach USD 8052.3 Million by 2035.

Key drivers include rising consumer awareness of gut health, advancements in probiotic formulations, increasing demand for functional foods, and the growing popularity of microbiome-based health solutions.

Capsules dominate by form, while Lactobacillus leads the bacteria type segment in 2025.

Top manufacturers include Danone, PepsiCo, NOW Foods, Yakult Honsha, Lifeway Foods, General Mills, Chobani, BioGaia, Global Healing, and Garden of Life.

The market is segmented into Lactobacillus, Bifidobacterium, Streptococcus, and others.

The market includes capsules, tablets, powder, and liquid probiotic.

The market is divided into retail pharmacies/drug stores, online retail, supermarkets/hypermarkets, and health food stores.

Curcumin Market Insights - Health Benefits & Industry Expansion 2025 to 2035

Microalgae in Fertilizers Market - Growth & Sustainability Trends 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Dinner Ready-to-Eat (RTE) Food Market - Trends & Consumer Insights 2025 to 2035

Potato Flakes Market Analysis Snack Foods, Ready Meals, Food Service, Bakery, Soups & Sauces, Others End Use Application Through 2035

A detailed analysis of the Australian Vitamin Premix industry and growth outlook covering vitamin type, form, and end user segment

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.